|

市场调查报告书

商品编码

1716702

儿童家具市场机会、成长动力、产业趋势分析及2025-2034年预测Kids Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

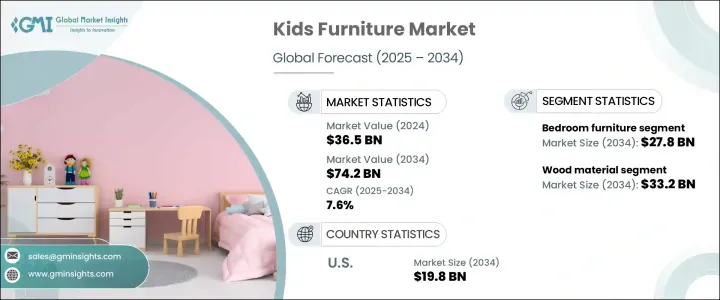

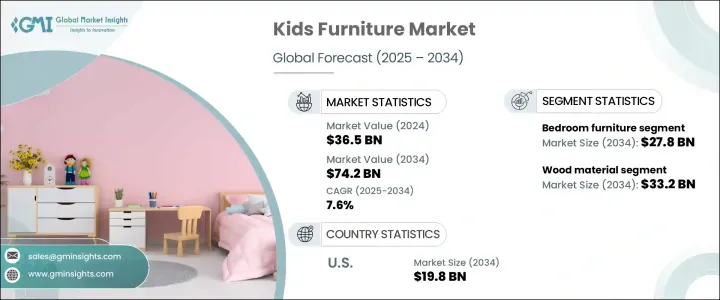

2024 年全球儿童家具市场规模达到 365 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.6%。儿童家具需求的成长受到多种因素的推动,包括各个地区出生率的上升、对儿童安全和舒适度的日益关注,以及政府透过生育和父母援助计画支持年轻家庭的倡议。随着现代家庭寻求为孩子创造安全、实用、时尚的生活空间,对高品质、耐用、美观的家具的需求持续激增。如今,父母更加意识到选择有利于孩子成长的家具的重要性,家具不仅要实用,还要提供视觉上吸引人的环境,以激发创造力和舒适感。

由于父母优先考虑能够反映孩子个性并满足其不断变化的需求的家具,市场也见证了高端和可定製家具解决方案的稳步增长。此外,社群媒体趋势、生活方式的改变以及城市化进程的加快,促使家庭投资于现代化、多功能的家具,以无缝融入当代家居设计。各品牌正专注于推出创新、模组化和节省空间的家具,以满足对灵活生活解决方案的需求,尤其是在空间通常有限的城市环境中。具有环保意识的消费者的影响力日益增强,也将焦点转向永续材料,进一步影响全球儿童家具市场的发展轨迹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 365亿美元 |

| 预测值 | 742亿美元 |

| 复合年增长率 | 7.6% |

2024 年,儿童家具市场中的卧室家具部分创造了 138 亿美元的收入,反映出儿童对多功能且时尚的卧室解决方案的需求日益增长。父母越来越多地选择各种各样的选择,包括床、书桌、梳妆台和储物柜,所有这些设计都兼具功能性和现代美感。由于父母优先考虑儿童安全,同时又不牺牲风格,因此对具有增强安全功能(如圆角、防倾倒机制和无毒饰面)的家具的需求正在增加。可自订的设计直接迎合了孩子们的兴趣——从他们喜欢的颜色和主题到独特的布局——也越来越受欢迎。父母寻求的家具不仅要支持孩子的日常活动,还要增强房间的视觉吸引力,营造出个人化和鼓舞人心的空间。

从材质来看,2024 年木材占据了儿童家具市场的 44.9% 份额。木製家具凭藉其无与伦比的耐用性、自然美感和环保特性,依然是家庭的首选。父母经常选择木材,因为它具有永恆的吸引力,适合各种室内主题,同时确保长久耐用。其坚固的结构使其成为成长中儿童的实用投资,木材的温暖和优雅自然提升了任何房间的外观,营造出孩子们多年来可以享受的舒适和温馨的环境。

受人们对儿童空间家居装饰和室内造型兴趣浓厚的推动,美国儿童家具市场将在 2024 年创造 96 亿美元的产值。由于美国家庭优先为孩子创造安全且设计精良的空间,消费者在高品质、实用且美观的家具上的支出增加正在推动市场发展。强大的零售业务,加上对创新和可定製家具解决方案不断增长的需求,继续推动美国市场的成长,美国的父母寻求将安全性、舒适性和现代美学完美融合。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 产业衝击力

- 成长动力

- 人口增长和对儿童发展的日益关注

- 电子商务的兴起伴随着可支配收入的增加。

- 产业陷阱与挑战

- 消费者偏好的改变

- 尺寸和款式种类有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:儿童家具市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 卧室家具

- 床和滚轮床

- 梳妆台和床头柜

- 书桌和桌椅

- 其他的

- 育儿家具

- 婴儿床和摇篮

- 换尿布台

- 其他(边桌等)

- 游戏室和书房家具

- 玩具收纳

- 游戏桌椅

- 书柜

- 其他(架子、挂钩等)

- 其他的

第六章:儿童家具市场估计与预测:依材料,2021 年至 2034 年

- 主要趋势

- 木头

- 塑胶

- 金属

- 其他的

第七章:儿童家具市场估计与预测:依年龄段,2021-2034

- 主要趋势

- 新生儿和婴儿

- 学步的儿童

- 学龄前儿童

- 学龄儿童

第八章:儿童家具市场估计与预测:按价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第九章:儿童家具市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

- 学校和游戏小组

- 日间照顾中心和幼儿园

- 卫生保健

- 其他(营地、 HoReCa等)

第十章:儿童家具市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 其他(家居装饰等)

第 11 章:儿童家具市场估计与预测:按地区,2021-2034 年

- 主要方向:按地区

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十二章:公司简介

- Dream On Me, Inc.

