|

市场调查报告书

商品编码

1721612

灯塔租赁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Light Tower Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

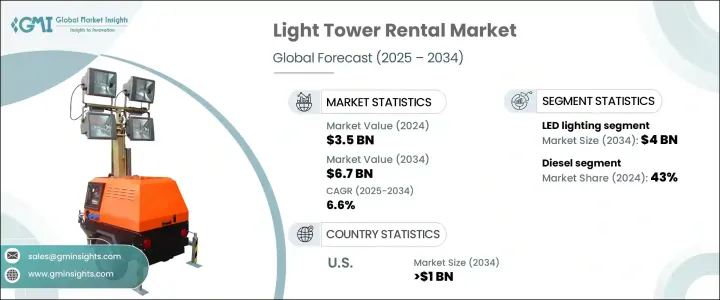

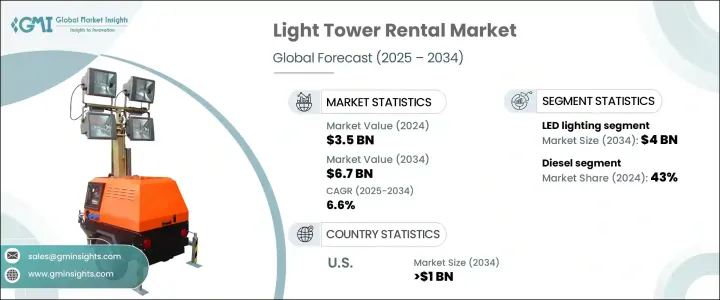

2024 年全球灯塔租赁市场价值为 35 亿美元,预计到 2034 年将以 6.6% 的复合年增长率成长,达到 67 亿美元。建筑、基础设施开发、紧急应变和户外活动等领域对可靠临时照明解决方案的需求不断增长,在推动市场扩张方面发挥重要作用。快速的城市化、持续的基础设施升级以及石油、天然气和采矿等行业夜间作业的增加,极大地促进了对便携式照明系统的需求。对于希望最大程度减少资本投资同时又能按项目获得先进、高性能灯塔的企业来说,租赁模式仍然是首选。人们对能源效率和环境影响的日益关注进一步强化了这一趋势,促使用户选择技术先进、环保的照明解决方案。製造商和租赁服务提供商正在不断透过混合动力、太阳能和 LED 系统升级其产品线,以满足不断变化的行业需求。随着永续发展目标在全球各行业中日益受到重视,预计未来几年向清洁能源照明塔的转变将会加速。

市场正在见证灯塔中远端监控和远端资讯处理等智慧技术的日益融合,使用户能够即时追踪燃料使用情况、运行时间和性能参数。这些创新不仅提高了营运效率,而且还支持预防性维护并减少停机时间。行业参与者提供量身定制的租赁计划和全天候支持,以满足建筑工地、灾后復原区和工业运营的不同客户需求。此外,政府和监管机构执行更严格的排放标准,正在推动最终用户采用更清洁的替代品,从而影响租赁公司透过可持续的选择来多样化其车队。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 67亿美元 |

| 复合年增长率 | 6.6% |

灯塔租赁市场根据电源进行细分,包括柴油、太阳能、直接能源和其他能源。其中,柴油发电塔将继续占据主导地位,到 2024 年将占据 43% 的市场份额,预计到 2034 年将以 5% 的复合年增长率成长。它们的广泛使用源于其在偏远离网地区的高输出和可靠性。儘管人们对燃料成本和排放的担忧日益加剧,但柴油因其坚固性和效率仍然是许多人的首选。然而,太阳能塔作为更清洁的替代品正在迅速普及,特别是在永续性是关键要求的项目中。

预计到 2034 年,LED 照明领域将创造 40 亿美元的产值。与金属卤化物灯等老技术相比,LED 因其卓越的能源效率、更长的使用寿命和最低的维护要求而越来越受到青睐。它们能够提供明亮、均匀的照明,同时消耗更少的电力,使其成为租赁应用的理想选择。

预计到 2034 年,美国灯塔租赁市场规模将达到 10 亿美元。建筑、石油、天然气和基础设施项目对太阳能和 LED 供电设备的需求不断增长,推动了这一成长。永续发展目标和不断发展的排放法规正在推动租赁公司采用环保照明解决方案来扩大其车队。远端监控和混合模型也在全国范围内得到更广泛的应用,从而支援营运效率和合规性。

全球市场的关键参与者包括 Pro Tool & Supply、Access Hire Australia、BigRentz、Caterpillar、MacAllister Machinery、Cooper Equipment Rentals、Guys Rents、The Home Depot、Larson Electronics、Modern Energy Rental、RentalYard、Sudhir Power、HSS Hire United Groups。为了保持竞争优势,这些公司专注于扩大船队、永续的产品线、远端监控技术和灵活的租赁模式,以满足客户的动态需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依明,2021 - 2034 年

