|

市场调查报告书

商品编码

1721606

住宅地毯捲市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Residential Carpet Roll Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

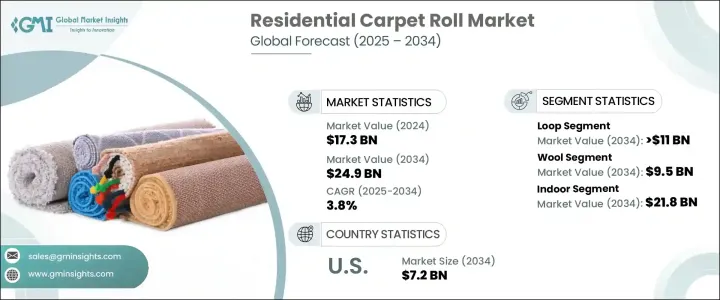

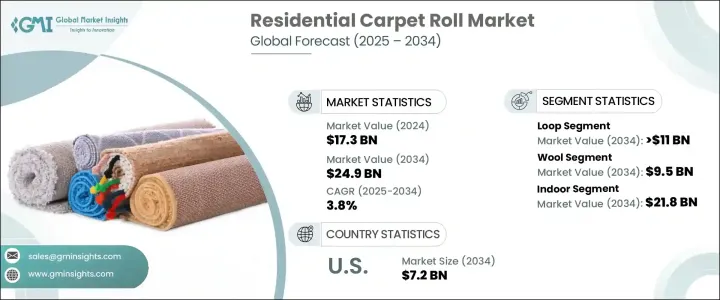

2024 年全球住宅地毯捲市场价值为 173 亿美元,预计到 2034 年将以 3.8% 的复合年增长率成长,达到 249 亿美元。随着全球房主更加重视室内舒适度、永续性和美观性,市场正在获得强劲发展势头。随着房屋建设和改造率的上升,特别是在城市地区和郊区,地毯捲正在成为首选的地板材料。它们具有柔软、温暖、吸音的表面,可改善日常生活。随着家居设计趋势转向舒适和个性化的室内装饰,消费者正在积极选择兼具功能性和风格的地毯捲。室内装潢师和房地产专业人士也建议铺设地毯,以提高房产吸引力和转售价值。新房主,尤其是千禧世代,倾向于易于安装、维护成本低且符合现代美学的地板。由于有各种各样的纹理、图案和永续材料可供选择,地毯捲现在被视为既实用又时尚的投资。

已开发地区房屋装修活动的兴起和新兴经济体持续的城市化浪潮推动了市场扩张。随着新住宅项目的出现和老房子的升级,地板仍然是一个关键的关注领域。地毯捲具有舒适性、隔音性和设计多功能性,使其成为首次购房者和升级空间者的热门选择。无论是新建住宅还是翻新住宅,对经济实惠、外观美观且易于铺设的地板解决方案的需求持续激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 173亿美元 |

| 预测值 | 249亿美元 |

| 复合年增长率 | 3.8% |

城市人口成长导致紧凑居住空间明显增加,尤其是在大城市。地毯捲可以节省空间,提供实用的地板,并且易于处理和维护。随着环保生活意识的增强,再生纤维地毯和低影响生产方法正在掀起波澜。消费者越来越倾向于提供可生物降解或永续来源材料的品牌,而拥抱这些绿色趋势的製造商正在获得竞争优势。

按产品类型划分,圈绒地毯市场在 2024 年的产值达 74 亿美元,预计到 2034 年将达到 110 亿美元。圈绒地毯因其耐污性、卓越的耐用性和轻鬆的保养而广受欢迎。圈绒地毯专为人流量大的区域而设计,由于采用连续纤维结构,因此能够保持形状,减少脱落和磨损。它们紧密的编织给人一种坚实的脚感,这对寻求长期价值和弹性的家庭来说很有吸引力。

根据材料,羊毛部分在 2024 年的价值为 64 亿美元,预计到 2034 年将达到 95 亿美元。羊毛因其天然的柔软性、可再生性和长寿命而脱颖而出。即使在繁忙区域也能保持其外观,并具有隔热和阻燃功能,使其成为优质的住宅地板选择。

