|

市场调查报告书

商品编码

1721592

生物光子学市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biophotonics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

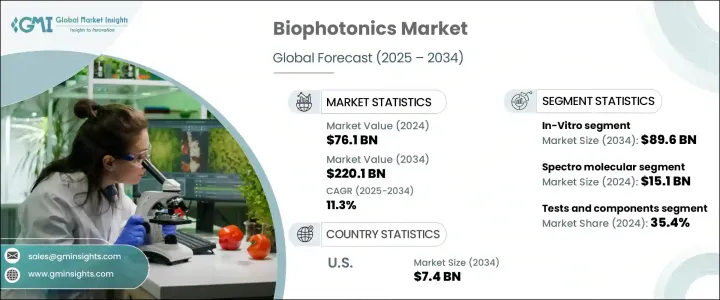

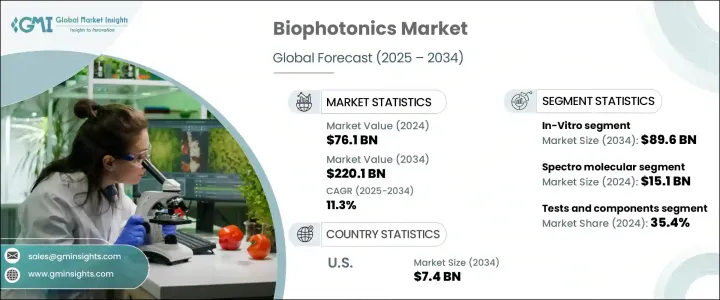

2024 年全球生物光子学市场价值为 761 亿美元,预计到 2034 年将以 11.3% 的复合年增长率成长,达到 2,201 亿美元。这一显着的成长轨迹主要得益于医疗技术的快速进步以及奈米技术在诊断和治疗平台上的加速融合。奈米技术在奈米尺度上增强光物质相互作用的能力彻底改变了生物系统的分析方式,使生物光子设备更加高效和精确。这些技术现在在检测生物标记和成像组织时提供了更高的灵敏度和特异性,为更准确的诊断和客製化治疗铺平了道路,特别是在早期疾病检测方面。

随着对非侵入性手术和即时诊断的日益重视,医疗保健领域对生物光子创新的需求正在激增。全球日益关注个人化医疗,而个人化医疗在很大程度上依赖精确的分子资料,这进一步加强了对先进光学技术的需求。随着技术的进步,医疗保健产业在研发、自动化和数据驱动决策方面的投资正在增加,这有助于简化研究、诊断和治疗领域的生物光子应用。此外,全球慢性病的增加促使人们更深入地探索高效、准确、更快捷的诊断方法——这是推动市场持续扩张的另一个因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 761亿美元 |

| 预测值 | 2201亿美元 |

| 复合年增长率 | 11.3% |

根据技术,市场分为体外和体内平台。其中,体外诊断领域成长显着,预计到 2034 年将达到 896 亿美元。这一增长主要得益于实验室诊断的突破以及人工智慧驱动的分析和自动化的整合。这些进步最大限度地减少了人为错误,提高了操作效率,并使实验室工作流程更加准确和灵敏。随着医疗保健产业继续优先考虑早期疾病检测,体外生物光子平台的采用正在迅速扩大。

在应用方面,市场涵盖各个领域,包括透视成像、显微镜、内部成像、光谱分子、分析感测、光疗、表面成像和生物感测器。光谱分子领域占据主导市场份额,2024 年价值 151 亿美元。其在该领域的领先地位归功于光谱工具的演变,这些工具现在可以在分子层面上提供更高的灵敏度和诊断精度。这些工具在识别与疾病相关的生化变化方面发挥着至关重要的作用,从而可以製定早期和更个性化的干预策略。

从最终用途的角度来看,市场分为测试和组件、医疗诊断、医疗治疗和非医疗应用。由于对先进诊断工具和精密成像技术的需求不断增长,测试和组件部分在 2024 年占据最大份额,为 35.4%。

从地区来看,美国引领北美生物光子学市场,预计到 2034 年其估值将达到 74 亿美元,这得益于大量的研发支出、先进的医疗保健基础设施以及为应对日益加重的慢性病负担而对先进诊断解决方案的需求不断增长。

该行业仍保持适度整合,赛默飞世尔科技公司、卡尔蔡司公司、滨松光子学株式会社、奥林巴斯公司和牛津仪器等顶级公司共占约 55%-60% 的市场份额。这些公司继续投资高精度生物光子技术,并扩大其地理覆盖范围以增强其竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 奈米科技的出现

- 人口老化和生活方式疾病增多

- 生物光子学在细胞和组织诊断的应用日益广泛

- 家用 POC 设备需求不断成长

- 与人工智慧和机器学习的日益融合

- 产业陷阱与挑战

- 技术成本高

- 商业化速度缓慢

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 体外

- 体内

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 透明成像

- 显微镜

- 内部影像

- 光谱分子

- 分析感知

- 光疗法

- 表面成像

- 生物感测器

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 测试和组件

- 医学治疗学

- 医疗诊断

- 非医疗应用

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 澳洲

- 韩国

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- Becton, Dickinson and Company

- Carl Zeiss AG

- Glenbrook Technologies

- Hamamatsu Photonics KK

- IDEX

- IPG Photonics Corporation

- NU Skin Enterprises

- Olympus Corporation

- Oxford Instruments PLC

- PerkinElmer Inc.

