|

市场调查报告书

商品编码

1721488

眼部过敏治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Eye Allergy Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

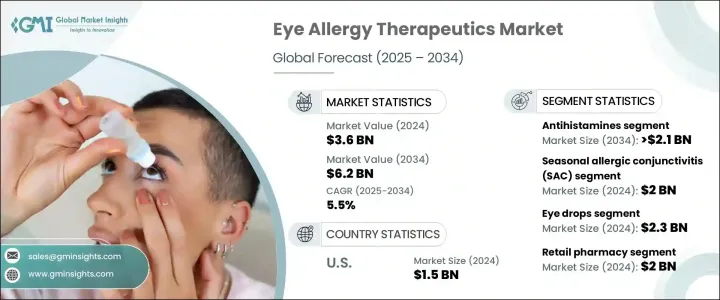

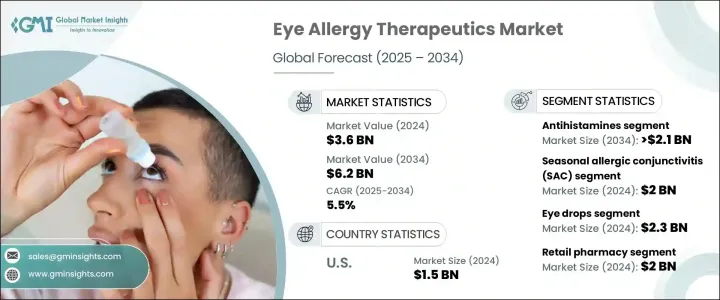

2024 年全球眼部过敏治疗市场价值为 36 亿美元,预计到 2034 年将以 5.5% 的复合年增长率成长,达到 62 亿美元。随着世界继续面临日益严重的空气污染和气候变迁的影响,过敏性结膜炎等眼睛过敏病例变得越来越常见。随着都市化进程的加快,以及人们越来越频繁地接触室内外过敏原,如花粉、宠物皮屑和尘螨,对更有效、更便捷的治疗方法的需求也随之激增。人们在空调和人工通风的空间里度过的时间越来越多,这也增加了他们对环境触发因素的敏感度。随着越来越多的消费者积极寻求快速、安全、便利的治疗方法,全球眼部过敏治疗市场正在稳步成长。药物输送系统的技术进步以及对患者友善配方的更多重视正在重塑竞争格局。个人化医疗和标靶治疗的转变也为製药公司提供了新的机会,使其能够提供更快、更持久的缓解的创新解决方案。

製药商正在加大研发力度,以推出副作用最小的先进配方。处方药和非处方药 (OTC) 的普及扩大了治疗管道,使消费者更容易控制症状,而无需频繁就诊。美国食品药物管理局 (FDA) 等监管机构透过批准新药和输送机制在这一增长中发挥关键作用。药物洗脱隐形眼镜和双效眼药水等产品正在扩大治疗选择并提高患者的依从性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 62亿美元 |

| 复合年增长率 | 5.5% |

市场依药物类别细分为肥大细胞稳定剂、抗组织胺、双重作用剂、减充血剂、皮质类固醇、免疫疗法等。其中,抗组织胺药物预计将成为主要的成长动力,预计年复合成长率为 5.4%,到 2034 年达到 21 亿美元。这些药物可以快速缓解搔痒、发红和流泪等症状,使其成为医疗保健提供者和患者的首选。由于可以透过处方药和非处方药管道轻鬆获得抗组织胺药,它已成为眼部过敏患者广泛信赖的解决方案。

季节性过敏性结膜炎 (SAC) 领域仍然是主要的收入来源,到 2024 年将产生 20 亿美元收入。在花粉水平达到高峰的春季和夏季,SAC 病例会激增,尤其是在污染严重的城市环境中。受积极的直接面向消费者的行销活动的影响,消费者越来越多地转向非处方药,以提高认知度和便利性。

美国眼部过敏治疗市场规模在 2024 年达到 15 亿美元,并且在强有力的监管监督和 FDA 对新疗法的批准的支持下,该市场将继续增长。零售连锁店和药局中非处方药的便利供应为数百万美国人提供了获得治疗的途径。

领先的市场参与者包括 Bausch Health、AbbVie、Hikma Pharmaceuticals、辉瑞、Teva Pharmaceutical Industries、Regeneron Pharmaceuticals、赛诺菲、迈兰、爱尔康、诺华、强生、Akorn、Nicox、参天製药和太阳製药。这些公司优先考虑产品创新、用户友好解决方案和更广泛的分销合作伙伴关係。透过对自我管理疗法、下一代隐形眼镜和策略性零售联盟的投资,产业领导者正在增强消费者参与度并加强其在全球市场的存在。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 污染和气候变迁导致过敏性结膜炎盛行率上升

- 越来越多地采用联合疗法来提高疗效

- 非处方抗过敏眼药水销售成长

- 药物输送系统的进展

- 产业陷阱与挑战

- 长期用药的副作用

- 低成本仿製药和非处方药替代品的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 抗组织胺药

- 肥大细胞稳定剂

- 双重作用剂

- 皮质类固醇

- 减充血剂

- 免疫疗法

- 其他药物类别

第六章:市场估计与预测:按过敏类型,2021 - 2034 年

- 主要趋势

- 季节性过敏性结膜炎(SAC)

