|

市场调查报告书

商品编码

1721478

瓦楞折迭包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Corrugated Fanfold Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

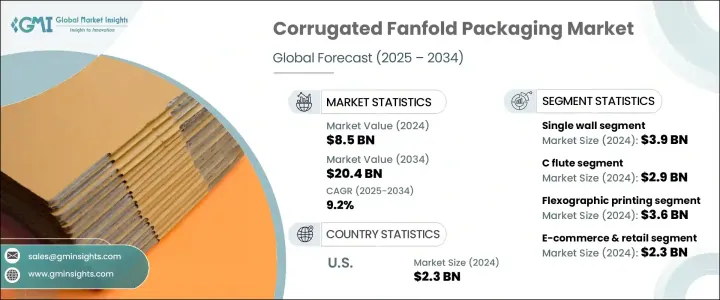

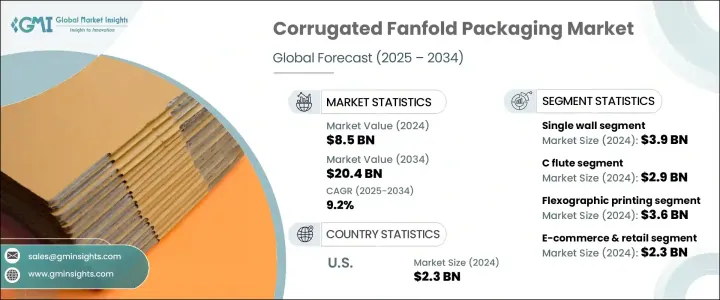

2024 年全球瓦楞纸折迭包装市场价值为 85 亿美元,预计到 2034 年将以 9.2% 的复合年增长率成长,达到 204 亿美元。这一增长主要归因于电子商务的快速崛起、消费者购买模式的动态变化以及整个行业向可持续且具有成本效益的包装解决方案的转变。随着线上零售在全球范围内的扩张,对更智慧、更灵活的包装形式的需求正在迅速增长。各行业的企业都在优先考虑能够实现合适尺寸包装的解决方案,以简化操作、减少浪费并降低运输成本。瓦楞纸折迭包装正迅速成为注重营运灵活性和永续性的企业的首选。折迭格式支援自动化和定制,同时无需储存多种预製盒子尺寸。这大大减少了存储空间,并允许公司根据不同的订单量定制包装。消费者的环保意识和监管部门对企业减少碳足迹的压力进一步加速了可回收、轻量折迭解决方案的采用。

随着技术进步和智慧包装解决方案的不断发展,製造商正在投资与折迭包装无缝整合的自动化工具和按需制盒系统。这些创新不仅提高了包装效率,而且最大限度地减少了过多材料的使用并降低了物流成本。此外,食品配送、电子产品和时尚等领域对环保包装的需求不断增长,激发了全球市场对折迭包装的持续兴趣。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 85亿美元 |

| 预测值 | 204亿美元 |

| 复合年增长率 | 9.2% |

在墙体类型中,单壁折迭板部分在 2024 年创造了 39 亿美元的收入。该部分因其轻量化设计和成本效益而广受欢迎,使其成为电子商务零售商和订阅服务的首选。随着线上购物的持续成长(特别是化妆品、时尚和食品等消费类别),单壁折迭板提供了一个可靠的解决方案,在强度和经济性之间取得平衡。食品配送平台的持续扩张也推动了对可持续且适合不同订单规模的包装的需求,有助于减少浪费并优化配送效率。

C 型瓦楞在瓦楞类型中占有最大的份额,2024 年的市值为 29 亿美元。它能够支撑中等重量,同时保持耐用性和抗衝击性,使其成为广泛应用的理想选择。这种瓦楞类型广泛用于包装食品和饮料,例如瓶装饮料、罐头食品和餐包。其结构完整性确保了运输安全,使其成为寻求提高包装性能和永续性的公司的首选。

2024 年,德国瓦楞纸折迭包装市场产值达到 4.811 亿美元。该国作为电子产品、消费品和食品主要出口国的强势地位继续推动对客製化和耐用包装的需求。德国工业和汽车行业的成长进一步推动了对双层和三层折迭纸板的需求。企业也面临越来越大的压力,需要遵守欧盟永续发展指令,鼓励广泛采用可回收和生物基包装替代品。

全球瓦楞折迭包装市场的主要参与者包括 Smurfit Kappa Group、Ribble Packaging、Papierfabrik Palm、Stora Enso、Hinojosa Packaging Group、Kite Packaging、Abbe、DS Smith、International Paper Company、Rondo Ganahl、Papeles y Conversiones de Mexico、Corrugated。这些公司正在积极投资自动化技术,扩大产品组合以满足电子和製药等利基行业的需求,并通过 FSC 认证和可回收包装材料符合绿色倡议。与电子商务平台和物流供应商的策略合作也使得包装作业更快、交货週转更快。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 电子商务与网上购物的兴起

