|

市场调查报告书

商品编码

1721410

多巴胺激动剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dopamine Agonists Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

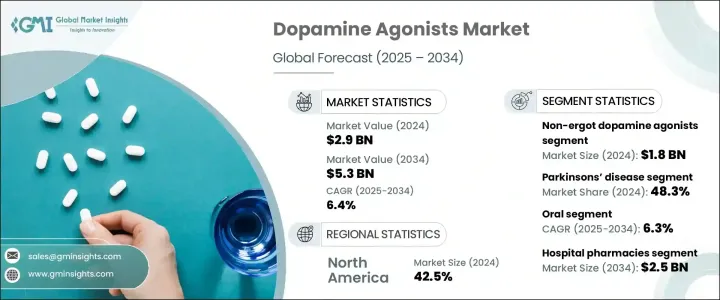

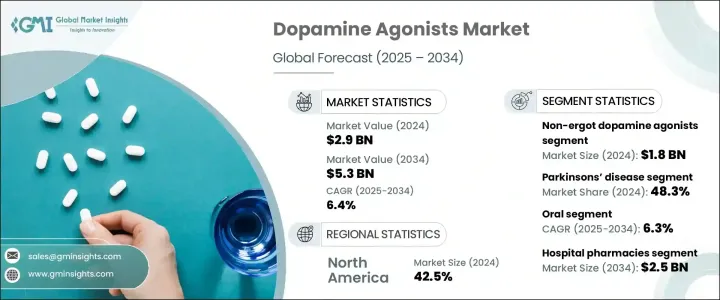

2024 年全球多巴胺激动剂市场价值为 29 亿美元,预计到 2034 年将以 6.4% 的复合年增长率成长,达到 53 亿美元。这种稳定的成长反映了对先进神经系统疗法日益增长的需求,而推动这一需求的因素是全球帕金森氏症和不安腿症候群 (RLS) 等神经退化性疾病的激增。由于人口老化、久坐的生活方式和压力水平升高,神经系统疾病变得越来越普遍,医疗保健提供者更加重视早期发现和介入。

随着患者对可用治疗方案的了解越来越多,诊断率也在上升,患者能够比以前更快地接受有效的药物治疗。同时,医药创新持续推动市场向前发展。公司正在积极投资具有卓越疗效和更少副作用的下一代多巴胺激动剂。透皮贴片和缓释片等药物传递系统的改进正在改变治疗体验并提高药物依从性。无论是在已开发经济体还是新兴经济体,不断增长的医疗保健投资和技术进步正在重塑神经系统疾病的治疗格局,为多巴胺激动剂领域的持续市场成长创造有利条件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 6.4% |

非麦角多巴胺激动剂在 2024 年创造了 18 亿美元的销售额,成为该治疗领域的主导药物类别。与传统的麦角类药物相比,临床医生现在更喜欢这些药物,因为它们更安全,而且心血管和纤维化併发症的风险显着降低。每日一次给药的便利性和使用者友善的透皮应用的可用性也促使更多患者选择非麦角替代品。製药公司正大力投入研发,以开发耐受性更好、长期效益更高的创新化合物。随着这些改进的治疗方案变得越来越普及,医生越来越多地推荐它们作为第一线疗法,这增加了处方量并改善了主要市场的患者治疗效果。

2024 年,帕金森氏症领域占据了整体市场的 48.3%,继续保持多巴胺激动剂最大应用领域的地位。鑑于帕金森氏症是全球第二常见的神经退化性疾病,其发生率不断上升(尤其是在老年人群中),持续推动对有效治疗的巨大需求。在新兴国家,医疗服务可近性的提高、公共卫生政策的加强以及疾病意识的增强正在促进治疗的采用率的提高。药物开发商正专注于开发能够解决运动和非运动症状(如疲劳、睡眠障碍和忧郁)的新配方。这些创新有助于弥合帕金森氏症治疗领域的差距,进一步扩大市场潜力。

2024 年,美国多巴胺激动剂市场规模达到 11 亿美元,这得益于强大的医疗保健基础设施和广泛的专业神经病学护理。市场受益于药物研究的不断创新和加速药物审批的支持性监管环境。人工智慧和先进影像技术的融合使得早期检测变得更加普遍,而宣传活动则鼓励主动进行神经系统筛检。这些努力正在推动全国患者获得更及时的诊断和更好的临床结果。

包括 Adamas Pharma、Sunovion Pharmaceuticals、诺华、Teva Pharmaceutical Industries、辉瑞、AbbVie、UCB Pharma、勃林格殷格翰製药、Avvisto Therapeutics (VeroScience)、葛兰素史克 (GSK)、Bertek Pharmaceuticals (Mylantical)、Amneal Pharmaceticals、Amneal Pharmaceticals 和控股公司正在竞争中的顶级生产公司格局。这些公司正在将投资投入尖端多巴胺激动剂疗法、改进药物传输机制以及扩大其在高成长地区的业务。与生技公司和学术机构的策略合作伙伴关係正在加速研发管道,实现快速创新,并使这些参与者在全球多巴胺激动剂市场中取得长期成功。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 帕金森氏症和其他神经系统疾病的盛行率不断上升