2024 年,美国住宅地毯捲市场产值达 47 亿美元,预计到 2034 年将达到 72 亿美元。强劲的住房趋势、高额的家居装修支出以及对舒适地板的偏好推动了这一需求。美国各地的独户住宅由于使用地毯来保暖和控制噪音,做出了巨大贡献。

为了扩大影响力,Milliken & Company、Beaulieu International Group、Tarkett、Shaw Industries Group、Dixie Group、Kraus Flooring、J+J Flooring Group、Bentley Mills、Godfrey Hirst Carpets、Mohawk Industries、Masland Carpets、Interface、Phenix Flooring、Engineered Flooring 和Engineered许多公司正在加强其数位影响力、扩大零售网路并提供客製化选项。与建筑商和家居装饰零售商建立策略合作伙伴关係,以及推出适合现代生活方式的产品,有助于品牌提高知名度并培养长期的客户忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 对部队的影响

- 成长动力

- 房屋装修日益增多

- 都市化进程加速

- 产业陷阱与挑战

- 偏爱硬地板

- 成长动力

- 成长潜力分析

- 消费者购买行为

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 首选价格范围

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 环形

- 切割和循环

- 割绒(纹理)

- 扭曲饰带

第六章:市场估计与预测:依资料,2021 年至 2034 年

- 主要趋势

- 尼龙

- 羊毛

- 丝绸

- 聚酯纤维

- 丙烯酸纤维

- 其他(黄麻、聚丙烯等)

第七章:市场估计与预测:依桩高,2021 年至 2034 年

- 主要趋势

- 低(小于 1/4 英吋)

- 中(1/4英寸 - 1/2英寸)

- 高(1/2吋以上)

第八章:市场估计与预测:依厚度,2021 年至 2034 年

- 主要趋势

- 小于6毫米

- 6毫米-10毫米

- 10毫米-15毫米

- 15毫米以上

第九章:市场估计与预测:依设计,2021 年至 2034 年

- 主要趋势

- 坚硬的

- 列印

第十章:市场估计与预测:依价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 11 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 室内的

- 客厅

- 卧室

- 楼梯

- 饭厅

- 其他(厨房、地下室、家庭剧院等)

- 户外的

- 花园

- 水池

- 其他的

第 12 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 离线

第 13 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 14 章:公司简介

- Beaulieu International Group

- Bentley Mills

- Dixie Group

- Engineered Floors

- Godfrey Hirst Carpets

- Interface

- J+J Flooring Group

- Kraus Flooring

- Masland Carpets

- Milliken & Company

- Mohawk Industries

- Phenix Flooring

- Shaw Industries Group

- Stanton Carpet

- Tarkett

The Global Residential Carpet Roll Market was valued at USD 17.3 billion in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 24.9 billion by 2034. This market is gaining strong momentum as homeowners worldwide place more focus on interior comfort, sustainability, and aesthetics. With housing construction and renovation rates climbing, especially in urban areas and suburban neighborhoods, carpet rolls are becoming a top flooring choice. They offer a soft, warm, and sound-absorbing surface that enhances everyday living. As home design trends shift toward cozy and personalized interiors, consumers are actively choosing carpet rolls that deliver both function and flair. Interior decorators and real estate professionals are also recommending carpeted floors to boost property appeal and resale value. New homeowners, particularly millennials, are leaning toward easy-to-install, low-maintenance flooring that fits modern aesthetics. With a wide variety of textures, patterns, and sustainable materials available, carpet rolls are now seen as both a practical and stylish investment.

Market expansion is fueled by rising home renovation activity in developed regions and the continued wave of urbanization across emerging economies. As new housing developments emerge and older homes undergo upgrades, flooring remains a critical focus area. Carpet rolls provide comfort, sound insulation, and design versatility, making them a popular pick for first-time buyers and those upgrading their spaces. The demand for budget-friendly, visually appealing, and easy-to-lay flooring solutions continues to surge in both new constructions and renovated residences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.3 Billion |

| Forecast Value | $24.9 Billion |

| CAGR | 3.8% |

Urban population growth has led to a noticeable uptick in compact living spaces, particularly in metro cities. Carpet rolls offer space-saving, practical flooring that's easy to handle and maintain. As eco-conscious living gains traction, recycled fiber carpets and low-impact production methods are making waves. Consumers are gravitating toward brands offering biodegradable or sustainably sourced materials, and manufacturers embracing these green trends are gaining a competitive edge.

