|

市场调查报告书

商品编码

1721574

切片设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biopsy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

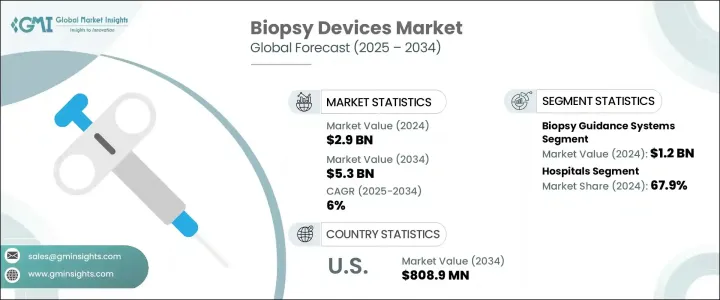

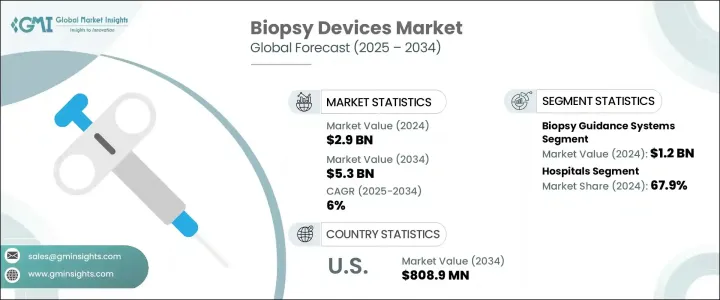

2024 年全球切片设备市场价值为 29 亿美元,预计到 2034 年将以 6% 的复合年增长率成长,达到 53 亿美元。活检设备在现代医疗保健中发挥关键作用,因为它可以提取组织样本进行诊断评估。这些工具可支援识别和分析各种医疗状况,通常有助于检测和确认恶性肿瘤。全球慢性疾病(尤其是癌症)负担的不断加重,推动了对先进诊断解决方案的需求。随着对早期发现、准确诊断和及时治疗计划的重视程度不断提高,活检设备的作用变得比以往任何时候都更加重要。人们对影像导引和微创手术的日益青睐推动了活检技术的不断创新,进一步提高了准确性并缩短了患者的恢復时间。

现在,越来越多的医疗保健专业人员开始转向提供精确性、易用性和即时监控的设备。医院和诊断中心也在迅速适应这种转变,这有助于简化工作流程并改善结果。全球意识的增强和获得先进诊断护理的机会正在推动已开发经济体和新兴经济体采用活检设备。政府致力于改善癌症诊断的措施和医疗改革也促进了市场扩张。此外,随着手术量的不断增加,医疗服务提供者正在投资高效、以患者为中心的活检解决方案,以满足现代临床需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 6% |

市场按产品类型细分为针基活检枪、活检引导系统、活检钳、活检针和其他相关设备。其中,活检引导系统占最大份额,2024 年的收入价值为 12 亿美元。其使用率的上升很大程度上归功于其提供即时成像和精确定位的能力,使其成为需要精确度和微创性的手术的理想选择。这些系统现在被视为临床工作流程不可或缺的一部分,其中有效的可视化对于定位和采样小的或难以到达的组织至关重要。透过增强不同影像模式之间的相容性,活检引导系统正在帮助医疗保健专业人员减少手术错误并提高病患安全性。这些工具越来越多地被整合到医院和诊断中心环境中,它们的多功能性正在提高吞吐量并优化整体结果。

从最终用户的角度来看,活检设备市场分为医院、门诊手术中心和其他环境。医院成为主要的使用者群体,占 2024 年整体市场收入的 67.9%,预计到 2034 年价值将达到 36 亿美元。医院由于能够使用高端成像设备和能够执行先进活检技术的技术人员,在采用方面继续保持领先地位。在复杂的诊断病例中,对准确、即时组织采样的需求日益增加,这使得医院成为进行这些程序的首选场所。与慢性病和先进诊断相关的入院人数的增加促使医院投资更复杂的活检系统。此外,在这些环境中,机器人辅助和微创手术的使用也显着增长,提高了效率和患者满意度。医院也正在成为多学科治疗方法的中心枢纽,其中精确的诊断发挥基础性的作用。

从区域来看,北美仍然是全球活检设备市场的主要贡献者。尤其是美国,其市场成长强劲,活检设备收入预计将从 2023 年的 4.519 亿美元增至 2034 年的 8.089 亿美元。这一增长可归因于完善的医疗保健基础设施、高手术量以及支持先进诊断干预措施的优惠保险覆盖范围。积极的报销环境使住院和门诊设施能够采用最新的活检技术,而不会遇到重大的财务障碍,从而促进在多个护理环境中的广泛使用。

竞争格局中存在着几家全球领先企业,它们透过持续投资于技术、产品创新和策略性收购来保持优势地位。老牌企业凭藉其强大的产品组合和对综合诊断解决方案的承诺,占据了相当大的市场份额。同时,新进业者和中端製造商正透过专注于满足目标临床应用的高性价比专业设备而获得发展。随着人们对精确引导、微创诊断工具的兴趣日益浓厚,活检设备产业有望不断进步,以满足现代医疗保健不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球癌症发生率上升

