|

市场调查报告书

商品编码

1721421

照明手术牵开器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lighted Surgical Retractor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

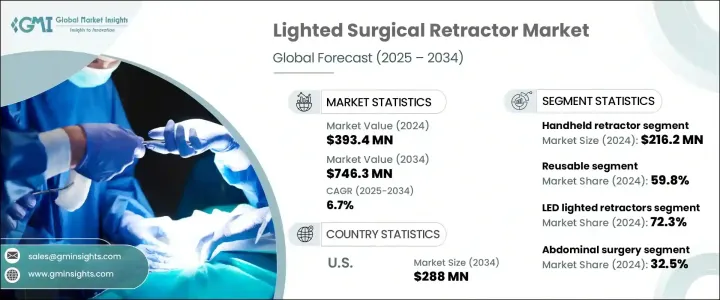

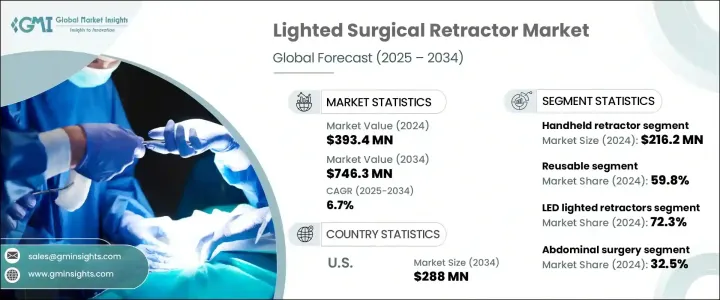

2024 年全球照明手术牵开器市场价值为 3.934 亿美元,预计到 2034 年将以 6.7% 的复合年增长率增长,达到 7.463 亿美元。随着旨在改善手术结果和降低手术风险的先进手术工具的日益普及,市场正在获得显着发展势头。带灯手术牵开器将组织牵开和照明功能集于一身,已成为现代手术室的必备工具。外科医生越来越依赖这些创新设备来提高深部和微创手术中的可视度,从而实现更高的精度和更短的手术时间。

随着手术过程的复杂性不断增加以及对更高手术效率的需求不断增长,全球的医疗保健提供者都在投资集功能性和易用性于一体的高性能手术器械。除了改善患者的治疗效果外,这些牵开器还简化了手术环境中的工作流程,使其成为当今医学进步不可或缺的一部分。微创手术的日益普及以及需要手术干预的慢性病的日益普及进一步推动了市场扩张。技术创新、优惠的报销结构以及对手术精准度的认识不断提高,共同促进了医院和门诊手术中心广泛采用带灯牵开器。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.934亿美元 |

| 预测值 | 7.463亿美元 |

| 复合年增长率 | 6.7% |

市场分为手持式和自保持式牵开器。手持式牵开器市场价值 2.162 亿美元,由于其轻量化设计、便携性和成本效益,正在实现显着成长。外科医生更喜欢手持式手术,因为它们具有灵活性和增强的照明能力,适用于从一般手术到高度专业化的干预等各种手术。这些牵开器易于操作且现场照明清晰,有助于提高准确性并减少併发症。

随着医疗机构继续优先考虑永续实践,可重复使用部分在 2024 年占据 59.8% 的份额。向可重复使用设备的转变得益于减少医疗保健相关浪费(尤其是一次性塑胶)和降低长期营运成本的需求。作为更广泛的绿色计划的一部分,医院和外科中心越来越多地投资可重复使用的发光牵开器,同时又不影响性能或安全性。

2024 年,美国照明手术牵开器市场占据了 90.2% 的主导份额。这一优势得益于技术的快速进步、对以患者为中心的护理的日益重视以及顶级公司和研究机构的持续支持。凭藉良好的监管框架和对医疗技术的持续投资,该国继续引领尖端手术工具(包括带灯牵引器)的开发和应用。

全球产业的主要参与者包括 Stryker、Medtronic、Millennium Surgical、Medline、Electro Surgical Instrument Company、Black & Black Surgical、Hayden Medical、Yasuico、Sunoptic Technologies、Carnegie Surgical 和 Cooper Surgical。这些公司专注于产品创新、研发以及与医疗保健提供者的策略合作伙伴关係,以提高绩效、扩大市场范围并满足日益增长的临床需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 微创手术的需求不断增加

- 慢性病盛行率不断上升

- 带灯手术牵开器的技术进步

- 产业陷阱与挑战

- 先进的带灯手术牵开器成本高昂

- 与维护和灭菌相关的挑战

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 手持式牵开器

- 自保持牵开器

第六章:市场估计与预测:按使用类型,2021 - 2034 年

- 一次性使用/抛弃式

- 可重复使用的

第七章:市场估计与预测:按光源,2021 - 2034 年

- 主要趋势

- LED照明牵开器

- 光纤牵开器

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 腹部手术

- 骨科手术

- 整型手术

- 妇科

- 神经外科

- 其他应用

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 专科诊所

- 医院

- 学术和研究机构

- 门诊手术中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Black and Black Surgical