- Thermo Fisher Scientific

- TOSHIBA CORPORATION

- Zecotek Photonics Inc.

- Zenalux Biomedical Inc

The Global Biophotonics Market was valued at USD 76.1 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 220.1 billion by 2034. This remarkable growth trajectory is largely driven by rapid advancements in medical technology and the accelerating integration of nanotechnology across diagnostic and therapeutic platforms. The ability of nanotechnology to enhance light-matter interactions at the nanoscale has revolutionized the way biological systems are analyzed, making biophotonic devices more efficient and precise. These technologies now offer increased sensitivity and specificity when detecting biomarkers and imaging tissues, paving the way for more accurate diagnostics and tailored treatments, especially in early-stage disease detection.

With a growing emphasis on non-invasive procedures and real-time diagnostics, the demand for biophotonic innovations is surging across healthcare settings. The increasing global focus on personalized medicine, which relies heavily on precise molecular data, further reinforces the need for advanced optical technologies. Alongside technological evolution, the healthcare industry is witnessing greater investment in R&D, automation, and data-driven decision-making, which is helping streamline biophotonic applications across research, diagnostics, and treatment. Additionally, the rise in chronic conditions worldwide is prompting deeper exploration into efficient, accurate, and faster diagnostic methods-another factor contributing to the market's sustained expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76.1 Billion |

| Forecast Value | $220.1 Billion |

| CAGR | 11.3% |

Based on technology, the market is bifurcated into In-Vitro and In-Vivo platforms. Among these, the In-Vitro segment is registering notable growth and is expected to reach USD 89.6 billion by 2034. This surge is primarily fueled by breakthroughs in lab-based diagnostics, as well as the integration of AI-driven analytics and automation. These advancements are minimizing human error, increasing operational efficiency, and making laboratory workflows more accurate and responsive. As the healthcare sector continues to prioritize early disease detection, the adoption of In-Vitro biophotonic platforms is expanding rapidly.

In terms of application, the market spans various segments, including see-through imaging, microscopy, inside imaging, spectro molecular, analytics sensing, light therapy, surface imaging, and biosensors. The spectro molecular segment held the dominant market share, valued at USD 15.1 billion in 2024. Its leadership in the segment is due to the evolution of spectroscopic tools that now offer enhanced sensitivity and diagnostic precision at the molecular level. These tools play a vital role in identifying biochemical changes linked to disease, thereby enabling early and more personalized intervention strategies.

From an end-use perspective, the market is segmented into tests and components, medical diagnostics, medical therapeutics, and non-medical applications. The tests and components segment accounted for the largest share at 35.4% in 2024, supported by rising demand for advanced diagnostic tools and precision imaging technologies.

Regionally, the United States leads the North American biophotonics market and is expected to achieve a valuation of USD 7.4 billion by 2034, thanks to heavy R&D spending, sophisticated healthcare infrastructure, and increasing demand for advanced diagnostic solutions in response to the growing burden of chronic illnesses.

The industry remains moderately consolidated, with top players like Thermo Fisher Scientific Inc., Carl Zeiss AG, Hamamatsu Photonics K.K., Olympus Corporation, and Oxford Instruments collectively controlling around 55%-60% of the market. These companies continue to invest in high-precision biophotonic technologies and expand their geographic footprint to reinforce their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Emergence of nanotechnology

- 3.2.1.2 Aging population and growing lifestyle diseases

- 3.2.1.3 Increasing use of biophotonics in cell and tissue diagnostics

- 3.2.1.4 Increasing demand for home-based POC devices

- 3.2.1.5 Rising integration with AI & ML

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of technology

- 3.2.2.2 Slow rate of commercialization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 In-Vitro

- 5.3 In-Vivo

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 See-Through imaging

- 6.3 Microscopy

- 6.4 Inside imaging

- 6.5 Spectro molecular

- 6.6 Analytics sensing

- 6.7 Light therapy

- 6.8 Surface imaging

- 6.9 Biosensors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tests and components

- 7.3 Medical therapeutics

- 7.4 Medical diagnostics

- 7.5 Non-medical application

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 South Korea

- 8.4.5 Japan

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 U.A.E.

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Becton, Dickinson and Company

- 9.2 Carl Zeiss AG

- 9.3 Glenbrook Technologies

- 9.4 Hamamatsu Photonics K.K

- 9.5 IDEX

- 9.6 IPG Photonics Corporation

- 9.7 NU Skin Enterprises

- 9.8 Olympus Corporation

- 9.9 Oxford Instruments PLC

- 9.10 PerkinElmer Inc.

- 9.11 Thermo Fisher Scientific

- 9.12 TOSHIBA CORPORATION

- 9.13 Zecotek Photonics Inc.

- 9.14 Zenalux Biomedical Inc