|

市场调查报告书

商品编码

1721434

发酵饮料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fermented Beverages Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

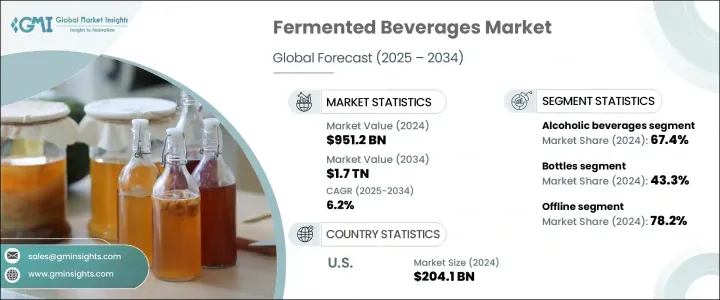

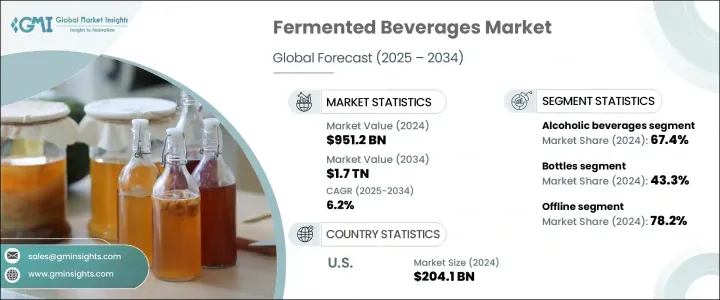

2024 年全球发酵饮料市场价值为 9,512 亿美元,预计到 2034 年将以 6.2% 的复合年增长率成长,达到 1.7 兆美元。随着消费者继续优先考虑功能性健康和肠道健康,发酵饮料在全球范围内迅速受到欢迎。这些饮料是透过控制微生物发酵和酵素过程开发出来的,天然富含益生菌、有机酸和支持消化和免疫健康的必需维生素。人们对清洁标籤成分的认识不断提高以及人们不再饮用含糖碳酸饮料,进一步加速了市场的发展势头。

随着健康趋势塑造消费者偏好,康普茶、克菲尔和培养茶等发酵饮料不仅受到健康爱好者的青睐,也受到主流消费者的青睐。这些饮料结合了浓郁的酸味和科学证实的健康益处,使其成为传统软性饮料的有吸引力的替代品。随着饮料业的创新不断模糊保健品和日常饮料之间的界限,发酵饮料正在成为全球家庭现代饮食中的主要食物。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9512亿美元 |

| 预测值 | 1.7兆美元 |

| 复合年增长率 | 6.2% |

市场分为酒精饮料和非酒精饮料,其中酒精饮料在 2024 年占据 67.4% 的主导份额。啤酒仍然是此类中消费最广泛的产品,推动了国际市场的强劲成长。对优质和精酿酒精饮料的需求不断增长,特别是在拥有丰富酿酒传统的国家,这为独立酿酒厂和精品酒庄的蓬勃发展创造了空间。手工风味的流行,加上消费者对真实性和当地食材的兴趣,正在促进这一领域的创新和多样性。

在包装方面,2024 年,瓶子占据了 43.3% 的市场。玻璃瓶仍然是葡萄酒、啤酒和富含益生菌的康普茶等高端产品的首选包装,因为它们可以保持风味的完整性、碳酸化和活性菌的活性。永续包装的吸引力也影响消费者的购买行为,玻璃是一种可回收、无反应的替代品,符合环保趋势。

光是美国发酵饮料市场在 2024 年就创造了 2,041 亿美元的产值。强劲的消费者需求、高可支配收入水平以及完善的啤酒厂、乳製品厂和发酵设施生态系统支撑了这一业绩。政府对本地酿酒商和新创企业的持续支持,以及低酒精、植物性和益生菌饮料等产品创新,持续塑造市场格局并推动成长。

全球发酵饮料产业的主要参与者包括 Biotiful Dairy、Dohler、Chr。科汉森、帝亚吉欧、喜力、达能、麒麟控股、Lifeway Foods、Sula Vineyards、百事可乐、三得利控股有限公司、可口可乐公司和养乐多本社。这些公司正在投资产品多样化,扩大强调健康益处的行销活动,并扩大分销网络以满足新地区日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对功能性和富含益生菌的饮料的偏好日益增加

