|

市场调查报告书

商品编码

1721406

加热挡风玻璃市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Heated Windshield Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

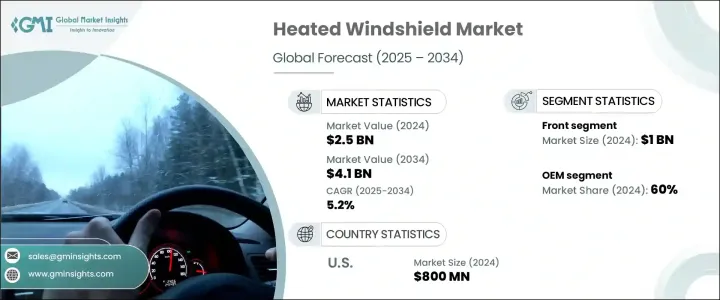

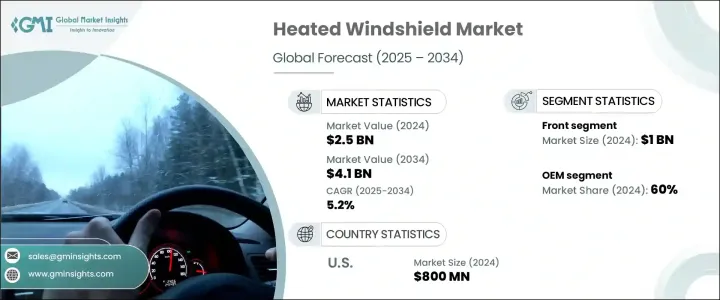

2024 年全球加热挡风玻璃市场价值为 25 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 41 亿美元。这一增长主要得益于消费者对提高可视性、增强安全功能以及增强极端天气条件下适应性的需求不断增长。随着天气越来越难以预测,尤其是在寒冷地区,汽车购买者更加重视确保驾驶员安全和舒适的技术。加热挡风玻璃尤其受到广泛关注,因为它们能够快速清除冰、霜和雾,而不会给 HVAC 系统带来过重负担。随着汽车产业向电动和豪华汽车的强劲转变,加热挡风玻璃系统正在成为支援能源效率和先进驾驶辅助系统(ADAS) 的标准功能。

智慧功能的日益融合以及对更高车辆性能的追求促使汽车製造商投资更可靠、耐用和节能的挡风玻璃技术。此外,导电涂层和嵌入式加热元件的进步正在重塑竞争格局,并影响OEM和售后市场管道的购买决策。製造商正在透过适应不断变化的监管标准和消费者对安全性、效率和永续性的期望来做出回应,预计这将在整个预测期内进一步推动采用和技术创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.2% |

加热挡风玻璃经过专门设计,可消除霜、雾和冰的积聚,从而在恶劣天气下提供清晰的视野,从而提高安全性。这些解决方案对于电动和高级汽车尤其重要,因为快速除霜不仅可以提高驾驶者的舒适度,还可以确保 ADAS 的无缝运作。嵌入式电线和透明导电层等先进加热技术的结合,可以实现更快的除雾、更强的耐磨性,并减少对传统气候控制系统的依赖,使加热挡风玻璃成为现代车辆的宝贵资产。

市场分为前挡风玻璃和后挡风玻璃,其中前挡风玻璃市场在 2024 年将创造 10 亿美元。该市场的重要性主要归功于其在保持驾驶员可视性和支持需要畅通视野的 ADAS 组件方面所发挥的作用。后加热挡风玻璃的牵引力也在增加,特别是在车队和商用车辆中,因为在倒车时后方可视性至关重要。然而,后挡风玻璃的采用率仍然落后于前挡风玻璃。

就销售通路而言,市场分为原始设备製造商(OEM)和售后市场。 2024 年,原始设备製造商 (OEM) 占据了 60% 的市场份额,这主要归因于电动和高端汽车对工厂安装解决方案的需求不断增长。这些挡风玻璃与 ADAS 和自动驾驶系统无缝集成,即使在恶劣条件下也能确保顶级性能。

受电动和豪华汽车日益普及以及对先进安全技术的需求推动,美国加热挡风玻璃市场规模到 2024 年将达到 8 亿美元。美国汽车製造商正在积极实施加热挡风玻璃系统,以满足消费者对节能和卓越可视性的需求。这些系统透过降低 HVAC 负载并确保最佳除霜性能,在保持电动车电池效率方面发挥关键作用。

全球加热挡风玻璃领域的主要领导者包括日本板硝子、AGC、福耀玻璃、加迪安玻璃、大众、皮尔金顿、麦格纳、圣戈班安全玻璃、特斯拉和丰田汽车。这些参与者正在大力投资研发下一代加热技术,并与原始设备製造商建立策略合作伙伴关係,以满足豪华和高性能汽车领域日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 电动车的普及率不断提高

- 智慧玻璃和导电涂层的进步

- 更严格的安全和能见度规定

- 商用车领域的扩张

- 产业陷阱与挑战

- 製造和更换成本高

- 与 ADAS 和智慧功能的复杂集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依位置,2021 - 2034 年

