|

市场调查报告书

商品编码

1721519

弹性地板市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Resilient Flooring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

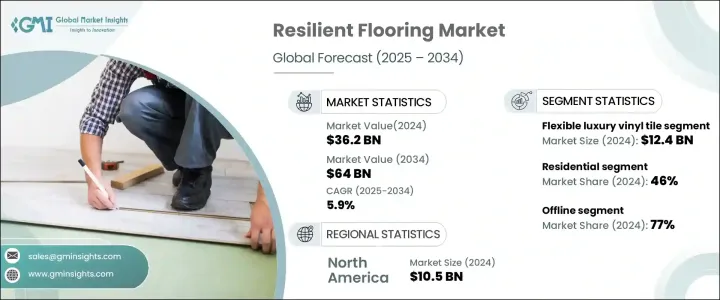

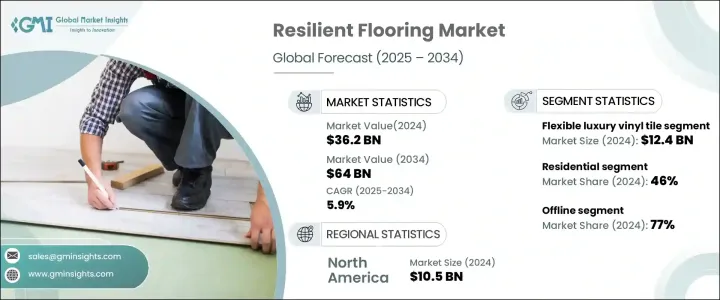

2024 年全球弹性地板市场价值为 362 亿美元,预计到 2034 年将以 5.9% 的复合年增长率成长,达到 640 亿美元。随着消费者对长期价值、低维护和卓越耐用性的认识不断提高,产业参与者正在见证对弹性地板解决方案的需求稳步增长。随着消费者和企业继续投资美观且实用的地板解决方案,市场正经历新的发展动能。弹性地板越来越受欢迎,不仅因为它能够复製木材、石材和陶瓷等高端材料,还因为它具有成本效益和环境相容性。快速的城市化、不断增长的可支配收入以及住宅和商业领域蓬勃发展的改造行业正在为未来的成长铺平道路。技术进步进一步推动了市场发展,製造商推出了满足现代消费者期望的创新设计和永续材料。此外,已开发经济体和新兴经济体对基础建设和智慧城市项目的投资不断增加,为全球弹性地板产业持续创造新的机会。

市场按产品类型细分,包括柔性豪华乙烯基瓷砖 (LVT)、刚性 LVT、片状乙烯基、油毡地板、软木地板、橡胶地板等。其中,柔性LVT领域成为2024年的最大贡献者,创造124亿美元的市场价值。柔性 LVT 因其与自然表面高度相似,且具有出色的耐用性、易于安装和低维护性而继续受到关注。寻求优质且实惠的地板解决方案的消费者越来越喜欢 LVT,尤其是在翻新项目中。製造商还利用永续发展趋势,推出由再生材料製成的产品并确保可回收性,这与日益增长的绿色建筑材料和循环经济实践的推动相一致。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 362亿美元 |

| 预测值 | 640亿美元 |

| 复合年增长率 | 5.9% |

在应用方面,住宅领域在 2024 年占据了 46% 的主导市场。这一增长主要得益于 DIY 家居装修的日益普及、环保地板替代品的日益普及以及对室内美观的高度关注。屋主选择弹性地板是因为其价格实惠、耐用且外观现代,使其成为客厅、厨房和地下室的首选。在商业方面,办公室、医院、教育设施和零售环境的需求仍然强劲,这些环境对弹性、卫生、易于维护和设计灵活性至关重要。

受活跃的建筑业、消费者对装修的倾向以及早期采用先进地板技术的推动,北美将在 2024 年占据全球 78% 的市场份额。美国继续引领潮流,得益于强劲的住房趋势、更高的装修预算以及向永续建筑实践的转变。

影响全球弹性地板领域的主要参与者包括 Shaw Industries、Mohawk Industries、Tarkett、Armstrong Flooring、Beaulieu、Gerflor、Forbo、Mannington Mills、Interface 和 Polyflor。这些公司正在透过策略性收购、环保产品创新和尖端製造业投资来扩大其影响力,以满足不断变化的消费者需求并加强其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 居家装潢趋势日益兴起

- 都市化进程加速

- 产业陷阱与挑战

- 初始成本高

- 挥发性有机化合物(VOC)问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 灵活的豪华乙烯基瓷砖

- 硬豪华乙烯基瓷砖

- 片状乙烯基

- 油毡地板

- 软木地板

- 橡胶地板

- 其他(乙烯基复合砖等)

