|

市场调查报告书

商品编码

1721499

骨科手术机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Orthopedic Surgical Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

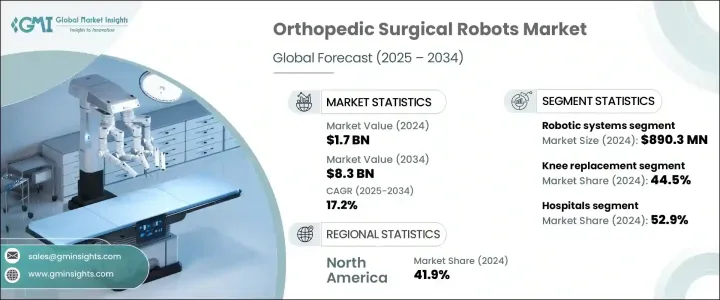

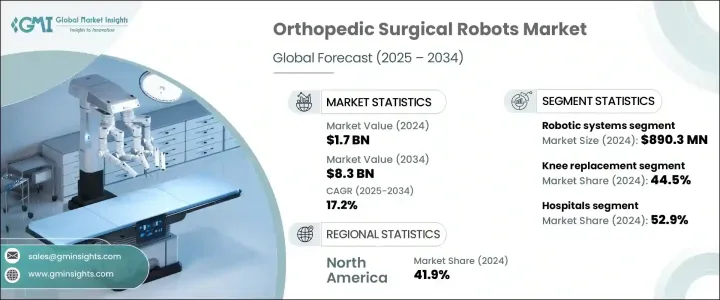

2024 年全球骨科手术机器人市场价值为 17 亿美元,预计到 2034 年将以 17.2% 的复合年增长率成长,达到 83 亿美元。随着医疗保健提供者寻求提高手术准确性、最大限度地减少併发症和确保患者更快康復的方法,对先进的机器人辅助手术系统的需求持续激增。随着骨关节炎、韧带损伤、退化性骨病和骨折等骨科疾病在全球的盛行率持续上升,越来越多的医疗机构开始转向使用机器人平台进行外科手术干预。人口老化、人们对微创手术的认识不断提高以及关节和脊椎手术量的增加进一步加速了这种转变。

此外,由于机器人系统具有增强的可视化能力、即时资料整合以及在复杂手术过程中更高的灵活性,外科医生也开始青睐机器人系统。随着机器人技术改变骨科手术的实施方式,越来越多的医院和外科中心正在投资这些系统以优化病患照护。一些国家推行基于价值的照护和优惠的保险覆盖也支持了这一趋势。随着机器人技术随着人工智慧和机器学习的发展而发展,这些系统预计将在未来十年在骨科医疗领域发挥更大的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 83亿美元 |

| 复合年增长率 | 17.2% |

组件部分包括机器人系统、配件、软体和服务。机器人系统部门在 2024 年创造了 8.903 亿美元的收入。这些系统越来越受到关注,因为它们为外科医生在执行精细的骨科手术(特别是在脊椎和关节手术)时提供了更高的控制力和精确度。它们能够改善植入物排列、降低併发症风险并缩短恢復时间,使其成为医院和专科诊所的首选。凭藉 3D 视觉化、触觉回馈和进阶影像支援等功能,机器人平台正在改变手术工作流程并提高整体效果。

按最终用途划分,医院部门在 2024 年占据 52.9% 的份额。医院凭藉其强大的临床基础设施、大量的骨科病例以及对技术升级的日益重视,继续占据市场主导地位。他们严重依赖机器人系统来提高程式一致性、减少人为错误并更有效率地管理复杂案例。老年患者数量的增加和优惠的报销政策也使得医院更容易采用和扩大机器人辅助手术解决方案。

2024 年,北美骨科手术机器人市场占有 41.9% 的份额。该地区的主导地位得益于其强大的医疗保健基础设施、人工智慧技术的日益普及以及对精准微创骨科手术日益增长的需求。随着骨关节炎和骨质疏鬆症等关节相关疾病的不断增加,北美的医院和外科中心正在率先将下一代机器人系统整合到他们的实践中。

全球骨科手术机器人市场的知名公司包括美敦力、Think Surgical、Globus Medical、Brainlab、Accuray、MicroPort Orthopedics、Intuitive、强生、CUREXO、施乐辉、Asensus Surgical、Zimmer Biomet、Corin、Stryker 和 NUVASIVE。这些参与者正在积极投资研发,以提高手术准确性、整合人工智慧和触觉技术,并针对不同的临床需求开发客製化解决方案。许多公司透过与医院和分销商合作来扩大其全球影响力,同时提供强大的售后支援和培训,以提高用户采用率和绩效。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 骨科疾病和损伤的盛行率不断上升