- Carnegie Surgical

- Cooper Surgical

- Electro Surgical Instrument Company

- Hayden Medical

- June Medical

- Medline

- Medtronic

- Millennium Surgical

- Stryker

- Sunoptic Technologies

- Yasuico

The Global Lighted Surgical Retractor Market was valued at USD 393.4 million in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 746.3 million by 2034. The market is gaining significant momentum due to the rising adoption of advanced surgical tools designed to improve outcomes and reduce procedural risks. Lighted surgical retractors, which combine tissue retraction and illumination into a single device, have emerged as essential tools in modern operating rooms. Surgeons are increasingly relying on these innovative devices to enhance visibility during deep and minimally invasive procedures, allowing for greater precision and shorter operative times.

With increasing procedural complexity and growing demand for better surgical efficiency, healthcare providers across the globe are investing in high-performance surgical instruments that integrate functionality and ease of use. In addition to improving patient outcomes, these retractors are also streamlining workflows in surgical settings, making them an integral part of today's medical advancements. The growing trend toward minimally invasive surgeries and the increasing prevalence of chronic diseases requiring surgical intervention are further propelling market expansion. Technological innovations, favorable reimbursement structures, and heightened awareness of surgical precision are collectively contributing to the widespread adoption of lighted retractors in hospitals and ambulatory surgery centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $393.4 Million |

| Forecast Value | $746.3 Million |

| CAGR | 6.7% |

The market is divided into handheld and self-retaining retractors. The handheld retractor segment, valued at USD 216.2 million in 2024, is witnessing significant growth driven by its lightweight design, portability, and cost-efficiency. Surgeons prefer handheld options for their flexibility and enhanced lighting capabilities, making them suitable for a wide range of procedures, from general surgeries to highly specialized interventions. These retractors offer ease of maneuverability and clear site illumination, helping improve accuracy and reduce complications.

The reusable segment held a 59.8% share in 2024 as healthcare institutions continue prioritizing sustainable practices. The shift toward reusable devices is supported by the need to reduce healthcare-related waste, especially single-use plastics, and lower long-term operational costs. Hospitals and surgical centers are increasingly investing in reusable lighted retractors as a part of their broader green initiatives without compromising on performance or safety.

The U.S. Lighted Surgical Retractor Market accounted for a dominant 90.2% share in 2024. This stronghold is fueled by rapid technological progress, increased emphasis on patient-centric care, and consistent support from top-tier companies and research bodies. With favorable regulatory frameworks and ongoing investments in medical technology, the country continues to lead the development and adoption of cutting-edge surgical tools, including lighted retractors.

Key players in the global industry include Stryker, Medtronic, Millennium Surgical, Medline, Electro Surgical Instrument Company, Black & Black Surgical, Hayden Medical, Yasuico, Sunoptic Technologies, Carnegie Surgical, and Cooper Surgical. These companies are focusing on product innovation, research and development, and strategic partnerships with healthcare providers to enhance performance, expand market reach, and meet growing clinical demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for minimally invasive surgeries

- 3.2.1.2 Growing prevalence of chronic diseases

- 3.2.1.3 Technological advancements in lighted surgical retractors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced lighted surgical retractors

- 3.2.2.2 Challenges associated with maintenance and sterilization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Handheld retractors

- 5.3 Self-retaining retractors

Chapter 6 Market Estimates and Forecast, By Usage Type, 2021 - 2034 ($ Mn)

- 6.1 Single use / disposable

- 6.2 Reusable

Chapter 7 Market Estimates and Forecast, By Light Source, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 LED lighted retractors

- 7.3 Fiber optic retractors

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Abdominal surgery

- 8.2 Orthopedic surgery

- 8.3 Plastic surgery

- 8.4 Gynecology

- 8.5 Neurological surgery

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Specialty clinics

- 9.3 Hospitals

- 9.4 Academic and research institutes

- 9.5 Ambulatory surgical centers

- 9.6 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Black and Black Surgical

- 11.2 Carnegie Surgical

- 11.3 Cooper Surgical

- 11.4 Electro Surgical Instrument Company

- 11.5 Hayden Medical

- 11.6 June Medical

- 11.7 Medline

- 11.8 Medtronic

- 11.9 Millennium Surgical

- 11.10 Stryker

- 11.11 Sunoptic Technologies

- 11.12 Yasuico