|

市场调查报告书

商品编码

1721441

兽医心臟病学市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Cardiology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

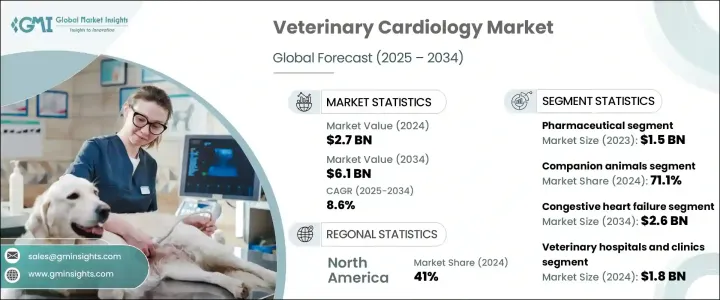

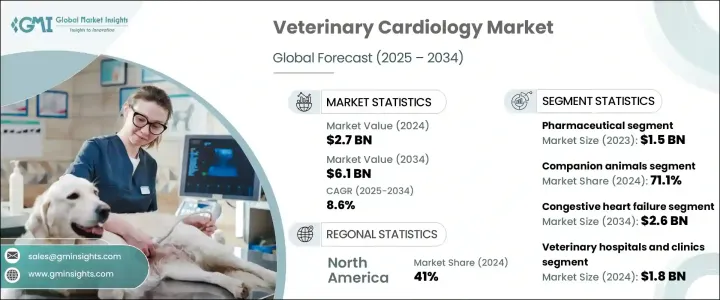

2024 年全球兽医心臟病学市场价值为 27 亿美元,预计到 2034 年将以 8.6% 的复合年增长率成长,达到 61 亿美元。宠物拥有量的增加和人们对动物健康意识的提高在这一扩张中发挥关键作用。随着宠物日益成为家庭不可或缺的成员,主人也更加积极主动地寻求及时和专业的慢性病护理,包括心血管疾病。兽医发现心臟相关病例明显增加,尤其是在老年犬和猫中,促使对心臟病学服务的投资增加。

此外,宠物保险覆盖范围正在逐步扩大,包括先进的诊断测试和治疗,这进一步鼓励主人选择专门的护理。随着兽医专家数量的不断增加、动物保健基础设施的不断扩大以及旨在改善伴侣动物心臟病学结果的研发投资的不断增加,市场也在不断增长。随着兽医学和技术的融合,该行业正在经历快速转型,重新定义动物心臟病的诊断、监测和治疗方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 61亿美元 |

| 复合年增长率 | 8.6% |

这种增长是由患有心臟病的宠物数量的增加以及诊断和治疗方法的进步所推动的。球囊瓣膜成形术和起搏器植入等微创手术由于风险降低和恢復时间较快而越来越受欢迎。匹莫苯丹、血管紧张素转换酶 (ACE) 抑制剂和β受体阻断剂等较新的药物也有助于延长患有心臟病的宠物的寿命。

市场分为药品和诊断。 2023 年,製药业创造了 15 亿美元的收入。这一显着表现主要归功于治疗方案的持续创新以及老年宠物心血管疾病发病率的不断上升。人们对能够调节心臟功能、控制体液积聚和控制动物血压的药物的需求不断增长,从而导致该领域的投资和产品开发增加。

2024 年,兽医心臟病学市场中的伴侣动物部分占有 71.1% 的份额。这一类别包括狗、猫和其他家养宠物,由于收养率不断提高以及宠物随着年龄增长而出现心臟问题的可能性更高,它们继续占据主导地位。如今,宠物主人更加重视疾病的早期发现,这促使他们寻求专门的心臟病学服务。超音波心动图和心电图 (ECG) 等先进诊断技术的需求正在不断增长。

2024 年,北美兽医心臟病学市场占有 41% 的份额。该地区的主导地位得益于大量的伴侣动物、诊断工具的进步以及专科兽医医院的扩张。尤其是美国市场,人工智慧和穿戴式心臟监测器的融合日益紧密,这正在改变宠物心臟健康的监测方式。

兽医心臟病学市场的主要参与者包括 TriviumVet、ESAOTE、Bionet America、Medtronic、Jurox、西门子医疗、富士胶片、Zoetis、Antech Diagnostics、通用电气公司、IDEXX、默克、勃林格殷格翰国际、Ceva 和 GSK 等。公司正专注于创新产品开发,引进超音波心动图和导管疗法等先进的诊断工具。与兽医诊所、研究机构和科技公司的策略合作正在帮助他们扩大在全球市场的影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 宠物收养率上升,动物保健支出增加

- 兽医心臟病诊断和治疗技术的进步

- 伴侣动物心血管疾病盛行率不断上升

- 产业陷阱与挑战

- 先进的兽医心臟病治疗和设备成本高昂

- 专业兽医心臟科专家数量有限

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 製药

- 匹莫苯丹

- 螺内酯和盐酸贝那普利

- 其他药品

- 诊断

- 身体检查

- 胸部X光检查

- 心电图(ECG)

