|

市场调查报告书

商品编码

1721562

仓库机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Warehouse Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

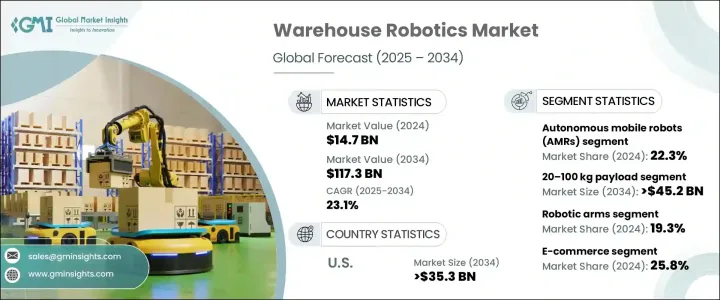

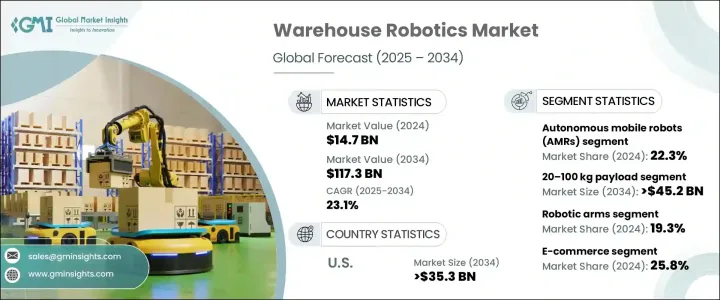

2024 年全球仓库机器人市场价值为 147 亿美元,预计到 2034 年将以 23.1% 的复合年增长率成长,达到 1,173 亿美元。随着仓储和物流运营日益向自动化转型以满足不断增长的消费者期望,该市场正在快速扩张。随着电子商务的爆炸式增长,对精简的供应链和更快的交付模式的需求比以往任何时候都更加强烈。线上零售商、第三方物流供应商和大型分销商正在迅速投资机器人解决方案,以提高生产力、最大限度地减少对劳动力的依赖并优化仓库占地面积。

从智慧导航系统到基于精度的拾放技术,仓库机器人正在改变库存的管理、处理和运输方式。工业 4.0 的出现以及人工智慧、物联网和机器学习技术的整合进一步加强了机器人在仓库生态系统中的作用。企业采用机器人技术不仅是为了管理大量订单,也是为了在竞争日益激烈和自动化驱动的环境中确保其营运的未来发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 147亿美元 |

| 预测值 | 1173亿美元 |

| 复合年增长率 | 23.1% |

2024 年,AMR 领域占有 22.3% 的份额。这些机器人采用人工智慧和地图技术,可以自主导航仓库地板并适应动态布局和高流量条件。它们无需固定基础设施即可运行,这使得它们非常适合电子商务履行中心等快节奏的环境。机械手臂也因其能够自动执行挑选、堆迭和分类等重复性任务的能力而在整个仓库设置中越来越受欢迎。当与人工智慧和机器学习相结合时,这些手臂可以实现更高的精度和灵活性,使它们能够以更高的准确度和速度处理不同的 SKU。

仓库机器人市场按最终用途细分为汽车、化学、半导体和电子、电子商务、医疗保健、食品和饮料、金属和重型机械以及其他行业。 2024年,电子商务领域占整体市占率的25.8%。对数位商务的日益依赖增加了对支援高吞吐量操作和及时最后一英里交付的先进自动化工具的需求。电子商务参与者正在利用机器人技术来简化库存控制、提高拣货效率并缩短订单週转时间以维持客户满意度。

预计到 2034 年,美国仓库机器人市场规模将达到 353 亿美元,这主要得益于顶级电子商务巨头引领的自动化倡议的蓬勃发展。随着劳动力成本的上升以及对智慧、可扩展自动化系统的需求不断增长,美国仓库正在转向机器人技术来提高营运效率并降低管理费用。

全球仓库机器人市场的知名企业包括 ABB、KUKA、Fanuc Corporation、Yaskawa Electric Corporation、Dematic 和 Honeywell Intelligrated。这些公司正在大力投资下一代机器人技术,以提供更智慧、更具适应性的解决方案。透过人工智慧整合、与物流领导者的策略合作以及持续的研发,这些公司旨在加强其在高成长地区的影响力并满足仓储领域不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 新兴的电子商务产业

- 人工智慧和机器学习的进步

- 劳动力短缺和工资上涨

- 自主移动机器人 (AMR) 的采用率不断提高

- 零售和物流行业对仓库自动化的需求不断增长

- 产业陷阱与挑战

- 初期投资成本高

- 系统整合的复杂性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按组件,2021 - 2034 年

- 安全系统

- 通讯系统

- 作业控制系统

- 交通管理系统

- 电池充电系统

- 感应器

- 控制器

- 驱动器

- 机械手臂

第六章:市场估计与预测:按机器人类型,2021 - 2034 年

- 自主移动机器人(AMR)

- 自动导引车(AGV)

