|

市场调查报告书

商品编码

1721425

吸入式一氧化氮输送系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Inhaled Nitric Oxide Delivery System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

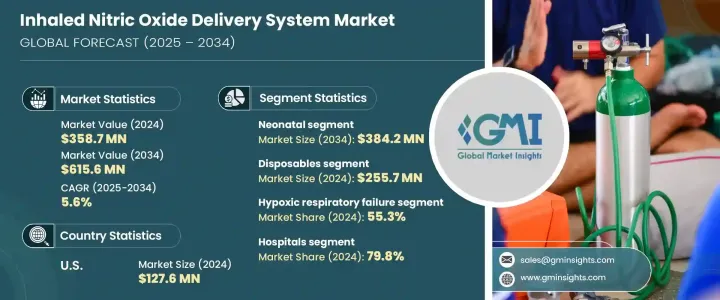

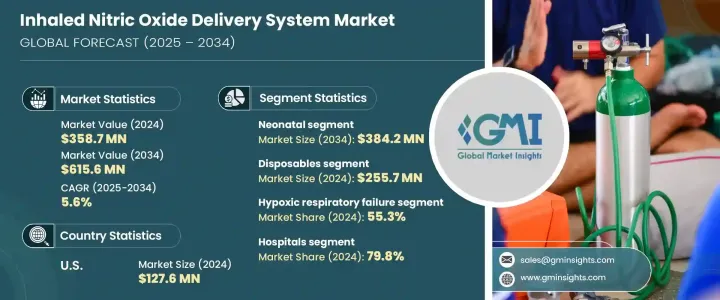

2024 年全球吸入式一氧化氮输送系统市值为 3.587 亿美元,预计到 2034 年将以 5.6% 的复合年增长率增长至 6.156 亿美元。随着急性呼吸窘迫症候群 (ARDS)、持续性肺动脉高压和缺氧呼吸衰竭等呼吸道疾病在各个年龄层中持续增加,市场正在经历显着增长。吸入一氧化氮 (iNO) 因其血管扩张作用而成为一种重要的治疗选择,有助于改善氧合併减少对更具侵入性呼吸支持的需求。无论在已开发地区或发展中地区,呼吸系统疾病的负担日益加重,这迫使医疗机构采用安全、有效且经济高效的先进治疗方式。随着呼吸护理中对精准和非侵入性治疗的日益重视,吸入式一氧化氮系统正成为新生儿加护病房 (NICU)、儿科重症监护病房和成人重症监护环境的首选。此外,医疗保健基础设施的增强以及对早期诊断和介入的日益重视,导致全球吸入式一氧化氮输送系统的采用率更高。越来越多的临床研究验证了 iNO 疗法的疗效,监管部门批准了创新输送设备,治疗肺部併发症的个人化医疗也随之转变,这进一步支持了市场的成长。

市场按年龄组细分,包括新生儿、儿科和成人类别。其中,新生儿领域表现突出,2024 年估值达到 2.212 亿美元,预计到 2034 年将成长至 3.842 亿美元。这一增长是由于新生儿呼吸窘迫发病率不断上升,尤其是早产儿。经常采用吸入式一氧化氮疗法来改善肺功能并减少体外生命维持的需要。早产率的上升,加上新兴经济体新生儿护理技术的进步和新生儿加护病房设施的改善,进一步加速了这一领域的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.587亿美元 |

| 预测值 | 6.156亿美元 |

| 复合年增长率 | 5.6% |

在应用方面,缺氧呼吸衰竭在 2024 年占据最大的市场份额,为 55.3%,预计到 2034 年将以 4.7% 的复合年增长率成长。这种疾病在新生儿和儿科患者中很常见,与体外膜氧合 (ECMO) 等侵入性手术相比,吸入一氧化氮提供了更容易获得且更具成本效益的治疗选择。它的易用性、最小的副作用以及在重症监护情况下的积极效果使其在儿科和新生儿环境中受到青睐。

2024 年美国吸入式一氧化氮输送系统市场价值为 1.276 亿美元,并将持续稳定扩张。新生儿 ARDS 病例不断增加,加上人们对其的高度认识以及先进呼吸护理基础设施的可用性,支持了强劲的市场成长。在医院和新生儿重症监护室 (NICU) 环境中的广泛应用凸显了该国在该领域的领导地位。

影响全球吸入式一氧化氮输送系统格局的主要参与者包括默克公司、液化空气医疗集团、林德、Bellerophon Therapeutics、Getinge、Beyond Air、普莱克斯、百特国际、Mallinckrodt Pharmaceuticals、Circassia Pharmaceuticals、EKU Elektronik、VEROtech、International Biomedical、MEDS、MED、MED、A 或 Biotechn Plus BioMNU。这些公司正在透过开发下一代交付系统、扩大其地理覆盖范围和建立策略联盟来优先进行创新。他们的重点仍然是透过与医疗机构和研究机构的合作来提高治疗效率、改善患者治疗效果并探索监管途径。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 呼吸系统疾病盛行率上升

