|

市场调查报告书

商品编码

1721515

配电自动化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Distribution Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

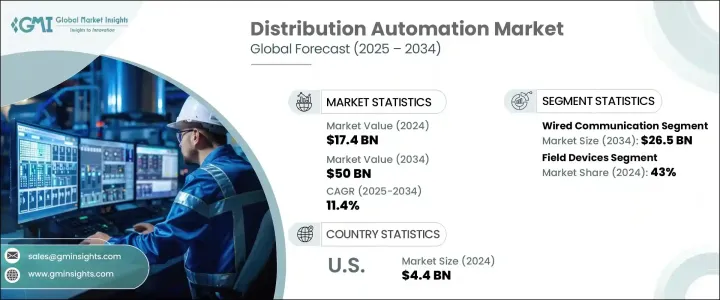

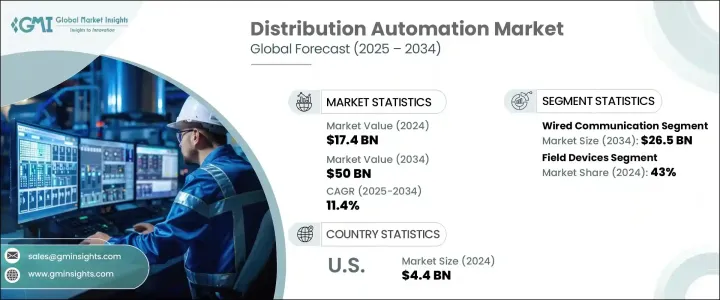

2024 年全球配电自动化市场价值为 174 亿美元,预计到 2034 年将以 11.4% 的复合年增长率成长,达到 500 亿美元。随着世界各地的公用事业公司采用先进技术来实现电网现代化,该市场正经历着显着的发展势头。不断增长的能源需求、不断增加的可再生能源整合以及对电网可靠性和弹性的日益关注,正在促使公共和私营部门的参与者优先考虑配电自动化解决方案。政府和公用事业供应商正在迅速投资自动化,以减少停电、提高能源效率并支援永续的电力基础设施。

随着电力基础设施老化以及城乡电气化趋势的不断加剧,自动化配电网路正成为向智慧能源系统转型的重要支柱。自动化在处理即时电力消耗资料和提高资产管理能力方面也发挥着至关重要的作用,使公用事业公司能够更快地应对故障并更有效地平衡能源供应。随着数位转型不断重塑能源基础设施,配电自动化系统在全球建立可靠、安全且适应性强的能源电网的努力中变得不可或缺。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 174亿美元 |

| 预测值 | 500亿美元 |

| 复合年增长率 | 11.4% |

电网现代化的日益增长的需求、智慧电网的实施以及可靠电力分配的需求是该市场的主要驱动力。公用事业公司越来越多地采用自动化解决方案来提高效率、降低营运成本并为消费者提供更稳定、更可靠的电力供应。作为向更智慧、更具弹性的基础设施迈进的一部分,配电自动化正在全球范围内获得关注,旨在提高电网性能并支持再生能源的整合。

有线通讯仍然是市场中的主导部分,预计到 2034 年将成长 265 亿美元。光纤和乙太网路以其稳定性、低延迟和抗干扰性而闻名,将继续为高可靠性应用提供帮助。公用事业公司严重依赖有线网路来实现 SCADA 系统和电网即时监控等功能,确保关键操作顺利运作。

现场设备部分包括智慧重合闸、自动开关和故障指示器,到 2024 年将占据 43% 的份额,因为这些设备与物联网和边缘运算相结合,可以提高电网的可靠性和效率。这些设备对于提高电网的功能和可靠性至关重要。透过与物联网 (IoT) 技术和边缘运算相结合,这些设备增强了即时监控、预测性维护和故障检测能力。智慧重合器对于自动侦测故障和在暂时中断后恢復供电尤为重要,可显着缩短停电时间。

2024 年,美国配电自动化市场产值将达 44 亿美元。这一成长归功于电网系统的进步、再生能源的采用以及创新技术的日益普及。旨在提高能源效率的联邦和州政策,以及 5G 和边缘网路的整合以增强监控和控制,正在进一步推动该市场的扩张。采用人工智慧和基于物联网的系统使公用事业公司能够优化营运、减少停机时间并增强电网弹性。

全球配电自动化市场的主要参与者包括 Landis+Gyr、ABB、思科、伊顿、通用电气、G&W Electric、S&C Electric Company、Hubbell、Itron、NovaTech、施耐德电气、日立、Schweitzer Engineering Laboratories、西门子、东芝能源系统与解决方案、Trilliant Holdings 和 Xylem。为了加强其影响力,配电自动化市场的公司正专注于技术创新和产品开发。许多公司正在投资基于人工智慧的自动化和物联网解决方案,以改善电网管理和优化能源分配。与公用事业和能源供应商的合作也是一项重要策略,使公司能够根据特定需求量身定制解决方案并扩大其影响力。此外,各公司正在探索併购方式,以实现产品多样化并进入新的区域市场。增加对网路安全解决方案的投资是解决与电网安全和资料隐私日益增长的担忧的另一个关键策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依通讯方式,2021 - 2034 年