第六章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 住宅

- 商业的

- 卫生保健

- 教育机构

- 饭店业

- 零售

- 其他(体育场、公共场所等)

- 工业的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Amtico

- Armstrong Flooring

- Beaulieu

- Congoleum

- COREtec

- Forbo

- Gerflor

- Interface

- Karndean

- LG Hausys

- Mannington Mills

- Mohawk Industries

- Polyflor

- Shaw Industries

- Tarkett

The Global Resilient Flooring Market was valued at USD 36.2 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 64 billion by 2034. Industry players are witnessing a steady surge in demand for resilient flooring solutions, driven by rising consumer awareness around long-term value, low maintenance, and superior durability. As consumers and businesses alike continue to invest in aesthetically pleasing yet functional flooring solutions, the market is experiencing renewed momentum. Resilient flooring is gaining popularity not only for its ability to replicate high-end materials like wood, stone, and ceramic but also for its cost-efficiency and environmental compatibility. Rapid urbanization, growing disposable incomes, and a booming remodeling sector across both residential and commercial sectors are paving the way for future growth. Technological advancements have further fueled the market, with manufacturers rolling out innovative designs and sustainable materials that meet the expectations of modern consumers. Additionally, increasing investments in infrastructure development and smart city projects across developed and emerging economies continue to create new opportunities for the global resilient flooring industry.

The market is segmented by product type, including flexible luxury vinyl tile (LVT), rigid LVT, sheet vinyl, linoleum flooring, cork flooring, rubber flooring, and others. Among these, the flexible LVT segment emerged as the top contributor in 2024, generating USD 12.4 billion. Flexible LVT continues to gain traction for its high resemblance to natural surfaces, combined with excellent durability, ease of installation, and low maintenance. Consumers looking for premium yet affordable flooring solutions increasingly prefer LVT, especially for renovation projects. Manufacturers are also leveraging the sustainability trend by introducing products made from recycled content and ensuring recyclability, aligning with the growing push for green building materials and circular economy practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.2 Billion |

| Forecast Value | $64 Billion |

| CAGR | 5.9% |

In terms of application, the residential segment held a dominant 46% market share in 2024. This growth is primarily fueled by the rising popularity of DIY home improvements, greater availability of eco-friendly flooring alternatives, and heightened focus on interior aesthetics. Homeowners are choosing resilient flooring for its affordability, durability, and modern appearance, making it a go-to option in living rooms, kitchens, and basements. On the commercial front, the demand remains strong across offices, hospitals, educational facilities, and retail environments where resilience, hygiene, ease of upkeep, and design flexibility are paramount.

North America accounted for 78% of the global market share in 2024, driven by an active construction landscape, consumer inclination toward renovations, and the early adoption of advanced flooring technologies. The U.S. continues to lead the charge, backed by robust housing trends, higher renovation budgets, and a shift toward sustainable building practices.

Key players shaping the global resilient flooring space include Shaw Industries, Mohawk Industries, Tarkett, Armstrong Flooring, Beaulieu, Gerflor, Forbo, Mannington Mills, Interface, and Polyflor. These companies are expanding their footprint through strategic acquisitions, innovation in eco-conscious products, and investment in cutting-edge manufacturing to meet evolving consumer needs and strengthen their global presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising trend of home renovations

- 3.5.1.2 Growing Urbanization

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High initial costs

- 3.5.2.2 Volatile Organic Compounds (VOCs) concerns

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Millions/Square Feet)

- 5.1 Key trends

- 5.2 Flexible luxury vinyl tile

- 5.3 Rigid luxury vinyl tile

- 5.4 Sheet vinyl

- 5.5 Linoleum flooring

- 5.6 Cork flooring

- 5.7 Rubber flooring

- 5.8 Others (vinyl composition tile, etc.)

Chapter 6 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Millions/Square Feet)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Millions/Square Feet)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Healthcare

- 7.3.2 Educational institute

- 7.3.3 Hospitality

- 7.3.4 Retail

- 7.3.5 Others (stadiums, public spaces, etc.)

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Millions/Square Feet)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Millions/Square Feet)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Amtico

- 10.2 Armstrong Flooring

- 10.3 Beaulieu

- 10.4 Congoleum

- 10.5 COREtec

- 10.6 Forbo

- 10.7 Gerflor

- 10.8 Interface

- 10.9 Karndean

- 10.10 LG Hausys

- 10.11 Mannington Mills

- 10.12 Mohawk Industries

- 10.13 Polyflor

- 10.14 Shaw Industries

- 10.15 Tarkett