|

市场调查报告书

商品编码

1740756

汽车主动侧倾控制系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Active Roll Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

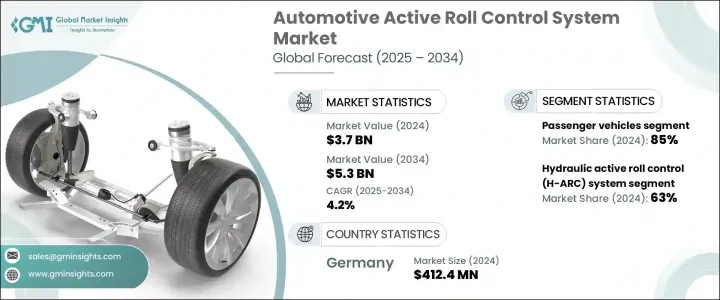

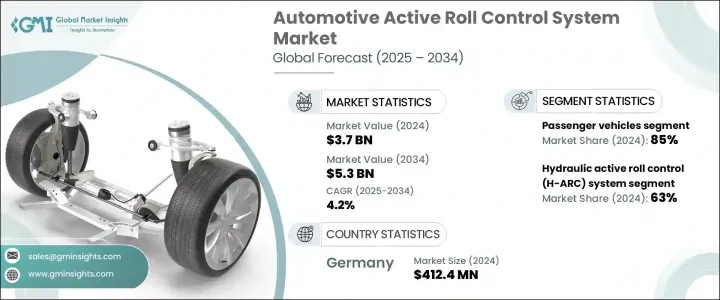

2024年,全球汽车主动侧倾控制系统市场规模达37亿美元,预计年复合成长率将达4.2%,2034年将达到53亿美元。这主要得益于消费者对车辆稳定性、安全性和驾驶舒适性日益增长的需求,尤其是在日益壮大的SUV和豪华车领域。随着越来越多的消费者重视驾驶体验和道路安全,主动侧倾控制系统等先进悬吊技术的采用也持续加速。这些系统在转弯或在崎岖地形上行驶时,能够有效减少车身侧倾,显着提高操控精度和整体安全性。越来越多的汽车製造商致力于在兼顾舒适性的同时,提供精緻、性能导向的驾驶体验,主动侧倾控制系统如今已成为现代汽车设计的关键。

由于SUV和跨界车销量激增,该市场正经历成长势头。这两款车型的重心较高,需要更出色的动态控制才能确保平稳安全的驾驶体验。消费者也越来越关注车辆在实际驾驶条件下的表现,尤其是在城市和郊区路面状况难以预测且高速转弯日益常见的环境下。如今,汽车製造商不仅在高阶车型中整合主动侧倾控制系统,也在中阶车型中整合该系统,以满足客户期望并提升品牌价值。同时,电动车和混合动力车的车身尺寸不断增大(由于电池系统的存在,它们通常会增加重量),这需要专门的悬吊和稳定係统,这进一步刺激了对主动侧倾控制技术的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 4.2% |

欧洲和北美等主要地区的安全法规在推动汽车製造商投资尖端技术方面发挥着重要作用。随着各国政府对车辆安全和性能的合规规范日益严格,製造商面临提升车辆安全性的压力。主动侧倾控制系统有助于满足这些法规要求,同时提供卓越的驾驶体验,对于希望确保产品线面向未来的原始设备製造商而言,这无疑是一项明智的投资。

汽车主动侧倾控制系统市场主要分为两大技术:液压主动侧倾控制 (H-ARC) 和机电主动侧倾控制 (eARC)。截至 2024 年,液压系统占据主导地位,市占率接近 63%。 H-ARC 系统以其高驱动力、高可靠性和快速响应时间而闻名,广泛应用于对稳定性和性能要求极高的 SUV 和豪华车。这些系统尤其适用于重型车辆,并将继续成为注重强劲性能的製造商的首选解决方案。

