|

市场调查报告书

商品编码

1740769

碳纤维船体市场机会、成长动力、产业趋势分析及2025-2034年预测Carbon Fiber Boat Hulls Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

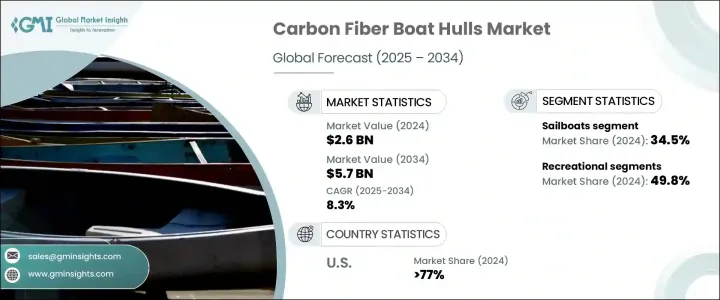

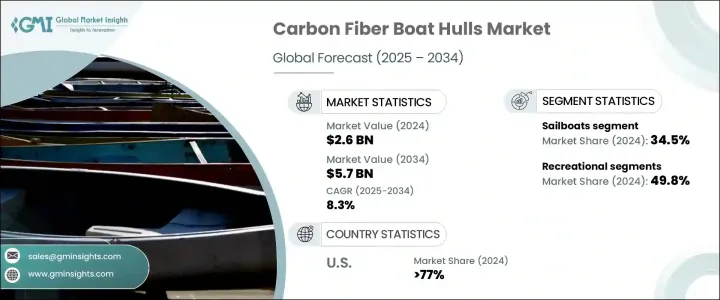

2024 年全球碳纤维船体市场价值为 26 亿美元,预计到 2034 年将以 8.3% 的复合年增长率增长至 57 亿美元。这一增长是由全球休閒和商业领域对轻型、高性能船舶日益增长的需求所推动的。随着海洋爱好者、国防实体和海上运营商寻求更快、更省油和耐腐蚀的解决方案,碳纤维船体正成为理想的材料选择。市场正在经历技术变革,碳纤维复合材料凭藉其卓越的强度重量比、增强的耐用性和长期性能优势取代了传统材料。此外,消费者在豪华游艇上的支出增加以及对环保旅游的兴趣日益浓厚,正在推动对先进、省油船舶的需求。碳纤维能够减少阻力并提高船舶反应能力,这使得它在游艇比赛和帆船等注重性能的领域尤其具有吸引力。对绿色推进技术的日益增长的倾向,加上促进海运业减排的严格监管框架,进一步加速了全球范围内碳纤维船体的应用。

对自主和无人驾驶船舶的投资正在显着推动碳纤维船体市场的发展。这些应用涵盖船舶监控、海洋学研究和海上维护,需要耐用且结构坚固的材料,以支援先进的导航系统和有效载荷整合。碳纤维复合材料满足所有这些要求,其耐腐蚀性、轻量化结构和结构完整性能够满足下一代海洋技术的复杂操作要求。公营和私营部门实体都纷纷转向碳纤维船体,因为它们能够提升船舶在极端海洋环境下的性能。这一趋势已促使国防机构、深海勘探公司和海洋研究机构将碳纤维船体纳入其采购规范,从而形成了一个可靠且不断增长的需求基础,将支撑市场稳定到2034年。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 57亿美元 |

| 复合年增长率 | 8.3% |

政府和私营部门的倡议,包括共同资助的创新拨款和技术加速器,也在将碳纤维融入海洋基础设施方面发挥关键作用。这些项目正在简化下一代船体采用先进复合材料的流程,有助于降低休閒、商业和国防海洋领域的营运排放和成本。

2024年,碳纤维船体市场按船型细分为帆船、游艇、渔船、军用船、救援船和其他类别。帆船占最大份额,为34.5%,这得益于复合材料製造技术的重大进步,这些技术在不断降低製造成本的同时,也提升了性能。由于人们对休閒帆船和竞技帆船的兴趣日益浓厚,帆船在该领域占据主导地位。碳纤维的使用可以减少流体动力阻力并提高机动性,这两者都是提高航行效率的关键因素。此外,日益增强的环保意识正在推动消费者转向风力驱动的船舶,而碳纤维结构可以提供无与伦比的耐海水性和燃油经济性。

按应用细分,市场主要分为休閒、商业、军事和国防等领域。休閒应用占据主导地位,占49.8%的份额,其次是商业用途。由于消费者越来越青睐造型流畅、性能卓越、速度一流、燃油经济性和美观性的船舶,碳纤维在休閒船舶领域越来越受欢迎。碳纤维船体特别适合高端帆船和游艇,具有轻量化结构和卓越的耐用性。越来越多的高净值人士寻求客製化、性能驱动的航海体验,推动了这一趋势。