- 客製化和个人化需求日益增长

- 自动化和智慧包装解决方案的兴起

- 食品饮料业的扩张

- 数位印刷技术的进步

- 产业陷阱与挑战

- 自动化包装系统初始投资高

- 回收和废弃物管理挑战

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按墙体类型,2021 年至 2034 年

- 主要趋势

- 单壁

- 双层墙

- 三层墙

第六章:市场估计与预测:按长笛类型,2021 年至 2034 年

- 主要趋势

- B长笛

- C长笛

- E长笛

- 其他的

第七章:市场估计与预测:按印刷技术,2021 年至 2034 年

- 主要趋势

- 柔版印刷

- 数位印刷

- 平版印刷

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 电子商务与零售

- 消费性电子产品

- 医疗保健和製药

- 个人护理和化妆品

- 汽车和工业产品

- 食品和饮料

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Abbe

- Corrugated Supplies Company

- DS Smith

- Hinojosa Packaging Group

- International Paper Company

- Kite Packaging

- Mondi

- Papeles y Conversiones de Mexico

- Papierfabrik Palm

- Ribble Packaging

- Rondo Ganahl

- Smurfit Kappa Group

- Stora Enso

- WestRock

The Global Corrugated Fanfold Packaging Market was valued at USD 8.5 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 20.4 billion by 2034. This surge is largely attributed to the rapid rise in e-commerce, dynamic shifts in consumer purchasing patterns, and an industry-wide pivot toward sustainable and cost-efficient packaging solutions. As online retail expands globally, the demand for smarter, more flexible packaging formats is growing rapidly. Businesses across sectors are prioritizing solutions that enable right-sized packaging to streamline operations, reduce waste, and lower shipping costs. Corrugated fanfold packaging is fast becoming a preferred choice for enterprises focused on operational agility and sustainability. The fanfold format supports automation and customization while eliminating the need for stocking multiple pre-formed box sizes. This significantly reduces storage space and allows companies to tailor packaging for varying order volumes. Environmental consciousness among consumers and regulatory pressure on businesses to cut down on their carbon footprint has further accelerated the adoption of recyclable, lightweight fanfold solutions.

With technological advancement and smart packaging solutions gaining traction, manufacturers are investing in automation tools and on-demand box-making systems that seamlessly integrate with fanfold packaging. These innovations not only improve packaging efficiency but also minimize excess material use and drive down logistics costs. Moreover, the increasing demand for eco-friendly packaging from sectors like food delivery, electronics, and fashion is fueling sustained interest in fanfold packaging across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 9.2% |

Among wall types, the single wall fanfold boards segment generated USD 3.9 billion in 2024. This segment is popular for its lightweight design and cost-effectiveness, making it the go-to option for e-commerce retailers and subscription-based services. As online purchasing continues to rise-especially for consumer categories like cosmetics, fashion, and food-single wall fanfold boards offer a reliable solution that balances strength with affordability. The continued expansion of food delivery platforms is also fueling demand for packaging that is both sustainable and tailored to different order sizes, helping reduce waste and optimize delivery efficiency.

C flute held the largest share among flute types, generating USD 2.9 billion in 2024. Its ability to support moderate weight while maintaining durability and impact resistance makes it ideal for a wide range of applications. This flute type is widely used for packaged food and beverage items such as bottled drinks, canned goods, and meal kits. Its structural integrity ensures safe transport, making it a preferred option for companies looking to enhance both performance and sustainability in packaging.

Germany Corrugated Fanfold Packaging Market generated USD 481.1 million in 2024. The country's strong position as a major exporter of electronics, consumer goods, and food products continues to drive demand for custom and durable packaging. Growth in Germany's industrial and automotive sectors further boosts the need for double and triple-wall fanfold boards. Businesses are also under increasing pressure to align with EU sustainability directives, encouraging widespread adoption of recyclable and bio-based packaging alternatives.

Key players in the Global Corrugated Fanfold Packaging Market include Smurfit Kappa Group, Ribble Packaging, Papierfabrik Palm, Stora Enso, Hinojosa Packaging Group, Kite Packaging, Abbe, DS Smith, International Paper Company, Rondo Ganahl, Papeles y Conversiones de Mexico, Corrugated Supplies Company, and Mondi. These companies are actively investing in automation technologies, expanding product portfolios to cater to niche industries such as electronics and pharmaceuticals, and aligning with green initiatives through FSC-certified and recyclable packaging materials. Strategic collaborations with e-commerce platforms and logistics providers are also enabling faster packaging operations and improved delivery turnaround.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise of e-commerce and online shopping

- 3.2.1.2 Growing demand for customization and personalization

- 3.2.1.3 Rise in automation and smart packaging solutions

- 3.2.1.4 Expansion in the food and beverage industry

- 3.2.1.5 Advancements in digital printing technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in automated packaging systems

- 3.2.2.2 Recycling and waste management challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Wall Type, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Single wall

- 5.3 Double wall

- 5.4 Triple wall

Chapter 6 Market Estimates and Forecast, By Flute Type, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 B flute

- 6.3 C flute

- 6.4 E flute

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Printing Technology, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Flexographic printing

- 7.3 Digital printing

- 7.4 Lithographic printing

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 E-commerce & retail

- 8.3 Consumer electronics

- 8.4 Healthcare & pharmaceuticals

- 8.5 Personal care & cosmetics

- 8.6 Automotive & industrial goods

- 8.7 Food & beverage

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbe

- 10.2 Corrugated Supplies Company

- 10.3 DS Smith

- 10.4 Hinojosa Packaging Group

- 10.5 International Paper Company

- 10.6 Kite Packaging

- 10.7 Mondi

- 10.8 Papeles y Conversiones de Mexico

- 10.9 Papierfabrik Palm

- 10.10 Ribble Packaging

- 10.11 Rondo Ganahl

- 10.12 Smurfit Kappa Group

- 10.13 Stora Enso

- 10.14 WestRock