|

市场调查报告书

商品编码

1721601

智慧尿布市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Diapers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

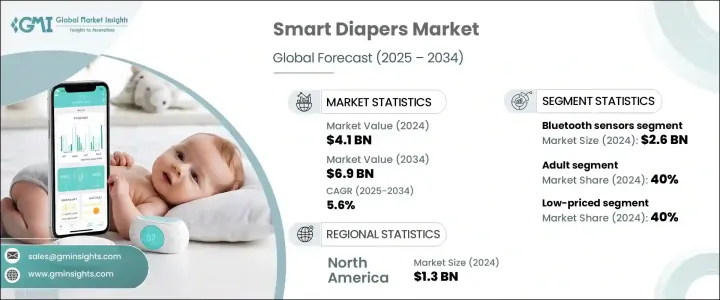

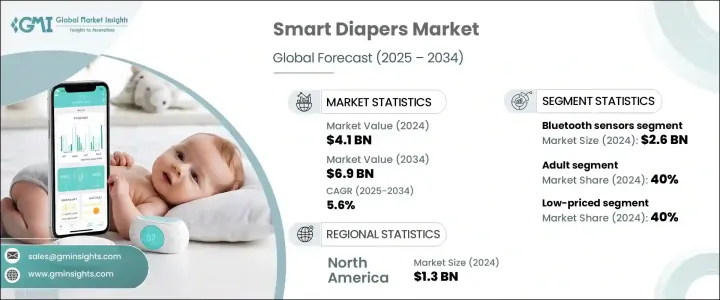

2024 年全球智慧尿布市场价值为 41 亿美元,预计到 2034 年将以 5.6% 的复合年增长率成长,达到 69 亿美元。随着数位健康和保健技术成为日常生活的一部分,智慧尿布解决方案在全球市场迅速受到关注。父母、照顾者和医疗保健提供者对提供便利、即时监控和改善卫生条件的智慧尿布表现出越来越浓厚的兴趣。这些产品与注重效率、舒适度和数据驱动护理的现代生活方式完美契合。无论是用于婴儿、成人或有特殊照护需求的个人,智慧尿布都比传统尿布有了重大进展。整合感测器使护理人员能够立即收到湿度水平警报,减少不必要的身体检查并最大限度地降低皮肤刺激或感染的风险。随着人们对个人护理技术的认识不断提高,市场也在不断增长,尤其是在城市家庭中,繁忙的日程需要实用的解决方案。随着消费者越来越多地选择儿童保育和老年人护理中的自动化支援系统,对智慧尿布的需求持续激增。这种转变得到了精通技术的消费者的进一步支持,他们积极寻求能够提供即时洞察、舒适感和长期健康益处的创新、应用程式连接产品。

2024 年,支援蓝牙的传感器尿布占据了最大的收入份额,创造了 26 亿美元的收入,预计到 2034 年将以 5.1% 的复合年增长率增长。这些智慧解决方案将即时资料传输到行动应用程式和连接的设备,使护理人员能够即时收到湿度通知。它们之所以受欢迎,是因为它们能够防止长时间暴露在潮湿环境中,因为潮湿会导致皮疹和泌尿道感染。由于介面易于使用且追踪精度高,蓝牙整合智慧尿布现在无论是在家庭还是在医院和老年护理中心等专业护理环境中都受到青睐。它们能够增强卫生状况并减少人工干预,从而不断吸引更多用户。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 69亿美元 |

| 复合年增长率 | 5.6% |

2024 年,成年用户占了 40% 的市占率。由于全球老龄人口的增长以及对改善疗养院和医疗机构护理品质的日益重视,这一细分市场将继续扩大。智慧尿布改变了失禁的管理方式,提供及时警报并让照护者更快采取行动。它们为老年人提供更好的皮肤保护和舒适度,同时减轻照护人员的工作量。消费者也将这些智慧解决方案融入他们的日常生活中,特别是有年长家庭成员或需要特殊照护的个人的家庭。

2024 年,北美智慧尿布市场产值达 13 亿美元。健康科技的广泛应用、可支配收入的增加以及大量双收入家庭支持了区域市场的主导地位。在职父母更喜欢智慧尿布解决方案,该解决方案透过自动湿度检测提供便利性并节省时间,帮助他们更有效地管理儿童保育。医疗保健和消费领域对技术驱动解决方案的日益依赖继续支持区域成长。

全球智慧尿布产业的主要参与者包括 Ontex、Sensassure、HARTMANN、Abena、Simavita、Pixie Scientific、Kimberly Clark、Drylock Technologies、Wonderkin、Monit、Sinopulsar Technology、Essity、宝洁、Attends Healthcare Products 和 Medline Industries。这些公司正在投资先进的传感器技术、应用程式连接和用户友好功能。一些公司正在与医疗机构合作扩大试验,而其他公司则专注于永续材料和订阅模式以吸引长期用户。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 零售商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 产品偏好

