|

市场调查报告书

商品编码

1721599

保险丝工业断路开关市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fused Industrial Disconnect Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

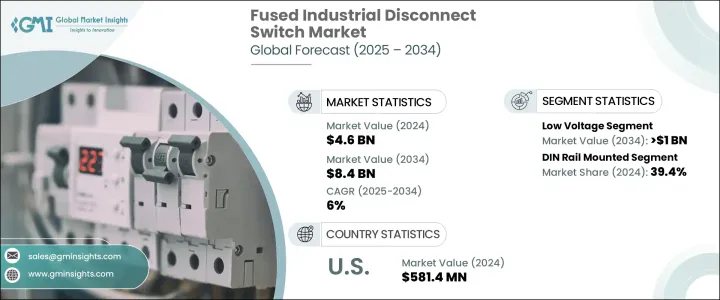

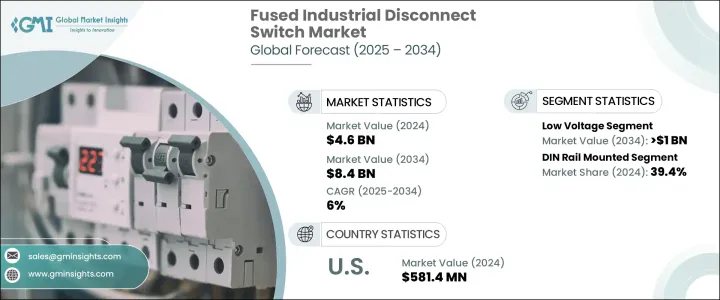

2024 年全球保险丝工业断路开关市场价值为 46 亿美元,预计到 2034 年将以 6% 的复合年增长率成长,达到 84 亿美元。由于人们越来越重视电气安全、设备可靠性和遵守严格的安全规范,市场正经历着显着的发展动能。全球各地的产业越来越重视高性能断路器,以保护电气系统并确保高效的运作控制。随着製造业自动化程度的提高以及对控制面板进行流程最佳化的日益依赖,对熔断式工业断路开关的需求持续稳定上升。

市场动态进一步受到政府支持的措施的影响,这些措施旨在执行旨在减轻电气危害的工作场所安全法规。这导致人们越来越倾向于采用环保、安全的开关设备系统。随着智慧製造的不断发展,对整合智慧安全机制(包括功能增强的断路开关)的需求正在成为现代工业基础设施的核心要求。开关设备解决方案中智慧感测器和故障侦测功能的整合可协助製造商减少停机时间、降低维护成本并增强资产保护。此外,预计电动车 (EV) 基础设施、再生能源装置和智慧城市发展的成长将在预测期内为开关设备製造商提供持续的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 84亿美元 |

| 复合年增长率 | 6% |

预计到 2034 年,低压熔断工业断路开关市场的规模将达到 10 亿美元。这些组件在维护电源中断期间的安全方面发挥关键作用,尤其是在电网基础设施和智慧电网应用中。随着数位化营运和智慧电网转型的加速,对强大保护和隔离设备的需求日益增加。断路开关对于维护期间隔离电源、防止敏感设备损坏以及确保高负载环境下的安全至关重要。

就安装类型而言,DIN 导轨安装开关在 2024 年占据了 39.4% 的显着市场。它们的主导地位可以归因于其紧凑的设计、易于安装和关键的安全功能,这使得它们在空间限制和营运效率是首要任务的领域尤其有价值。由于这些交换机能够适应不同的配电需求,再生能源专案的持续激增也推动了这些交换器的部署。

预计到 2034 年,北美熔断工业断路开关市场将以 5.5% 的复合年增长率成长。该地区不断扩大的製造业和采矿业对可靠的断路解决方案产生了持续的需求。开关设备技术的进步,包括智慧诊断和即时故障检测,正在增强该地区的市场前景。

熔断器工业断路开关市场的主要参与者包括西门子、施耐德电气、罗克韦尔自动化、美尔森、WEG、Hubbell、罗格朗、Jean Muller、艾默生电气、ABB、通用电气、威图、Lovato Electric、Socomec、Littlefuse、Feman Jagodina、Orient Electric、Pronutec 和 Wohner。这些公司持续专注于研发,推出节能、智慧的断开解决方案。战略合作伙伴关係和针对特定市场的产品客製化正在帮助他们扩大全球影响力,特别是在再生能源和智慧电网基础设施等新兴市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第六章:市场规模及预测:依安装情况,2021 - 2034