- 扩大产品创新和新口味供应

- 天然和有机发酵饮料的需求不断增加

- 产业陷阱与挑战

- 生产成本高且供应链复杂

- 监管障碍和标籤合规问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 酒精饮料

- 啤酒

- 葡萄酒

- 苹果酒

- 葡萄酒冷却器

- 酒精饮料

- 其他的

- 非酒精饮料

- 发酵茶饮料

- 发酵乳饮料

- 发酵水果饮料

- 发酵谷物饮料

- 其他的

第六章:市场估计与预测:依包装,2021-2034

- 主要趋势

- 瓶子

- 罐头

- 小袋

- 纸箱

- 其他的

第七章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 品牌网站

- 电子商务平台

- 离线

- 超市和大卖场

- 便利商店

- 专卖店

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Dohler

- Biotiful Dairy

- Chr. Hansen

- Danone

- Diageo

- Heineken

- Kirin Holdings

- Lifeway Foods

- PepsiCo

- Sula Vineyards

- Suntory Holdings Limited

- The Coca-Cola Company

- Yakult Honsha

The Global Fermented Beverages Market was valued at USD 951.2 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 1.7 trillion by 2034. Fermented beverages are witnessing rapid traction worldwide as consumers continue to prioritize functional wellness and gut health. These drinks, developed through controlled microbial fermentation and enzymatic processes, are naturally enriched with probiotics, organic acids, and essential vitamins that support digestive and immune health. Increasing awareness around clean-label ingredients and the shift away from sugary carbonated drinks are further accelerating the market momentum.

With wellness trends shaping consumer preferences, fermented beverages such as kombucha, kefir, and cultured teas are finding favor not just among health enthusiasts but also among mainstream consumers. These drinks offer a combination of bold, tangy flavors and scientifically backed health benefits, making them an attractive alternative to traditional soft drinks. As innovation in the beverage industry continues to blur the lines between health supplements and everyday refreshments, fermented drinks are becoming a staple in modern diets across global households.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $951.2 Billion |

| Forecast Value | $1.7 Trillion |

| CAGR | 6.2% |

The market is segmented into alcoholic and non-alcoholic beverages, with alcoholic beverages commanding a dominant 67.4% share in 2024. Beer remains the most widely consumed product in this category, driving strong growth across international markets. The rising demand for premium and craft alcoholic beverages, particularly in countries with rich brewing heritages, is creating space for independent breweries and boutique wineries to flourish. The popularity of artisanal flavors, coupled with consumer interest in authenticity and local ingredients, is encouraging innovation and variety in this space.

In terms of packaging, bottles accounted for a leading 43.3% market share in 2024. Glass bottles remain the packaging of choice for premium offerings such as wine, beer, and probiotic-rich kombucha, as they preserve flavor integrity, carbonation, and the activity of live cultures. The appeal of sustainable packaging is also influencing consumer buying behavior, with glass offering a recyclable and non-reactive alternative that aligns with eco-conscious trends.

The U.S. Fermented Beverages Market alone generated USD 204.1 billion in 2024. Strong consumer demand, high disposable income levels, and a well-established ecosystem of breweries, dairies, and fermentation facilities underpin this performance. Ongoing government support for local brewers and startups, along with product innovations like low-alcohol, plant-based, and probiotic-enhanced beverages, continue to shape the market landscape and fuel growth.

Major players in the global fermented beverages industry include Biotiful Dairy, Dohler, Chr. Hansen, Diageo, Heineken, Danone, Kirin Holdings, Lifeway Foods, Sula Vineyards, PepsiCo, Suntory Holdings Limited, The Coca-Cola Company, and Yakult Honsha. These companies are investing in product diversification, scaling up marketing campaigns that emphasize wellness benefits, and expanding distribution networks to tap into growing demand across new geographies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer preference for functional and probiotic-rich beverages

- 3.6.1.2 Expanding product innovation and new flavor offering

- 3.6.1.3 Increasing demand for natural and organic fermented drinks

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs and supply chain complexities

- 3.6.2.2 Regulatory hurdles and labeling compliance issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alcoholic beverages

- 5.2.1 Beer

- 5.2.2 Wine

- 5.2.3 Cider

- 5.2.4 Wine coolers

- 5.2.5 Alcopops

- 5.2.6 Others

- 5.3 Non-alcoholic beverages

- 5.3.1 Fermented tea drinks

- 5.3.2 Fermented dairy-based drinks

- 5.3.3 Fermented fruit-based drinks

- 5.3.4 Fermented cereal-based drinks

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Cans

- 6.4 Sachets

- 6.5 Cartons

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online

- 7.2.1 Brand websites

- 7.2.2 E-commerce platforms

- 7.3 Offline

- 7.3.1 Supermarkets & hypermarkets

- 7.3.2 Convenience stores

- 7.3.3 Specialty stores

- 7.3.4 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Dohler

- 9.2 Biotiful Dairy

- 9.3 Chr. Hansen

- 9.4 Danone

- 9.5 Diageo

- 9.6 Heineken

- 9.7 Kirin Holdings

- 9.8 Lifeway Foods

- 9.9 PepsiCo

- 9.10 Sula Vineyards

- 9.11 Suntory Holdings Limited

- 9.12 The Coca-Cola Company

- 9.13 Yakult Honsha