- 切片设备的技术进步

- 有利的报销方案

- 提高对乳癌的认识

- 产业陷阱与挑战

- 活检后併发症的风险

- 缺乏熟练的医疗保健专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 切片引导系统

- 手动的

- 机器人

- 针基切片枪

- 真空辅助切片(VAB)设备

- 细针抽吸活检 (FNAB) 设备

- 芯针切片(CNB)设备

- 切片针

- 一次性的

- 可重复使用的

- 切片钳

- 普通活检钳

- 热活检钳

- 其他产品类型

- 刷子

- 刮匙

- 冲孔

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Argon Medical Devices

- B. Braun Melsungen

- Becton, Dickinson, and Company

- Boston Scientific

- Cardinal Health

- Cook Group

- Devicor Medical Products

- FUJIFILM

- Hologic

- INRAD

- Medtronic

- Olympus Corporation

- Stryker Corporation

The Global Biopsy Devices Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 5.3 billion by 2034. Biopsy devices serve a critical role in modern healthcare by allowing the extraction of tissue samples for diagnostic evaluation. These tools support the identification and analysis of a wide range of medical conditions, often being instrumental in detecting and confirming malignancies. The increasing global burden of chronic diseases, particularly cancer, is pushing the demand for advanced diagnostic solutions. With rising emphasis on early detection, accurate diagnosis, and timely treatment planning, the role of biopsy devices has become more important than ever. The growing preference for image-guided and minimally invasive procedures has led to continuous innovation in biopsy technologies, further improving accuracy and reducing patient recovery time.

More healthcare professionals are now shifting toward devices that offer precision, ease of use, and real-time monitoring. Hospitals and diagnostic centers are also adapting quickly to this shift, which is helping streamline workflows and improve outcomes. Increasing global awareness and access to advanced diagnostic care are fueling the adoption of biopsy equipment across developed and emerging economies. Government initiatives and healthcare reforms focused on improving cancer diagnostics are also contributing to market expansion. Moreover, as procedural volumes continue to rise, providers are investing in efficient, patient-centric biopsy solutions that align with modern clinical demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6% |

The market is segmented by product type into needle-based biopsy guns, biopsy guidance systems, biopsy forceps, biopsy needles, and other associated devices. Among these, biopsy guidance systems held the largest share, generating revenue worth USD 1.2 billion in 2024. Their rising use is largely due to their ability to deliver real-time imaging and precise targeting, making them ideal for procedures requiring accuracy and minimal invasiveness. These systems are now seen as integral to clinical workflows where effective visualization is essential for locating and sampling tissues that are small or difficult to reach. With enhanced compatibility across different imaging modalities, biopsy guidance systems are helping healthcare professionals reduce procedural errors and boost patient safety. These tools are increasingly being integrated into hospital and diagnostic center environments, where their multi-functional capabilities are improving throughput and optimizing overall outcomes.

From the end-user perspective, the biopsy devices market is categorized into hospitals, ambulatory surgical centers, and other settings. Hospitals emerged as the dominant user segment, accounting for 67.9% of the overall market revenue in 2024, with projections estimating the value to reach USD 3.6 billion by 2034. Hospitals continue to lead in terms of adoption due to their access to high-end imaging equipment and skilled personnel capable of performing advanced biopsy techniques. The increasing need for accurate, real-time tissue sampling in complex diagnostic cases makes hospitals a preferred setting for these procedures. The rise in admissions related to chronic diseases and advanced diagnostics is pushing hospitals to invest in more sophisticated biopsy systems. Additionally, there has been significant growth in the use of robotic-assisted and minimally invasive procedures within these environments, improving both efficiency and patient satisfaction. Hospitals are also becoming central hubs for multidisciplinary treatment approaches, where precise diagnostics play a foundational role.

In regional terms, North America remains a leading contributor to the global biopsy devices market. The United States, in particular, has demonstrated strong market growth, with biopsy device revenue expected to rise from USD 451.9 million in 2023 to USD 808.9 million by 2034. This growth can be attributed to a well-established healthcare infrastructure, high procedural volumes, and favorable insurance coverage that supports advanced diagnostic interventions. Positive reimbursement environments enable both in-patient and out-patient facilities to adopt the latest biopsy technologies without significant financial barriers, promoting widespread use across multiple care settings.

The competitive landscape features several global leaders who maintain a stronghold through continued investments in technology, product innovation, and strategic acquisitions. Established players hold a considerable portion of the market thanks to their robust portfolios and commitment to integrated diagnostic solutions. At the same time, newer entrants and mid-tier manufacturers are gaining ground by focusing on cost-effective, specialized devices catering to targeted clinical applications. With growing interest in precision-guided, less invasive diagnostic tools, the biopsy devices industry is expected to see ongoing advancements tailored to the evolving demands of modern healthcare.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cancer across the globe

- 3.2.1.2 Technological advancements in biopsy devices

- 3.2.1.3 Favorable reimbursement scenario

- 3.2.1.4 Increasing awareness regarding breast cancer

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of complications after biopsy

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biopsy guidance systems

- 5.2.1 Manual

- 5.2.2 Robotic

- 5.3 Needle based biopsy guns

- 5.3.1 Vacuum-assisted biopsy (VAB) devices

- 5.3.2 Fine needle aspiration biopsy (FNAB) devices

- 5.3.3 Core needle biopsy (CNB) devices

- 5.4 Biopsy needles

- 5.4.1 Disposable

- 5.4.2 Reusable

- 5.5 Biopsy forceps

- 5.5.1 General biopsy forceps

- 5.5.2 Hot biopsy forceps

- 5.6 Other product types

- 5.6.1 Brushes

- 5.6.2 Curettes

- 5.6.3 Punches

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Argon Medical Devices

- 8.2 B. Braun Melsungen

- 8.3 Becton, Dickinson, and Company

- 8.4 Boston Scientific

- 8.5 Cardinal Health

- 8.6 Cook Group

- 8.7 Devicor Medical Products

- 8.8 FUJIFILM

- 8.9 Hologic

- 8.10 INRAD

- 8.11 Medtronic

- 8.12 Olympus Corporation

- 8.13 Stryker Corporation