|

市场调查报告书

商品编码

1721501

全球印刷版市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Global Printing Plates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

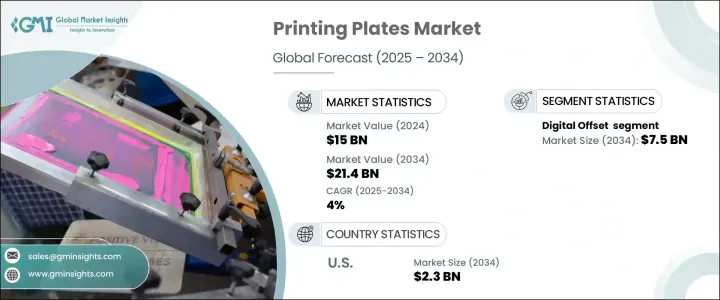

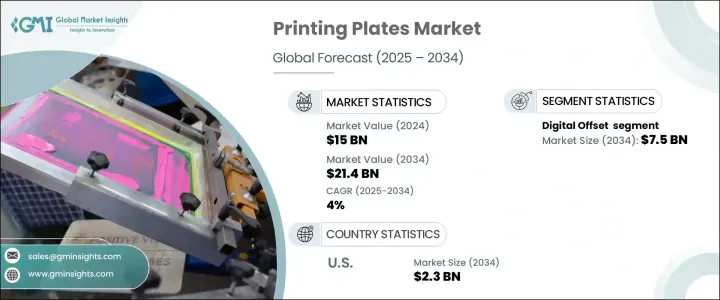

2024 年全球印刷版市场价值为 150 亿美元,预计到 2034 年将以 4% 的复合年增长率成长,达到 214 亿美元。市场扩张的动力来自于各行各业对高品质包装和促销印刷的持续需求。随着消费品、食品饮料、製药和出版业的企业不断强调优质包装和行销材料,对先进、经济高效的印刷解决方案的需求也在增加。印版在确保卓越的影像再现、更快的处理速度和更高的生产效率方面发挥着至关重要的作用。工业和商业领域的印刷产量不断增长,促使製造商采用技术先进的印版,以提供稳定的品质和最少的浪费。随着消费者偏好的变化推动产品客製化和生产週期的缩短,该行业正在迅速发展以支援高解析度、短版和可变资料列印。从类比到数位工作流程的转变已经获得了显着的势头,特别是当公司寻求优化营运工作流程和缩短週转时间时。此外,永续性已成为关键考虑因素,製造商越来越倾向于采用环保解决方案,最大限度地减少化学品的使用并符合全球环境标准。

印版市场极大地受益于印刷技术的快速创新,尤其是自动化和数位化。随着公司寻求简化营运并减少材料浪费,电脑直接製版 (CTP) 系统等现代解决方案正在提供变革性的优势。这些系统显着提高了列印工作流程的速度、精确度和永续性。透过消除多个手动步骤,CTP 技术可确保更快的设定、减少劳动力需求并提高列印品质。事实证明,这些进步对于企业满足动态的客户需求并在快节奏的市场中保持竞争力至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 150亿美元 |

| 预测值 | 214亿美元 |

| 复合年增长率 | 4% |

数位胶印版材在 2024 年占最大份额,产值达 51 亿美元,预计到 2034 年将达到 75 亿美元。由于这些版材能够取代传统的基于胶片的工艺,因此正迅速成为行业标准。它们的使用不仅可以减少设定时间和材料消耗,还可以保证高品质、可重复的影像再现。商业印刷、包装和出版等应用领域对短版、高解析度印刷的需求日益增长,进一步加速了对数位胶印版的需求。印刷供应商青睐这些印版,因为它们具有成本效益、清晰的细节输出以及最大限度减少生产週期延迟的能力。

预计 2025 年至 2034 年间,德国印刷版市场将以 4.4% 的复合年增长率成长。该国拥有强大的印刷设备製造商和版材供应商生态系统,他们在研发方面投入了大量资金,以开发可持续的高性能解决方案。随着国家对品质和创新的重视,优质胶印和柔印版在食品包装、个人护理和药品等关键领域越来越受到重视。随着对环保、高耐用性印刷品的需求不断增加,德国製造商在製定性能和环境责任的行业标准方面处于领先地位。

全球印刷版市场的主要参与者包括富士胶卷控股公司、特瑞堡公司、杜邦公司、麦德美德图形解决方案有限责任公司、爱克发-吉华公司、伊士曼柯达公司、东丽株式会社、Plate Crafters LLC、CRON-ECRM LLC、Luscher Technologies AG、海德堡印刷机械股份公司、东家日照相公司、美国三龙科艺术公司、EZBA、TVoBA 公司、奥富林摄影公司、图科机械公司。这些公司正在积极投资研发,以推出只需最少处理且能提供更高印刷清晰度的下一代 CTP 版材。随着製造商努力减少化学品的使用和整体浪费,永续性成为人们关注的重点,环保产品线越来越受到关注。与商业印刷商和包装公司的策略合作伙伴关係正在实现客製化产品开发,而数位印版成像和印版开发速度的进步正在帮助重塑竞争格局。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 包装产业需求不断成长

- 印刷技术的进步

- 促销和广告活动增多

- 产业陷阱与挑战

- 转向数位科技转变

- 来自喷墨和雷射列印等替代产品的竞争

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 柔版印刷版

- 网版印刷版

- 凹版印刷版

- 轮转凹版印刷版

- 热敏印刷板

- 印刷版清洁机

- 瓦楞柔性版印刷版

- 数位柔版印刷版

- 数位胶印版材

- 直接雷射雕刻製版印刷设备

- 干式胶印版

- 印刷活字、木版、印版、滚筒和平版印刷石

第六章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第七章:公司简介

- Agfa-Gevaert NV

- Asahi Photoproducts Europe NV

- CRON-ECRM LLC

- DuPont de Nemours, Inc.

