|

市场调查报告书

商品编码

1721543

商业节能窗户市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Commercial Energy Efficient Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

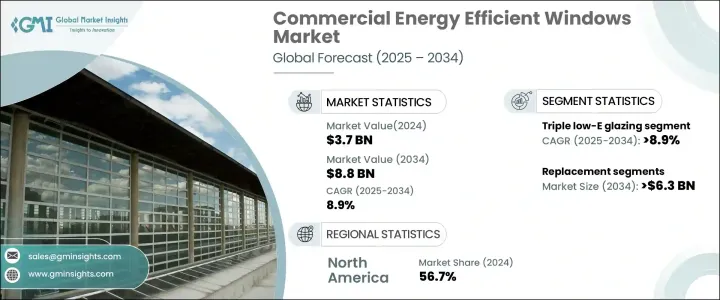

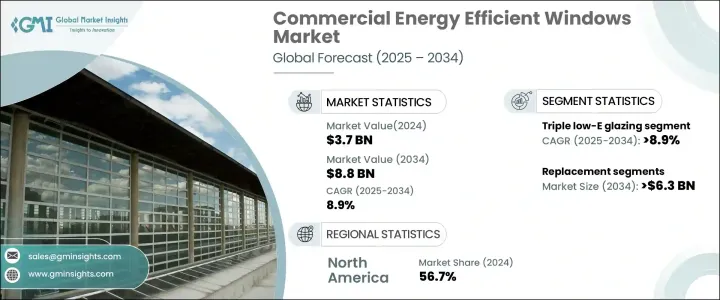

2024 年全球商业节能窗户市场价值为 37 亿美元,预计到 2034 年将以 8.9% 的复合年增长率增长至 88 亿美元。这一增长反映了永续建筑实践的快速发展以及商业房地产领域对降低能源消耗的广泛推动。为了因应不断上涨的能源成本和环境法规,房地产开发商和建筑业主越来越多地采用高性能、节能的解决方案。由于建筑物占全球能源消耗的很大一部分,因此越来越需要透过创新的开窗解决方案来提高热性能并减少暖通空调负荷。

商业节能窗户透过提供高绝缘值、紫外线防护和提高居住者的舒适度,在支持这一转变中发挥关键作用。製造商正在利用电致变色玻璃、真空隔热玻璃和热致变色膜等尖端材料不断突破界限,使节能窗户不仅更加高效,而且在美学上也适应现代建筑趋势。市场也见证了改造项目的强劲发展,其中过时的基础设施正在升级以符合现代能源效率要求。减少水电费、提高房产价值以及获得永续性认证资格等经济效益进一步加速了商业空间采用节能窗户。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 88亿美元 |

| 复合年增长率 | 8.9% |

2024 年,商业节能窗户市场价值为 37 亿美元。由于许多老化的商业建筑缺乏适当的隔热,对节能窗户更换的需求持续激增。这些窗户的设计符合不断发展的建筑能源法规,并降低了与暖气和冷气相关的营运成本。业主正在迅速采取行动升级其基础设施,因为不符合最新的能源标准可能会受到监管处罚。带有 Low-E(低辐射)涂层的三层玻璃窗等产品正成为首选,尤其是在极端天气条件的地区。这些先进的窗户显着降低了能量损失,帮助建筑物运营商保持室内温度稳定,同时降低能源消耗。随着永续发展目标成为焦点,商业开发商正在积极选择节能係统来减少碳足迹并满足租户和投资者对环保基础设施日益增长的需求。

2024 年,北美商业节能窗户市场占有 56.7% 的份额。仅美国就占据了 16 亿美元的份额,并且由于严格的能源效率标准和绿色建筑实践的日益普及,继续引领市场。 LEED 和 BREEAM 等认证的兴起,对有助于这些永续发展框架下的积分的高性能窗户解决方案的需求也随之增加。全国各地的开发商都优先考虑具有先进热性能的窗户,如 Low-E 涂层和三层玻璃,这对于实现能源目标和吸引环保意识的居住者至关重要。新建建筑和改造建筑领域市场均经历强劲成长。

全球商业节能窗户市场的主要参与者包括 Aeroseal Windows、Atrium Corporation、Alpen High-Performance Products、Fenesta、Champion Window、Jeld-Wen、Marvin Windows & Doors、Milgard Manufacturing、Pella Corporation 和 Winco Window 等。这些公司正在透过持续创新和积极的研发投资积极扩大其产品组合,专注于提供卓越绝缘性和耐用性的下一代玻璃技术。与建筑公司和商业开发商的合作也使主要製造商能够渗透尚未开发的区域市场并利用向永续建筑的转变。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依玻璃类型,2021 - 2034