- 常年性过敏性结膜炎(PAC)

- 春季角结膜炎(VKC)

- 特应性角结膜炎(AKC)

- 巨乳头性结膜炎(GPC)

第七章:市场估计与预测:按剂型,2021 - 2034

- 主要趋势

- 眼药水

- 注射剂

- 口服片剂/胶囊

- 凝胶和软膏

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 电子商务

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Akorn

- Alcon

- Bausch Health

- Hikma Pharmaceuticals

- Johnson & Johnson

- Mylan

- Nicox

- Novartis

- Pfizer

- Regeneron Pharmaceuticals

- Sanofi

- Santen Pharmaceutical

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

The Global Eye Allergy Therapeutics Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 6.2 billion by 2034. As the world continues to face rising levels of air pollution and the impact of climate change, cases of eye allergies such as allergic conjunctivitis are becoming increasingly common. Growing urbanization, along with extended exposure to indoor and outdoor allergens like pollen, pet dander, and dust mites, is triggering a spike in demand for more effective and convenient treatments. People are spending more time in air-conditioned and artificially ventilated spaces, which has also increased their sensitivity to environmental triggers. With more consumers actively seeking quick, safe, and accessible treatments, the global market for eye allergy therapeutics is witnessing steady growth. Technological advancements in drug delivery systems and a greater emphasis on patient-friendly formulations are reshaping the competitive landscape. The shift toward personalized medicine and targeted therapies is also opening up new opportunities for pharmaceutical companies to deliver innovative solutions that offer faster and longer-lasting relief.

Pharmaceutical manufacturers are ramping up research and development efforts to introduce advanced formulations with minimal side effects. The availability of both prescription and over-the-counter (OTC) products has broadened treatment access, making it easier for consumers to manage symptoms without frequent clinical visits. Regulatory authorities like the U.S. Food and Drug Administration (FDA) are playing a pivotal role in this growth by approving new drugs and delivery mechanisms. Products like drug-eluting contact lenses and dual-action drops are expanding therapeutic options and improving patient compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.5% |

The market is segmented by drug class into mast cell stabilizers, antihistamines, dual-action agents, decongestants, corticosteroids, immunotherapy, and others. Among these, antihistamines are anticipated to be the primary growth driver, projected to grow at a CAGR of 5.4% and reach USD 2.1 billion by 2034. These medications offer rapid relief from symptoms such as itching, redness, and tearing, making them the go-to choice for both healthcare providers and patients. With easy availability through both prescription and OTC channels, antihistamines have become a widely trusted solution for eye allergy sufferers.

The seasonal allergic conjunctivitis (SAC) segment remains a major revenue generator, producing USD 2 billion in 2024. SAC cases surge in spring and summer when pollen levels peak, particularly in highly polluted urban environments. Consumers are increasingly turning to OTC remedies, influenced by aggressive direct-to-consumer marketing campaigns that promote awareness and convenience.

The U.S. Eye Allergy Therapeutics Market reached USD 1.5 billion in 2024 and continues to grow, supported by strong regulatory oversight and the FDA's approval of novel therapies. Easy OTC availability in retail chains and pharmacies has streamlined access to treatments for millions of Americans.

Leading market players include Bausch Health, AbbVie, Hikma Pharmaceuticals, Pfizer, Teva Pharmaceutical Industries, Regeneron Pharmaceuticals, Sanofi, Mylan, Alcon, Novartis, Johnson & Johnson, Akorn, Nicox, Santen Pharmaceutical, and Sun Pharmaceutical Industries. These companies are prioritizing product innovation, user-friendly solutions, and broader distribution partnerships. With investments in self-administered therapies, next-gen contact lenses, and strategic retail alliances, industry leaders are enhancing consumer engagement and strengthening their presence across the global market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of allergic conjunctivitis due to pollution and climate change

- 3.2.1.2 Increasing adoption of combination therapies for better efficacy

- 3.2.1.3 Growth in OTC allergy eye drops

- 3.2.1.4 Advancements in drug delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of long-term medication use

- 3.2.2.2 Availability of low-cost generics and OTC alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antihistamines

- 5.3 Mast cell stabilizers

- 5.4 Dual-action agents

- 5.5 Corticosteroids

- 5.6 Decongestants

- 5.7 Immunotherapy

- 5.8 Other drug classes

Chapter 6 Market Estimates and Forecast, By Allergy Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Seasonal allergic conjunctivitis (SAC)

- 6.3 Perennial allergic conjunctivitis (PAC)

- 6.4 Vernal keratoconjunctivitis (VKC)

- 6.5 Atopic keratoconjunctivitis (AKC)

- 6.6 Giant papillary conjunctivitis (GPC)

Chapter 7 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Eye drops

- 7.3 Injectables

- 7.4 Oral tablets/capsules

- 7.5 Gels and ointments

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Akorn

- 10.3 Alcon

- 10.4 Bausch Health

- 10.5 Hikma Pharmaceuticals

- 10.6 Johnson & Johnson

- 10.7 Mylan

- 10.8 Nicox

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Regeneron Pharmaceuticals

- 10.12 Sanofi

- 10.13 Santen Pharmaceutical

- 10.14 Sun Pharmaceutical Industries

- 10.15 Teva Pharmaceutical Industries