|

市场调查报告书

商品编码

1721479

5G企业专用网路市场机会、成长动力、产业趋势分析及2025年至2034年预测5G Enterprise Private Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

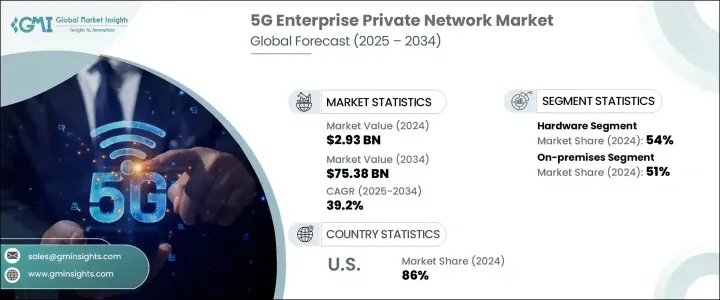

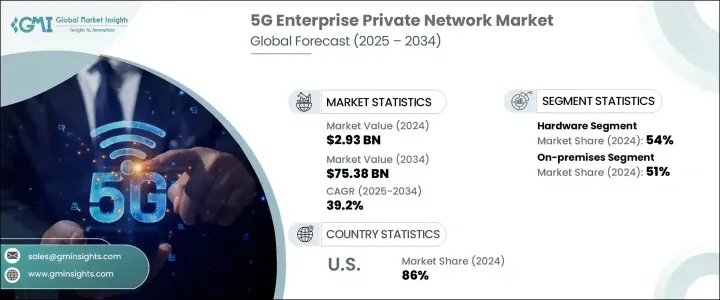

2024 年全球 5G 企业专用网路市场价值为 29.3 亿美元,预计到 2034 年将以 39.2% 的复合年增长率成长,达到 753.8 亿美元。各个行业的企业越来越多地采用私人 5G 网络,以更严格地控制其数位营运、提高安全性并增强可扩展性。这种需求是由对超可靠、低延迟通讯的日益依赖以及对无缝、高速资料流的需求所驱动的。私人 5G 网路正在透过实现即时决策、不间断资料流和安全通讯来改变企业连接,特别是对于关键任务应用程式。

製造、物流、能源和医疗保健领域的公司正在利用这些网路来实现智慧自动化、工业物联网、机器人和远端监控系统。数位转型的推动,加上有利的监管支持和强劲的研发计划,进一步加速了市场成长。随着对智慧城市、互联基础设施和边缘运算的投资不断增加,私有 5G 网路正成为下一代企业策略的关键推动因素。支持数位基础设施的国家级倡议,包括广泛的 5G 部署和智慧技术区的创建,在塑造这一格局方面发挥关键作用。这些发展为早期采用者创造了竞争优势,并促进了需要弹性和高度安全的网路解决方案的各个领域的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29.3亿美元 |

| 预测值 | 753.8亿美元 |

| 复合年增长率 | 39.2% |

硬体继续主导 5G 企业专用网路领域,到 2024 年将占据全球市场的 54%,预计到 2034 年将以 39.9% 的复合年增长率成长。对天线、路由器、小型基地台和基地台等高性能设备日益增长的需求正在推动这一发展势头。这些硬体组件对于部署可扩展且安全的私人 5G 基础设施至关重要,特别是在製造、物流和国防等性能和安全性不能受到影响的领域。企业正在策略性地投资强大的硬体,以确保顺畅、不间断的连接,并适应需要最小延迟和最大可靠性的高级用例。

内部部署模式在 2024 年占据 51% 的市场份额,占据市场主导地位,预计未来几年仍将保持强势地位。管理敏感资料的企业(包括国防、工业製造和医疗保健领域的企业)更喜欢内部部署网络,因为它可以增强控制、改善资料保护并实现即时资料管理。这些网路提供客製化的基础设施,可实现营运连续性、降低安全风险并与现有企业系统无缝整合。对客製化和遵守严格的行业法规的需求日益增长,进一步支持了对现场部署的偏好。

由于先进的研究生态系统、高度的自动化普及率以及积极主动的监管框架,美国将在 2024 年占据全球 86% 的市场份额。该国的私人 5G 网路正在促进国防、能源和医疗保健等关键领域的安全高效运营,边缘运算和机器人技术在这些领域正变得不可或缺。

全球5G企业专网市场的主要参与者包括高通、思科系统、微软Azure、埃森哲、IBM、NVIDIA、华为技术、AT&T、惠普企业(HPE)和AWS(亚马逊网路服务)。这些公司正在与电信营运商和云端服务供应商建立强有力的合作伙伴关係,以提供可扩展、安全且特定于产业的 5G 解决方案。许多公司也专注于整合人工智慧优化工具和边缘运算技术,以增强网路效能并满足即时需求。针对智慧製造、物流和基础设施开发等领域的客製化服务,以及策略性试点计画和监管合作,正在帮助企业加强市场影响力并加速全球企业的采用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 设备製造商

- 电信服务供应商

- 系统整合商

- 技术提供者

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 低延迟通讯需求不断成长

- 边缘运算的兴起

- 日益增长的资料安全和隐私需求

- 物联网和连网设备激增

- 产业陷阱与挑战

- 初始部署成本高

- 与遗留系统的整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 无线接取网路(RAN)

- 核心网路

- 边缘运算基础设施

- 软体

- 网路管理软体

- 安全软体

- 网路切片软体

- 自动化和编排工具

- 服务

- 咨询

- 託管服务

- 支援和维护

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

- 杂交种

第七章:市场估计与预测:按频段,2021 - 2034 年

- 主要趋势

- 低于 6 GHz

- 毫米波(mmWave)