- 药物开发和配方的进步

- 提高对神经系统疾病的认识和早期诊断

- 产业陷阱与挑战

- 监理挑战和新药审批延迟

- 来自替代疗法的竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类型,2021 - 2034 年

- 主要趋势

- 麦角多巴胺激动剂

- 非麦角类多巴胺激动剂

第六章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 帕金森氏症

- 不安腿症候群(RLS)

- 高催乳素血症

- 其他适应症

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 注射剂

- 其他给药途径

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 药局和零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Adamas Pharma

- Amneal Pharmaceuticals

- Avvisto Therapeutics (VeroScience)

- Boehringer Ingelheim Pharmaceuticals

- Bertek Pharmaceuticals (Mylan)

- GlaxoSmithKline (GSK)

- Kirin Holdings Company

- Novartis

- Pfizer

- Sunovion Pharmaceuticals

- Teva Pharmaceutical Industries

- UCB Pharma

The Global Dopamine Agonists Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 5.3 billion by 2034. This steady growth reflects the increasing demand for advanced neurological therapies, driven by a global surge in neurodegenerative conditions like Parkinson's disease and restless legs syndrome (RLS). With neurological disorders becoming more common due to aging populations, sedentary lifestyles, and heightened stress levels, healthcare providers are placing greater emphasis on early detection and intervention.

As patients become more aware of available treatment options, diagnosis rates are rising, and patients are being placed on effective medication regimens sooner than before. In parallel, pharmaceutical innovation continues to drive the market forward. Companies are actively investing in next-generation dopamine agonists with superior efficacy and reduced side effects. Improvements in drug delivery systems, such as transdermal patches and extended-release tablets, are transforming treatment experiences and improving medication adherence. Across both developed and emerging economies, rising healthcare investments and technological advancements are reshaping the treatment landscape for neurological disorders, creating favorable conditions for sustained market growth in the dopamine agonists space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.4% |

Non-ergot dopamine agonists generated USD 1.8 billion in 2024, establishing themselves as the dominant drug class in this therapeutic area. Clinicians now prefer these over traditional ergot-based options due to their safer profiles and significantly lower risk of cardiovascular and fibrotic complications. The convenience of once-daily dosing and the availability of user-friendly transdermal applications are also pushing more patients toward non-ergot alternatives. Pharmaceutical companies are focusing heavily on R&D to develop innovative compounds that offer better tolerability and long-term benefits. As these improved options become more widely available, physicians are increasingly recommending them as first-line therapies, which is boosting prescription volumes and improving patient outcomes across key markets.

The Parkinson's disease segment held a 48.3% share of the overall market in 2024, maintaining its position as the largest application area for dopamine agonists. Given that Parkinson's is the second most prevalent neurodegenerative disorder worldwide, its rising incidence-especially among the elderly-continues to drive significant demand for effective treatments. In emerging countries, enhanced access to medical care, stronger public health policies, and increased disease awareness are contributing to higher treatment adoption. Drug developers are focusing on novel formulations that address both motor and non-motor symptoms, such as fatigue, sleep disturbances, and depression. These innovations are helping bridge therapeutic gaps in Parkinson's management, further amplifying market potential.

The U.S. Dopamine Agonists Market reached USD 1.1 billion in 2024, underpinned by robust healthcare infrastructure and widespread access to specialized neurology care. The market benefits from continuous innovation in pharmaceutical research and a supportive regulatory environment that accelerates drug approvals. The integration of AI and advanced imaging technologies is making early detection more common, while awareness campaigns encourage proactive neurological screenings. These efforts are driving more timely diagnoses and better clinical outcomes for patients nationwide.

Top pharmaceutical players, including Adamas Pharma, Sunovion Pharmaceuticals, Novartis, Teva Pharmaceutical Industries, Pfizer, AbbVie, UCB Pharma, Boehringer Ingelheim Pharmaceuticals, Avvisto Therapeutics (VeroScience), GlaxoSmithKline (GSK), Bertek Pharmaceuticals (Mylan), Amneal Pharmaceuticals, and Kirin Holdings Company, are actively reshaping the competitive landscape. These companies are channeling investments into cutting-edge dopamine agonist therapies, improving drug delivery mechanisms, and expanding their presence in high-growth regions. Strategic partnerships with biotech firms and academic institutions are accelerating R&D pipelines, enabling rapid innovation and positioning these players for long-term success in the global dopamine agonists market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of parkinson’s disease and other neurological disorders

- 3.2.1.2 Advancements in drug development and formulations

- 3.2.1.3 Growing awareness and early diagnosis of neurological disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and delay in approvals of new drugs

- 3.2.2.2 Competition from alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ergot dopamine agonists

- 5.3 Non-ergot dopamine agonists

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parkinson’s disease

- 6.3 Restless legs syndrome (RLS)

- 6.4 Hyperprolactinemia

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Drug store and retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Adamas Pharma

- 10.3 Amneal Pharmaceuticals

- 10.4 Avvisto Therapeutics (VeroScience)

- 10.5 Boehringer Ingelheim Pharmaceuticals

- 10.6 Bertek Pharmaceuticals (Mylan)

- 10.7 GlaxoSmithKline (GSK)

- 10.8 Kirin Holdings Company

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sunovion Pharmaceuticals

- 10.12 Teva Pharmaceutical Industries

- 10.13 UCB Pharma