|

市场调查报告书

商品编码

1721497

静液压传动市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hydrostatic Transmission Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

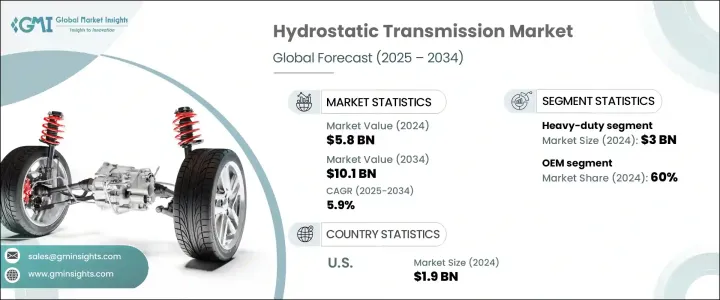

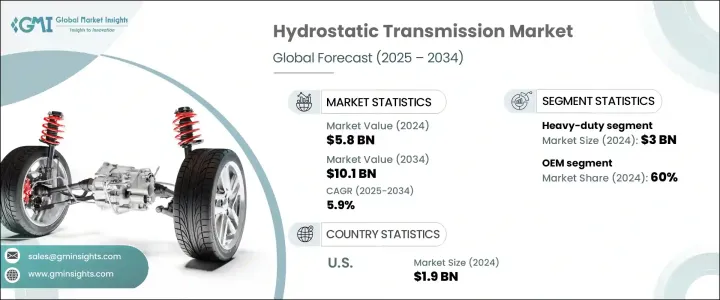

2024 年全球静液压传动市场价值为 58 亿美元,预计到 2034 年将以 5.9% 的复合年增长率成长,达到 101 亿美元。随着全球各行各业不断朝向更智慧、更干净、更节能的技术发展,静液压传动系统正获得强劲发展。汽车、农业、建筑和采矿等行业对市场的需求日益增加,这些行业对平稳、响应迅速且省油的电力传输的需求正在重塑设计重点。工业和车辆平台日益采用自动化和电气化,对传输技术产生了重大影响。

製造商正专注于整合支援无缝机器操作和智慧控制的先进功能,以满足下一代设备的需求。最终用户倾向于确保精确处理、减少排放和更高可靠性的系统,这些因素在当今以性能为导向、注重永续性的环境中至关重要。此外,不断增长的基础设施投资、劳动力短缺以及对智慧农业和自动化物料处理的推动,为静液压传动市场增添了巨大的发展动力,尤其是在北美、欧洲、亚太地区以及中东和非洲。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 58亿美元 |

| 预测值 | 101亿美元 |

| 复合年增长率 | 5.9% |

各主要产业的成长主要受到对节能输电系统的日益青睐以及对无缝功率调节的需求的推动。增强的车辆性能、精确的控制和提高的燃油经济性是推动采用的核心优势。随着液压技术的不断成熟,製造商正在将电子控制和智慧感测器等智慧功能融入他们的系统中。这些创新正在重新定义车辆架构,以实现更平稳的运作和更高的系统可靠性。向自动化、永续机械的转变正在推动重型建筑、农业设备和工业车辆等领域的强劲需求。

按容量划分,市场包括轻型、中型和重型系统。其中,重型静液压传动装置在 2024 年占据主导地位,市场规模达 30 亿美元。这种主导地位源于其在高负荷、恶劣应用中提供高扭矩、长使用寿命和可靠性的能力。重型系统因其在极端条件下保持稳定的性能并保持燃油效率而特别具有吸引力。产业领导者正在开发配备精密控制模组、电子管理单元和节能增强功能的下一代系统,以满足不断升级的工业需求。这些升级加强了重型解决方案在关键任务操作中的立足点。

根据分销情况,市场分为OEM通路和售后市场通路。到 2024 年, OEM部门将获得 60% 的份额,这得益于静液压系统越来越多地融入新车设计中。消费者越来越青睐工厂安装的、与内建安全和自动化功能同步运作的设备。原始设备製造商 (OEM) 的应对措施是提供与 ADAS 和其他智慧驾驶系统相容而最佳化的设备。高阶车型的需求尤其高,因为平稳的驾驶控制和节省燃料是不可妥协的。监管要求加强安全性和永续性,继续推动OEM 的采用。

2024 年,美国静液压传动市场规模达 19 亿美元,预估 2025 年至 2034 年期间复合年增长率将达到 6.2%。成长主要受到液压系统设计创新、基础设施投资以及农业和建筑领域精密设备的激增的推动。混合动力变速箱和基于感测器的控制功能的采用正在加速。随着国家对自动化和永续工业实践的重视,美国市场正在见证各种应用的快速部署。

派克汉尼汾、德纳、博世力士乐、约翰迪尔、凯斯纽荷兰工业、伊顿、丹佛斯、马恆达、胡斯瓦纳和久保田等公司正在透过研发投资、策略合作伙伴关係和创新产品发布来增强其优势。许多参与者正在投资支援物联网的系统和诊断技术,以优化生命週期性能和营运效率。与 OEM 的合作简化了与先进汽车平台的集成,而合併和区域扩张使全球参与者能够更好地满足新兴市场不断增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 在非公路车辆和特殊车辆的使用增加