光是美国碳纤维船体市场在2024年的市值就高达4.1亿美元。美国政府正提议修订北美产业分类系统(NAICS)分类,纳入更具体的纤维增强复合材料船舶建造类别,以反映该行业日益增长的经济重要性。此举预计将增强整个行业的监管透明度、资料追踪能力和针对性投资。受对轻量化、高性能、燃油效率和环保合规船舶的需求推动,各地区对碳纤维船体的需求都在增加。

全球碳纤维船体市场的领导者包括达勒姆船体 (Durham Boat)、北海船体 (North Sea Boats)、DCB Performance Boats、Scout Boats 和萨泰克斯 (SAERTEX) Stade。这些公司正在采用尖端技术,设计出更高等级的碳纤维复合材料,以提高强度、减轻重量并提升耐用性。他们的重点是满足日益增长的对豪华高性能船舶的需求,即使在最恶劣的海洋条件下,也能保持速度、节省燃料并减少维护。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对轻型和节能船舶的需求不断增长

- 碳纤维製造和复合材料技术的进步

- 产业陷阱与挑战

- 回收和环境问题

- 材料和生产成本高

- 成长动力

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 对贸易的影响

- 展望与未来考虑

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依船型,2021 - 2034 年

- 主要趋势

- 帆船

- 游艇

- 渔船

- 军舰

- 救援船

- 其他的

第六章:市场估计与预测:按船体类型,2021 - 2034 年

- 主要趋势

- 单体船

- 多体船

- 滑行船体

- 排水型船体

- 半排水型船体

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 休閒娱乐

- 商业的

- 军事与国防

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Arrow Shark RC

- Carbon

- DCB Performance Boat

- Durham Boat

- Ghostworks Marine

- North Sea Boats

- Oxean Marine

- SAERTEX Stade

- Scout Boats

- TFL North America

The Global Carbon Fiber Boat Hulls Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 5.7 billion by 2034. This surge is fueled by a growing global appetite for lightweight, high-performance marine vessels across both recreational and commercial sectors. As marine enthusiasts, defense entities, and offshore operators seek faster, more fuel-efficient, and corrosion-resistant solutions, carbon fiber hulls are emerging as the ideal material choice. The market is experiencing a technological shift, with carbon fiber composites replacing traditional materials due to their superior strength-to-weight ratio, enhanced durability, and long-term performance benefits. Additionally, increased consumer spending on luxury watercraft and rising interest in environmentally conscious tourism are driving the demand for advanced, fuel-efficient vessels. Carbon fiber's ability to reduce drag and improve vessel responsiveness makes it especially appealing in performance-oriented segments like yacht racing and sailing. The growing inclination toward green propulsion technologies, combined with stringent regulatory frameworks promoting emission reductions in the maritime sector, is further accelerating the adoption of carbon fiber hulls worldwide.

Investments in autonomous and unmanned marine vehicles are significantly boosting the carbon fiber boat hulls market. These applications, spanning surveillance, oceanographic research, and offshore maintenance, require durable, structurally robust materials capable of supporting advanced navigation systems and payload integration. Carbon fiber composites check all these boxes, offering corrosion resistance, lightweight construction, and structural integrity that aligns with the complex operational requirements of next-gen marine technology. Public and private sector entities alike are turning to carbon fiber hulls for their ability to enhance vessel performance in extreme marine environments. This trend has led defense agencies, deep-sea exploration firms, and marine research institutions to include carbon fiber hulls in their procurement specifications-creating a reliable and growing demand base that will support market stability through 2034.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 8.3% |

Government and private initiatives, including co-funded innovation grants and technology accelerators, are also playing a pivotal role in integrating carbon fiber into marine infrastructure. These programs are streamlining the adoption of advanced composites for next-generation hulls, helping reduce operational emissions and costs across recreational, commercial, and defense marine segments.

In 2024, the carbon fiber boat hulls market was segmented by boat type into sailboats, yachts, fishing boats, military boats, rescue boats, and other categories. Sailboats held the largest share at 34.5%, driven by major advances in composite fabrication technologies that continue to reduce manufacturing costs while enhancing performance. Sailboats dominate the segment due to increased interest in leisure sailing and competitive racing. The use of carbon fiber reduces hydrodynamic drag and enhances maneuverability, both crucial factors in sailing efficiency. Additionally, growing eco-consciousness is pushing consumers toward wind-powered vessels, where carbon fiber construction provides unmatched saltwater resistance and fuel economy.

