|

市场调查报告书

商品编码

1721503

西兰花种子水萃取物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Broccoli Seed Aqueous Extract Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

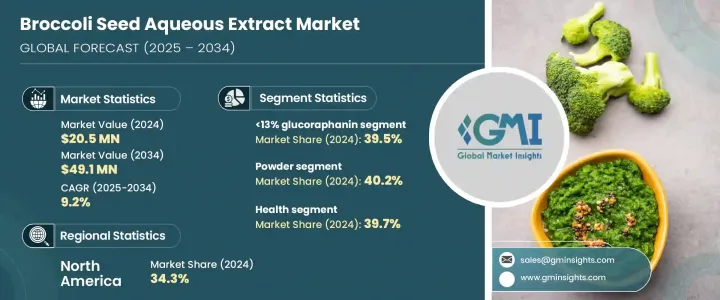

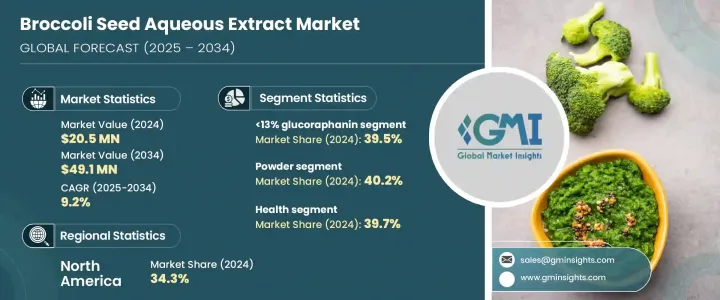

2024 年全球西兰花籽水萃取物市场价值为 2,050 万美元,预计到 2034 年将以 9.2% 的复合年增长率增长至 4,910 万美元。随着越来越多的消费者接受植物性保健产品并在健康养生法中优先考虑天然成分,市场经历了持续增长。随着人们越来越意识到合成补充剂的风险,注重健康的人们开始转向有机和植物性替代品。西兰花种子水萃取物以其高浓度的萝卜硫素(一种有效的抗氧化剂)而闻名,因其支持解毒、减少发炎和对抗氧化压力的能力而受到关注。萝卜硫素广泛的治疗潜力不仅引起了消费者的兴趣,也引起了科学界的兴趣,研究不断揭示其对各种慢性疾病的保护作用。此外,素食主义和植物性饮食的兴起进一步扩大了对西兰花种子衍生补充剂的需求,尤其是在已开发市场。强调清洁标籤、功能性成分和采购透明度的品牌正在蓬勃发展,符合现代消费者的价值观和健康目标。

最初,对西兰花种子水萃取物的需求主要来自于注重健康的个人和膳食补充剂领域。随着认知的增强,这种需求已经扩大到功能性食品生产商和临床营养部门。市场分为不同的类别,其中一种是树脂型 - 包括 13% 的萝卜硫苷、13% 和 20% 的萝卜硫苷组合以及 20% 的萝卜硫苷浓度。 2024年,13%萝卜硫苷部分占39.5%的市场。它因其强大的抗氧化和抗炎特性而特别受欢迎,使其成为一般健康补充剂和功能性食品配方的首选成分。与高浓度产品相比,其价格更便宜,可供大众市场补充剂製造商购买。均衡的生物活性和合理的成本使该类别成为临床级膳食补充剂和医疗营养品牌供应商的主要产品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2050万美元 |

| 预测值 | 4910万美元 |

| 复合年增长率 | 9.2% |

市场进一步按产品形式细分,包括粉末、胶囊和片剂。 2024 年,粉状产品占了 40.2% 的市场份额,预计 2025 年至 2034 年期间的复合年增长率将达到 9.4%。粉状产品因其多功能性以及在冰沙、蛋白质混合物和植物性营养产品中的易用性而受到健康和保健领域的青睐。胶囊也越来越受欢迎,尤其是对于那些寻求方便和无需准备即可获得精确剂量的用户来说。这种格式与营养保健品和预防保健市场产生了共鸣,因为一致性和准确性至关重要。

2024 年,北美占据全球西兰花种子水萃取物市场的 34.3%。该地区的成长得益于消费者对天然植物性健康解决方案的偏好日益增加。可支配收入的增加,加上预防保健意识的增强,促进了这一势头。在北美、欧洲、亚太和拉丁美洲等不同地区,消费者的行为、收入水准和健康优先事项各不相同,从而决定了区域成长模式和市场潜力。

全球市场的主要参与者包括 Sabinsa Corporation、Kemin Industries、NutraScience Labs、Frutarom Health、NutraBio 和 Nikko Chemicals。这些公司正在扩大其产品组合,推出粉末、胶囊和片剂等多种产品形式,以满足不断变化的消费者需求。许多公司专注于创新和提高生物利用度,正在投资研发以提供更有效的配方。与健康影响者的策略合作伙伴关係以及与零售商和线上平台的合作对于提升品牌知名度和吸引新受众至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计数据