By product type, the loop carpets segment generated USD 7.4 billion in 2024 and is projected to reach USD 11 billion by 2034. Their popularity stems from their stain resistance, superior durability, and hassle-free upkeep. Built for high-traffic areas, loop carpets hold their form due to continuous fiber construction, reducing shedding and wear. Their tight weave gives a firm feel underfoot, which appeals to households seeking long-term value and resilience.

Based on materials, the wool segment accounted for USD 6.4 billion in 2024 and is forecasted to reach USD 9.5 billion by 2034. Wool stands out for its natural softness, renewability, and longevity. It retains its appearance even in busy areas and offers thermal insulation and flame resistance, positioning it as a premium residential flooring option.

The U.S. Residential Carpet Roll Market generated USD 4.7 billion in 2024 and is projected to hit USD 7.2 billion by 2034. The demand is driven by strong housing trends, high home improvement spending, and a preference for cozy flooring. Single-family homes across the U.S. contribute significantly due to their use of carpets for warmth and noise control.

To expand their footprint, companies like Milliken & Company, Beaulieu International Group, Tarkett, Shaw Industries Group, Dixie Group, Kraus Flooring, J+J Flooring Group, Bentley Mills, Godfrey Hirst Carpets, Mohawk Industries, Masland Carpets, Interface, Phenix Flooring, Engineered Floors, and Stanton Carpet are prioritizing eco-friendly product innovation. Many are strengthening their digital presence, widening retail networks, and offering customization options. Strategic partnerships with builders and home improvement retailers, along with launches tailored to modern lifestyles, are helping brands gain visibility and foster long-term customer loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising home renovations

- 3.10.1.2 Growing urbanization

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Preference for hard flooring

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.12.1 Demographic trends

- 3.12.2 Factors affecting buying decisions

- 3.12.3 Consumer product adoption

- 3.12.4 Preferred distribution channel

- 3.12.5 Preferred price range

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion) (Million Square Meters)

- 5.1 Key trends

- 5.2 Loop

- 5.3 Cut & loop

- 5.4 Cut pile (texture)

- 5.5 Twist frieze

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Million Square Meters)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Wool

- 6.4 Silk

- 6.5 Polyester

- 6.6 Acrylic

- 6.7 Others (jute, polypropylene, etc.)

Chapter 7 Market Estimates & Forecast, By Pile Height, 2021 – 2034, (USD Billion) (Million Square Meters)

- 7.1 Key trends

- 7.2 Low (less than 1/4")

- 7.3 Medium (1/4" - 1/2")

- 7.4 High (1/2" and above)

Chapter 8 Market Estimates & Forecast, By Thickness, 2021 – 2034, (USD Billion) (Million Square Meters)

- 8.1 Key trends

- 8.2 Less than 6 mm

- 8.3 6mm -10mm

- 8.4 10mm - 15mm

- 8.5 Above 15mm

Chapter 9 Market Estimates & Forecast, By Design, 2021 – 2034, (USD Billion) (Million Square Meters)

- 9.1 Key trends

- 9.2 Solid

- 9.3 Printed

Chapter 10 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion) (Million Square Meters)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion) (Million Square Meters)

- 11.1 Key trends

- 11.2 Indoor

- 11.2.1 Living room

- 11.2.2 Bedroom

- 11.2.3 Stairs

- 11.2.4 Dining room

- 11.2.5 Others (kitchen, basement, home theater, etc.)

- 11.3 Outdoor

- 11.3.1 Garden

- 11.3.2 Pool

- 11.3.3 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Square Meters)

- 12.1 Key trends

- 12.2 Online

- 12.3 Offline

Chapter 13 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Square Meters)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Beaulieu International Group

- 14.2 Bentley Mills

- 14.3 Dixie Group

- 14.4 Engineered Floors

- 14.5 Godfrey Hirst Carpets

- 14.6 Interface

- 14.7 J+J Flooring Group

- 14.8 Kraus Flooring

- 14.9 Masland Carpets

- 14.10 Milliken & Company

- 14.11 Mohawk Industries

- 14.12 Phenix Flooring

- 14.13 Shaw Industries Group

- 14.14 Stanton Carpet

- 14.15 Tarkett