When segmented by application, the market is primarily divided into recreational, commercial, military and defense, and others. Recreational applications dominate with a commanding 49.8% share, followed by commercial use. Carbon fiber is increasingly popular in leisure boating due to the rising consumer preference for sleek, high-performance vessels with top-tier speed, fuel economy, and aesthetic appeal. Carbon fiber hulls are particularly well-suited for high-end sailboats and yachts, offering lightweight construction and exceptional durability. This trend is being propelled by the growing number of high-net-worth individuals seeking customized, performance-driven marine experiences.

The U.S. Carbon Fiber Boat Hulls Market alone was valued at USD 410 million in 2024. The U.S. government is proposing a revision of the NAICS classification to include a more specific category for fiber-reinforced composite boat building-reflecting the sector's rising economic significance. This move is expected to enhance regulatory clarity, data tracking, and targeted investments across the industry. The demand for carbon fiber boat hulls is rising across all regions, driven by the need for lightweight, high-performance vessels that support fuel efficiency and environmental compliance.

Leading players in the global carbon fiber boat hulls market include Durham Boat, North Sea Boats, DCB Performance Boats, Scout Boats, and SAERTEX Stade. These companies are adopting cutting-edge technologies to engineer next-level carbon fiber composites that offer greater strength, reduced weight, and improved durability. Their focus is to meet the rising demand for luxury and performance-driven watercraft that deliver speed, fuel savings, and reduced maintenance in even the harshest marine conditions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for lightweight and fuel-efficient vessels

- 3.6.1.2 Advancements in carbon fiber manufacturing and composites technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Recycling and environmental concerns

- 3.6.2.2 High material and production costs

- 3.6.1 Growth drivers

- 3.7 Impact of trump administration tariffs – structured overview

- 3.7.1 Impact on trade

- 3.7.1.1 Trade volume disruptions

- 3.7.1.2 Retaliatory measures

- 3.7.2 Impact on the industry

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.2.2 Price volatility in key materials

- 3.7.2.3 Supply chain restructuring

- 3.7.2.4 Production cost implications

- 3.7.2.5 Demand-side impact (selling price)

- 3.7.2.6 Price transmission to end markets

- 3.7.2.7 Market share dynamics

- 3.7.2.8 Consumer response patterns

- 3.7.3 Key companies impacted

- 3.7.4 Strategic industry responses

- 3.7.4.1 Supply chain reconfiguration

- 3.7.4.2 Pricing and product strategies

- 3.7.4.3 Policy engagement

- 3.7.1 Impact on trade

- 3.8 Outlook and future considerations

- 1.1 Growth potential analysis

- 1.2 Porter's analysis

- 1.3 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 1.4 Introduction

- 1.5 Company market share analysis

- 1.6 Competitive positioning matrix

- 1.7 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Boat Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 1.8 Key trends

- 1.9 Sailboats

- 1.10 Yachts

- 1.11 Fishing boats

- 1.12 Military boats

- 1.13 Rescue boats

- 1.14 Others

Chapter 6 Market Estimates and Forecast, By Hull Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 1.15 Key trends

- 1.16 Monohull

- 1.17 Multihull

- 1.18 Planing hull

- 1.19 Displacement hull

- 1.20 Semi-displacement hull

- 1.21 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 1.22 Key trends

- 1.23 Recreational

- 1.24 Commercial

- 1.25 Military & defense

- 1.26 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 1.27 Key trends

- 1.28 North America

- 1.28.1 U.S.

- 1.28.2 Canada

- 1.29 Europe

- 1.29.1 Germany

- 1.29.2 UK

- 1.29.3 France

- 1.29.4 Spain

- 1.29.5 Italy

- 1.29.6 Netherlands

- 1.30 Asia Pacific

- 1.30.1 China

- 1.30.2 India

- 1.30.3 Japan

- 1.30.4 Australia

- 1.30.5 South Korea

- 1.31 Latin America

- 1.31.1 Brazil

- 1.31.2 Mexico

- 1.32 Middle East and Africa

- 1.32.1 Saudi Arabia

- 1.32.2 South Africa

- 1.32.3 UAE

Chapter 9 Company Profiles

- 9.1 Arrow Shark RC

- 9.2 Carbon

- 9.3 DCB Performance Boat

- 9.4 Durham Boat

- 9.5 Ghostworks Marine

- 9.6 North Sea Boats

- 9.7 Oxean Marine

- 9.8 SAERTEX Stade

- 9.9 Scout Boats

- 9.10 TFL North America