|

市场调查报告书

商品编码

1721428

非 MEMS 感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Non-MEMS Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

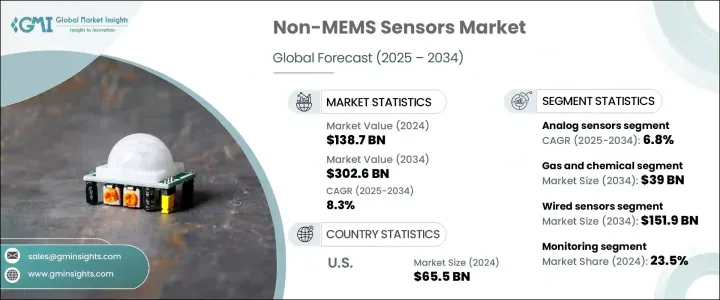

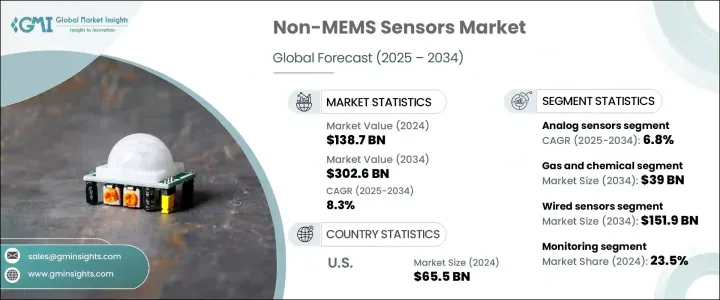

2024 年全球非 MEMS 感测器市场价值为 1,387 亿美元,预计到 2034 年将以 8.3% 的复合年增长率成长,达到 3,026 亿美元。受汽车、医疗保健、工业和环境监测等关键领域对高精度感测器的广泛需求的推动,市场呈上升趋势。随着全球向自动化、电气化和数位健康的转变不断加强,非 MEMS 感测器在支援下一代技术中的作用变得越来越重要。这些感测器现在是变革性创新的核心,从自动驾驶汽车到智慧医疗设备,实现即时资料处理、安全性增强和营运效率。企业优先考虑先进的感测能力以获得竞争优势,促使製造商大力投资研发并扩大生产能力。工业 4.0、智慧城市和永续能源基础设施的兴起进一步加强了对强大、可靠和特定应用的感测器技术的需求。随着终端用户应用范围的不断扩大,全球非 MEMS 感测器市场预计将在未来十年见证重大的技术变革和业务扩张。

这一成长主要得益于汽车产业的不断扩张以及医疗穿戴式装置和数位医疗技术的日益普及。对高级驾驶辅助系统 (ADAS)、自动驾驶汽车和电动车的需求不断增长,大大增加了对非 MEMS 感测器(如雷射雷达、雷达、光学和压力感测器)的需求,这些感测器可以提高车辆的安全性和导航能力。在医疗保健领域,远端病人监控的激增和慢性病的日益普及推动了对非侵入性健康监测设备中使用的生物感测器、红外线感测器和光学感测器的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1387亿美元 |

| 预测值 | 3026亿美元 |

| 复合年增长率 | 8.3% |

市场根据技术分为类比感测器和数位感测器。到 2034 年,模拟感测器预计将以 6.8% 的复合年增长率成长,因为它们在需要精确资料收集的应用中仍然至关重要。由于它们在恶劣条件下稳定可靠,且无需复杂的讯号处理,因此广泛应用于工业自动化、温度控制和压力测量。就感测器类型而言,市场包括声学、气体和化学、运动和位置、光学、压力和温度感测器。预计到 2034 年,气体和化学感测器的市场规模将达到 390 亿美元,这得益于它们在工业安全、环境监测和医疗保健领域发挥的关键作用。严格的环境法规和对工作场所安全的关注正在推动这些领域先进的感测技术。

2024 年,美国非 MEMS 感测器市场规模达到 655 亿美元,反映了医疗保健产业的成长和医疗技术的进步所推动的强劲需求。远端病人监控、数位健康解决方案和穿戴式装置的日益普及,增加了对支援这些创新的高精度感测器的需求。

全球非 MEMS 感测器市场的主要参与者包括德州仪器、霍尼韦尔、ADI 公司、TE Connectivity 和英飞凌。公司采取的关键策略包括专注于技术创新以开发先进的感测器解决方案、投资研发以增强感测器性能以及扩大其产品组合以满足不同的行业需求。公司也正在建立策略伙伴关係和合作关係,以加强其市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 消费性电子产品对智慧感测器的需求不断增长

