|

市场调查报告书

商品编码

1721472

环栅 (GAA) 电晶体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gate-All-Around (GAA) Transistor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

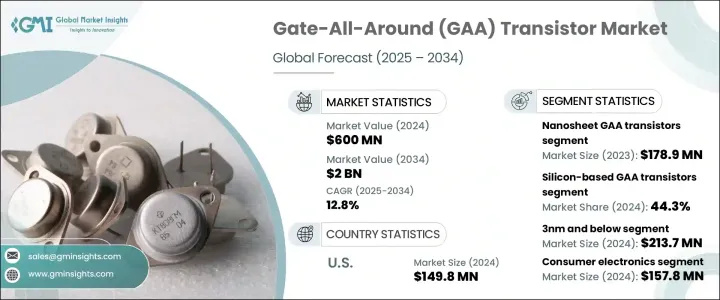

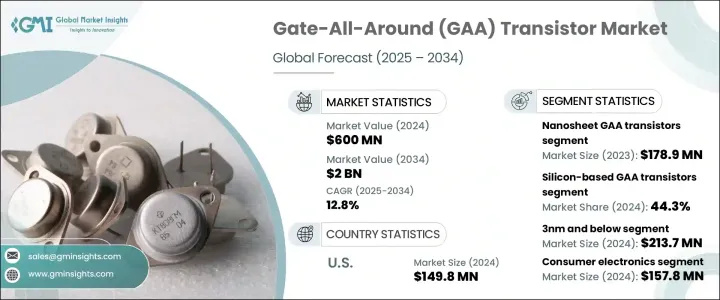

2024 年全球环栅电晶体市场价值为 6 亿美元,预计到 2034 年将以 12.8% 的复合年增长率成长,达到 20 亿美元。这一增长是由对高效能处理器日益增长的需求、5G 网路的扩展以及边缘运算技术的兴起所推动的。 GAA 电晶体将在行动处理器、网路硬体和 AI 驱动平台使用的下一代晶片组中发挥关键作用。与传统的 FinFET 设计相比,它们具有更高的能源效率、更快的切换能力以及卓越的静电控制,是满足现代运算应用效能需求的理想解决方案。随着云端运算、电信和汽车等资料密集产业的发展,GAA 电晶体正在成为未来技术的基石。

奈米片 GAA 电晶体已成为市场上最突出的部分,2023 年的产值达到 1.789 亿美元。这些电晶体因其对短沟道效应的先进控制、针对 3nm 以下製程节点的改进可扩展性以及更高的电晶体密度而备受青睐。领先的半导体代工厂正在采用奈米片架构来提高电源效率和晶片性能,使其成为人工智慧、高效能运算和行动平台的关键选择。奈米片 GAA 电晶体与现有製造设备的兼容性也有助于其在大规模生产中的快速应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6亿美元 |

| 预测值 | 20亿美元 |

| 复合年增长率 | 12.8% |

2024 年,硅基 GAA 电晶体领域占有 44.3% 的市占率。硅的成本效益以及与成熟半导体製造製程的兼容性使其成为市场主导。英特尔和台湾半导体製造公司 (TSMC) 等主要参与者正在其 5nm 以下技术中利用基于硅的奈米片设计,优化能源效率并提高逻辑密度。这些进步对于满足数位设备日益增长的性能需求和解决晶体管尺寸缩小的挑战至关重要。

在德国,GAA 电晶体市场规模预计到 2034 年将达到 1.126 亿美元。该国强大的半导体产业与汽车、自动化和智慧製造等产业相结合,正在推动 GAA 电晶体的采用。值得注意的是,GAA 技术正在整合到电动车系统和工业自动化平台中。德国也大力投资研究,以保持在先进晶片技术的前沿,将自己定位为欧洲半导体自力更生和技术主权策略的关键参与者。

该市场正见证英特尔、三星电子和台湾半导体製造公司 (TSMC) 等行业巨头的重大贡献。这些领先的公司正在大力投资奈米片和叉片电晶体架构的研发。此外,他们正在与设计工具提供者和代工厂建立战略合作伙伴关係,以加快产品上市时间,同时扩大其地理覆盖范围并参与政府资助的半导体计划。这些努力有助于他们在快速发展的 GAA 晶体管市场中保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对高效能运算(HPC)的需求不断增长

- 半导体製造技术的进步

- 5G和边缘运算的成长

- 人工智慧和物联网设备投资不断增加

- 代工厂和IDM的策略性扩张

- 产业陷阱与挑战

- 製造复杂性高且成本高

- 供应炼和产量挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 奈米片 GAA 电晶体

- 奈米线GAA电晶体

- Forksheet GAA电晶体

- 其他的

第六章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 硅基GAA电晶体

- 锗基GAA电晶体

- III-V族化合物半导体GAA电晶体

第七章:市场预估与预测:依节点规模,2021-2034

- 主要趋势

- 3奈米及以下

- 3奈米以上

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 高效能运算 (HPC)

- 物联网 (IoT) 设备

- 人工智慧和机器学习处理器

- 5G和通讯基础设施

- 其他的

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 消费性电子产品

- 汽车

- 资料中心和云端运算

- 工业电子

- 医疗保健和医疗器械

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Analog Devices

- ams-OSRAM AG

- Broadcom Inc.

