|

市场调查报告书

商品编码

1721524

人工智慧治理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测AI Governance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

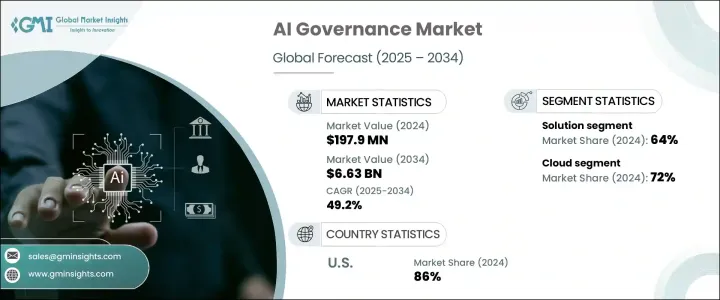

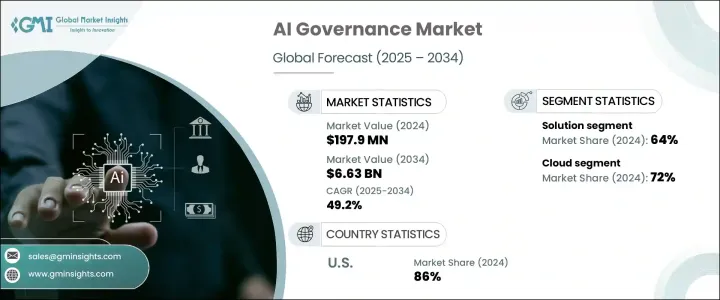

2024 年全球人工智慧治理市场价值为 1.979 亿美元,预计到 2034 年将以 49.2% 的复合年增长率成长,达到 66.3 亿美元。随着人工智慧在各个领域的迅速应用,组织在保护敏感资料和维持对人工智慧系统的控制方面面临越来越大的挑战。随着人工智慧不断影响核心业务功能,对治理框架的需求变得更加迫切,以防止资料滥用、模型偏差和未经授权的存取等风险。人工智慧治理在确保遵守道德标准、保持透明度以及在智慧系统中实现负责任的决策方面发挥着至关重要的作用。

虽然人工智慧驱动的工具可以透过诈欺检测和自动威胁分析等应用来帮助保护数位基础设施,但它们日益复杂的特点要求严格的监督。监管漏洞和潜在的道德违规行为会造成必须主动解决的漏洞。随着人们对人工智慧系统完整性的担忧日益加剧,企业认识到部署治理解决方案的重要性,这些解决方案不仅可以检测风险,还可以提供有关演算法效能、偏见缓解和资料准确性的即时洞察。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.979亿美元 |

| 预测值 | 66.3亿美元 |

| 复合年增长率 | 49.2% |

复杂的网路攻击不断增多,通常受到国家行为者的支持,这加剧了实施强有力的人工智慧治理结构的迫切性。组织也开始利用人工智慧渗透测试,模拟真实世界的攻击来侦测内部弱点。然而,如果没有完善的治理协议,这些先进的防御策略就有可能引入偏见和合规错误。人工智慧治理确保与道德、可解释性和问责制等核心网路安全原则保持一致,帮助组织在人工智慧部署中保持可见度和控制力。

在市场区隔方面,组件格局分为解决方案与服务。 2024 年,解决方案领域将引领市场,占据全球近 64% 的份额,并将在预测期内以超过 48% 的复合年增长率成长。这些平台整合了政策制定、实施和监控,为有效管理人工智慧系统提供了集中的框架。他们还支持使用先进的可解释性工具来检测和减少训练资料和演算法中的偏差。这些解决方案透过旨在使开发人员和稽核人员能够理解和追踪 AI 产生的输出的技术来强调可解释性。