- 首选价格范围

- 首选配销通路

- 衝击力

- 成长动力

- 人们对便利和卫生的意识不断增强

- 进军医疗保健产业

- 人口老化加剧

- 产业陷阱与挑战

- 尿布成本高

- 发展中国家缺乏意识

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- RFID标籤

- 蓝牙感测器

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 婴儿

- 成人

第七章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 电子商务平台

- 公司网站

- 离线

- 超市/大卖场

- 专卖店

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Abena

- Attends Healthcare Products

- Drylock Technologies

- Essity

- HARTMANN

- Kimberly Clark

- Medline Industries

- Monit

- Ontex

- Pixie Scientific

- Procter & Gamble

- Sensassure

- Simavita

- Sinopulsar Technology

- Wonderkin

The Global Smart Diapers Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 6.9 billion by 2034. With digital health and wellness technologies becoming a regular part of daily life, smart diapering solutions are gaining rapid traction across global markets. Parents, caregivers, and healthcare providers are showing increased interest in smart diapers that offer convenience, real-time monitoring, and improved hygiene. These products align perfectly with the modern lifestyle that prioritizes efficiency, comfort, and data-driven caregiving. Whether used for infants, adults, or individuals with special care needs, smart diapers serve as a meaningful advancement over traditional alternatives. Integrated sensors enable caregivers to receive instant alerts on moisture levels, reducing unnecessary physical checks and minimizing the risk of skin irritation or infection. The market is also seeing growth due to the rising awareness surrounding personal care technologies, especially in urban households, where busy schedules demand practical solutions. As consumers increasingly opt for automated support systems in childcare and eldercare, the demand for smart diapers continues to surge. This shift is further supported by tech-savvy consumers who actively seek innovative, app-connected products that offer real-time insights, comfort, and long-term health benefits.

Bluetooth-enabled sensor diapers held the largest revenue share in 2024, generating USD 2.6 billion, and are projected to expand at a CAGR of 5.1% through 2034. These smart solutions transmit real-time data to mobile apps and connected devices, allowing caregivers to receive instant wetness notifications. Their popularity stems from their ability to prevent prolonged exposure to moisture, which is known to cause skin rashes and urinary infections. With easy-to-use interfaces and high accuracy in tracking, Bluetooth-integrated smart diapers are now preferred both at home and in professional caregiving settings such as hospitals and senior care centers. Their ability to enhance hygiene and reduce manual intervention continues to attract more users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 5.6% |

Adult users accounted for 40% of the market share in 2024. This segment continues to expand due to the global rise in elderly populations and the growing focus on improving the quality of care in nursing homes and healthcare facilities. Smart diapers have transformed how incontinence is managed, providing prompt alerts and allowing caregivers to act faster. They offer better skin protection and comfort for seniors while reducing the workload of caregivers. Consumers are also integrating these smart solutions into their everyday routines, particularly in households with aging family members or individuals requiring special care.

North America Smart Diapers Market generated USD 1.3 billion in 2024. Widespread adoption of health tech, increasing disposable incomes, and a high number of dual-income households support regional market dominance. Working parents prefer smart diapering solutions that offer convenience and save time through automated wetness detection, helping them manage childcare more effectively. The growing dependence on tech-driven solutions across the healthcare and consumer sectors continues to support regional growth.

Key players in the Global Smart Diapers Industry include Ontex, Sensassure, HARTMANN, Abena, Simavita, Pixie Scientific, Kimberly Clark, Drylock Technologies, Wonderkin, Monit, Sinopulsar Technology, Essity, Procter & Gamble, Attends Healthcare Products, and Medline Industries. These companies are investing in advanced sensor technology, app connectivity, and user-friendly features. Some are collaborating with healthcare institutions to expand trials, while others are focusing on sustainable materials and subscription models to attract long-term users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Consumer buying behavior analysis

- 3.6.1 Demographic trends

- 3.6.2 Factors affecting buying decisions

- 3.6.3 Product preference

- 3.6.4 Preferred price range

- 3.6.5 Preferred distribution channel

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing awareness towards convivence & hygiene

- 3.7.1.2 Expansion into healthcare industry

- 3.7.1.3 Increasing aging population

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of diaper

- 3.7.2.2 Lack of awareness among developing countries

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 RFID tags

- 5.3 Bluetooth sensors

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Baby

- 6.3 Adult

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce platforms

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/hypermarkets

- 8.3.2 Specialty stores

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Abena

- 10.2 Attends Healthcare Products

- 10.3 Drylock Technologies

- 10.4 Essity

- 10.5 HARTMANN

- 10.6 Kimberly Clark

- 10.7 Medline Industries

- 10.8 Monit

- 10.9 Ontex

- 10.10 Pixie Scientific

- 10.11 Procter & Gamble

- 10.12 Sensassure

- 10.13 Simavita

- 10.14 Sinopulsar Technology

- 10.15 Wonderkin