|

市场调查报告书

商品编码

1721526

伴侣动物疫苗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Companion Animal Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

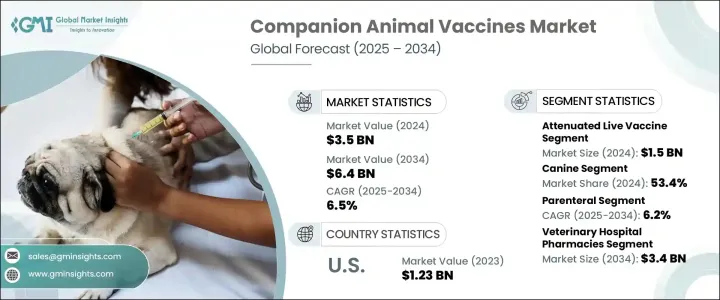

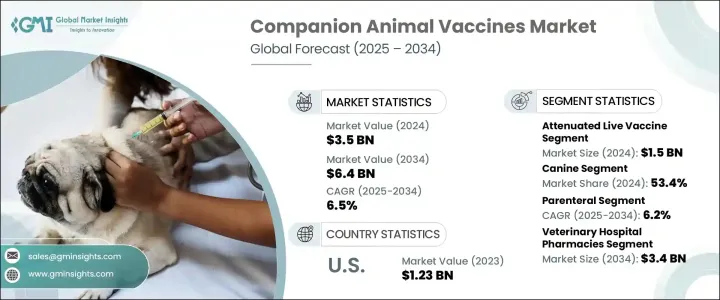

2024 年全球伴侣动物疫苗市场价值为 35 亿美元,预计到 2034 年将以 6.5% 的复合年增长率成长,达到 64 亿美元。这一良好的成长轨迹源于多种因素,例如宠物拥有量的增加、人们对动物健康意识的提高以及宠物人性化的不断扩大。随着全球各地的家庭继续稳步饲养宠物,对疫苗接种等预防性医疗保健解决方案的需求正在迅速增长。宠物主人非常重视伴侣动物的整体健康和福祉,通常将对宠物的照顾与对人类家庭成员的照顾等同起来。这种态度的转变推动了对常规兽医护理的投资,导致对保护宠物免受传染病侵害的疫苗的需求激增。此外,全球动物卫生组织正在推广早期疫苗接种计划,强调免疫接种对于减少人畜共通传染病流行和改善公共卫生结果的重要性。随着可支配收入的增加和兽医服务的进步,人们对早期疾病预防的重视程度不断提高,这为未来十年的持续市场扩张奠定了基础。

伴侣动物疫苗市场依疫苗类型细分,包括减毒活疫苗、合併疫苗、灭活疫苗、DNA疫苗、重组疫苗等。其中,减毒活疫苗市场在 2024 年的价值为 15 亿美元。这些疫苗因其能够引发强烈的免疫反应并以较少的加强剂量提供持久的免疫力而受到青睐。他们利用弱化形式的病原体来刺激免疫力,从而有效地预防各种传染病。宠物主人和兽医继续选择这种疫苗类型,因为它具有成本效益、可靠性以及最大限度地减少宠物疾病爆发的能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 6.5% |

就动物类型而言,市场分为犬科动物、猫科动物、马科动物和禽科动物。随着全球犬类数量的增加和人们对犬类健康意识的不断提高,犬类市场到 2024 年将占到整体市场份额的 53.4%。养狗率高的国家对有针对性的疫苗产品的需求正在不断增长。製造商不断创新并扩大专门针对狗的疫苗组合,以支持犬类市场占据主导地位。

2023 年,美国伴侣动物疫苗市场规模达 12.3 亿美元。宠物拥有量高,加上兽医医疗保健基础设施先进,推动了疫苗需求的持续成长。宠物人性化趋势进一步支持了常规检查和免疫接种的支出。在硕腾、默克动物保健、礼来动物保健等主要製药公司引领创新的背景下,美国仍是该领域的关键市场。

全球市场的主要参与者致力于透过研发、与兽医诊所的合作以及区域扩张来增强其疫苗供应。 Vetoquinol、Virbac、Boehringer Ingelheim International、Bioveta、Sinovac、Biogen Bago、Brilliant Bio Pharma、HIPRA 等公司正在开发有效且经济实惠的解决方案,以满足全球宠物主人不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 宠物拥有量和宠物消费的增加

- 伴侣动物疫苗接种意识不断增强

- 受保宠物数量不断增加

- 人畜共通传染病发生率上升

- 政府加强对伴侣动物疫苗接种的力度

- 产业陷阱与挑战

- 疫苗研发成本高昂

- 疫苗研发的严格监管环境

- 成长动力

- 成长潜力分析

- 技术格局

- 按动物类型分類的核心疫苗和非核心疫苗清单

- 犬科动物

- 猫科动物

- 马

- 禽类

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按疫苗类型,2021 - 2034 年

- 主要趋势

- 减毒活疫苗

- 结合疫苗

- 灭活疫苗

- DNA疫苗

- 重组疫苗

- 其他疫苗类型

第六章:市场估计与预测:依动物类型,2021 - 2034 年

- 主要趋势

- 犬科动物

- 猫科动物

- 马

- 禽类

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 肠外

- 口服

- 鼻腔

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 兽医院药房

- 零售药局

- 电子商务

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Boehringer Ingelheim International

