|

市场调查报告书

商品编码

1721626

家具市场机会、成长动力、产业趋势分析及2025-2034年预测Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

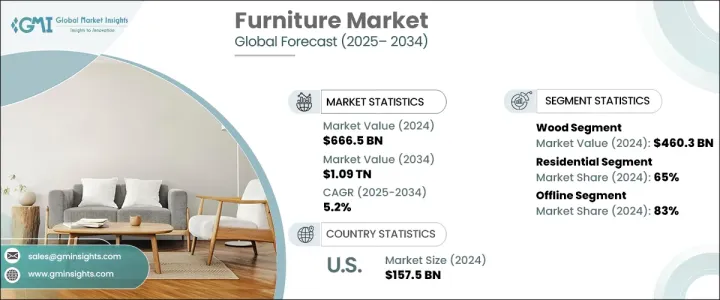

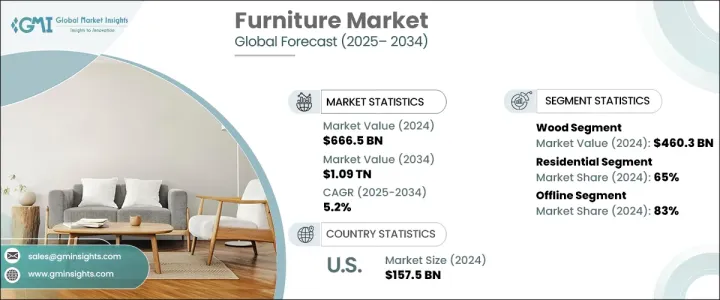

2024 年全球家具市场价值为 6,665 亿美元,预计到 2034 年将以 5.2% 的复合年增长率成长,达到 1.09 兆美元。这一稳定成长反映了可支配收入增加、城市化快速发展、基础设施扩张以及全球建筑活动增加的强大影响。消费者生活方式的转变、对室内美学的关注度提高以及对永续生活的意识不断增强,进一步推动了市场需求。随着全球人口越来越多地投资于实用而时尚的生活空间,家具已成为住宅和商业设计的关键方面。此外,对多功能家具的需求,尤其是在紧凑的城市环境中,正在改变人们选择和使用家具的方式。数位零售通路为顾客获取各种家具系列开闢了新途径,使市场比以往任何时候都更具竞争力和以消费者为中心。家具製造商正在推出更多样化的设计、模组化的产品和环保的选择,以满足当今买家不断变化的需求。

欧洲拥有超过2.3亿个家庭,是人均家具消费水准最高的地区之一,占全球家具市场的四分之一以上。该地区在影响生产价值、塑造国际贸易模式和定义全球设计趋势方面发挥关键作用。强劲的国内需求加上高出口活动使欧洲成为全球格局的主导力量。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6665亿美元 |

| 预测值 | 1.09兆美元 |

| 复合年增长率 | 5.2% |

2024 年木材产业的产值达到 4,603 亿美元。随着消费者越来越青睐木製家具的永恆魅力、耐用性以及在不同室内风格的多功能性,木製家具的受欢迎程度也持续上升。手工製作和工匠製作的木製作品越来越受到那些重视精湛工艺、道德采购和耐用性的买家的青睐。无论是乡村风格还是现代风格,木製家具仍然是住宅和商业室内装潢的首选。

根据最终用户,家具市场分为住宅和商业类别。 2024 年,住宅领域将占据 65% 的市场份额,这主要归功于艺术木製家具的吸引力不断上升。家居装修项目支出的增加以及室内外社交的趋势推动了对餐具、长凳和椅子组合、沙发和多功能户外家具的需求。屋主们也正在投资户外厨房、酒吧区和用餐区,进一步增加了对时尚、耐用和耐候家具的需求。

光是美国家具市场在 2024 年就创造了 1,575 亿美元的产值,占该地区份额的 80%。美国的成长主要受到装修趋势、对高檔家具的偏好增加以及对木质内饰不断增长的需求的支持。纽约、迈阿密、洛杉矶和旧金山等城市正在兴起高端住宅项目,需要订製家具来提升豪华居住空间。

全球家具产业的主要参与者包括 Artek、Roche Bobois、Restoration Hardware、Ashley Furniture、La-Z-Boy、Boca do Lobo、Bernhardt Furniture、Hartmann Mobelwerke、Herman Miller、Haworth、HNI Corporation、Steelcase、Kimball International、The Senator Group 和 Vitra。这些公司正在扩大产品线,投资创新设计研发,拥抱数位零售平台,并与设计师和建筑师合作提供个人化的家具解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 都市化和基础设施发展

- 装潢和改造趋势

- 产业陷阱与挑战

- 原料成本和可用性

- 消费者偏好的转变

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 座椅家具

- 椅子

- 沙发和长沙发

- 脚凳和脚凳

- 长椅

- 凳子

- 其他(躺椅等)

- 储物家具

- 橱柜

- 货架

- 宝箱

- 书柜

- 其他(脚凳等)

- 餐厅家具

- 餐桌

- 餐椅

- 餐椅

- 自助餐檯和餐柜

- 其他(酒吧推车等)

- 娱乐家具

- 电视柜和媒体控制台

- 家庭剧院座位

- 扬声器支架和安装座

- 酒柜和家用酒吧

- 其他(游戏椅等)

- 其他(睡眠家具等)