- 关节型机器人

- 圆柱形机器人

- SCARA机器人

- 协作机器人

- 并联机器人

- 笛卡儿机器人

第七章:市场估计与预测:按有效载荷容量,2021 - 2034 年

- 少于20公斤

- 20–100公斤

- 100–200公斤

- 超过200公斤

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 汽车

- 化学

- 半导体和电子产品

- 电子商务

- 食品和饮料

- 卫生保健

- 金属和重型机械

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- ABB

- Amazon Robotics

- Bastian Solutions

- Boston Dynamics

- Daifuku

- Dematic

- Fanuc Corporation

- Fives

- Fortna

- Geek+

- GreyOrange

- Honeywell Intelligrated

- Knapp

- Korber

- KUKA

- Murata Machinery

- SSI Schaefer

- Symbotic

- Swisslog

- Vanderlande

- Yaskawa Electric Corporation

The Global Warehouse Robotics Market was valued at USD 14.7 billion in 2024 and is anticipated to grow at a CAGR of 23.1% to reach USD 117.3 billion by 2034. The market is witnessing rapid expansion as warehousing and logistics operations increasingly transition toward automation to meet rising consumer expectations. With the explosion of e-commerce, the need for streamlined supply chains and faster delivery models has never been greater. Online retailers, third-party logistics providers, and large-scale distributors are rapidly investing in robotic solutions to boost productivity, minimize labor dependency, and optimize warehouse floor space.

From intelligent navigation systems to precision-based pick-and-place technologies, warehouse robotics are transforming how inventory is managed, handled, and shipped. The emergence of Industry 4.0 and the convergence of AI, IoT, and ML technologies are further reinforcing the role of robotics in warehouse ecosystems. Organizations are adopting robotics not only to manage high order volumes but also to future-proof their operations in an increasingly competitive and automation-driven landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.7 Billion |

| Forecast Value | $117.3 Billion |

| CAGR | 23.1% |

AMRs segment held a 22.3% share in 2024. These robots are powered by AI and mapping technologies, allowing them to navigate warehouse floors autonomously and adapt to dynamic layouts and high-traffic conditions. Their ability to operate without fixed infrastructure makes them ideal for fast-paced environments such as e-commerce fulfillment centers. Robotic arms are also gaining traction across warehouse setups for their capacity to automate repetitive tasks like picking, palletizing, and sorting. When integrated with AI and machine learning, these arms achieve higher precision and flexibility, enabling them to handle diverse SKUs with greater accuracy and speed.

The warehouse robotics market is segmented by end-use into automotive, chemical, semiconductor & electronics, e-commerce, healthcare, food & beverage, metals & heavy machinery, and other industries. In 2024, the e-commerce sector accounted for 25.8% of the overall market share. The increasing reliance on digital commerce has amplified the demand for advanced automation tools to support high-throughput operations and timely last-mile delivery. E-commerce players are leveraging robotics to streamline inventory control, improve picking efficiency, and deliver faster order turnaround times to maintain customer satisfaction.

U.S. Warehouse Robotics Market is projected to reach USD 35.3 billion by 2034, largely driven by surging automation initiatives led by top-tier e-commerce giants. With rising labor costs and the growing need for intelligent, scalable automation systems, U.S. warehouses are turning to robotics to enhance operational efficiency and reduce overheads.

Prominent players in the Global Warehouse Robotics Market include ABB, KUKA, Fanuc Corporation, Yaskawa Electric Corporation, Dematic, and Honeywell Intelligrated. These companies are investing heavily in next-gen robotics to deliver smarter, more adaptive solutions. Through AI integration, strategic collaborations with logistics leaders, and continuous R&D, these firms aim to strengthen their presence across high-growth regions and address the evolving demands of the warehousing landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising E-commerce industry

- 3.2.1.2 Advancements in AI and machine learning

- 3.2.1.3 Labor shortages and rising wages

- 3.2.1.4 Increasing adoption of autonomous mobile robots (AMRs)

- 3.2.1.5 Growing demand for warehouse automation in the retail and logistics sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complexity in system integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Billion)

- 5.1 Safety systems

- 5.2 Communication systems

- 5.3 Job control systems

- 5.4 Traffic management systems

- 5.5 Battery charging systems

- 5.6 Sensors

- 5.7 Controllers

- 5.8 Drives

- 5.9 Robotic arms

Chapter 6 Market estimates & forecast, By Robot Type, 2021 - 2034 (USD Billion)

- 6.1 Autonomous mobile robots (AMRs)

- 6.2 Automated guided vehicles (AGVs)

- 6.3 Articulated robots

- 6.4 Cylindrical robots

- 6.5 SCARA robots

- 6.6 Collaborative robots

- 6.7 Parallel robots

- 6.8 Cartesian robots

Chapter 7 Market estimates & forecast, By Payload Capacity, 2021 - 2034 (USD Billion)

- 7.1 Less than 20 kg

- 7.2 20–100 kg

- 7.3 100–200 kg

- 7.4 More than 200 kg

Chapter 8 Market estimates & forecast, By End Use, 2021 - 2034 (USD Billion)

- 8.1 Automotive

- 8.2 Chemical

- 8.3 Semiconductor & electronics

- 8.4 E-commerce

- 8.5 Food & beverage

- 8.6 Healthcare

- 8.7 Metals & heavy machinery

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Amazon Robotics

- 10.3 Bastian Solutions

- 10.4 Boston Dynamics

- 10.5 Daifuku

- 10.6 Dematic

- 10.7 Fanuc Corporation

- 10.8 Fives

- 10.9 Fortna

- 10.10 Geek+

- 10.11 GreyOrange

- 10.12 Honeywell Intelligrated

- 10.13 Knapp

- 10.14 Korber

- 10.15 KUKA

- 10.16 Murata Machinery

- 10.17 SSI Schaefer

- 10.18 Symbotic

- 10.19 Swisslog

- 10.20 Vanderlande

- 10.21 Yaskawa Electric Corporation