- 主要趋势

- 金属卤化物

- 引领

- 电的

- 其他的

第六章:市场规模及预测:依电源分类,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 太阳的

- 直接的

- 其他的

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 手动升降系统

- 液压升降系统

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 建造

- 基础建设发展

- 石油和天然气

- 矿业

- 军事与国防

- 紧急救灾

- 其他的

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 伊朗

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第十章:公司简介

- Access Hire Australia

- BigRentz

- Caterpillar

- Cooper Equipment Rentals

- Guys Rents

- The Home Depot

- HSS Hire Group

- Larson Electronics

- MacAllister Machinery

- Modern Energy Rental

- Pro Tool & Supply

- RentalYard

- Sudhir Power

- The Duke Company

- United Rentals

The Global Light Tower Rental Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 6.7 billion by 2034. The rising need for reliable, temporary lighting solutions across sectors such as construction, infrastructure development, emergency response, and outdoor events is playing a significant role in driving market expansion. Rapid urbanization, ongoing infrastructure upgrades, and increasing nighttime operations in industries like oil and gas and mining are contributing heavily to the demand for portable lighting systems. The rental model remains a preferred choice for businesses aiming to minimize capital investment while gaining access to advanced, high-performing light towers on a project basis. This trend is further reinforced by growing concerns around energy efficiency and environmental impact, which are prompting users to opt for technologically advanced, eco-friendly lighting solutions. Manufacturers and rental service providers are continuously upgrading their product lines with hybrid, solar-powered, and LED-based systems to meet evolving industry requirements. With sustainability targets gaining prominence across global industries, the shift toward clean energy-powered lighting towers is expected to accelerate in the coming years.

The market is witnessing increasing integration of smart technologies like remote monitoring and telematics in light towers, allowing users to track fuel usage, operating hours, and performance parameters in real time. These innovations not only enhance operational efficiency but also support preventive maintenance and reduce downtime. Industry participants are offering tailored rental plans and round-the-clock support to meet diverse client needs across construction sites, disaster recovery areas, and industrial operations. Moreover, governments and regulatory bodies enforcing stricter emission norms are pushing end-users to adopt cleaner alternatives, thereby influencing rental companies to diversify their fleets with sustainable options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 6.6% |

The light tower rental market is segmented based on power sources, including diesel, solar, direct, and others. Among these, diesel-powered towers continue to dominate with a 43% market share in 2024 and are estimated to grow at a CAGR of 5% through 2034. Their widespread use stems from their high output and reliability in remote, off-grid areas. Despite growing concerns over fuel costs and emissions, diesel remains a go-to option for many due to its robustness and efficiency. However, solar-powered towers are quickly gaining ground as cleaner alternatives, especially in projects where sustainability is a key requirement.

The LED lighting segment is expected to generate USD 4 billion by 2034. LEDs are becoming increasingly favored due to their superior energy efficiency, extended lifespan, and minimal maintenance requirements compared to older technologies such as metal halide lamps. Their ability to provide bright, uniform illumination while consuming less power makes them ideal for rental applications.

The U.S. Light Tower Rental Market is forecast to reach USD 1 billion by 2034. Rising demand for solar and LED-powered units in construction, oil, gas, and infrastructure projects is driving this growth. Sustainability goals and evolving emissions regulations are pushing rental firms to expand their fleets with environmentally friendly lighting solutions. Remote monitoring and hybrid models are also seeing greater adoption across the country, supporting operational efficiency and compliance.

Key players in the global market include Pro Tool & Supply, Access Hire Australia, BigRentz, Caterpillar, MacAllister Machinery, Cooper Equipment Rentals, Guys Rents, The Home Depot, Larson Electronics, Modern Energy Rental, RentalYard, Sudhir Power, HSS Hire Group, The Duke Company, and United Rentals. To maintain their competitive edge, these companies are focusing on fleet expansion, sustainable product lines, remote monitoring technology, and flexible leasing models to meet the dynamic demands of customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Lighting, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Metal halide

- 5.3 LED

- 5.4 Electric

- 5.5 Others

Chapter 6 Market Size and Forecast, By Power Source, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Solar

- 6.4 Direct

- 6.5 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Manual lifting system

- 7.3 Hydraulic lifting system

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Infrastructure development

- 8.4 Oil & gas

- 8.5 Mining

- 8.6 Military & defense

- 8.7 Emergency & disaster relief

- 8.8 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Iran

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 Access Hire Australia

- 10.2 BigRentz

- 10.3 Caterpillar

- 10.4 Cooper Equipment Rentals

- 10.5 Guys Rents

- 10.6 The Home Depot

- 10.7 HSS Hire Group

- 10.8 Larson Electronics

- 10.9 MacAllister Machinery

- 10.10 Modern Energy Rental

- 10.11 Pro Tool & Supply

- 10.12 RentalYard

- 10.13 Sudhir Power

- 10.14 The Duke Company

- 10.15 United Rentals