- 机器人辅助手术技术的进步

- 微创手术(MIS)的需求不断增加

- 老年人口不断增加

- 产业陷阱与挑战

- 机器人手术系统和手术成本高昂

- 有限的报销政策

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 监管格局

- 技术格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按组成部分,2021 年至 2034 年

- 主要趋势

- 机器人系统

- 配件

- 软体和服务

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 膝关节置换术

- 髋关节置换术

- 肩关节置换术

- 脊椎手术

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心(ASC)

- 专科骨科诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Accuray

- Asensus Surgical

- Brainlab

- Corin

- CUREXO

- Globus Medical

- Intuitive

- Johnson & Joshnson

- Medtronic

- MicroPort Orthopedics

- NUVASIVE

- Smith & Nephew

- Stryker

- Think Surgical

- Zimmer Biomet

The Global Orthopedic Surgical Robots Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 8.3 billion by 2034. The demand for advanced robotic-assisted surgical systems continues to surge as healthcare providers look for ways to increase procedural accuracy, minimize complications, and ensure quicker patient recovery. As the prevalence of orthopedic disorders-including osteoarthritis, ligament injuries, degenerative bone diseases, and fractures-continues to rise globally, more healthcare facilities are shifting toward robotic platforms for surgical interventions. Aging populations, growing awareness about minimally invasive surgeries, and the increasing volume of joint and spinal procedures are further accelerating this shift.

In addition, surgeons are embracing robotic systems due to their enhanced visualization capabilities, real-time data integration, and improved dexterity during complex procedures. With robotics transforming the way orthopedic surgeries are performed, more hospitals and surgical centers are investing in these systems to optimize patient care. The push for value-based care and favorable insurance coverage in several countries is also supporting this trend. As robotics evolve with AI and machine learning, these systems are expected to play an even bigger role in orthopedic healthcare over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 17.2% |

The component segment includes robotic systems, accessories, software, and services. The robotic systems segment generated USD 890.3 million in 2024. These systems are gaining traction because they offer surgeons greater control and precision in performing delicate orthopedic surgeries, particularly in spinal and joint procedures. Their ability to improve implant alignment, reduce the risk of complications, and shorten recovery time makes them a preferred choice across hospitals and specialty clinics. With features like 3D visualization, haptic feedback, and advanced imaging support, robotic platforms are transforming the surgical workflow and enhancing overall outcomes.

By end use, the hospitals segment held a 52.9% share in 2024. Hospitals continue to dominate the market due to their strong clinical infrastructure, a high influx of orthopedic cases, and a growing emphasis on technological upgrades. They rely heavily on robotic systems to improve procedural consistency, reduce human error, and manage complex cases with greater efficiency. The rising number of geriatric patients and favorable reimbursement policies are also making it easier for hospitals to adopt and scale robotic-assisted surgical solutions.

North America Orthopedic Surgical Robots Market held a 41.9% share in 2024. The region's dominance is driven by its robust healthcare infrastructure, rising adoption of AI-powered technologies, and an increasing need for precision-based, minimally invasive orthopedic procedures. As joint-related conditions like osteoarthritis and osteoporosis continue to rise, North American hospitals and surgical centers are leading the charge in integrating next-gen robotic systems into their practices.

Prominent companies in the Global Orthopedic Surgical Robots Market include Medtronic, Think Surgical, Globus Medical, Brainlab, Accuray, MicroPort Orthopedics, Intuitive, Johnson & Johnson, CUREXO, Smith & Nephew, Asensus Surgical, Zimmer Biomet, Corin, Stryker, and NUVASIVE. These players are actively investing in R&D to refine surgical accuracy, integrate AI and haptics, and develop tailored solutions for diverse clinical needs. Many are expanding their global presence through partnerships with hospitals and distributors, while offering robust post-sales support and training to enhance user adoption and performance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of orthopedic disorders and injuries

- 3.2.1.2 Advancements in robotic-assisted surgery technology

- 3.2.1.3 Increasing demand for minimally invasive surgeries (MIS)

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of robotic surgical systems and procedures

- 3.2.2.2 Limited reimbursement policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Robotic systems

- 5.3 Accessories

- 5.4 Software and services

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Knee replacement

- 6.3 Hip replacement

- 6.4 Shoulder replacement

- 6.5 Spinal surgeries

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Specialty orthopedic clinics

- 7.5 Other end uses

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accuray

- 9.2 Asensus Surgical

- 9.3 Brainlab

- 9.4 Corin

- 9.5 CUREXO

- 9.6 Globus Medical

- 9.7 Intuitive

- 9.8 Johnson & Joshnson

- 9.9 Medtronic

- 9.10 MicroPort Orthopedics

- 9.11 NUVASIVE

- 9.12 Smith & Nephew

- 9.13 Stryker

- 9.14 Think Surgical

- 9.15 Zimmer Biomet