|

市场调查报告书

商品编码

1721504

空气管道市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Air Ducts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

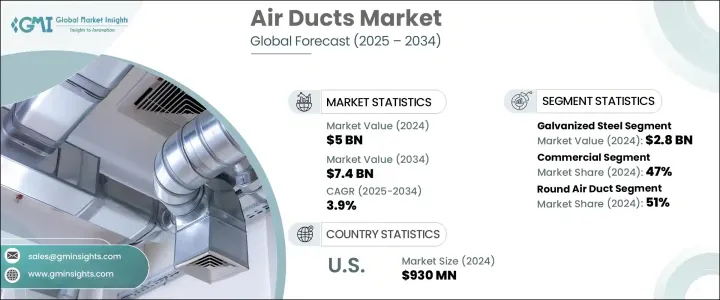

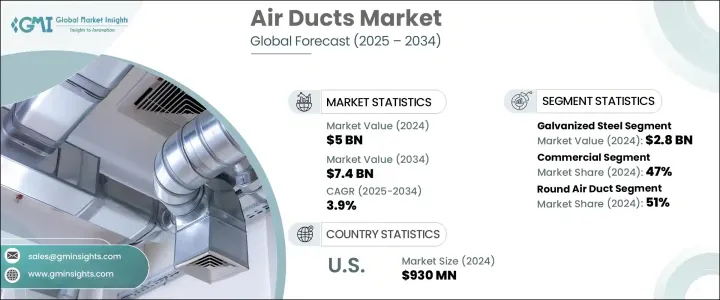

2024 年全球空气管道市场价值为 50 亿美元,预计到 2034 年将以 3.9% 的复合年增长率增长至 74 亿美元。这一增长主要得益于全球快速的城市化进程和日益严格的能源效率法规的采用。随着全球城市的不断扩张,对住宅、商业和工业基础设施的需求激增,直接影响对先进 HVAC 系统的需求。这些系统严重依赖空气管道来维持最佳的室内温度和空气品质。发展中国家和已开发地区的建筑活动日益增多,推动了现代暖通空调系统的安装,从而刺激了对高效、可持续且易于维护的空气管道的需求。

HVAC 系统现在是新建筑的核心功能,主要用于确保热舒适度和能源效率。对绿建筑实践的日益重视为空气管道产业创造了新的机会,尤其是注重环保材料製成的产品。在气候极端的地区,特别是在冷却和通风系统不可或缺的地区,耐用、高效的空气管道系统的使用明显增加。商业建筑是这些系统的主要采用者,因为空气管道对于维持办公室、零售店、交通站和多用途综合体等人流量大区域的室内空气品质至关重要。这些区域需要全天候的空气循环,因此对既实用又与建筑外观相容的高性能管道的需求也越来越大。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 50亿美元 |

| 预测值 | 74亿美元 |

| 复合年增长率 | 3.9% |

2024 年,镀锌钢风管占最大的市场份额,创造超过 28 亿美元的收入。由于其出色的耐用性和抗磨损性,这种材料仍然是承包商和建筑商的首选。镀锌钢管道需要的维护很少,并且能够提供持久的性能,从长远来看具有成本效益。聚合物基空气管道也越来越受欢迎,预计 2025 年至 2034 年的复合年增长率将达到 3.6% 左右。这些管道主要由 PVC 和聚乙烯等经济高效且耐用的塑胶製成。它们重量轻、耐腐蚀且易于安装,为预算紧张、时间紧迫的专案提供了可靠的解决方案。其光滑的内表面还可以最大限度地减少空气阻力,从而改善气流并提高整体 HVAC 性能。

2024 年,商业部门将主导空气管道市场,约占全球收入份额的 47%。商业设施,尤其是位于城市中心的商业设施,优先考虑支援能源效率和空气品质合规性的 HVAC 系统。在这些空间中,美学也发挥关键作用,推动了对与现代室内设计无缝融合的空气管道的需求。商业设施中使用的管道必须提供最佳气流,同时适应各种布局和结构配置。

从形状来看,圆形风管在 2024 年占据主导地位,占整个市场的 51% 以上。它们的空气动力学设计确保了高效的气流、降低了噪音并最大限度地减少了压力降,使其成为住宅和商业应用的理想选择。圆形管道也更易于清洁和维护,具有更好的长期可靠性和安装灵活性。矩形管道通常由镀锌钢等金属製成,由于其结构坚固且与标准化建筑设计相容,因此受到大型商业和工业项目的青睐。这些管道通常整合到天花板或墙壁系统中,从而提供更紧凑的占地面积。椭圆形管道结合了圆形和矩形两种类型的特点,也越来越受欢迎。它们外观时尚,同时保持强大的气流效率,使其成为性能和设计齐头并进的现代建筑的理想选择。

2024 年,北美占据了全球空气管道市场的很大份额,光是美国就贡献了约 9.3 亿美元的收入,相当于该地区份额的近 80%。美国建筑和基础设施建设的强劲成长刺激了对先进暖通空调设备的需求,特别是支持长期永续发展目标的系统。建筑商正在积极采用环保材料製成的管道,以符合绿色建筑法规和认证。此外,智慧型 HVAC 系统的日益普及也推动了对能够支援连接技术的兼容风管的需求。这导致人们开始转向使用新一代管道系统改造旧建筑,以提高空气品质、能源效率和温度控制。

该行业的主要参与者正在投资技术升级、设施扩建和战略合作伙伴关係,以扩大其市场份额并满足不断变化的客户需求。这些倡议使他们能够提供符合全球市场不断变化的建筑规范、能源规范和设计期望的高性能空气管道解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 都市化和基础设施发展

