|

市场调查报告书

商品编码

1721401

小型语言模型 (SLM) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Small Language Models (SLM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

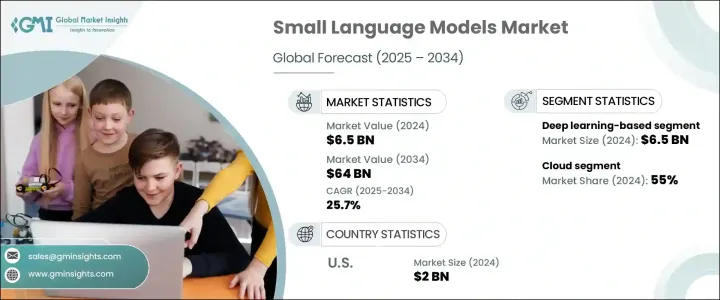

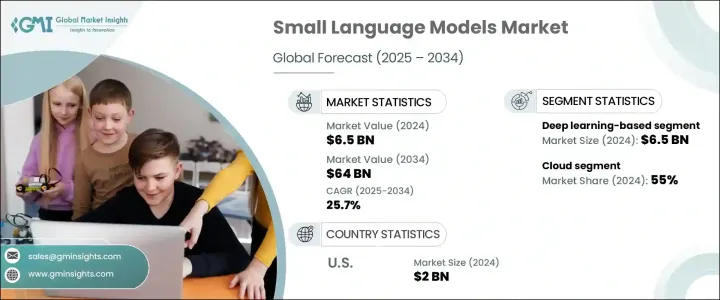

2024 年全球小型语言模型市场价值为 65 亿美元,预计到 2034 年将以 25.7% 的复合年增长率成长,达到 640 亿美元。随着人工智慧继续塑造企业营运的未来,SLM 正在不断发展的人工智慧领域中开闢出一个独特的利基市场。现在,全球企业都优先考虑智慧自动化、即时通讯和超个人化的用户体验,而无需承担通常与大型语言模型 (LLM) 相关的巨额基础设施成本。

这种转变引发了对 SLM 的需求急剧上升,特别是在需要快速决策、高效语言处理和资料敏感操作的领域。随着全球企业越来越依赖人工智慧驱动的工具来提高生产力,在有限资源上提供高性能的紧凑、灵活模型的采用正在稳步上升。随着组织转向分散式 AI 解决方案,SLM 成为装置应用程式的完美选择,可在准确性、效率和成本之间实现无缝平衡。人们对资料隐私的日益关注以及边缘运算部署的激增进一步放大了 SLM 在当今技术前沿世界中的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 640亿美元 |

| 复合年增长率 | 25.7% |

企业正在积极转向小型语言模型,以释放人工智慧的潜力,而无需承担传统 LLM 繁重的计算和财务负担。这些模型在医疗保健、金融、教育和客户服务领域获得了显着的关注,其中即时文字生成、语音识别和上下文理解发挥关键作用。无论是支援智慧聊天机器人、增强语音助理或实现动态内容创建,SLM 都正在成为现代企业必不可少的工具。它们的轻量级架构使其成为必须在行动装置、边缘系统或嵌入式平台上高效运行的低延迟应用程式的理想选择。

仅基于深度学习的小型语言模型领域在 2024 年就创造了 65 亿美元的收入,凸显了对神经网路和基于变压器的架构的日益依赖。这些模型针对摘要、自然对话、翻译等高精度任务进行了最佳化。随着企业加速数位转型,各个垂直产业对这些人工智慧解决方案的需求正在迅速扩大。

2024 年,基于云端的部署占据了 SLM 市场主导地位,占有 55% 的份额。组织更喜欢云端原生解决方案,因为它们具有可扩展性、可负担性和易于整合。这一趋势反映了向灵活部署模式的更广泛转变,企业可以快速调整其人工智慧工具以适应不断变化的营运需求,而无需投资复杂的内部设定。

光是美国小型语言模型市场在 2024 年的规模就达到了 20 亿美元。这一增长得益于该国创新驱动的技术生态系统、广泛的云端运算采用以及医疗保健、电子商务和金融等行业对基于 NLP 的自动化的日益广泛使用。

推动这一市场发展的关键参与者包括亚马逊 AWS AI、苹果 AI、Cerebras Systems、Cohere、Databricks、Google、IBM Watson AI、Meta、微软和 Nvidia。这些公司正在透过策略合作伙伴关係、云端平台扩展和有针对性的研发投资来加强其影响力,以增强模型的可扩展性和特定领域的适应性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 对经济高效的人工智慧解决方案的需求不断增长

