|

市场调查报告书

商品编码

1721409

机械性能调校零件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Mechanical Performance Tuning Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

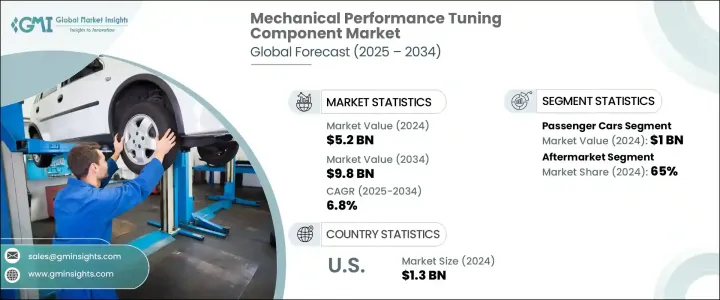

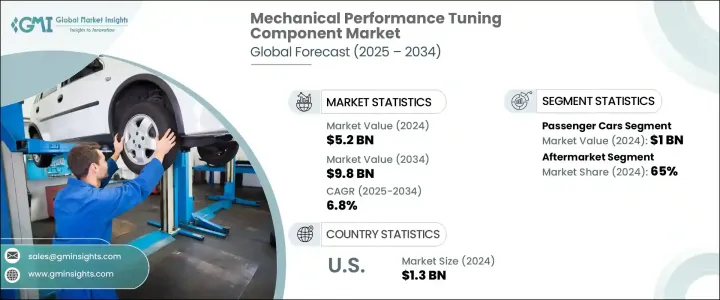

2024 年全球机械性能调校零件市场价值为 52 亿美元,预计到 2034 年将以 6.8% 的复合年增长率增长,达到 98 亿美元。消费者对汽车个人化和性能提升的热情日益高涨,在塑造该市场的未来方面发挥着重要作用。随着汽车製造商不断突破汽车技术的界限,驾驶者正在寻求更聪明、更快、更有反应的汽车。性能调校组件(从升级的悬吊和高性能排气系统到先进的控制模组)在爱好者和日常驾驶员中越来越受欢迎。

随着技术进步的不断推进,性能调校组件的整合变得更加复杂,可同时满足 ICE(内燃机)和 EV(电动车)平台的需求。调校组件不再仅适用于赛车运动或汽车爱好者;它们正在成为提高燃油效率、增强加速和提升整体驾驶动力的主流解决方案。数位连网汽车和智慧诊断的兴起也帮助车主在改装升级方面做出更明智的决定,从而推动售后市场的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 52亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 6.8% |

对电动车(EV)的需求不断增长,为性能调校组件提供了巨大的成长机会,尤其是在混合动力和电动车市场。随着电动车销量的成长,人们更加重视改进电池系统、动力系统和车辆软体等各种机械部件。这一趋势推动了对性能晶片和电动马达等更先进的调校组件的需求,进一步推动了市场扩张。

从应用方面来看,机械性能调校零件市场包括乘用车、商用车、越野车、摩托车、船舶和赛车运动等领域。 2024年,乘用车市场占有25%的份额,价值10亿美元。这个细分市场由售后性能部件的需求推动,这些部件是根据乘用车的特定需求量身定制的。这些部件很容易获得,并为车主提供了一种经济实惠的方式来提高汽车性能。

根据分销管道,市场分为售后市场和OEM。 2024 年售后市场占有 65% 的份额。售后零件对于缺少OEM零件或型号较旧的车辆至关重要。这些组件可透过线上平台、零售店和专业性能网点轻鬆取得,为消费者提供更灵活、更易于调整的选项。这种广泛的可用性和采购的便利性使售后市场成为整个市场的重要参与者。

2024 年,北美机械性能调校零件市场占有 30% 的份额。美国以 2024 年 13 亿美元的市值领先该地区。美国的汽车文化是性能调校需求的主要驱动力,在美国,汽车被视为个人身分和自由的延伸。这种文化倾向导致车辆客製化和售后改装服务的增加,进一步推动了市场成长。

机械性能调校组件市场的关键公司包括 Magna International、AEM Electronics、ZF Friedrichshafen、BorgWarner、Borla Performance Industries、Bosch、Brembo、COBB Tuning、Holley Performance Products 和 K&N Filters。为了巩固其地位,这些公司正专注于产品创新、策略合作伙伴关係和扩大分销管道。他们透过开发先进的高性能组件来不断改进产品,以满足电动和混合动力汽车不断变化的需求。许多公司正在投资研发以提高产品的耐用性和效率,同时也透过区域分销商和零售商扩大其全球影响力,以拓宽市场范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 改装专家和定製商店

- 售后市场供应商和经销商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 价格趋势

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 调音组件的技术进步

- 电动车日益普及

- 提高汽车产业的性能标准

- 人们对越野车和探险车的兴趣日益浓厚

- 产业陷阱与挑战

- 相容性问题和可用性有限

- 性能调校部件成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 引擎

- 涡轮增压器和机械增压器

- 进气系统

- 排气系统

- 引擎管理系统

- 燃油系统部件

- 悬吊和底盘

- 支撑桿和塔桿

- 防倾桿/稳定桿

- 降低弹簧

- 其他的

- 煞车

- 高性能煞车广告

- 高性能煞车碟盘/碟盘

- 升级的煞车钳

- 其他的

- 传染

- 离合器

- 飞轮

- 短换檔桿

- 冷却系统

- 散热器

- 油冷却器

- 其他的

- 其他的

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 平均血红素 (MCV)