- 主要趋势

- 双层玻璃

- 三层低辐射玻璃

第六章:市场规模及预测:依采用情况,2021 - 2034 年

- 主要趋势

- 替代品

- 绝缘

第七章:市场规模及预测:依窗户数量,2021 - 2034

- 主要趋势

- 最多 6 个单位

- >6至10个单位

- >10个单位

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚太地区

- 中国

- 日本

- 澳洲

- 世界其他地区

第九章:公司简介

- Atrium Corporation

- Aeroseal windows

- Alpen High Performance Products

- Champion Window

- Fenesta

- Jeld-Wen

- Marvin Windows & Doors

- Milgard Manufacturing

- Pella Corporation

- Winco Window

The Global Commercial Energy Efficient Windows Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 8.8 billion by 2034. This growth reflects the rapid evolution of sustainable construction practices and a widespread push toward minimizing energy consumption in the commercial real estate sector. Property developers and building owners are increasingly embracing high-performance, energy-saving solutions in response to rising energy costs and environmental regulations. As buildings account for a significant share of global energy consumption, there is a growing need to enhance thermal performance and reduce HVAC loads through innovative fenestration solutions.

Commercial energy efficient windows are playing a pivotal role in supporting this transition by offering high insulation value, UV protection, and improved occupant comfort. Manufacturers are pushing boundaries with cutting-edge materials like electrochromic glass, vacuum-insulated glazing, and thermochromic films, making energy-efficient windows not only more effective but also aesthetically adaptable to modern architectural trends. The market is also witnessing strong traction in retrofitting projects, where outdated infrastructure is being upgraded to comply with modern energy efficiency mandates. The economic benefits, such as reduced utility bills, improved property value, and eligibility for sustainability certifications, are further accelerating the adoption of energy-efficient windows in commercial spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $8.8 Billion |

| CAGR | 8.9% |

In 2024, the commercial energy efficient windows market was valued at USD 3.7 billion. With many aging commercial structures lacking proper insulation, the demand for energy-efficient window replacements continues to surge. These windows are engineered to meet evolving building energy codes and reduce operational costs associated with heating and cooling. Property owners are acting fast to upgrade their infrastructure, as failing to meet the latest energy standards can result in regulatory penalties. Products like triple-glazed windows with Low-E (low emissivity) coatings are becoming the preferred choice, especially in areas experiencing extreme weather conditions. These advanced windows significantly lower energy loss, helping building operators maintain indoor temperature stability while cutting down on energy expenses. As sustainable development goals take center stage, commercial developers are proactively choosing energy-efficient systems to reduce their carbon footprint and meet the rising demand for eco-friendly infrastructure from tenants and investors alike.

North America Commercial Energy Efficient Windows Market held a 56.7% share in 2024. The U.S. alone accounted for USD 1.6 billion and continues to lead the market owing to stringent energy efficiency standards and the growing adoption of green building practices. The rise in certifications such as LEED and BREEAM has created greater demand for high-performance window solutions that contribute to points under these sustainability frameworks. Developers across the country are prioritizing windows with advanced thermal properties like Low-E coatings and triple glazing, which are instrumental in meeting energy targets and attracting environmentally conscious occupants. The market is experiencing robust growth across both new construction and retrofitting sectors.

Major players operating in the global commercial energy-efficient windows market include Aeroseal Windows, Atrium Corporation, Alpen High-Performance Products, Fenesta, Champion Window, Jeld-Wen, Marvin Windows & Doors, Milgard Manufacturing, Pella Corporation, and Winco Window, among others. These companies are actively expanding their portfolios through continuous innovation and aggressive R&D investments focused on next-generation glazing technologies that offer exceptional insulation and durability. Collaborations with construction firms and commercial developers are also enabling key manufacturers to penetrate untapped regional markets and capitalize on the shift toward sustainable construction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Glazing Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Double glazing

- 5.3 Triple low-E glazing

Chapter 6 Market Size and Forecast, By Adoption, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Replacement

- 6.3 Insulation

Chapter 7 Market Size and Forecast, By Number of Windows, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 6 units

- 7.3 >6 to 10 units

- 7.4 >10 units

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Atrium Corporation

- 9.2 Aeroseal windows

- 9.3 Alpen High Performance Products

- 9.4 Champion Window

- 9.5 Fenesta

- 9.6 Jeld-Wen

- 9.7 Marvin Windows & Doors

- 9.8 Milgard Manufacturing

- 9.9 Pella Corporation

- 9.10 Winco Window