- 人工智慧在边缘运算和设备处理的应用日益广泛

- 越来越关注以隐私为中心的人工智慧模型

- 扩展人工智慧客户支援和内容生成

- 产业陷阱与挑战

- 有限的训练资料和模型效能限制

- 对偏见、道德人工智慧和合规问题的担忧

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 基于深度学习

- 基于机器学习

- 基于规则的系统

第六章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 预先训练

- 精细调整

- 开源

第七章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 云

- 杂交种

- 本地

第八章:市场估计与预测:依最终用途 2021 - 2034

- 主要趋势

- 客户支援和聊天机器人

- 金融服务及银行业务

- 医疗保健和医疗人工智慧

- 媒体和内容生成

- 零售与电子商务

- 教育与电子学习

- 法律与合规

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AI21 Labs

- Aleph Alpha

- Amazon AWS AI

- Anthropic

- Apple AI

- Cerebras Systems

- Cohere

- Databricks (MosaicML)

- Google DeepMind

- Hugging Face

- IBM Watson AI

- Meta (FAIR)

- Microsoft

- Mistral AI

- NVIDIA AI

- OpenAI

- Rasa AI

- Salesforce AI Research

- SAP AI

- Stability AI

The Global Small Language Models Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 25.7% to reach USD 64 billion by 2034. As artificial intelligence continues to shape the future of enterprise operations, SLMs are carving a distinct niche in the evolving AI landscape. Businesses worldwide are now prioritizing intelligent automation, real-time communication, and hyper-personalized user experiences-all without incurring the massive infrastructure costs typically associated with large language models (LLMs).

This shift has triggered a sharp rise in the demand for SLMs, particularly in sectors that require quick decision-making, efficient language processing, and data-sensitive operations. With global enterprises increasingly leaning on AI-driven tools to enhance productivity, the adoption of compact, agile models that offer high performance on limited resources is steadily climbing. As organizations move toward decentralized AI solutions, SLMs emerge as the perfect fit for on-device applications, offering a seamless balance between accuracy, efficiency, and cost. Growing concerns over data privacy and the surge in edge computing deployment further amplify the relevance of SLMs in today's tech-forward world.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $64 Billion |

| CAGR | 25.7% |

Businesses are actively turning to small language models to unlock the potential of artificial intelligence without the heavy computational and financial load of traditional LLMs. These models have gained notable traction in healthcare, finance, education, and customer service, where real-time text generation, voice recognition, and contextual understanding play critical roles. Whether powering intelligent chatbots, enhancing voice assistants, or enabling dynamic content creation, SLMs are becoming essential tools for modern enterprises. Their lightweight architecture makes them ideal for low-latency applications that must run efficiently on mobile devices, edge systems, or embedded platforms.

The deep learning-based small language models segment alone generated USD 6.5 billion in 2024, underscoring the growing reliance on neural networks and transformer-based architectures. These models are optimized for high-precision tasks such as summarization, natural conversation, translation, and more. As companies accelerate digital transformation, demand for these AI-powered solutions is rapidly expanding across verticals.

Cloud-based deployment dominated the SLM market in 2024, holding a 55% share. Organizations prefer cloud-native solutions for their scalability, affordability, and ease of integration. This trend reflects a broader movement toward flexible deployment models, where businesses can quickly adapt their AI tools to evolving operational needs without investing in complex on-premise setups.

The United States Small Language Models Market alone accounted for USD 2 billion in 2024. This growth is fueled by the nation's innovation-driven tech ecosystem, widespread cloud adoption, and increasing use of NLP-based automation across industries such as healthcare, e-commerce, and finance.

Key players driving this market include Amazon AWS AI, Apple AI, Cerebras Systems, Cohere, Databricks, Google, IBM Watson AI, Meta, Microsoft, and Nvidia. These companies are strengthening their presence through strategic partnerships, cloud platform expansions, and targeted investments in R&D to enhance model scalability and domain-specific adaptability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for cost-efficient AI solutions

- 3.7.1.2 Growing adoption of AI in edge computing & on-device processing

- 3.7.1.3 Increasing focus on privacy-centric AI models

- 3.7.1.4 Expansion of AI-powered customer support & content generation

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Limited training data & model performance constraints

- 3.7.2.2 Concerns over bias, ethical ai, and compliance issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Deep learning based

- 5.3 Machine learning based

- 5.4 Rule based system

Chapter 6 Market Estimates & Forecast, By Model Type, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Pre-trained

- 6.3 Fine-tuned

- 6.4 Open source

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 Hybrid

- 7.4 On-premises

Chapter 8 Market Estimates & Forecast, By End Use 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Customer support & chatbots

- 8.3 Financial services & banking

- 8.4 Healthcare & medical AI

- 8.5 Media & content generation

- 8.6 Retail & E-commerce

- 8.7 Education & E-learning

- 8.8 Legal & compliance

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AI21 Labs

- 10.2 Aleph Alpha

- 10.3 Amazon AWS AI

- 10.4 Anthropic

- 10.5 Apple AI

- 10.6 Cerebras Systems

- 10.7 Cohere

- 10.8 Databricks (MosaicML)

- 10.9 Google DeepMind

- 10.10 Hugging Face

- 10.11 IBM Watson AI

- 10.12 Meta (FAIR)

- 10.13 Microsoft

- 10.14 Mistral AI

- 10.15 NVIDIA AI

- 10.16 OpenAI

- 10.17 Rasa AI

- 10.18 Salesforce AI Research

- 10.19 SAP AI

- 10.20 Stability AI