在部署方面,人工智慧治理市场分为云端和本地模型。 2024 年,云端运算领域占据了约 72% 的市场份额,预计 2025 年至 2034 年期间的复合年增长率将超过 49.5%。人们对云端託管平台日益增长的偏好源于其可扩展性、可存取性以及易于整合到现有工作流程中。基于云端的 AI 治理工具有助于自动化合规任务、实现即时策略执行并简化 AI 监控工作。云端供应商还提供强大的安全功能,包括加密、存取控制和身分管理,以保护敏感的人工智慧资料免受外部威胁。

根据组织规模,市场分为大型企业和中小企业。由于大型企业在不同营运部门更广泛地采用人工智慧,它们将在 2024 年占据主导地位。这些企业通常会投资专门的人工智慧治理团队来监督内部和外部框架内的整合、合规性和问责制。他们在标准化人工智慧道德实践、确保系统负责任地部署并符合全球监管要求方面发挥关键作用。从效能监控到风险缓解,大型组织依赖治理结构来维护整个 AI 部署的完整性。

从地区来看,北美在 2024 年成为领先市场,光是美国就贡献了近 7,500 万美元,约占北美份额的 86%。区域成长主要得益于各行业人工智慧部署的增加,以及不断发展的监管框架和公众对人工智慧伦理的认识。该地区的企业正在大力投资优先考虑透明度、审计能力以及遵守当地和国际标准的治理工具。

塑造人工智慧治理格局的主要公司包括凯捷、IBM、Alphabet、Meta Platforms、NTT DATA、微软、甲骨文、SAP、Palantir Technologies 和 SAS Institute。这些供应商专注于自动化 AI 模型监督、将治理整合到 MLOps 中,并开发客製化框架以满足特定行业的合规需求。他们还与监管机构合作,共同创建支持在全球市场上合乎道德和负责任地使用人工智慧的治理模式。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 平台提供者

- 软体供应商

- 服务提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球网路安全事件发生率高

- 对道德骇客和渗透测试的兴趣日益浓厚

- 资料安全和隐私问题日益严重

- 道德人工智慧与物联网科技的融合

- 产业陷阱与挑战

- 实施成本高且资源需求大

- 缺乏标准化的人工智慧治理框架

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 平台

- 软体工具

- 服务

- 咨询

- 一体化

- 支援与维护

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 云

- 本地

第七章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 金融服务业

- 政府和国防

- 医疗保健与生命科学

- 媒体和娱乐

- 资讯科技和电信

- 汽车

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Alphabet

- BigID

- Capgemini

- Dataiku

- Deloitte

- EY (Ernst & Young)

- FICO

- H2O.ai

- IBM

- KPMG

- Meta Platforms

- Microsoft

- NTT DATA

- Oracle

- Palantir Technologies

- PWC

- SAP

- SAS Institute

- Stefanini

- Teradata

The Global AI Governance Market was valued at USD 197.9 million in 2024 and is estimated to grow at a CAGR of 49.2% to reach USD 6.63 billion by 2034. With the rapid adoption of artificial intelligence across various sectors, organizations are facing increasing challenges in protecting sensitive data and maintaining control over AI-powered systems. As AI continues to influence core business functions, the need for governance frameworks becomes more urgent to safeguard against risks such as data misuse, model bias, and unauthorized access. AI governance plays a crucial role in ensuring compliance with ethical standards, maintaining transparency, and enabling responsible decision-making across intelligent systems.

While AI-driven tools help secure digital infrastructures through applications like fraud detection and automated threat analysis, their growing complexity demands rigorous oversight. Regulatory gaps and the potential for ethical breaches create vulnerabilities that must be addressed proactively. With mounting concerns over the integrity of AI systems, businesses are recognizing the importance of deploying governance solutions that can not only detect risks but also provide real-time insights into algorithm performance, bias mitigation, and data accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $197.9 Million |

| Forecast Value | $6.63 Billion |

| CAGR | 49.2% |

The increase in sophisticated cyberattacks, often backed by state actors, has amplified the urgency to implement strong AI governance structures. Organizations are also beginning to leverage AI-enabled penetration testing, simulating real-world attacks to detect internal weaknesses. However, without solid governance protocols, these advanced defense strategies risk introducing bias and compliance errors. AI governance ensures alignment with core cybersecurity principles like ethics, explainability, and accountability, helping organizations maintain visibility and control in AI deployments.