- 丙型肝炎病毒

- 越野车

- 摩托车

- 海洋

- 赛车运动

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- AEM Electronics

- BorgWarner

- Borla Performance Industries

- Bosch

- Brembo SpA

- COBB Tuning

- Corsa Performance

- Edelbrock

- Flowmaster Mufflers

- Garrett Motion

- HKS

- Holley Performance Products

- Injen Technology

- K&N Filters

- Magna International

- MagnaFlow

- Sparco

- Whiteline Automotive

- Wilwood Engineering

- ZF Friedrichshafen

The Global Mechanical Performance Tuning Component Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 9.8 billion by 2034. Rising consumer enthusiasm for vehicle personalization and performance enhancement is playing a major role in shaping the future of this market. As automakers continue to push the boundaries of automotive technology, drivers are seeking smarter, faster, and more responsive vehicles. Performance tuning components-ranging from upgraded suspensions and high-performance exhaust systems to advanced control modules-are increasingly in demand among enthusiasts and daily drivers alike.

With technological advancements gaining momentum, the integration of performance tuning components has become more sophisticated, catering to both ICE (internal combustion engine) and EV (electric vehicle) platforms. Tuning components are no longer just for motorsports or car hobbyists; they are becoming mainstream solutions for improving fuel efficiency, enhancing acceleration, and boosting overall driving dynamics. The rise in digitally connected vehicles and intelligent diagnostics is also helping car owners make more informed decisions about tuning upgrades, fueling a growing aftermarket.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 6.8% |

The increasing demand for electric vehicles (EVs) is providing significant growth opportunities for performance tuning components, particularly in hybrid and electric vehicle markets. As EV sales rise, there is a heightened focus on improving various mechanical components such as battery systems, powertrains, and vehicle software. This trend is driving the need for more advanced tuning components like performance chips and electric motors, further fueling market expansion.

In terms of application, the mechanical performance tuning component market includes segments such as passenger cars, commercial vehicles, off-road vehicles, motorcycles, marine, and motorsports. In 2024, the passenger cars segment held a 25% share, valued at USD 1 billion. This segment is driven by the demand for aftermarket performance parts, which are customized to meet the specific needs of passenger vehicles. These components are easily accessible and offer vehicle owners an affordable way to enhance their car's performance.

Based on distribution channels, the market is divided into aftermarket and OEM. The aftermarket segment held a 65% share in 2024. Aftermarket parts are crucial for vehicles that either lack OEM parts or are older models. These components are readily available through online platforms, retail stores, and specialized performance outlets, giving consumers more flexibility and accessibility to tuning options. This widespread availability and ease of procurement make the aftermarket segment a significant player in the overall market.

North America Mechanical Performance Tuning Component Market held 30% share in 2024. The U.S. led the region with a market value of USD 1.3 billion in 2024. The automotive culture in the U.S. is a key driver for the demand for performance tuning, where cars are seen as an extension of personal identity and freedom. This cultural inclination has led to an increase in vehicle customization and aftermarket tuning services, further propelling market growth.

Key companies in the mechanical performance tuning component market include Magna International, AEM Electronics, ZF Friedrichshafen, BorgWarner, Borla Performance Industries, Bosch, Brembo, COBB Tuning, Holley Performance Products, and K&N Filters. To strengthen their position, these companies are focusing on product innovation, strategic partnerships, and expanding distribution channels. They are continuously improving product offerings by developing advanced, high-performance components that cater to the evolving demands of electric and hybrid vehicles. Many firms are investing in R&D to enhance product durability and efficiency while also expanding their global footprint through regional distributors and retailers to broaden market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Tuning specialists and customization shops

- 3.2.4 Aftermarket suppliers and distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Price trend

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Technological advancements in tuning components

- 3.9.1.2 Rising popularity of EVs

- 3.9.1.3 Enhanced performance standards in the automotive industry

- 3.9.1.4 Growing interest in off-road and adventure vehicles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Compatibility issues and limited availability

- 3.9.2.2 High cost of performance tuning parts

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Engine

- 5.2.1 Turbochargers & superchargers

- 5.2.2 Intake system

- 5.2.3 Exhaust system

- 5.2.4 Engine management system

- 5.2.5 Fuel system component

- 5.3 Suspension & chassis

- 5.3.1 Strut braces & tower bars

- 5.3.2 Anti-roll/sway bars

- 5.3.3 Lowering springs

- 5.3.4 Others

- 5.4 Brake

- 5.4.1 High-performance brake ads

- 5.4.2 Performance brake rotors/discs

- 5.4.3 Upgraded brake calipers

- 5.4.4 Others

- 5.5 Transmission

- 5.5.1 Clutches

- 5.5.2 Flywheels

- 5.5.3 Short shifters

- 5.6 Cooling system

- 5.6.1 Radiators

- 5.6.2 Oil coolers

- 5.6.3 Others

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Off road vehicles

- 6.5 Motorcycle

- 6.6 Marine

- 6.7 Motorsport

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AEM Electronics

- 9.2 BorgWarner

- 9.3 Borla Performance Industries

- 9.4 Bosch

- 9.5 Brembo S.p.A

- 9.6 COBB Tuning

- 9.7 Corsa Performance

- 9.8 Edelbrock

- 9.9 Flowmaster Mufflers

- 9.10 Garrett Motion

- 9.11 HKS

- 9.12 Holley Performance Products

- 9.13 Injen Technology

- 9.14 K&N Filters

- 9.15 Magna International

- 9.16 MagnaFlow

- 9.17 Sparco

- 9.18 Whiteline Automotive

- 9.19 Wilwood Engineering

- 9.20 ZF Friedrichshafen