|

市场调查报告书

商品编码

1721423

小分子 API 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Small Molecule API Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

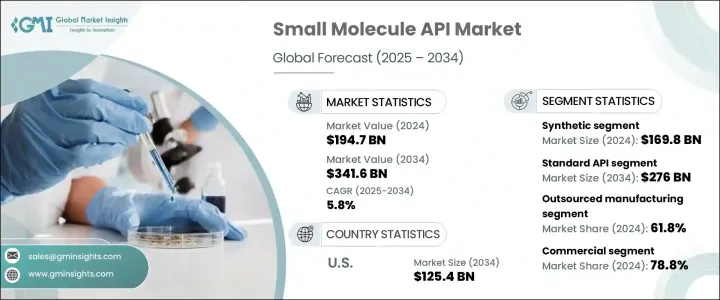

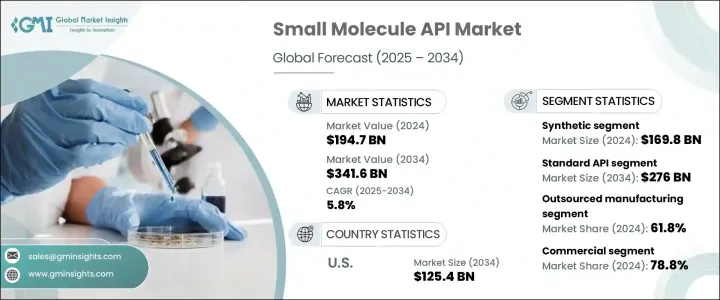

2024 年全球小分子 API 市场价值为 1,947 亿美元,预计到 2034 年将以 5.8% 的复合年增长率成长,达到 3,416 亿美元。小分子活性药物成分 (API) 因其易于配製、口服生物利用度高且製造工艺完善,继续在现代治疗中发挥关键作用。这些化合物具有低分子量的特点,容易穿透细胞膜,为多种疾病提供治疗效果。随着製药业越来越关注精准医疗和快速药物开发,小分子 API 重新引起了人们的兴趣。製药公司越来越多地利用人工智慧和高通量筛选工具来优化发现和开发过程。这些创新缩短了药物开发时间,提高了标靶效率,并显着降低了生产成本。此外,慢性病盛行率上升、人口老化以及对高性价比药物的需求不断增长等全球医疗保健趋势正在推动製药公司扩大 API 生产。主要市场的政府也积极推动仿製药的普及,为 API 製造创造良好的生态系统。对经济实惠、可扩展且有效的治疗方法的需求进一步推动 API 製造商投资于强大的基础设施、法规遵循和研发创新。

市场按类型细分为生物技术 API 和合成 API,其中合成类别在 2024 年创造 1,698 亿美元的产值。合成 API 因其可扩展性、可负担性和广谱治疗应用而占据主导地位。这些 API 透过化学合成生产,具有一致的品质和稳定性,因此在大规模生产过程中具有高度的可靠性。他们在感染、心血管疾病、代谢疾病等治疗领域的强大立足点使其成为全球药物製剂的中坚力量。由于医疗保健系统面临着以较低成本提供有效解决方案的压力,合成 API 正在应对这项挑战,确保大规模生产且不影响品质或效能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1947亿美元 |

| 预测值 | 3416亿美元 |

| 复合年增长率 | 5.8% |

根据效力,小分子 API 市场分为标准 API 和高效能 API(HPAPI)。标准 API 部分在 2024 年占据了 81.4% 的市场份额,预计到 2034 年将达到 2,760 亿美元。这些 API 对于製造仿製药至关重要,而仿製药占全球药品消费的很大一部分。它们的成本效益和对各种治疗类别(从疼痛管理到慢性病治疗)的适应性使製药公司能够维持广泛、有利可图的产品线。透过提供可负担性和治疗多样性,标准 API 可确保全球人口能够持续获得基本药物。

预计到 2034 年,美国小分子 API 市场规模将达到 1,254 亿美元。美国拥有先进的製药生态系统、强大的仿製药製造商网路以及支持加速药品审批的监管框架。医疗保健基础设施的持续投资、慢性病治疗需求的不断增长以及可负担药物取得的政策支持正在推动市场成长。

百时美施贵宝、庄信万丰、阿斯特捷利康、诺华、吉利德科学、默克、勃林格殷格翰、罗氏、梯瓦製药、葛兰素史克、Curia Global、巴斯夫、辉瑞、EUROAPI、南京康友生化製药等领先公司正在优先考虑扩大研发、开发先进的合成技术和人工智慧驱动的药物开发。许多公司正在寻求许可交易、收购和製造扩张,以扩大营运规模并拓宽治疗范围。随着企业努力加强全球供应链并满足不断增长的需求,监管合规性和永续性也处于首要地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 药物开发技术的进步

- 扩大仿製药和生物相似药市场

- 产业陷阱与挑战

- 製造成本高

- 严格的监管情景

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 合成的

- 生物技术

第六章:市场估计与预测:依效力,2021 年至 2034 年

- 主要趋势

- 标准 API

- 高效API

第七章:市场估计与预测:依製造类型,2021 年至 2034 年

- 主要趋势

- 内部

- 外包

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 临床

- 商业的

第九章:市场估计与预测:按治疗领域,2021 年至 2034 年

- 主要趋势

- 心血管

- 肿瘤学

- 中枢神经系统和神经病学

- 骨科

- 内分泌学

- 肺部疾病学

- 胃肠病学

- 肾臟病学

- 眼科

- 其他治疗领域

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製药公司

- 生技公司

- 合约开发与製造组织 (CDMO)