- KidKraft

- Legare

- Milliard Brands

- Million Dollar Baby Co.

- Sorelle Furniture

- Summer Infant, Inc.

- Universal Kids Furniture

- Wayfair LLC

- Williams-Sonoma Inc.

The Global Kids Furniture Market reached USD 36.5 billion in 2024 and is expected to grow at a CAGR of 7.6% between 2025 and 2034. The rising demand for kids' furniture is fueled by several factors, including increasing birth rates in various regions, a growing focus on child safety and comfort, and government initiatives supporting young families through fertility and parental assistance programs. As modern families look to create safe, functional, and stylish living spaces for their children, the need for high-quality, durable, and aesthetically pleasing furniture continues to surge. Parents today are more aware of the importance of choosing furniture that supports their child's development, offering not only practicality but also a visually appealing environment that encourages creativity and comfort.

The market is also witnessing a steady rise in premium and customizable furniture solutions as parents prioritize pieces that reflect their children's personalities and cater to their evolving needs. Additionally, the influence of social media trends, lifestyle changes, and increasing urbanization has led families to invest in modern, multifunctional furniture that fits seamlessly into contemporary home designs. Brands are focusing on launching innovative, modular, and space-saving furniture to meet the demand for flexible living solutions, especially in urban settings where space is often limited. The growing influence of eco-conscious consumers has also shifted focus toward sustainable materials, further shaping the trajectory of the global kids furniture market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.5 Billion |

| Forecast Value | $74.2 Billion |

| CAGR | 7.6% |

The bedroom furniture segment in the kids furniture market generated USD 13.8 billion in 2024, reflecting the rising need for versatile and stylish bedroom solutions for children. Parents are increasingly opting for a wide variety of options, including beds, study tables, dressers, and storage units, all designed to offer both functionality and a modern aesthetic. The demand for furniture with enhanced safety features, such as rounded corners, anti-tip mechanisms, and non-toxic finishes, is on the rise as parents prioritize child safety without compromising on style. Customizable designs that appeal directly to children's interests-ranging from favorite colors and themes to unique layouts-are also gaining significant popularity. Parents seek furniture that not only supports their children's daily activities but also enhances the visual appeal of their rooms, allowing for a personalized and inspiring space.

In terms of material, the wood segment dominated the kids furniture market with a 44.9% share in 2024. Wooden furniture remains a preferred choice among families due to its unmatched durability, natural aesthetic, and eco-friendly attributes. Parents often choose wood because it offers timeless appeal, fitting a variety of interior themes while ensuring longevity. Its sturdy structure makes it a practical investment for growing children, and the warmth and elegance of wood naturally elevate the look of any room, creating a cozy and welcoming environment that children can enjoy over the years.

U.S. kids furniture market generated USD 9.6 billion in 2024, driven by a booming interest in home decor and interior styling for children's spaces. Higher consumer spending on high-quality, functional, and attractive furniture is boosting the market, as American families prioritize creating safe and well-designed spaces for their kids. A strong retail presence, combined with rising demand for innovative and customizable furniture solutions, continues to propel market growth in the U.S., where parents seek to blend safety, comfort, and modern aesthetics seamlessly.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing population and rising focus on child development

- 3.2.1.2 Rising E-commerce followed by increasing disposable income.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Changing consumer preferences

- 3.2.2.2 Limited variety of sizes and styles available

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Company market share analysis

- 4.2 Competitive positioning matrix

- 4.3 Strategic outlook matrix

Chapter 5 Kids Furniture Market Estimates & Forecast, By Product Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Bedroom furniture

- 5.2.1 Beds & trundles

- 5.2.2 Dressers & nightstands

- 5.2.3 Desks & desk chairs

- 5.2.4 Others

- 5.3 Nursery furniture

- 5.3.1 Cribs & bassinets

- 5.3.2 Changing tables

- 5.3.3 Others (Side tables etc.)

- 5.4 Playroom & study furniture

- 5.4.1 Toy storage

- 5.4.2 Play tables & chairs

- 5.4.3 Bookcases

- 5.4.4 Others (Shelves and Hooks etc.)

- 5.5 Others

Chapter 6 Kids Furniture Market Estimates & Forecast, By Material, 2021 – 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Plastic

- 6.4 Metal

- 6.5 Others

Chapter 7 Kids Furniture Market Estimates & Forecast, By Age Group, 2021 -2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Newborn & infants

- 7.3 Toddler

- 7.4 Preschooler

- 7.5 School-aged child

Chapter 8 Kids Furniture Market Estimates & Forecast, By Price, 2021 -2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Kids Furniture Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 School & playgroup

- 9.3.2 Daycare centers & preschools

- 9.3.3 Healthcare

- 9.3.4 Others (Camps, HoReCa, etc.)

Chapter 10 Kids Furniture Market Estimates & Forecast, By Distribution Channel, 2021 -2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-Commerce sites

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Mega retail stores

- 10.3.3 Others (Home Decor etc.)

Chapter 11 Kids Furniture Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends, by region

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Dream On Me, Inc.

- 12.2 KidKraft

- 12.3 Legare

- 12.4 Milliard Brands

- 12.5 Million Dollar Baby Co.

- 12.6 Sorelle Furniture

- 12.7 Summer Infant, Inc.

- 12.8 Universal Kids Furniture

- 12.9 Wayfair LLC

- 12.10 Williams-Sonoma Inc.