- 汽车产业扩张

- 工业4.0和智慧製造的扩展

- 医疗穿戴式装置和数位医疗应用的成长

- 航太和国防领域越来越多地使用先进感测器

- 产业陷阱与挑战

- 先进感测器成本高昂

- 与遗留系统的复杂集成

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按感测器类型,2021-2034

- 主要趋势

- 声学感测器

- 气体和化学感测器

- 运动和位置感测器

- 光学感测器

- 压力感测器

- 温度感测器

- 其他的

第六章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 类比感测器

- 数位感测器

第七章:市场估计与预测:依连结性,2021-2034

- 主要趋势

- 有线感应器

- 无线感测器

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 监控

- 导航定位

- 安全与保障

- 监视与侦测

- 追踪和资产管理

- 其他的

第九章:市场估计与预测:依最终用途产业,2021-2034 年

- 主要趋势

- 航太与国防

- 汽车与运输

- 消费性电子产品

- 能源与公用事业

- 卫生保健

- 工业和製造业

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Allegro Microsystems

- AMS-Osram

- Analog Devices

- Honeywell International

- Infineon Technologies

- Keyence

- Murata Manufacturing

- OmniVision Technologies

- Omron

- Panasonic

- Sensirion

- SICK

- TE Connectivity

- Texas Instruments

- XJCSensor

The Global Non-MEMS Sensors Market was valued at USD 138.7 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 302.6 billion by 2034. The market is on an upward trajectory, driven by the widespread demand for high-precision sensors across key sectors such as automotive, healthcare, industrial, and environmental monitoring. As the global shift toward automation, electrification, and digital health intensifies, the role of non-MEMS sensors in enabling next-gen technologies has become increasingly critical. These sensors are now at the core of transformative innovations, from self-driving cars to intelligent medical devices, enabling real-time data processing, safety enhancement, and operational efficiency. Businesses are prioritizing advanced sensing capabilities to gain competitive advantages, prompting manufacturers to invest heavily in R&D and scale their production capabilities. The rise of Industry 4.0, smart cities, and sustainable energy infrastructure further reinforces the demand for robust, reliable, and application-specific sensor technologies. With an ever-expanding scope of end-user applications, the global non-MEMS sensors market is expected to witness significant technological evolution and business expansion over the coming decade.

This growth is primarily fueled by the expanding automotive sector and the rising adoption of medical wearables and digital healthcare technologies. The increasing demand for advanced driver-assistance systems (ADAS), autonomous vehicles, and electric cars has significantly boosted the need for non-MEMS sensors like LiDAR, radar, optical, and pressure sensors, which enhance vehicle safety and navigation. In the healthcare sector, the surge in remote patient monitoring and the growing prevalence of chronic diseases has driven the demand for biosensors, infrared sensors, and optical sensors used in non-invasive health monitoring devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $138.7 Billion |

| Forecast Value | $302.6 Billion |

| CAGR | 8.3% |

The market is segmented by technology into analog and digital sensors. Analog sensors are projected to grow at a CAGR of 6.8% by 2034, as they remain crucial in applications requiring precise data collection. They are widely used in industrial automation, temperature control, and pressure measurement due to their stability and reliability in harsh conditions without complex signal processing. In terms of sensor types, the market includes acoustic, gas and chemical, motion and position, optical, pressure, and temperature sensors. Gas and chemical sensors are expected to reach USD 39 billion by 2034, driven by their critical role in industrial safety, environmental monitoring, and healthcare. The stringent environmental regulations and the focus on workplace safety are pushing for advanced sensing technologies in these areas.

U.S. Non-MEMS Sensors Market generated USD 65.5 billion in 2024, reflecting strong demand driven by the healthcare sector's growth and advancements in medical technology. The increasing adoption of remote patient monitoring, digital health solutions, and wearable devices has escalated the need for high-precision sensors to support these innovations.

Key players in the Global Non-MEMS Sensors Market include Texas Instruments, Honeywell, Analog Devices, TE Connectivity, and Infineon. Key strategies adopted by companies include focusing on technological innovation to develop advanced sensor solutions, investing in research and development for enhanced sensor performance, and expanding their product portfolios to meet diverse industry needs. Companies are also forming strategic partnerships and collaborations to strengthen their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for smart sensors in consumer electronics

- 3.2.1.2 Expansion of automotive industry

- 3.2.1.3 Expansion of industry 4.0 and smart manufacturing

- 3.2.1.4 Growth in medical wearables and digital healthcare adoption

- 3.2.1.5 Increasing use of advanced sensors in aerospace & defense

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced sensors

- 3.2.2.2 Complex integration with legacy systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Acoustic sensor

- 5.3 Gas & chemical sensor

- 5.4 Motion & position sensor

- 5.5 Optical sensor

- 5.6 Pressure sensor

- 5.7 Temperature sensor

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Analog sensors

- 6.3 Digital sensors

Chapter 7 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Wired sensors

- 7.3 Wireless sensors

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Monitoring

- 8.3 Navigation & positioning

- 8.4 Safety & security

- 8.5 Surveillance & detection

- 8.6 Tracking & asset management

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.3 Automotive & transportation

- 9.4 Consumer electronics

- 9.5 Energy & utilities

- 9.6 Healthcare

- 9.7 Industrial & manufacturing

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Allegro Microsystems

- 11.2 AMS-Osram

- 11.3 Analog Devices

- 11.4 Honeywell International

- 11.5 Infineon Technologies

- 11.6 Keyence

- 11.7 Murata Manufacturing

- 11.8 OmniVision Technologies

- 11.9 Omron

- 11.10 Panasonic

- 11.11 Sensirion

- 11.12 SICK

- 11.13 TE Connectivity

- 11.14 Texas Instruments

- 11.15 XJCSensor