- 吸入式一氧化氮输送系统的技术进步

- 提高医疗专业人员和患者的意识

- 产业陷阱与挑战

- 吸入一氧化氮疗法成本高昂

- 存在严格的规定

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 专利分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 新生儿

- 儿科

- 成人

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 缺氧性呼吸衰竭

- 急性低氧血症性呼吸衰竭

- 其他应用

第七章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 免洗用品

- 系统

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊中心

- 诊所

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Air Liquide Healthcare

- Baxter International

- Bellerophon Therapeutics

- Beyond Air

- Circassia Pharmaceuticals

- EKU Elektronik

- Getinge

- International Biomedical

- Linde

- Mallinckrodt Pharmaceuticals

- Merck KGaA

- NU-MED Plus

- Praxair

- SLE

- VERO Biotech

The Global Inhaled Nitric Oxide Delivery System Market was valued at USD 358.7 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 615.6 million by 2034. The market is witnessing notable growth as respiratory conditions like acute respiratory distress syndrome (ARDS), persistent pulmonary hypertension, and hypoxic respiratory failure continue to rise across various age groups. Inhaled nitric oxide (iNO) has emerged as a vital therapeutic option due to its vasodilatory effects, helping improve oxygenation and reducing the need for more invasive respiratory support. The increasing burden of respiratory illnesses, both in developed and developing regions, is pushing healthcare facilities to adopt advanced treatment modalities that are safe, effective, and cost-efficient. With the growing emphasis on precision and non-invasive therapies in respiratory care, inhaled nitric oxide systems are becoming a preferred choice across neonatal intensive care units (NICUs), pediatric ICUs, and adult critical care settings. Additionally, enhanced access to healthcare infrastructure and an increasing focus on early diagnosis and intervention have led to higher adoption of inhaled nitric oxide delivery systems globally. The market's growth is further supported by the rising number of clinical studies validating the efficacy of iNO therapy, regulatory approvals for innovative delivery devices, and a shift toward personalized medicine in treating pulmonary complications.

The market is segmented by age groups, including neonatal, pediatric, and adult categories. Among these, the neonatal segment stood out prominently, reaching a valuation of USD 221.2 million in 2024 and projected to grow to USD 384.2 million by 2034. This growth is fueled by the rising incidence of neonatal respiratory distress, especially among premature newborns. Inhaled nitric oxide therapy is frequently administered to improve pulmonary function and reduce the need for extracorporeal life support. The increasing rate of preterm births, combined with advancements in neonatal care technology and improved NICU facilities in emerging economies, is further accelerating demand within this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $358.7 Million |

| Forecast Value | $615.6 Million |

| CAGR | 5.6% |

In terms of application, hypoxic respiratory failure held the largest market share at 55.3% in 2024 and is expected to grow at a CAGR of 4.7% through 2034. This condition is commonly seen in both neonatal and pediatric patients and inhaled nitric oxide offers a more accessible and cost-effective treatment option compared to invasive procedures like extracorporeal membrane oxygenation (ECMO). Its ease of use, minimal side effects, and positive outcomes in critical care scenarios are driving its preference across pediatric and neonatal settings.

The U.S. Inhaled Nitric Oxide Delivery System Market was valued at USD 127.6 million in 2024 and continues to expand steadily. The growing number of ARDS cases among newborns, coupled with high awareness and availability of advanced respiratory care infrastructure, supports strong market uptake. Widespread adoption across hospital and NICU environments underscores the country's leadership in this space.

Key players shaping the global inhaled nitric oxide delivery system landscape include Merck KGaA, Air Liquide Healthcare, Linde, Bellerophon Therapeutics, Getinge, Beyond Air, Praxair, Baxter International, Mallinckrodt Pharmaceuticals, Circassia Pharmaceuticals, EKU Elektronik, VERO Biotech, International Biomedical, SLE, and NU-MED Plus. These companies are prioritizing innovation through the development of next-generation delivery systems, expanding their geographic footprint, and forming strategic alliances. Their focus remains on enhancing therapy efficiency, improving patient outcomes, and navigating regulatory pathways through collaborations with healthcare institutions and research bodies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of respiratory diseases

- 3.2.1.2 Technological advancements in inhaled nitric oxide delivery systems

- 3.2.1.3 Increased awareness among healthcare professionals and patients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with inhaled nitric oxide therapy

- 3.2.2.2 Presence of stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Patent analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Neonatal

- 5.3 Pediatric

- 5.4 Adult

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hypoxic respiratory failure

- 6.3 Acute hypoxemic respiratory failure

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Disposables

- 7.3 System

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory centers

- 8.4 Clinics

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Air Liquide Healthcare

- 10.2 Baxter International

- 10.3 Bellerophon Therapeutics

- 10.4 Beyond Air

- 10.5 Circassia Pharmaceuticals

- 10.6 EKU Elektronik

- 10.7 Getinge

- 10.8 International Biomedical

- 10.9 Linde

- 10.10 Mallinckrodt Pharmaceuticals

- 10.11 Merck KGaA

- 10.12 NU-MED Plus

- 10.13 Praxair

- 10.14 SLE

- 10.15 VERO Biotech