In terms of market segmentation, the component landscape is divided into solutions and services. In 2024, the solution segment led the market, accounting for nearly 64% of the global share, and is set to grow at over 48% CAGR through the forecast period. These platforms integrate policy formulation, implementation, and monitoring, offering a centralized framework for managing AI systems effectively. They also support the detection and reduction of bias in training data and algorithms using advanced interpretability tools. These solutions emphasize explainability through technologies designed to make AI-generated outputs understandable and traceable for both developers and auditors.

When it comes to deployment, the AI governance market is segmented into cloud and on-premises models. In 2024, the cloud segment captured approximately 72% of the market and is projected to register a CAGR of over 49.5% between 2025 and 2034. The growing preference for cloud-hosted platforms stems from their scalability, accessibility, and ease of integration into existing workflows. Cloud-based AI governance tools help automate compliance tasks, enable real-time policy enforcement, and streamline AI monitoring efforts. Cloud providers also offer robust security features, including encryption, access controls, and identity management to protect sensitive AI data from external threats.

By organization size, the market is classified into large enterprises and SMEs. Large enterprises dominated the space in 2024 due to their broader AI adoption across diverse operational units. These businesses typically invest in dedicated AI governance teams that oversee integration, compliance, and accountability within internal and external frameworks. They play a pivotal role in standardizing ethical AI practices, ensuring systems are deployed responsibly and aligned with global regulatory mandates. From performance monitoring to risk mitigation, large organizations rely on governance structures to maintain integrity across AI deployments.

Regionally, North America emerged as a leading market in 2024, with the United States alone contributing nearly USD 75 million, representing around 86% of the North American share. The regional growth is largely driven by increased AI deployment across industries, supported by evolving regulatory frameworks and public awareness of AI ethics. Businesses in this region are investing heavily in governance tools that prioritize transparency, auditing capabilities, and compliance with local and international standards.

Key companies shaping the AI governance landscape include Capgemini, IBM, Alphabet, Meta Platforms, NTT DATA, Microsoft, Oracle, SAP, Palantir Technologies, and SAS Institute. These vendors are focusing on automating AI model oversight, integrating governance into MLOps, and developing tailored frameworks to match sector-specific compliance needs. They are also collaborating with regulatory authorities to co-create governance models that support ethical and responsible AI use across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Platform providers

- 3.2.2 Software providers

- 3.2.3 Service providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 High rate of cybersecurity events globally

- 3.8.1.2 Proliferating interest towards ethical hacking and penetration testing

- 3.8.1.3 Growing data security and privacy concerns

- 3.8.1.4 Integration of ethical AI and IoT technology

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High implementation costs & resource requirements

- 3.8.2.2 Lack of standardized AI governance frameworks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Platform

- 5.2.2 Software tools

- 5.3 Service

- 5.3.1 Consulting

- 5.3.2 Integration

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprise

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Government & defense

- 8.4 Healthcare & life sciences

- 8.5 Media & entertainment

- 8.6 IT & telecommunication

- 8.7 Automotive

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alphabet

- 10.2 BigID

- 10.3 Capgemini

- 10.4 Dataiku

- 10.5 Deloitte

- 10.6 EY (Ernst & Young)

- 10.7 FICO

- 10.8 H2O.ai

- 10.9 IBM

- 10.10 KPMG

- 10.11 Meta Platforms

- 10.12 Microsoft

- 10.13 NTT DATA

- 10.14 Oracle

- 10.15 Palantir Technologies

- 10.16 PWC

- 10.17 SAP

- 10.18 SAS Institute

- 10.19 Stefanini

- 10.20 Teradata