第八章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

- 化学品和危险品

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製造业

- 卫生保健

- 运输和物流

- 零售

- 能源和公用事业

- 智慧城市

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Accenture

- AT&T

- AWS (Amazon Web Services)

- BT Group (British Telecom)

- Cisco Systems

- Ericsson

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- IBM

- Intel

- Juniper Networks

- Mavenir

- Microsoft Azure

- Nokia

- NVIDIA

- Qualcomm

- Samsung Electronics

- T-Mobile US

- Verizon Communications

- ZTE

The Global 5G enterprise private network market was valued at USD 2.93 billion in 2024 and is estimated to grow at a CAGR of 39.2% to reach USD 75.38 billion by 2034. Enterprises across sectors are increasingly embracing private 5G networks to gain tighter control over their digital operations, improve security, and enhance scalability. The demand is driven by the growing reliance on ultra-reliable, low-latency communication and the need for seamless, high-speed data flow. Private 5G networks are transforming enterprise connectivity by enabling real-time decision-making, uninterrupted data streaming, and secure communication, particularly for mission-critical applications.

Companies in manufacturing, logistics, energy, and healthcare are leveraging these networks to implement intelligent automation, industrial IoT, robotics, and remote monitoring systems. The push for digital transformation, combined with favorable regulatory support and robust R&D initiatives, is further accelerating market growth. With increasing investments in smart cities, connected infrastructure, and edge computing, private 5G networks are emerging as a key enabler of next-gen enterprise strategies. National-level initiatives that support digital infrastructure, including expansive 5G rollouts and the creation of smart technology zones, are playing a pivotal role in shaping this landscape. These developments are creating a competitive advantage for early adopters and fostering innovation across sectors that demand resilient and highly secure network solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.93 Billion |

| Forecast Value | $75.38 Billion |

| CAGR | 39.2% |

Hardware continues to dominate the 5G enterprise private network space, accounting for 54% of the global market in 2024, and is projected to grow at a CAGR of 39.9% through 2034. The rising need for high-performance equipment such as antennas, routers, small cells, and base stations is fueling this momentum. These hardware components are essential to deploying scalable and secure private 5G infrastructures, particularly in sectors like manufacturing, logistics, and defense, where performance and security cannot be compromised. Businesses are strategically investing in robust hardware to ensure smooth, uninterrupted connectivity and to accommodate advanced use cases that demand minimal latency and maximum reliability.

The on-premises deployment model led the market with a 51% share in 2024 and is expected to retain a strong position in the coming years. Enterprises that manage sensitive data, including those in defense, industrial manufacturing, and healthcare, prefer on-premises networks due to enhanced control, improved data protection, and real-time data management. These networks provide tailored infrastructure that allows for operational continuity, reduced security risks, and seamless integration with existing enterprise systems. The preference for on-site deployment is further supported by the growing demand for customization and compliance with strict industry regulations.

The United States held an 86% share of the global market in 2024, driven by its advanced research ecosystem, high automation penetration, and proactive regulatory framework. Private 5G networks in the country are facilitating secure and efficient operations across critical sectors like defense, energy, and healthcare, where edge computing and robotics are becoming integral.

Major players in the global 5G enterprise private network market include Qualcomm, Cisco Systems, Microsoft Azure, Accenture, IBM, NVIDIA, Huawei Technologies, AT&T, Hewlett Packard Enterprise (HPE), and AWS (Amazon Web Services). These companies are forging strong partnerships with telecom operators and cloud service providers to deliver scalable, secure, and industry-specific 5G solutions. Many are also focusing on integrating AI-powered optimization tools and edge computing technologies to enhance network performance and meet real-time demands. Tailored offerings for sectors such as smart manufacturing, logistics, and infrastructure development, along with strategic pilot programs and regulatory collaborations, are helping firms strengthen their market footprint and accelerate adoption across global enterprises.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Equipment manufacturers

- 3.2.2 Telecom service providers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for low-latency communication

- 3.8.1.2 Rise in edge computing

- 3.8.1.3 Growing data security & privacy needs

- 3.8.1.4 Surge in IoT and connected devices

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial deployment costs

- 3.8.2.2 Integration challenges with legacy systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Radio Access Network (RAN)

- 5.2.2 Core network

- 5.2.3 Edge computing infrastructure

- 5.3 Software

- 5.3.1 Network management software

- 5.3.2 Security software

- 5.3.3 Network slicing software

- 5.3.4 Automation and orchestration tools

- 5.4 Services

- 5.4.1 Consulting

- 5.4.2 Managed services

- 5.4.3 Support and maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Sub-6 GHz

- 7.3 Millimeter Wave (mmWave)

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SMEs

- 8.4 Chemicals & hazardous materials

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Healthcare

- 9.4 Transportation and logistics

- 9.5 Retail

- 9.6 Energy and utilities

- 9.7 Smart cities

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Accenture

- 11.2 AT&T

- 11.3 AWS (Amazon Web Services)

- 11.4 BT Group (British Telecom)

- 11.5 Cisco Systems

- 11.6 Ericsson

- 11.7 Hewlett Packard Enterprise (HPE)

- 11.8 Huawei Technologies

- 11.9 IBM

- 11.10 Intel

- 11.11 Juniper Networks

- 11.12 Mavenir

- 11.13 Microsoft Azure

- 11.14 Nokia

- 11.15 NVIDIA

- 11.16 Qualcomm

- 11.17 Samsung Electronics

- 11.18 T-Mobile US

- 11.19 Verizon Communications

- 11.20 ZTE