另一方面,机电式主动侧倾控制系统正逐渐受到青睐,尤其是在汽车製造商探索更节能、更紧凑、更电子化控制的解决方案之际。儘管eARC的市场份额仍然较小,但其与下一代电动车和混合动力车的整合预计将在未来十年推动其稳步普及。向电气化和软体定义汽车的转变与eARC系统的功能高度契合,该系统能够提供更精确的控制并与车辆电子设备整合。

乘用车是主导的汽车类别,到2024年将占据全球约85%的市场。这个细分市场的领先地位源于人们对拥有高端驾驶体验和顶级安全配置的汽车日益增长的偏好。随着汽车製造商加大电动车和混合动力车的产量,对能够适应独特设计和重量分配挑战的创新悬吊系统的需求也日益增长。主动侧倾控制系统完美契合了这个需求,它在不牺牲能源效率的情况下,提供了更佳的控制力和舒适性。

德国是其中的佼佼者,2024年占据全球汽车主动侧倾控制系统市场29%的份额。凭藉其强劲的汽车产业——汇聚了众多全球顶级豪华和高性能汽车製造商——德国在尖端汽车技术的采用方面持续领先。强大的研发投入、成熟的供应商基础以及严格的监管框架,帮助德国在各类车型先进稳定係统的部署方面保持领先地位。

该市场的主要参与者包括采埃孚、蒂森克虏伯、现代摩比斯、电装、舍弗勒、罗伯特·博世、海拉有限公司、麦格纳国际和大陆集团。这些公司正加倍投入研发,致力于开发更智慧、更具成本效益的侧倾控制解决方案。与全球汽车製造商的合作正在扩大其业务范围,尤其是在将这些系统整合到电动车和混合动力车型方面。高度重视法规合规性、技术进步以及在新兴经济体的布局,使这些公司能够保持竞争力,同时满足日益增长的安全性、舒适性和高性能驾驶需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件供应商

- 一级供应商

- 汽车製造商(OEM)

- 软体和技术供应商

- 研发机构

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 价格趋势

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对增强车辆稳定性和操控性的需求不断增加

- SUV 和豪华车销售成长

- 严格的政府法规强制要求安全功能

- 与高级驾驶辅助系统 (ADAS) 和自动驾驶技术的集成

- 悬吊技术的进步

- 产业陷阱与挑战

- 初始成本高

- 整合和校准的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 执行器

- 电子控制单元(ECU)

- 感应器

- 连桿和支架

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 液压主动侧倾控制(H-ARC)系统

- 机电主动侧倾控制(eARC)系统

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM(原始设备製造商)

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Benteler

- BWI Group

- Continental

- Denso

- Eibach

- HELLA GmbH

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies

- JTEKT Corporation

- KYB Corporation

- Magna International

- Mando Corporation

- Robert Bosch

- Schaeffler

- Tenneco

- ThyssenKrupp

- TRW Automotive

- WABCO

- ZF Friedrichshafen

The Global Automotive Active Roll Control System Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 5.3 billion by 2034, driven by the rising need for enhanced vehicle stability, safety, and ride comfort-especially in the growing SUV and luxury vehicle segments. As more consumers prioritize driving experience and on-road safety, the adoption of advanced suspension technologies like active roll control systems continues to accelerate. These systems play a vital role in reducing body roll when cornering or driving on uneven terrain, significantly improving handling precision and overall safety. With more automakers aiming to deliver a refined, performance-oriented ride without compromising comfort, active roll control systems are now seen as critical to modern vehicle design.

This market is witnessing increased momentum thanks to the surge in SUV and crossover vehicle sales, both of which have a higher center of gravity and require better dynamic control to ensure a smooth and safe ride. Consumers are also becoming more conscious of how vehicles perform in real-world driving conditions, especially with unpredictable road surfaces and high-speed cornering becoming more common in urban and suburban environments. Automakers are now integrating active roll control systems not only in premium vehicles but also in mid-range models to meet customer expectations and boost brand value. At the same time, the growing footprint of electric and hybrid vehicles-which often carry additional weight due to battery systems-calls for specialized suspension and stability systems, further fueling demand for active roll control technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 4.2% |

Safety regulations across key regions like Europe and North America are playing a major role in pushing automakers to invest in cutting-edge technologies. As governments impose stricter compliance norms around vehicle safety and performance, manufacturers are under pressure to enhance the safety profiles of their vehicles. Active roll control systems help meet these regulatory demands while simultaneously offering a superior driving experience, making them a smart investment for OEMs looking to future-proof their product lines.