- 其他诊断

第六章:市场估计与预测:依动物类型,2021 - 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 其他伴侣动物

- 牲畜

- 牛

- 家禽

- 其他牲畜

第七章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 充血性心臟衰竭

- 心肌疾病

- 心律不整

- 其他适应症

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医医院和诊所

- 学术和研究机构

- 其他最终用户

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Antech Diagnostics

- Boehringer Ingelheim International

- Jurox

- Ceva

- Merck

- IDEXX

- General Electric Company

- FUJIFILM

- ESAOTE

- Medtronic

- Siemens Healthineers

- TriviumVet

- Zoetis

- Bionet America

The Global Veterinary Cardiology Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6.1 billion by 2034. The rise in pet ownership and heightened awareness of animal health are playing a pivotal role in this expansion. As pets increasingly become integral family members, owners are more proactive in seeking timely and specialized care for chronic conditions, including cardiovascular diseases. Veterinarians are witnessing a notable surge in heart-related cases, especially among aging dogs and cats, prompting increased investments in cardiology services.

Moreover, pet insurance coverage is gradually expanding to include advanced diagnostic tests and treatments, which is further encouraging owners to opt for specialized care. The market is also gaining momentum with the growing presence of veterinary specialists, expanding infrastructure in animal healthcare, and rising R&D investments aimed at improving cardiology outcomes in companion animals. With the convergence of veterinary medicine and technology, the industry is undergoing a rapid transformation that is redefining how heart conditions in animals are diagnosed, monitored, and treated.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 8.6% |

This growth is driven by a rising number of pets with heart disease and advancements in diagnostic and treatment methods. Minimally invasive procedures, such as balloon valvuloplasty and pacemaker implantation, are gaining popularity due to reduced risks and quicker recovery times. Newer medications like pimobendan, ACE inhibitors, and beta-blockers are also helping extend the lifespan of pets diagnosed with heart conditions.

The market is divided into pharmaceuticals and diagnostics. The pharmaceuticals segment generated USD 1.5 billion in 2023. This notable performance is mainly attributed to ongoing innovation in treatment protocols and a growing incidence of cardiovascular conditions in senior pets. There is a rising demand for medications that can regulate heart function, manage fluid buildup, and control blood pressure in animals, leading to increased investments and product development in this space.

The companion animal segment in the veterinary cardiology market held a 71.1% share in 2024. This category, which includes dogs, cats, and other domestic pets, continues to dominate due to increasing adoption rates and the higher likelihood of pets developing heart issues as they age. Pet owners today are far more conscious about the early detection of diseases, prompting them to pursue specialized cardiology services. Advanced diagnostics such as echocardiograms and electrocardiograms (ECGs) are seeing growing demand.

North America Veterinary Cardiology Market held a 41% share in 2024. The region's dominance is supported by a large population of companion animals, advancements in diagnostic tools, and the expansion of specialty veterinary hospitals. The U.S. market, in particular, is seeing growing integration of artificial intelligence and wearable heart monitors, which are changing how cardiac health is monitored in pets.

Major players involved in the veterinary cardiology market include TriviumVet, ESAOTE, Bionet America, Medtronic, Jurox, Siemens Healthineers, Fujifilm, Zoetis, Antech Diagnostics, General Electric Company, IDEXX, Merck, Boehringer Ingelheim International, Ceva, and GSK among others. Companies are focusing on innovative product development, introducing advanced diagnostic tools like echocardiograms and catheter-based therapies. Strategic collaborations with veterinary clinics, research bodies, and tech firms are helping them expand their reach and influence across global markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet adoption and increasing expenditure on animal healthcare

- 3.2.1.2 Advancements in veterinary cardiology diagnostics and treatment technologies

- 3.2.1.3 Increasing prevalence of cardiovascular diseases in companion animals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced veterinary cardiology treatments and devices

- 3.2.2.2 Limited availability of specialized veterinary cardiologists

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Pimobendan

- 5.2.2 Spironolactone and benazepril hydrochloride

- 5.2.3 Other pharmaceuticals

- 5.3 Diagnostics

- 5.3.1 Physical exam

- 5.3.2 Chest X-rays

- 5.3.3 Electrocardiogram (ECG)

- 5.3.4 Other diagnostics

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Poultry

- 6.3.3 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Congestive heart failure

- 7.3 Myocardial (heart muscle) disease

- 7.4 Arrhythmias

- 7.5 Other indications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Academic and research institutions

- 8.4 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Antech Diagnostics

- 10.2 Boehringer Ingelheim International

- 10.3 Jurox

- 10.4 Ceva

- 10.5 Merck

- 10.6 IDEXX

- 10.7 General Electric Company

- 10.8 FUJIFILM

- 10.9 ESAOTE

- 10.10 Medtronic

- 10.11 Siemens Healthineers

- 10.12 TriviumVet

- 10.13 Zoetis

- 10.14 Bionet America