- 主要趋势

- 面板安装

- DIN导轨安装

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 阿曼

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 秘鲁

- 阿根廷

第八章:公司简介

- ABB

- Emerson Electric

- Feman Jagodina

- General Electric

- Havells

- Hubbell

- Jean Muller

- Legrand

- Littlefuse

- Lovato Electric

- Mersen

- Orient Electric

- Pronutec

- Rittal

- Rockwell Automation

- Schneider Electric

- Siemens

- Socomec

- WEG

- Wohner

The Global Fused Industrial Disconnect Switch Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 8.4 billion by 2034. The market is witnessing significant momentum due to the rising emphasis on electrical safety, equipment reliability, and compliance with stringent safety codes. Industries worldwide are increasingly prioritizing high-performance disconnect switches to safeguard electrical systems and ensure efficient operational control. With the surge in automation across manufacturing sectors and the growing reliance on control panels for process optimization, demand for fused industrial disconnect switches continues to rise steadily.

Market dynamics are further influenced by government-backed initiatives that enforce workplace safety regulations aimed at mitigating electrical hazards. This has led to a growing shift toward the adoption of environmentally friendly, safe switchgear systems. As smart manufacturing gains traction, the need for integrated and intelligent safety mechanisms, including disconnect switches with enhanced functionalities, is becoming a core requirement for modern industrial infrastructures. The integration of smart sensors and fault detection features within switchgear solutions is helping manufacturers drive down downtime, reduce maintenance costs, and enhance asset protection. Moreover, the growth of electric vehicle (EV) infrastructure, renewable energy installations, and smart city development are expected to offer sustained opportunities for switchgear manufacturers over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 6% |

The low-voltage fused industrial disconnect switch segment is anticipated to reach USD 1 billion by 2034. These components play a pivotal role in maintaining safety during power interruptions, particularly in grid infrastructure and smart grid applications. As the transition to digitized operations and smart grids accelerates, the demand for robust protection and isolation equipment is increasing. Disconnect switches are vital for isolating power during maintenance, preventing damage to sensitive equipment, and ensuring safety in high-load environments.

In terms of mounting types, DIN rail-mounted switches held a notable market share of 39.4% in 2024. Their dominance can be attributed to their compact design, ease of installation, and critical safety functions, making them especially valuable in sectors where space constraints and operational efficiency are top priorities. The ongoing surge in renewable energy projects is also fueling the deployment of these switches, given their adaptability to varying power distribution needs.

The North America fused industrial disconnect switch market is projected to grow at a CAGR of 5.5% through 2034. The region's expanding manufacturing and mining sectors are creating a consistent demand for reliable disconnect solutions. Advancements in switchgear technology, including smart diagnostics and real-time fault detection, are bolstering the market outlook in the region.

Key players operating in the fused industrial disconnect switch market include Siemens, Schneider Electric, Rockwell Automation, Mersen, WEG, Hubbell, Legrand, Jean Muller, Emerson Electric, ABB, General Electric, Rittal, Lovato Electric, Socomec, Littlefuse, Feman Jagodina, Orient Electric, Pronutec, and Wohner. These companies continue to focus on research and development to launch energy-efficient, intelligent disconnect solutions. Strategic partnerships and market-specific product customization are helping them expand their global reach, particularly in emerging markets such as renewable energy and smart grid infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

- 5.4 High

Chapter 6 Market Size and Forecast, By Mounting, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Panel mounted

- 6.3 DIN rail mounted

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Oman

- 7.5.5 South Africa

- 7.5.6 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Peru

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Emerson Electric

- 8.3 Feman Jagodina

- 8.4 General Electric

- 8.5 Havells

- 8.6 Hubbell

- 8.7 Jean Muller

- 8.8 Legrand

- 8.9 Littlefuse

- 8.10 Lovato Electric

- 8.11 Mersen

- 8.12 Orient Electric

- 8.13 Pronutec

- 8.14 Rittal

- 8.15 Rockwell Automation

- 8.16 Schneider Electric

- 8.17 Siemens

- 8.18 Socomec

- 8.19 WEG

- 8.20 Wohner