註:以上贸易状况将依重点国家提供

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对天然产品的偏好日益增加

- 清洁美容和个人护理的成长

- 更严格的法规和清洁标籤需求

- 产业陷阱与挑战

- 生产成本高

- 供应链约束

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- <13% 萝卜硫苷

- 13% 萝卜硫苷

- 20% 萝卜硫苷

第六章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 粉末

- 胶囊

- 药片

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 保健产品

- 功能性食品

- 製药

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Kemin Industries

- Sabinsa Corporation

- Frutarom Health

- NutraScience Labs

- NutraBio

- Sabinsa Corporation

- Nikko Chemicals

The Global Broccoli Seed Aqueous Extract Market was valued at USD 20.5 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 49.1 million by 2034. The market has experienced consistent growth as more consumers embrace plant-based wellness products and prioritize natural ingredients in their health regimens. With the rising awareness of the risks associated with synthetic supplements, health-focused individuals are shifting toward organic and plant-based alternatives. Broccoli seed aqueous extract, known for its high concentration of sulforaphane-a potent antioxidant compound-has gained attention for its ability to support detoxification, reduce inflammation, and combat oxidative stress. Sulforaphane's broad therapeutic potential has sparked interest not only among consumers but also within the scientific community, where research continues to uncover its protective effects against various chronic conditions. Additionally, the surge in veganism and plant-based diets has further amplified demand for broccoli seed-derived supplements, particularly in developed markets. Brands that highlight clean labels, functional ingredients, and transparency in sourcing are thriving, aligning with modern consumer values and wellness goals.

Initially, the demand for broccoli seed aqueous extract came primarily from health-conscious individuals and the dietary supplement segment. As awareness grows, this demand has broadened to include functional food producers and clinical nutrition sectors. The market is divided into various categories, one of which is resin type-this includes 13% glucoraphanin, a combination of 13% and 20% glucoraphanin, and 20% glucoraphanin concentrations. In 2024, the 13% glucoraphanin segment accounted for a 39.5% market share. It is especially popular due to its strong antioxidant and anti-inflammatory characteristics, making it a go-to ingredient for general wellness supplements and functional food formulations. Its affordability compared to higher concentrations makes it accessible to mass-market supplement manufacturers. The balanced bioactivity and reasonable cost have made this category a staple among suppliers of clinical-grade dietary supplements and medical nutrition brands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.5 Million |

| Forecast Value | $49.1 Million |

| CAGR | 9.2% |

The market is further segmented by product form, including powder, capsules, and tablets. In 2024, powder form captured a 40.2% share and is expected to expand at a 9.4% CAGR from 2025 to 2034. Powders are favored in the health and wellness space due to their versatility and ease of use in smoothies, protein blends, and plant-based nutrition products. Capsules are also gaining momentum, especially among users seeking convenience and precise dosage without preparation. This format resonates with the nutraceutical and preventive health markets where consistency and accuracy matter.

North America held a 34.3% share of the global broccoli seed aqueous extract market in 2024. Growth in this region is driven by increasing consumer preference for natural, plant-based wellness solutions. Rising disposable incomes, coupled with growing awareness of preventive healthcare, have contributed to this momentum. Across regions-including North America, Europe, Asia Pacific, and Latin America-consumer behaviors, income levels, and health priorities vary, shaping regional growth patterns and market potential.

Key players in the global market include Sabinsa Corporation, Kemin Industries, NutraScience Labs, Frutarom Health, NutraBio, and Nikko Chemicals. These companies are expanding their portfolios with diverse product formats such as powders, capsules, and tablets to meet evolving consumer needs. With a focus on innovation and enhanced bioavailability, many are investing in R&D to deliver more effective formulations. Strategic partnerships with wellness influencers and collaborations with retailers and online platforms have been instrumental in boosting brand visibility and capturing new audiences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics

Note: the above trade status will be provided for key countries

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising consumer preference for natural products

- 3.8.1.2 Growth in clean beauty & personal care

- 3.8.1.3 Stricter regulations & clean label demand

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Supply chain constraints

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 <13% Glucoraphanin

- 5.3 13% Glucoraphanin

- 5.4 20% Glucoraphanin

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Capsule

- 6.4 Tablet

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Health products

- 7.3 Functional foods

- 7.4 Pharmaceutical

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Kemin Industries

- 9.2 Sabinsa Corporation

- 9.3 Frutarom Health

- 9.4 NutraScience Labs

- 9.5 NutraBio

- 9.6 Sabinsa Corporation

- 9.7 Nikko Chemicals