- 智慧液压系统的进步

- 监理推动燃油效率

- 静液压电动混合动力传动系统的开发

- 产业陷阱与挑战

- 初始成本高

- 复杂的维护要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产能,2021 - 2034 年

- 主要趋势

- 重负

- 中型

- 轻型

第六章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 液压泵浦

- 油压马达

- 阀门和控制器

- 过滤器

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 农业

- 建造

- 物料处理

- 其他的

第八章:市场估计与预测:依传输方式,2021 - 2034 年

- 主要趋势

- 闭环

- 开环

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 售后市场

- OEM

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- AGCO

- Ariens

- Bosch Rexroth

- CNH Industrial

- Daedong Industrial

- Dana

- Danfoss

- Eaton

- Husqvarna

- Iseki

- JCB

- John Deere

- Kubota

- Mahindra & Mahindra

- MTD

- Parker Hannifin

- Sauer-Danfoss

- Tuff Torq

- Yanmar

- ZF Friedrichshafen

The Global Hydrostatic Transmission Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 10.1 billion by 2034. As industries worldwide continue to evolve toward smarter, cleaner, and more energy-efficient technologies, hydrostatic transmission systems are gaining strong traction. The market is experiencing heightened demand from sectors such as automotive, agriculture, construction, and mining, where the need for smooth, responsive, and fuel-efficient power delivery is reshaping design priorities. The increasing adoption of automation and electrification across industrial and vehicular platforms is significantly influencing transmission technologies.

Manufacturers are focusing on integrating advanced features that support seamless machine operation and intelligent control to match the needs of next-generation equipment. End users are leaning toward systems that ensure precision handling, reduced emissions, and higher reliability-factors that are crucial in today's performance-driven and sustainability-conscious landscape. Moreover, growing infrastructure investments, labor shortages, and the push for smart farming and automated material handling are adding substantial momentum to the hydrostatic transmission market, especially across North America, Europe, Asia Pacific, and the Middle East & Africa.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 5.9% |

Growth across key industries is largely driven by the rising preference for energy-efficient transmission systems and the demand for seamless power modulation. Enhanced vehicle performance, precise control, and improved fuel economy are among the core benefits propelling adoption. As hydraulic technology continues to mature, manufacturers are incorporating intelligent features such as electronic controls and smart sensors into their systems. These innovations are redefining vehicle architecture, allowing smoother operation and greater system reliability. The movement toward automated, sustainable machinery is fueling robust demand in sectors such as heavy construction, agricultural equipment, and industrial vehicles.

Segmented by capacity, the market includes light-duty, medium-duty, and heavy-duty systems. Among these, heavy-duty hydrostatic transmissions held a commanding USD 3 billion in 2024. This dominance stems from their ability to deliver high torque, long operational life, and reliability in high-load, rugged applications. Heavy-duty systems are especially attractive for their consistent performance under extreme conditions while maintaining fuel efficiency. Industry leaders are developing next-gen systems equipped with precision control modules, electronic management units, and energy-saving enhancements to meet escalating industrial requirements. These upgrades are strengthening the foothold of heavy-duty solutions across mission-critical operations.

Based on distribution, the market is split between OEM and aftermarket channels. The OEM segment secured a 60% share in 2024, bolstered by rising integration of hydrostatic systems into new vehicle designs. Consumers are increasingly favoring factory-installed units that work in sync with built-in safety and automation features. OEMs are responding by delivering units optimized for compatibility with ADAS and other intelligent driving systems. The demand is especially high among premium models where smooth drive control and fuel savings are non-negotiable. Regulatory mandates pushing for enhanced safety and sustainability continue to drive OEM adoption.

United States Hydrostatic Transmission Market generated USD 1.9 billion in 2024 and is poised to grow at 6.2% CAGR between 2025-2034. Growth is primarily driven by innovation in hydraulic system designs, infrastructure investments, and the surge in precision-focused equipment in agriculture and construction. The adoption of hybrid transmissions and sensor-based control features is accelerating. With a national focus on automation and sustainable industrial practices, the US market is witnessing fast-paced deployment across varied applications.

Companies such as Parker Hannifin, Dana, Bosch Rexroth, John Deere, CNH Industrial, Eaton, Danfoss, Mahindra & Mahindra, Husqvarna, and Kubota are sharpening their edge with R&D investments, strategic partnerships, and innovative product launches. Many players are investing in IoT-enabled systems and diagnostic technologies to optimize lifecycle performance and operational efficiency. Collaborations with OEMs are simplifying integration into advanced vehicle platforms, while mergers and regional expansions are enabling global players to better serve the surging demand from emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased use in off-highway and specialty vehicles

- 3.7.1.2 Advancements in smart hydraulic systems

- 3.7.1.3 Regulatory push for fuel efficiency

- 3.7.1.4 Development of hybrid hydrostatic-electric powertrains

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs

- 3.7.2.2 Complex maintenance requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Heavy-duty

- 5.3 Medium-duty

- 5.4 Light-duty

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hydraulic pumps

- 6.3 Hydraulic motors

- 6.4 Valves & controls

- 6.5 Filters

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Construction

- 7.4 Material handling

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Transmission, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Closed-loop

- 8.3 Open-loop

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Aftermarket

- 9.3 OEM

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AGCO

- 11.2 Ariens

- 11.3 Bosch Rexroth

- 11.4 CNH Industrial

- 11.5 Daedong Industrial

- 11.6 Dana

- 11.7 Danfoss

- 11.8 Eaton

- 11.9 Husqvarna

- 11.10 Iseki

- 11.11 JCB

- 11.12 John Deere

- 11.13 Kubota

- 11.14 Mahindra & Mahindra

- 11.15 MTD

- 11.16 Parker Hannifin

- 11.17 Sauer-Danfoss

- 11.18 Tuff Torq

- 11.19 Yanmar

- 11.20 ZF Friedrichshafen