|

市场调查报告书

商品编码

1721424

汽车清洗系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Washer Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

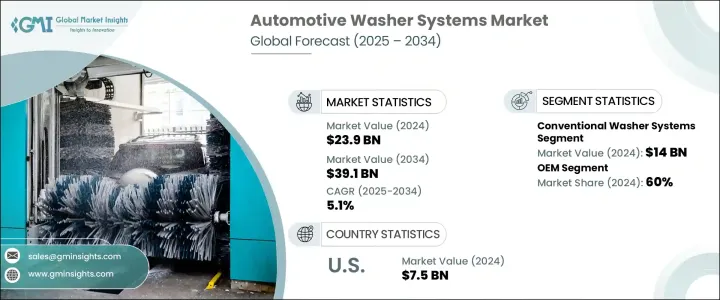

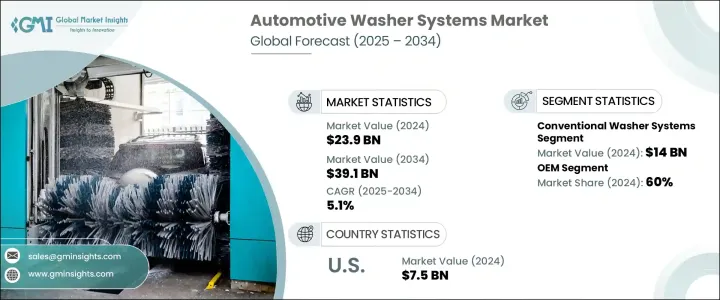

2024 年全球汽车清洗系统市场价值为 239 亿美元,预计到 2034 年将以 5.1% 的复合年增长率成长,达到 391 亿美元。随着汽车格局的快速转变,清洗系统市场在全球范围内获得了巨大的发展动力。车主和製造商都越来越关注定期维护和清晰可见性对于最佳驾驶安全的重要性。清洗系统已经从简单的清洁工具发展成为整合到现代车辆的复杂解决方案。智慧感测器清洁系统的整合、与先进驾驶辅助系统(ADAS) 的兼容性以及向电动和自动驾驶汽车的转变共同加速了对更高效和创新的清洗系统的需求。政府对车辆安全和可视性的监管进一步支持了这一需求,尤其是在天气条件恶劣的地区。随着汽车製造商继续优先考虑安全性、性能和舒适性,清洗系统对于确保摄影机和感测器的畅通运作变得至关重要,尤其是在下一代汽车中。

2024 年,传统清洗系统领域将引领市场,创造 140 亿美元的收入。该领域的领先地位源于传统系统因其简单、可靠和成本效益而被广泛采用。这些系统采用机械驱动和标准流体喷嘴设计,为乘用车和商用车领域提供简单且经济实惠的解决方案。汽车製造商通常青睐这些清洗系统,因为它们具有经过验证的性能,并且易于整合到现有的车辆设计中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 239亿美元 |

| 预测值 | 391亿美元 |

| 复合年增长率 | 5.1% |

市场按销售管道细分为OEM和售后市场,其中OEM市场在 2024 年将占据 60% 的份额。这种主导地位主要归因于主要经济体的汽车产量不断增长以及对工厂安装的清洗技术的需求不断增加。製造商正在为新车型配备头灯清洗器、先进的挡风玻璃清洁系统和 ADAS 相容技术,以提高可视性、支援感测器精度并满足全球安全标准。

光是美国汽车清洗系统市场在 2024 年就创造了 75 亿美元的收入,凸显了其作为主要收入来源的重要性。受汽车产量高、配备 ADAS 的汽车和电动车激增以及汽车安全法规的严格推动,美国的需求持续成长。这些因素促使原始设备製造商整合创新的清洗技术,以确保无论环境条件如何,感测器和车载摄影机等关键系统都能不间断运作。

影响全球汽车清洗系统市场的关键参与者包括法雷奥集团、Trico、士林电机、麦格纳、三叶、罗伯特博世、海拉、考泰斯德事隆、电装和大陆集团。这些公司专注于透过高压喷嘴、高效能流体系统和智慧感测器清洁机制开发先进的清洗解决方案。透过投资研发并与汽车製造商建立策略合作伙伴关係,这些製造商正在增强其在不断发展的汽车领域中的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 增加汽车产量和销售