- Eastman Kodak Company

- Esko-Graphics BVBA

- Flint Group

- FUJIFILM Holdings Corporation

- Heidelberger Druckmaschinen AG

- Luscher Technologies AG

- MacDermid Graphics Solutions LLC

- Mitsubishi Chemical Corporation

- PlateCrafters LLC

- Toray Industries, Inc.

- Trelleborg AB

The Global Printing Plates Market was valued at USD 15 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 21.4 billion by 2034. Market expansion is fueled by the ongoing demand for high-quality packaging and promotional printing across industries. As businesses across consumer goods, food and beverage, pharmaceuticals, and publishing continue to emphasize premium packaging and marketing collateral, the need for advanced, cost-effective printing solutions is on the rise. Printing plates play a crucial role in ensuring superior image reproduction, faster processing, and greater production efficiency. Growing volumes of print output in both industrial and commercial segments are pushing manufacturers to adopt technologically advanced plates that deliver consistent quality with minimal waste. With shifting consumer preferences driving product customization and shorter production runs, the industry is rapidly evolving to support high-resolution, short-run, and variable data printing. The transition from analog to digital workflows has gained significant momentum, especially as companies seek to optimize operational workflows and reduce turnaround times. Additionally, sustainability has become a pivotal consideration, with manufacturers increasingly leaning toward eco-conscious solutions that minimize chemical use and align with global environmental standards.

The printing plates market benefits immensely from the rapid innovation in printing technologies, especially automation and digitalization. As companies look to streamline operations and reduce material waste, modern solutions like computer-to-plate (CTP) systems are offering transformative benefits. These systems significantly improve speed, precision, and sustainability in printing workflows. By eliminating several manual steps, CTP technology ensures faster setup, reduced labor requirements, and enhanced print quality. Such advancements are proving vital for businesses aiming to meet dynamic client demands while staying competitive in a fast-paced market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 4% |

Digital offset printing plates held the largest share in 2024, generating USD 5.1 billion, and are expected to reach USD 7.5 billion by 2034. These plates are quickly becoming the industry standard due to their ability to replace traditional film-based processes. Their usage not only cuts down setup time and material consumption but also guarantees high-quality, repeatable image reproduction. The growing need for short-run, high-resolution printing across applications such as commercial printing, packaging, and publishing is further accelerating demand for digital offset plates. Print providers favor these plates for their cost-efficiency, sharp detail output, and ability to minimize delays in production cycles.

Germany Printing Plates Market is forecasted to grow at a CAGR of 4.4% between 2025 and 2034. The country is home to a strong ecosystem of printing equipment manufacturers and plate suppliers who are deeply invested in R&D to develop sustainable and high-performance solutions. With a national emphasis on quality and innovation, premium offset and flexographic plates are gaining prominence in key segments such as food packaging, personal care, and pharmaceuticals. As demand increases for eco-friendly, high-durability prints, German manufacturers are leading the charge in setting industry standards for both performance and environmental responsibility.

Major players in the Global Printing Plates Market include FUJIFILM Holdings Corporation, Trelleborg AB, DuPont de Nemours, Inc., MacDermid Graphics Solutions LLC, Agfa-Gevaert NV, Eastman Kodak Company, Toray Industries, Inc., Plate Crafters LLC, CRON-ECRM LLC, Luscher Technologies AG, Heidelberger Druckmaschinen AG, Asahi Photoproducts Europe NV, Esko-Graphics BVBA, Mitsubishi Chemical Corporation, and Flint Group. These companies are actively investing in R&D to introduce next-generation CTP plates that require minimal processing and deliver enhanced print sharpness. A strong focus is being placed on sustainability, with eco-friendly product lines gaining traction as manufacturers work to reduce chemical use and overall waste. Strategic partnerships with commercial printers and packaging firms are enabling tailored product development, while advancements in digital plate imaging and plate development speed are helping reshape the competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in packaging industries

- 3.2.1.2 Advancements in printing technology

- 3.2.1.3 Rise in promotional and advertising activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Shift toward digital technology

- 3.2.2.2 Competition from alternatives such as inkjet and laser printing

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Flexographic printing plates

- 5.3 Screen printing plates

- 5.4 Gravure printing plates

- 5.5 Rotogravure printing plates

- 5.6 Thermal printing plates

- 5.7 Printing plate cleaning machines

- 5.8 Corrugated flexographic printing plates

- 5.9 Digital flexographic printing plates

- 5.10 Digital offset printing plates

- 5.11 Direct laser engraving to plate printing equipment

- 5.12 Dry offset printing plates

- 5.13 Printing type, blocks, plates, cylinders, and lithographic stones

Chapter 6 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.4.6 Malaysia

- 6.4.7 Indonesia

- 6.5 Latin America

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.6 MEA

- 6.6.1 Saudi Arabia

- 6.6.2 UAE

- 6.6.3 South Africa

Chapter 7 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 7.1 Agfa-Gevaert NV

- 7.2 Asahi Photoproducts Europe NV

- 7.3 CRON-ECRM LLC

- 7.4 DuPont de Nemours, Inc.

- 7.5 Eastman Kodak Company

- 7.6 Esko-Graphics BVBA

- 7.7 Flint Group

- 7.8 FUJIFILM Holdings Corporation

- 7.9 Heidelberger Druckmaschinen AG

- 7.10 Luscher Technologies AG

- 7.11 MacDermid Graphics Solutions LLC

- 7.12 Mitsubishi Chemical Corporation

- 7.13 PlateCrafters LLC

- 7.14 Toray Industries, Inc.

- 7.15 Trelleborg AB