- 能源效率监管

- 气候变迁

- 产业陷阱与挑战

- 安装和维护成本高

- 现有结构改造的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 镀锌钢

- 铝

- 玻璃纤维

- 聚合物

- 其他的

第六章:市场估计与预测:依形状,2021-2034

- 主要趋势

- 矩形的

- 圆形的

- 椭圆形

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

- 工业的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- DC Duct & Sheet Metal

- Deflecto

- DUNDAS JAFINE

- Eastern Sheet Metal

- Lindab Group

- Lennox International

- M&M Manufacturing

- Novaflex Group

- Nuaire

- Rubber World Industries

- Ruskin Titus India

- Saint-Gobain

- Sisneros Bros

- Thermaflex

- Tin Man Sheet Metal

- Turnkey Duct Systems

- Zinger Sheet Metal

The Global Air Ducts Market was valued at USD 5 billion in 2024 and is estimated to grow a CAGR of 3.9% to reach USD 7.4 billion by 2034. This growth is largely driven by the rapid pace of urbanization worldwide and the rising adoption of stringent energy efficiency regulations. As global cities continue to expand, the need for residential, commercial, and industrial infrastructure has surged, directly impacting demand for advanced HVAC systems. These systems rely heavily on air ducts to maintain optimal indoor temperatures and air quality. The growing construction activity across developing and developed regions alike is boosting the installation of modern HVAC systems, consequently fueling the demand for air ducts that are efficient, sustainable, and easy to maintain.

HVAC systems are now a core feature in new buildings, primarily to ensure thermal comfort and energy efficiency. The growing emphasis on green construction practices is creating fresh opportunities in the air ducts industry, with a particular focus on products made from eco-friendly materials. In regions with extreme climates, especially where cooling and ventilation systems are indispensable, there is an evident rise in the use of durable and efficient air duct systems. Commercial buildings are leading adopters of these systems, as air ducts are critical to maintaining indoor air quality in high-traffic zones such as offices, retail stores, transit stations, and multi-use complexes. These areas require round-the-clock air circulation, increasing the necessity for high-performance ducts that are both functional and visually compatible with the architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 3.9% |

In 2024, galvanized steel air ducts held the largest share of the market, generating revenue of over USD 2.8 billion. This material remains a preferred choice among contractors and builders due to its exceptional durability and resistance to wear over time. Galvanized steel ducts require minimal upkeep and offer prolonged performance, making them cost-effective over the long term. Polymer-based air ducts are also gaining traction and are expected to register a CAGR of around 3.6% from 2025 to 2034. These ducts are primarily made from cost-efficient and durable plastics such as PVC and polyethylene. They are lightweight, corrosion-resistant, and easy to install, providing a reliable solution for projects with tight budgets and strict timelines. Their smooth inner surfaces also minimize air resistance, leading to improved airflow and better overall HVAC performance.

The commercial sector dominated the air ducts market in 2024, accounting for about 47% of the global revenue share. Commercial facilities, especially those in urban centers, are prioritizing HVAC systems that support energy efficiency and air quality compliance. In these spaces, aesthetics also play a key role, pushing demand for air ducts that seamlessly integrate with modern interior designs. Ducts used in commercial setups must provide optimal airflow while being adaptable to various layouts and structural configurations.

By shape, round air ducts took the lead in 2024, capturing over 51% of the total market. Their aerodynamic design ensures efficient airflow with reduced noise and minimal pressure drop, making them ideal for both residential and commercial applications. Round ducts are also easier to clean and maintain, offering better long-term reliability and installation flexibility. Rectangular ducts, typically manufactured from metals like galvanized steel, are favored for large-scale commercial and industrial projects due to their structural robustness and compatibility with standardized building designs. These ducts are often integrated into ceilings or wall systems, offering a more compact footprint. Oval ducts, combining the features of both round and rectangular types, are also becoming increasingly popular. They offer a sleek appearance while maintaining strong airflow efficiency, making them ideal for modern buildings where performance and design go hand in hand.

North America represented a significant share of the global air ducts market in 2024, with the United States alone contributing approximately USD 930 million in revenue, which equated to nearly 80% of the regional share. The robust growth in construction and infrastructure development across the U.S. has spurred demand for advanced HVAC installations, particularly systems that support long-term sustainability goals. Builders are actively adopting ducts made from eco-conscious materials to comply with green building regulations and certifications. Moreover, the increased incorporation of smart HVAC systems is driving the need for compatible air ducts that can support connected technologies. This is resulting in a shift toward retrofitting older buildings with new-generation ductwork to enhance air quality, energy efficiency, and temperature control.

Key players in the industry are investing in technology upgrades, facility expansions, and strategic partnerships to expand their market presence and meet evolving customer needs. These moves are enabling them to deliver high-performance air duct solutions that align with changing building codes, energy norms, and design expectations across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Urbanization and infrastructure development

- 3.5.1.2 Energy efficiency regulation

- 3.5.1.3 Climate change

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High installation and maintenance costs

- 3.5.2.2 Complexity of retrofitting in existing structures

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Galvanized steel

- 5.3 Aluminum

- 5.4 Fiber glass

- 5.5 Polymers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Shape, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Rectangular

- 6.3 Round

- 6.4 Oval

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 DC Duct & Sheet Metal

- 9.2 Deflecto

- 9.3 DUNDAS JAFINE

- 9.4 Eastern Sheet Metal

- 9.5 Lindab Group

- 9.6 Lennox International

- 9.7 M&M Manufacturing

- 9.8 Novaflex Group

- 9.9 Nuaire

- 9.10 Rubber World Industries

- 9.11 Ruskin Titus India

- 9.12 Saint-Gobain

- 9.13 Sisneros Bros

- 9.14 Thermaflex

- 9.15 Tin Man Sheet Metal

- 9.16 Turnkey Duct Systems

- 9.17 Zinger Sheet Metal