- Brilliant Bio Pharma

- Bioveta

- Biogenesis Bago

- Ceva Sante Animale

- Durvet

- Elanco Animal Health

- HIPRA

- Indian Immunologicals

- Merck Animal Health

- Sinovac

- Vetoquinol

- Virbac

- Zoetis

The Global Companion Animal Vaccines Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 6.4 billion by 2034. This promising growth trajectory stems from a combination of factors such as increasing pet ownership, rising awareness around animal health, and the expanding trend of pet humanization. As households across the globe continue to adopt pets at a steady pace, the need for preventive healthcare solutions like vaccinations is growing rapidly. Pet owners are prioritizing the overall health and well-being of their companion animals, often equating their care to that of human family members. This shift in attitude is fueling investments in routine veterinary care, creating a surge in demand for vaccines that protect pets from infectious diseases. Moreover, global animal health organizations are promoting early vaccination programs, reinforcing the importance of immunization in reducing the prevalence of zoonotic diseases and improving public health outcomes. The growing emphasis on early-stage disease prevention, supported by rising disposable incomes and advancements in veterinary services, is setting the stage for sustained market expansion through the next decade.

The companion animal vaccines market is segmented by vaccine type, including attenuated live vaccines, conjugate vaccines, inactivated vaccines, DNA vaccines, recombinant vaccines, and others. Among these, the attenuated live vaccine segment was valued at USD 1.5 billion in 2024. These vaccines are favored for their ability to trigger a strong immune response and deliver long-lasting immunity with fewer booster doses. They use weakened forms of pathogens to stimulate immunity, offering effective protection against a variety of infectious conditions. Pet owners and veterinarians continue to choose this vaccine type for its cost-efficiency, reliability, and ability to minimize disease outbreaks in pets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 6.5% |

In terms of animal type, the market is categorized into canines, felines, equines, and avians. The canine segment accounted for 53.4% of the overall market share in 2024, supported by the increasing global dog population and rising awareness of canine health. Countries with high dog ownership rates are witnessing growing demand for targeted vaccine products. Manufacturers are continuously innovating and expanding their vaccine portfolios tailored specifically to dogs, supporting the dominance of the canine segment in the market.

The U.S. Companion Animal Vaccines Market reached USD 1.23 billion in 2023. High pet ownership, coupled with an advanced veterinary healthcare infrastructure, is driving consistent vaccine demand. The pet humanization trend further supports spending on routine checkups and immunizations. With key pharmaceutical companies like Zoetis, Merck Animal Health, Elanco Animal Health, and others leading innovation, the U.S. remains a pivotal market in this space.

Key players in the global market are focused on enhancing their vaccine offerings through R&D, partnerships with veterinary clinics, and regional expansions. Companies such as Vetoquinol, Virbac, Boehringer Ingelheim International, Bioveta, Sinovac, Biogenesis Bago, Brilliant Bio Pharma, HIPRA, and others are developing effective, affordable solutions to meet the evolving needs of global pet owners.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership and spending

- 3.2.1.2 Growing awareness about companion animal vaccination

- 3.2.1.3 Growing number of insured pets

- 3.2.1.4 Rising prevalence of zoonotic diseases

- 3.2.1.5 Increasing government initiatives for companion animal vaccination

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of vaccine development

- 3.2.2.2 Stringent regulatory scenario for vaccine development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 List of core and non core vaccines by animal type

- 3.5.1 Canine

- 3.5.2 Feline

- 3.5.3 Equine

- 3.5.4 Avian

- 3.6 Regulatory landscape

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Attenuated live vaccine

- 5.3 Conjugate vaccine

- 5.4 Inactivated vaccine

- 5.5 DNA vaccine

- 5.6 Recombinant vaccine

- 5.7 Other vaccine types

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Canine

- 6.3 Feline

- 6.4 Equine

- 6.5 Avian

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Parenteral

- 7.3 Oral

- 7.4 Nasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Boehringer Ingelheim International

- 10.2 Brilliant Bio Pharma

- 10.3 Bioveta

- 10.4 Biogenesis Bago

- 10.5 Ceva Sante Animale

- 10.6 Durvet

- 10.7 Elanco Animal Health

- 10.8 HIPRA

- 10.9 Indian Immunologicals

- 10.10 Merck Animal Health

- 10.11 Sinovac

- 10.12 Vetoquinol

- 10.13 Virbac

- 10.14 Zoetis