|

市场调查报告书

商品编码

1721438

BOPP 薄膜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测BOPP Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

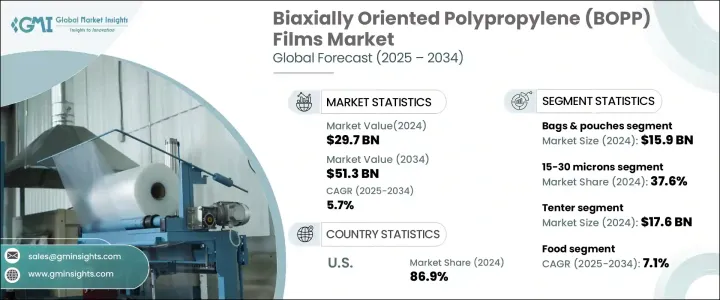

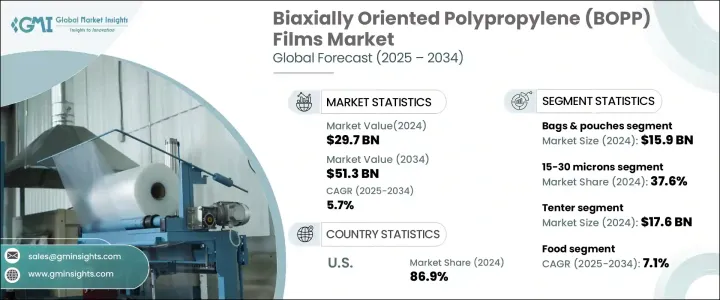

2024 年全球 BOPP 薄膜市场价值为 297 亿美元,预计到 2034 年将以 5.7% 的复合年增长率成长,达到 513 亿美元。随着各行各业认识到 BOPP 薄膜在包装应用中的卓越性能和成本优势,市场将继续保持强劲成长。这些薄膜之所以受到青睐,不仅是因为价格低廉,还因为其卓越的强度、清晰度和多功能性。食品饮料、製药、电子和个人护理行业的製造商越来越多地转向 BOPP 薄膜,以满足消费者对轻质、耐用和可持续包装材料不断变化的偏好。

在高效的供应链和产品货架吸引力对企业成功至关重要的时代,BOPP 薄膜提供了满足功能和美学需求的理想解决方案。它们的可回收性和与不断发展的永续发展目标的兼容性进一步巩固了它们在软包装市场中的地位。随着包装要求变得越来越复杂以及全球需求持续成长,BOPP 薄膜生产和涂层技术的创新仍然是製造商保持竞争力的重点。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 297亿美元 |

| 预测值 | 513亿美元 |

| 复合年增长率 | 5.7% |

推动这一市场扩张的主要动力是 BOPP 薄膜因其成本效益、高抗拉强度、防潮性和出色的印刷性而在各个行业中的应用日益广泛。顺序拉伸和同时拉伸等先进的生产方法显着提高了透明度和阻隔性。金属化增强了视觉吸引力和保质期,使这些薄膜成为高端品牌的首选。涂层 BOPP 薄膜具有耐热性能,特别适合微波炉包装,增加了其功能价值。

市场依产品分为包装纸、袋子和小袋子、胶带和标籤。 2024 年,仅箱包和小袋领域的市场规模就将达到 159 亿美元,主要得益于电子商务的快速成长。与传统的硬质包装形式相比,零售商和配送中心越来越青睐 BOPP 袋和小袋,因为它们具有抗穿刺性、结构轻巧、并且能够降低物流成本。

按厚度分类,15-30 微米的部分在 2024 年占 37.6% 的份额。这一类别在强度、成本效益和材料减少之间实现了完美平衡,这些属性与人们对环保和高效包装解决方案的日益重视相一致。这些薄膜广泛用于食品包装,其耐用性和最少的材料使用至关重要。

2024 年,美国 BOPP 薄膜市场占北美营收的 86.9%。其主导地位源自于领先製造商的大量研发投资,旨在提高薄膜强度、清晰度和多功能性,以拓宽最终用途应用。随着电子商务的激增以及对轻质、可持续包装的需求,美国市场继续在全球范围内引领步伐。

Uflex Ltd.、Inteplast Group 和 Jindal Poly Films 等主要参与者正在大力投资先进的生产系统、产品创新和永续发展计划,以扩大其市场份额并满足不断变化的行业需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 快速的技术创新和自动化

- 对永续和环保包装解决方案的需求不断增长

- 研发的进步提高了薄膜的品质和性能

- 扩大食品、医疗、电子等领域的应用

- 监管变化

- 产业陷阱与挑战

- 原料成本波动

- 激烈的市场竞争导致价格压力

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 裹麵

- 包包和小袋

- 磁带

- 标籤

第六章:市场估计与预测:依厚度,2021 年至 2034 年

- 主要趋势

- 低于15微米

- 15-30微米

- 30-45微米

- 超过45微米

第七章:市场估计与预测:依生产工艺,2021 年至 2034 年

- 主要趋势

- 拉幅机

- 管状

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食物

- 饮料

- 烟草

- 个人护理

- 製药

- 电气和电子产品

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 澳洲

- 韩国

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- CCL Industries

- Cosmo Films Limited

- Gulf Packaging Industries Co.