- 严格的安全和能见度规定

- 与 ADAS 和智慧车辆技术的集成

- 环保高效洗涤液的进步

- 产业陷阱与挑战

- 智慧洗衣机系统初始成本高

- 电动和自动驾驶汽车的兼容性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 传统清洗系统

- 雨量感应清洗系统

- 加热清洗系统

第六章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 商用车

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 雨刷片

- 泵浦

- 喷嘴

- 软管和连接器

- 水库

第八章:市场估计与预测:按销售管道 2021 - 2034

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Asmo

- Bowles Fluidics

- Continental

- Denso

- Doga

- DOGA

- Exo-S

- Federal-Mogul

- HELLA

- ITW

- Kautex Textron

- Magna

- Mergon

- Mitsuba

- Mitsubishi

- PIAA

- Robert Bosch

- Shihlin Electric

- Trico

- Valeo SA

The Global Automotive Washer Systems Market was valued at USD 23.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 39.1 billion by 2034. With the automotive landscape undergoing rapid transformation, the market for washer systems is gaining substantial traction worldwide. Vehicle owners and manufacturers alike are becoming increasingly attentive to the importance of regular maintenance and clear visibility for optimal driving safety. Washer systems have evolved from simple cleaning tools to sophisticated solutions integrated into modern vehicles. The integration of smart sensor-cleaning systems, compatibility with advanced driver assistance systems (ADAS), and the shift toward electric and autonomous vehicles are collectively accelerating the need for more efficient and innovative washer systems. This demand is further supported by government regulations focusing on vehicle safety and visibility, especially in regions with harsh weather conditions. As carmakers continue to prioritize safety, performance, and comfort, washer systems are becoming essential for ensuring unimpeded camera and sensor operation, particularly in next-generation vehicles.

In 2024, the conventional washer systems segment led the market, generating USD 14 billion in revenue. This segment's leadership stems from the wide-scale adoption of traditional systems due to their simplicity, reliability, and cost-effectiveness. Designed with mechanical activation and standard fluid nozzles, these systems offer a straightforward and budget-friendly solution for both passenger and commercial vehicle segments. Automakers often favor these washer systems for their proven performance and ease of integration into existing vehicle designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $39.1 Billion |

| CAGR | 5.1% |

The market is segmented by sales channels into OEM and aftermarket, with the OEM segment capturing a 60% share in 2024. This dominance is primarily due to the rising volume of vehicle production across major economies and the increasing demand for factory-installed washer technologies. Manufacturers are equipping new models with headlight washers, advanced windshield cleaning systems, and ADAS-compatible technologies to enhance visibility, support sensor accuracy, and meet global safety standards.

The U.S. Automotive Washer Systems Market alone generated USD 7.5 billion in 2024, underlining its significance as a key revenue contributor. Demand in the U.S. continues to grow, driven by high vehicle production levels, a surge in ADAS-equipped and electric vehicles, and stringent regulations around automotive safety. These factors are pushing OEMs to integrate innovative washer technologies that ensure uninterrupted operation of critical systems such as sensors and onboard cameras, regardless of environmental conditions.

Key players shaping the Global Automotive Washer Systems Market include Valeo SA, Trico, Shihlin Electric, Magna, Mitsuba, Robert Bosch, HELLA, Kautex Textron, Denso, and Continental. These companies are focused on developing advanced washer solutions through high-pressure nozzles, fluid-efficient systems, and smart sensor-cleaning mechanisms. By investing in R&D and forming strategic partnerships with automakers, these manufacturers are enhancing their presence in the evolving automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing vehicle production & sales

- 3.7.1.2 Stringent safety & visibility regulations

- 3.7.1.3 Integration with ADAS & smart vehicle technologies

- 3.7.1.4 Advancements in eco-friendly & efficient washer fluids

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs for smart washer systems

- 3.7.2.2 Compatibility issues with electric & autonomous vehicles

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Conventional washer systems

- 5.3 Rain-sensing washer systems

- 5.4 Heated washer systems

Chapter 6 Market Estimates & Forecast, By Vehicle Type, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Wiper blades

- 7.3 Pumps

- 7.4 Nozzles

- 7.5 Hoses & connectors

- 7.6 Reservoirs

Chapter 8 Market Estimates & Forecast, By Sale Channel 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Asmo

- 10.2 Bowles Fluidics

- 10.3 Continental

- 10.4 Denso

- 10.5 Doga

- 10.6 DOGA

- 10.7 Exo-S

- 10.8 Federal-Mogul

- 10.9 HELLA

- 10.10 ITW

- 10.11 Kautex Textron

- 10.12 Magna

- 10.13 Mergon

- 10.14 Mitsuba

- 10.15 Mitsubishi

- 10.16 PIAA

- 10.17 Robert Bosch

- 10.18 Shihlin Electric

- 10.19 Trico

- 10.20 Valeo SA