The automotive active roll control system market is segmented into two primary technologies: hydraulic active roll control (H-ARC) and electromechanical active roll control (eARC). As of 2024, hydraulic systems dominate the space, accounting for nearly 63% of the market share. Known for their high actuation force, reliability, and fast response times, H-ARC systems are widely used in SUVs and luxury vehicles where superior stability and performance are non-negotiable. These systems are particularly suited for heavier vehicles and continue to be the go-to solution for manufacturers prioritizing robust performance.

On the other hand, electromechanical active roll control systems are gradually gaining traction, especially as automakers explore more energy-efficient, compact, and electronically controlled solutions. While eARC still holds a smaller portion of the market, its integration into next-gen EVs and hybrids is expected to drive steady adoption over the next decade. The shift toward electrification and software-defined vehicles aligns well with the capabilities of eARC systems, which offer more precise control and integration with vehicle electronics.

Passenger cars represent the dominant vehicle category, capturing around 85% of the global market share in 2024. This segment's lead stems from the growing preference for cars that offer a premium driving experience coupled with top-tier safety features. As automakers ramp up the production of electric and hybrid cars, there is an increasing need for innovative suspension systems that can adapt to unique design and weight distribution challenges. Active roll control systems fit perfectly into this equation, offering enhanced control and comfort without sacrificing energy efficiency.

Germany stands out as a major player, holding a 29% share of the global automotive active roll control system market in 2024. With its robust automotive sector-home to some of the world's top luxury and performance car manufacturers-Germany continues to lead in the adoption of cutting-edge vehicle technologies. Strong R&D investment, a mature supplier base, and stringent regulatory frameworks have helped the country maintain a leadership position in deploying advanced stability systems across vehicle categories.

Key players in this market include ZF Friedrichshafen, ThyssenKrupp, Hyundai Mobis, Denso, Schaeffler, Robert Bosch, HELLA GmbH, Magna International, and Continental. These companies are doubling down on innovation by investing heavily in R&D to develop smarter, more cost-effective roll control solutions. Collaborations with global automakers are expanding their reach, especially in integrating these systems into EVs and hybrid models. A strong focus on regulatory alignment, technology advancement, and presence in emerging economies is allowing these companies to stay competitive while meeting rising demand for safety, comfort, and high-performance driving.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Tier 1 suppliers

- 3.2.3 Automotive manufacturers (OEMs)

- 3.2.4 Software and technology providers

- 3.2.5 Research and development institutions

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Patent analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for enhanced vehicle stability and handling

- 3.10.1.2 Increasing sales of SUVs and luxury vehicles

- 3.10.1.3 Stringent government regulations mandating safety features

- 3.10.1.4 Integration with advanced driver-assistance systems (ADAS) and autonomous driving technologies

- 3.10.1.5 Advancements in suspension technologies

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 Complexity of integration and calibration

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Actuators

- 5.3 Electronic Control Units (ECUs)

- 5.4 Sensors

- 5.5 Linkages and mounts

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hydraulic active roll control (H-ARC) system

- 6.3 Electromechanical active roll control (eARC) system

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEMs (Original Equipment Manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Benteler

- 10.2 BWI Group

- 10.3 Continental

- 10.4 Denso

- 10.5 Eibach

- 10.6 HELLA GmbH

- 10.7 Hitachi Astemo

- 10.8 Hyundai Mobis

- 10.9 Infineon Technologies

- 10.10 JTEKT Corporation

- 10.11 KYB Corporation

- 10.12 Magna International

- 10.13 Mando Corporation

- 10.14 Robert Bosch

- 10.15 Schaeffler

- 10.16 Tenneco

- 10.17 ThyssenKrupp

- 10.18 TRW Automotive

- 10.19 WABCO

- 10.20 ZF Friedrichshafen