第六章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 室内家具

- 户外家具

第七章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 塑胶

- 木头

- 金属

- 其他的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

- 商业/办公

- 教育机构

- 卫生保健

- 饭店业

- 其他的

第九章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低的

- 中等的

- 高级/豪华

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Artek

- Ashley Furniture

- Bernhardt Furniture

- Boca do Lobo

- Hartmann Mobelwerke

- Haworth

- Herman Miller

- HNI Corporation

- Kimball International

- La-Z-Boy

- Restoration Hardware

- Roche Bobois

- Steelcase

- The Senator Group

- Vitra

The Global Furniture Market was valued at USD 666.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.09 trillion by 2034. This steady growth reflects the strong influence of rising disposable incomes, rapid urbanization, expanding infrastructure, and an uptick in construction activities worldwide. The shift in consumer lifestyle, a heightened focus on interior aesthetics, and growing awareness of sustainable living are further driving market demand. With the global population increasingly investing in functional yet stylish living spaces, furniture has become a key aspect of both residential and commercial design. Moreover, the demand for multifunctional furniture, especially in compact urban settings, is transforming how people choose and use furniture pieces. Digital retail channels have opened new avenues for customers to access a broad variety of furniture collections, making the market more competitive and consumer-centric than ever. Furniture makers are responding with more versatile designs, modular products, and eco-friendly options to meet the evolving needs of today's buyers.

Europe, home to over 230 million households and boasting one of the highest per capita consumption levels, accounts for more than a quarter of the global furniture market. The region plays a key role in influencing production values, shaping international trade patterns, and defining global design trends. Its strong domestic demand, coupled with high export activity, positions Europe as a dominant force in the global landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $666.5 Billion |

| Forecast Value | $1.09 Trillion |

| CAGR | 5.2% |

The wood segment generated USD 460.3 billion in 2024. The preference for wooden furniture continues to rise as consumers gravitate toward its timeless appeal, durability, and versatility across different interior styles. Handcrafted and artisan-made wooden pieces are gaining traction among buyers who value intricate craftsmanship, ethical sourcing, and longevity. Whether it's rustic or contemporary, wooden furniture remains a top choice for both residential and commercial interiors.

Based on end users, the furniture market is segmented into residential and commercial categories. In 2024, the residential segment captured a 65% market share, largely due to the rising appeal of artistic wooden furniture. Increased spending on home improvement projects and the trend of indoor and outdoor socializing have driven demand for dining sets, bench and chair combos, sofas, and multifunctional outdoor furniture. Homeowners are also investing in outdoor kitchens, bar areas, and dining spaces, further boosting the need for stylish, durable, and weather-resistant furniture.

The United States Furniture Market alone generated USD 157.5 billion in 2024, accounting for 80% of the regional share. Growth in the U.S. is largely supported by renovation trends, increasing preferences for premium furniture, and a growing demand for wooden interiors. Cities like New York, Miami, Los Angeles, and San Francisco are seeing high-end residential projects demanding bespoke furniture that enhances luxurious living spaces.

Key players in the global furniture industry include Artek, Roche Bobois, Restoration Hardware, Ashley Furniture, La-Z-Boy, Boca do Lobo, Bernhardt Furniture, Hartmann Mobelwerke, Herman Miller, Haworth, HNI Corporation, Steelcase, Kimball International, The Senator Group, and Vitra. These companies are expanding their product lines, investing in R&D for innovative design, embracing digital retail platforms, and collaborating with designers and architects to deliver personalized furniture solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Urbanization and infrastructure development

- 3.6.1.2 Renovation and remodeling trends

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Raw material costs and availability

- 3.6.2.2 Shifting consumer preferences

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Seating furniture

- 5.2.1 Chairs

- 5.2.2 Sofas and couches

- 5.2.3 Ottomans and footstools

- 5.2.4 Benches

- 5.2.5 Stools

- 5.2.6 Others (chaise lounges etc.)

- 5.3 Storage furniture

- 5.3.1 Cabinets

- 5.3.2 Shelves

- 5.3.3 Chests

- 5.3.4 Bookcases

- 5.3.5 Others (ottomans etc.)

- 5.4 Dining furniture

- 5.4.1 Dining tables

- 5.4.2 Dining chairs

- 5.4.3 Dining benches

- 5.4.4 Buffets and sideboards

- 5.4.5 Others (bar carts etc.)

- 5.5 Entertainment furniture

- 5.5.1 TV stands and media consoles

- 5.5.2 Home theater seating

- 5.5.3 Speaker stands and mounts

- 5.5.4 Bar cabinets and home bars

- 5.5.5 Others (gaming chairs etc.)

- 5.6 Others (sleeping furniture etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Indoor furniture

- 6.3 Outdoor furniture

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Wood

- 7.4 Metal

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Business/office

- 8.3.2 Educational institute

- 8.3.3 Healthcare

- 8.3.4 Hospitality

- 8.3.5 Others

Chapter 9 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High/luxury

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Artek

- 12.2 Ashley Furniture

- 12.3 Bernhardt Furniture

- 12.4 Boca do Lobo

- 12.5 Hartmann Mobelwerke

- 12.6 Haworth

- 12.7 Herman Miller

- 12.8 HNI Corporation

- 12.9 Kimball International

- 12.10 La-Z-Boy

- 12.11 Restoration Hardware

- 12.12 Roche Bobois

- 12.13 Steelcase

- 12.14 The Senator Group

- 12.15 Vitra