- 其他最终用户

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- AstraZeneca

- BASF

- Boehringer Ingelheim

- Bristol-Myers

- Curia Global

- EUROAPI

- GILEAD Sciences

- GlaxoSmithKline

- Hoffmann-La Roche

- Johnson Matthey

- Merck

- Nanjing King-Friend Biochemical Pharmaceutical

- Novartis

- Pfizer

- Teva Pharmaceuticals

The Global Small Molecule API Market was valued at USD 194.7 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 341.6 billion by 2034. Small molecule active pharmaceutical ingredients (APIs) continue to play a pivotal role in modern therapeutics due to their ease of formulation, oral bioavailability, and well-established manufacturing processes. These compounds, characterized by low molecular weight, easily penetrate cell membranes to deliver therapeutic benefits across a wide range of diseases. As the pharmaceutical industry intensifies its focus on precision medicine and rapid drug development, small molecule APIs are witnessing renewed interest. Pharmaceutical companies are increasingly leveraging artificial intelligence and high-throughput screening tools to optimize discovery and development processes. These innovations have shortened drug development timelines, improved targeting efficiency, and significantly reduced production costs. Additionally, global healthcare trends such as the increasing prevalence of chronic diseases, aging populations, and rising demand for cost-effective drugs are pushing pharmaceutical firms to scale up API production. Governments across key markets are also actively promoting generic drug availability, creating a favorable ecosystem for API manufacturing. The need for affordable, scalable, and effective treatments is further driving API manufacturers to invest in robust infrastructure, regulatory compliance, and R&D innovation.

The market is segmented by type into biotech and synthetic APIs, with the synthetic category generating USD 169.8 billion in 2024. Synthetic APIs dominate the landscape due to their scalability, affordability, and broad-spectrum therapeutic applications. Produced through chemical synthesis, these APIs offer consistent quality and stability, making them highly reliable during mass production. Their strong foothold in treatments for infections, cardiovascular diseases, metabolic conditions, and more has positioned them as the backbone of global pharmaceutical formulations. With healthcare systems under pressure to deliver effective solutions at lower costs, synthetic APIs are meeting the challenge by ensuring large-scale production without compromising on quality or efficacy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $194.7 Billion |

| Forecast Value | $341.6 Billion |

| CAGR | 5.8% |

Based on potency, the small molecule API market is divided into standard APIs and high potency APIs (HPAPIs). The standard API segment held an 81.4% market share in 2024 and is forecasted to reach USD 276 billion by 2034. These APIs are crucial for manufacturing generic medications, which account for a significant portion of global drug consumption. Their cost-effective nature and adaptability across various therapeutic categories-from pain management to chronic disease treatment-allow pharmaceutical companies to maintain broad, profitable product pipelines. By delivering affordability and therapeutic versatility, standard APIs are ensuring consistent access to essential medications for global populations.

The U.S. Small Molecule API Market is projected to reach USD 125.4 billion by 2034. The country benefits from an advanced pharmaceutical ecosystem, a robust network of generic drug manufacturers, and a regulatory framework that supports accelerated drug approvals. Ongoing investments in healthcare infrastructure, rising demand for chronic illness treatments, and policy support for affordable medication access are propelling market growth.

Leading companies such as Bristol-Myers, Johnson Matthey, AstraZeneca, Novartis, GILEAD Sciences, Merck, Boehringer Ingelheim, Hoffmann-La Roche, Teva Pharmaceuticals, GlaxoSmithKline, Curia Global, BASF, Pfizer, EUROAPI, and Nanjing King-Friend Biochemical Pharmaceutical are prioritizing R&D expansion, advanced synthesis technologies, and AI-powered drug development. Many are pursuing licensing deals, acquisitions, and manufacturing expansions to scale operations and broaden therapeutic offerings. Regulatory compliance and sustainability are also at the forefront as companies strive to enhance global supply chains and meet escalating demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Advancements in drug development technologies

- 3.2.1.3 Expanding generic and biosimilar market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biotech

Chapter 6 Market Estimates and Forecast, By Potency, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standard API

- 6.3 HPAPI

Chapter 7 Market Estimates and Forecast, By Manufacturing Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-house

- 7.3 Outsourced

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Clinical

- 8.3 Commercial

Chapter 9 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cardiovascular

- 9.3 Oncology

- 9.4 CNS and Neurology

- 9.5 Orthopedic

- 9.6 Endocrinology

- 9.7 Pulmonology

- 9.8 Gastroenterology

- 9.9 Nephrology

- 9.10 Ophthalmology

- 9.11 Other therapeutic areas

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Pharmaceutical companies

- 10.3 Biotechnology companies

- 10.4 Contract development and manufacturing organizations (CDMOs)

- 10.5 Other end users

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AstraZeneca

- 12.2 BASF

- 12.3 Boehringer Ingelheim

- 12.4 Bristol-Myers

- 12.5 Curia Global

- 12.6 EUROAPI

- 12.7 GILEAD Sciences

- 12.8 GlaxoSmithKline

- 12.9 Hoffmann-La Roche

- 12.10 Johnson Matthey

- 12.11 Merck

- 12.12 Nanjing King-Friend Biochemical Pharmaceutical

- 12.13 Novartis

- 12.14 Pfizer

- 12.15 Teva Pharmaceuticals