- Inteplast Group

- Jindal Poly Films

- Oben Group

- Polibak

- Polinas

- Sibur Holdings

- Taghleef Industries

- TOPPAN Group

- Toray Industries

- Uflex Ltd.

- Zhejiang Kinlead Innovative Materials

The Global BOPP Films Market was valued at USD 29.7 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 51.3 billion by 2034. The market continues to witness robust growth as industries across the board recognize the superior performance and cost advantages of BOPP films in packaging applications. These films are gaining traction not only due to their affordability but also because of their exceptional strength, clarity, and versatility. Manufacturers across food and beverage, pharmaceutical, electronics, and personal care sectors are increasingly shifting toward BOPP films to meet changing consumer preferences for lightweight, durable, and sustainable packaging materials.

In an era where efficient supply chains and product shelf appeal are critical to business success, BOPP films offer an ideal solution that meets both functional and aesthetic demands. Their recyclability and compatibility with evolving sustainability goals have further strengthened their position in the flexible packaging market. As packaging requirements become more complex and global demand continues to rise, innovation in BOPP film production and coating technologies remains a key focus for manufacturers aiming to stay competitive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.3 Billion |

| CAGR | 5.7% |

The primary driver of this market expansion is the increasing use of BOPP films across diverse industries due to their cost-effectiveness, high tensile strength, moisture resistance, and excellent printability. Advanced production methods like sequential and simultaneous stretching have significantly improved clarity and barrier properties. Metallization enhances visual appeal and shelf life, making these films a preferred choice for premium branding. Coated BOPP films, with heat-resistant capabilities, are especially suitable for microwaveable packaging, adding to their functional value.

The market is segmented by product into wraps, bags and pouches, tapes, and labels. In 2024, the bags and pouches segment alone accounted for USD 15.9 billion, driven largely by the exponential growth of e-commerce. Retailers and fulfillment centers increasingly prefer BOPP bags and pouches for their puncture resistance, lightweight structure, and ability to reduce logistics costs when compared to traditional rigid packaging formats.

When classified by thickness, the 15-30 microns segment commanded a 37.6% share in 2024. This category offers a perfect balance of strength, cost-efficiency, and material reduction-key attributes that align with the growing emphasis on eco-friendly and efficient packaging solutions. These films are widely used in food packaging, where durability and minimal material usage are essential.

The U.S. BOPP Films Market accounted for 86.9% of North American revenue in 2024. Its dominance stems from significant R&D investments by leading manufacturers aiming to enhance film strength, clarity, and versatility for broadening end-use applications. With the surge in e-commerce and demand for lightweight, sustainable packaging, the U.S. market continues to set the pace globally.

Key players like Uflex Ltd., Inteplast Group, and Jindal Poly Films are investing heavily in advanced production systems, product innovation, and sustainability initiatives to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid technological innovation and automation

- 3.2.1.2 Growing demand for sustainable and eco-friendly packaging solutions

- 3.2.1.3 Advancements in R&D enhance film quality and performance

- 3.2.1.4 Expanding applications in sectors like food, medical, and electronics

- 3.2.1.5 Regulatory changes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material costs

- 3.2.2.2 Intense market competition results in pricing pressures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Wraps

- 5.3 Bags & pouches

- 5.4 Tapes

- 5.5 Labels

Chapter 6 Market Estimates and Forecast, By Thickness, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Below 15 microns

- 6.3 15-30 microns

- 6.4 30-45 microns

- 6.5 More than 45 microns

Chapter 7 Market Estimates and Forecast, By Production Process, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Tenter

- 7.3 Tubular

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food

- 8.3 Beverage

- 8.4 Tobacco

- 8.5 Personal care

- 8.6 Pharmaceutical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 CCL Industries

- 10.2 Cosmo Films Limited

- 10.3 Gulf Packaging Industries Co.

- 10.4 Inteplast Group

- 10.5 Jindal Poly Films

- 10.6 Oben Group

- 10.7 Polibak

- 10.8 Polinas

- 10.9 Sibur Holdings

- 10.10 Taghleef Industries

- 10.11 TOPPAN Group

- 10.12 Toray Industries

- 10.13 Uflex Ltd.

- 10.14 Zhejiang Kinlead Innovative Materials