- 主要趋势

- 正面

- 后部

第六章:市场估计与预测:按玻璃,2021 - 2034 年

- 主要趋势

- 层压

- 导电镀膜玻璃

- 经过调和

- 其他的

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车

- 平均血红素 (MCV)

- 丙型肝炎病毒

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 售后市场

- OEM

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AGC

- BMW

- Corning

- Ford Motor

- Fuyao Glass

- General Motors

- Guardian Glass

- Hyundai Motor

- Magna

- Mercedes-Benz

- Nippon Sheet Glass

- Pilkington

- Saint-Gobain Sekurit

- Stellantis

- Tesla

- Toyota

- Volkswagen

- Volvo

- Webasto

- Xinyi Glass

The Global Heated Windshield Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 4.1 billion by 2034. This growth is primarily driven by rising consumer demand for improved visibility, enhanced safety features, and increased adaptability in extreme weather conditions. As weather unpredictability intensifies, especially in colder regions, automotive buyers are placing greater importance on technologies that ensure driver safety and comfort. Heated windshields, in particular, are gaining significant attention due to their ability to rapidly clear ice, frost, and fog without overburdening the HVAC system. With the automotive industry witnessing a strong shift toward electric and luxury vehicles, heated windshield systems are becoming standard features that support energy efficiency and advanced driver assistance systems (ADAS).

The growing integration of smart features and the push for higher vehicle performance have prompted automakers to invest in more reliable, durable, and energy-efficient windshield technologies. Additionally, advancements in conductive coatings and embedded heating elements are reshaping the competitive landscape and influencing purchase decisions across both OEM and aftermarket channels. Manufacturers are responding by aligning with evolving regulatory standards and consumer expectations for safety, efficiency, and sustainability, which is expected to further drive adoption and technological innovation throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.2% |

Heated windshields are specifically designed to boost safety by eliminating the accumulation of frost, fog, and ice, thereby offering clear visibility in adverse weather. These solutions are especially important in electric and premium vehicles where fast defrosting supports not only driver comfort but also ensures the seamless functioning of ADAS. The incorporation of advanced heating technologies, such as embedded wires and transparent conductive layers, allows for faster defogging, greater resistance to wear, and reduced reliance on traditional climate control systems-making heated windshields a valuable asset in modern vehicles.

The market is categorized into front and rear windshields, with the front segment generating USD 1 billion in 2024. The prominence of this segment is largely attributed to its role in maintaining driver visibility and supporting ADAS components that require an unobstructed view. Rear heated windshields are also experiencing increased traction, especially in fleet and commercial vehicles, where rear visibility is critical during reversing. However, the adoption rate of rear windshields still trails that of the front segment.

In terms of sales channels, the market is divided between original equipment manufacturers (OEMs) and the aftermarket. OEMs accounted for 60% of the market share in 2024, largely due to the rising demand for factory-installed solutions in electric and high-end vehicles. These windshields are seamlessly integrated with ADAS and self-driving systems, ensuring top-tier performance even in harsh conditions.

The U.S. Heated Windshield Market reached USD 800 million in 2024, propelled by the growing adoption of electric and luxury vehicles, along with the demand for advanced safety technologies. U.S. automakers are actively implementing heated windshield systems to address consumer needs for energy savings and superior visibility. These systems play a pivotal role in preserving battery efficiency in EVs by reducing the HVAC load and ensuring optimal defrosting performance.

Key companies leading the global heated windshield space include Nippon Sheet Glass, AGC, Fuyao Glass, Guardian Glass, Volkswagen, Pilkington, Magna, Saint-Gobain Sekurit, Tesla, and Toyota Motor. These players are heavily investing in R&D to develop next-generation heating technologies and are forging strategic partnerships with OEMs to cater to the rising demand in luxury and high-performance vehicle segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing adoption in electric vehicles

- 3.7.1.2 Advancements in smart glass & conductive coatings

- 3.7.1.3 Stricter safety & visibility regulations

- 3.7.1.4 Expansion in the commercial vehicle segment

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High manufacturing & replacement costs

- 3.7.2.2 Complex integration with ADAS & smart features

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Position, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front

- 5.3 Rear

Chapter 6 Market Estimates & Forecast, By Glass, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Laminated

- 6.3 Conductive coated glass

- 6.4 Tempered

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Aftermarket

- 8.3 OEM

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AGC

- 10.2 BMW

- 10.3 Corning

- 10.4 Ford Motor

- 10.5 Fuyao Glass

- 10.6 General Motors

- 10.7 Guardian Glass

- 10.8 Hyundai Motor

- 10.9 Magna

- 10.10 Mercedes-Benz

- 10.11 Nippon Sheet Glass

- 10.12 Pilkington

- 10.13 Saint-Gobain Sekurit

- 10.14 Stellantis

- 10.15 Tesla

- 10.16 Toyota

- 10.17 Volkswagen

- 10.18 Volvo

- 10.19 Webasto

- 10.20 Xinyi Glass