- Everlight Electronics Co., Ltd.

- Honeywell International Inc.

- Melexis NV

- Microchip Technology Inc.

- OmniVision Technologies, Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Renesas Electronics Corporation

- ROHM Semiconductor

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Silicon Labs

- Sony Semiconductor Solutions Corporation

- STMicroelectronics

- Texas Instruments Incorporated

- Vishay Intertechnology

The Global Gate-All-Around Transistor Market was valued at USD 600 million in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 2 billion by 2034. This growth is driven by the increasing demand for high-performance processors, the expansion of 5G networks, and the rise of edge computing technologies. GAA transistors are poised to play a critical role in next-generation chipsets used across mobile processors, network hardware, and AI-driven platforms. Their enhanced energy efficiency, faster switching capabilities, and superior electrostatic control compared to traditional FinFET designs make them an ideal solution for addressing the performance demands of modern computing applications. As data-intensive industries like cloud computing, telecom, and automotive evolve, GAA transistors are emerging as a cornerstone for future technology.

Nanosheet GAA transistors have become the most prominent segment in the market, generating USD 178.9 million in 2023. These transistors are highly favored due to their advanced control over short-channel effects, improved scalability for sub-3nm process nodes, and higher transistor density. Leading semiconductor foundries are adopting nanosheet architecture to enhance power efficiency and chip performance, making them a critical choice for AI, high-performance computing, and mobile platforms. The compatibility of nanosheet GAA transistors with existing manufacturing equipment is also contributing to their rapid adoption in large-scale production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $600 Million |

| Forecast Value | $2 Billion |

| CAGR | 12.8% |

The silicon-based GAA transistor segment held a 44.3% market share in 2024. Silicon's cost-effectiveness and compatibility with established semiconductor fabrication processes contribute to its dominance. Major players like Intel and Taiwan Semiconductor Manufacturing Company (TSMC) are leveraging silicon-based nanosheet designs in their sub-5nm technologies, optimizing energy efficiency, and boosting logic density. These advancements are crucial for meeting the growing performance needs of digital devices and addressing the challenges of shrinking transistor sizes.

In Germany, the GAA transistor market is set to reach USD 112.6 million by 2034. The country's strong semiconductor sector, aligned with industries like automotive, automation, and smart manufacturing, is driving the adoption of GAA transistors. Notably, GAA technology is being integrated into electric vehicle systems and industrial automation platforms. Germany is also investing heavily in research to stay at the forefront of advanced chip technologies, positioning itself as a key player in Europe's strategy for semiconductor self-reliance and technological sovereignty.

The market is witnessing significant contributions from industry giants such as Intel, Samsung Electronics, and Taiwan Semiconductor Manufacturing Company (TSMC). These leading companies are investing heavily in research and development for nanosheet and forksheet transistor architectures. Additionally, they are forming strategic partnerships with design tool providers and foundries to speed up time-to-market, while expanding their geographic reach and participating in government-funded semiconductor initiatives. These efforts help maintain their competitive edge in the rapidly evolving GAA transistor market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for High-Performance Computing (HPC)

- 3.6.1.2 Advancements in semiconductor fabrication technology

- 3.6.1.3 Growth in 5G and edge computing

- 3.6.1.4 Rising investments in AI and IoT devices

- 3.6.1.5 Strategic expansion by foundries and IDMs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing complexity and costs

- 3.6.2.2 Supply chain and yield challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Nanosheet GAA transistors

- 5.3 Nanowire GAA transistors

- 5.4 Forksheet GAA transistors

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Silicon-based GAA transistors

- 6.3 Germanium-based GAA transistors

- 6.4 III-V compound semiconductor GAA transistors

Chapter 7 Market Estimates & Forecast, By Node Size, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 3nm and below

- 7.3 Above 3nm

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 High-Performance Computing (HPC)

- 8.3 Internet of Things (IoT) devices

- 8.4 AI & machine learning processors

- 8.5 5G & communication infrastructure

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.3 Automotive

- 9.4 Data centers & cloud computing

- 9.5 Industrial electronics

- 9.6 Healthcare & medical devices

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices

- 11.2 ams-OSRAM AG

- 11.3 Broadcom Inc.

- 11.4 Everlight Electronics Co., Ltd.

- 11.5 Honeywell International Inc.

- 11.6 Melexis NV

- 11.7 Microchip Technology Inc.

- 11.8 OmniVision Technologies, Inc.

- 11.9 ON Semiconductor Corporation

- 11.10 Panasonic Corporation

- 11.11 Renesas Electronics Corporation

- 11.12 ROHM Semiconductor

- 11.13 Samsung Electronics Co., Ltd.

- 11.14 Sharp Corporation

- 11.15 Silicon Labs

- 11.16 Sony Semiconductor Solutions Corporation

- 11.17 STMicroelectronics

- 11.18 Texas Instruments Incorporated

- 11.19 Vishay Intertechnology