- 主要趋势

- 有线

- 无线的

第六章:市场规模及预测:依组成部分,2021 - 2034 年

- 主要趋势

- 软体

- 现场设备

- 服务

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 公用事业

- 私人公用事业

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印度

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 智利

第九章:公司简介

- ABB

- Cisco

- Eaton

- GE

- G&W Electric

- Hitachi

- Hubbell

- Itron

- Landis+Gyr

- NovaTech

- Schneider Electric

- Schweitzer Engineering Laboratories

- S&C Electric Company

- Siemens

- Toshiba Energy Systems & Solutions

- Trilliant Holdings

- Xylem

The Global Distribution Automation Market was valued at USD 17.4 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 50 billion by 2034. The market is witnessing remarkable momentum as utilities worldwide embrace advanced technologies to modernize power grids. Rising energy demands, increasing integration of renewable energy sources, and heightened concerns around grid reliability and resilience are pushing both public and private sector players to prioritize distribution automation solutions. Governments and utility providers are rapidly investing in automation to reduce power outages, enhance energy efficiency, and support a sustainable electricity infrastructure.

With aging electrical infrastructure and surging electrification trends across urban and rural areas alike, automated distribution networks are emerging as a critical pillar in the transition toward smarter energy systems. Automation is also proving essential in handling real-time power consumption data and improving asset management capabilities, enabling utilities to respond faster to faults and balance energy supply more effectively. As digital transformation continues to reshape energy infrastructure, distribution automation systems are becoming indispensable in the global effort to build a reliable, secure, and adaptive energy grid.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.4 Billion |

| Forecast Value | $50 Billion |

| CAGR | 11.4% |

The growing demand for grid modernization, the implementation of smart grids, and the need for reliable power distribution are the primary drivers of this market. Utilities are increasingly turning to automation solutions to enhance efficiency, reduce operational costs, and provide a more stable and reliable power supply to consumers. Distribution automation is gaining traction globally as part of the larger push toward smarter, more resilient infrastructure, aiming to improve grid performance and support the integration of renewable energy sources.

Wired communication remains the dominant segment within the market and is projected to grow by USD 26.5 billion by 2034. Fiber optics and Ethernet networks, known for their stability, low latency, and resistance to interference, continue to help in high-reliability applications. Utility companies rely heavily on wired networks for functions like SCADA systems and real-time monitoring of the grid, ensuring that critical operations run smoothly.

The field devices segment, which includes smart reclosers, automated switches, and fault indicators, accounted for a 43% share in 2024, as these devices integrate with IoT and edge computing to improve the reliability and efficiency of power grids. These devices are essential for improving the functionality and reliability of power grids. By integrating with Internet of Things (IoT) technology and edge computing, these devices enhance real-time monitoring, predictive maintenance, and fault detection capabilities. Smart reclosers are particularly important for automatically detecting faults and restoring power after temporary disruptions, significantly reducing the duration of outages.

U.S. Distribution Automation Market generated USD 4.4 billion in 2024. The growth is attributed to advancements in grid systems, the adoption of renewable energy sources, and the increasing deployment of innovative technologies. Federal and state policies aimed at improving energy efficiency, along with the integration of 5G and edge networks for enhanced monitoring and control, are further driving the expansion of this market. The adoption of artificial intelligence and IoT-based systems is enabling utilities to optimize operations, reduce downtime, and enhance grid resilience.

Key players in the Global Distribution Automation Market include Landis+Gyr, ABB, Cisco, Eaton, GE, G&W Electric, S&C Electric Company, Hubbell, Itron, NovaTech, Schneider Electric, Hitachi, Schweitzer Engineering Laboratories, Siemens, Toshiba Energy Systems & Solutions, Trilliant Holdings, and Xylem. To strengthen their presence, companies in the distribution automation market are focusing on technological innovation and product development. Many are investing in AI-based automation and IoT solutions to improve grid management and optimize energy distribution. Partnerships with utilities and energy providers are also a significant strategy, allowing companies to tailor solutions to specific needs and expand their reach. Additionally, companies are exploring mergers and acquisitions to diversify their offerings and enter new regional markets. Increased investment in cybersecurity solutions is another key strategy to address the growing concerns related to grid security and data privacy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Communication, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Wired

- 5.3 Wireless

Chapter 6 Market Size and Forecast, By Components, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Software

- 6.3 Field devices

- 6.4 Services

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Public utility

- 7.3 Private utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 India

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cisco

- 9.3 Eaton

- 9.4 GE

- 9.5 G&W Electric

- 9.6 Hitachi

- 9.7 Hubbell

- 9.8 Itron

- 9.9 Landis+Gyr

- 9.10 NovaTech

- 9.11 Schneider Electric

- 9.12 Schweitzer Engineering Laboratories

- 9.13 S&C Electric Company

- 9.14 Siemens

- 9.15 Toshiba Energy Systems & Solutions

- 9.16 Trilliant Holdings

- 9.17 Xylem