|

市场调查报告书

商品编码

1740770

除毛化妆品成分市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cosmetic Ingredients for Hair Removal Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

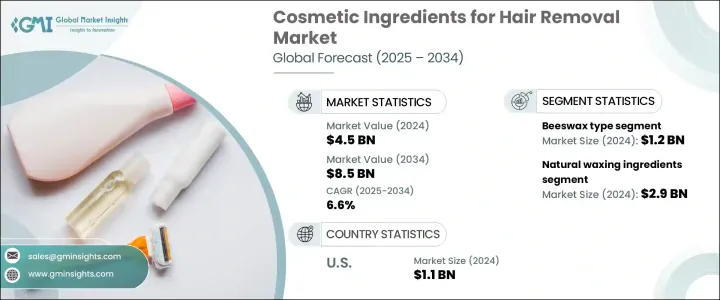

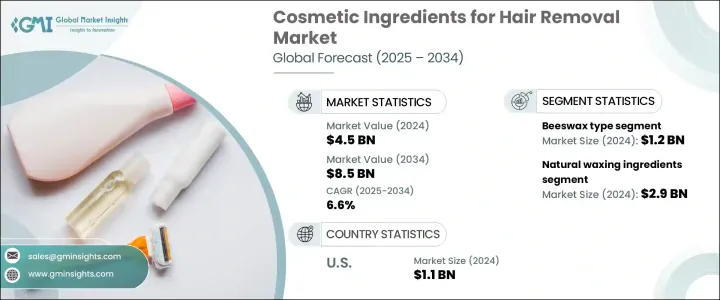

2024年,全球除毛化妆品成分市场规模达45亿美元,预计2034年将以6.6%的复合年增长率成长,达到85亿美元。这一增长主要源于消费者对个人护理和健康习惯日益增长的关注,尤其是随着消费者越来越重视日常护肤。过去十年,除毛产品中使用的化妆品成分在配方和创新方面都取得了显着进展。无论是乳霜、凝胶、蜡还是泡沫,对有效除毛且温和的成分的需求都在激增。製造商不断开发配方,以满足消费者不断变化的期望,尤其是那些偏好更干净、更安全、更永续产品的消费者。

消费者行为向天然环保产品的转变极大地塑造了这个市场。消费者越来越倾向于避免使用合成化学品,而对源自天然来源的成分錶现出明显的偏好。这种偏好不仅体现在产品成分上,也延伸到透明度、道德采购和环境安全等价值。因此,化妆品品牌现在非常注重清洁标籤产品,并强调产品纯度和合规性。不含人工添加剂或刺激性防腐剂的产品的吸引力,促使人们对不影响功效的无化学除毛解决方案的需求不断增长。这种转变与个人护理行业的更广泛趋势密切相关,该行业优先考虑成分透明度和产品安全性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 45亿美元 |

| 预测值 | 85亿美元 |

| 复合年增长率 | 6.6% |

在众多成分类型中,蜂蜡基配方表现出显着的吸引力。 2024年,蜂蜡基化妆品除毛成分市场规模估计为12亿美元,预计在2025年至2034年的预测期内,复合年增长率将达到6.9%。蜂蜡因其天然来源、良好的护肤功效和便捷的使用方式,仍然是备受青睐的成分。它广泛用于硬蜡配方,无需使用布条,适合家庭用户和专业人士使用。其半固体状的浓稠度使其可直接涂抹,方便使用者使用,特别适用于敏感部位。

人们对采用天然蜜蜡成分製成的除毛产品日益青睐。 2024年,天然蜜蜡成分市场规模达29亿美元,预计到2034年将以6.9%的复合年增长率成长,占65.4%的市场。消费者之所以选择这些替代品,是因为它们被认为安全可靠、副作用小,适合敏感肌肤。随着人们对整体自我照顾的需求不断增长,人们对采用天然材料製成、符合健康生活方式的产品的兴趣也日益浓厚。对有机、永续和无防腐剂配方的追求已成为产品开发和购买决策的主要驱动力。清洁标籤、有机认证和环保声明在品牌市场定位中发挥着至关重要的作用。

在美国,2024年用于除毛的化妆品成分市场规模达11亿美元,预计2025年至2034年的复合年增长率为6.9%。这一区域成长的动力源自于消费者对个人健康和卫生态度的显着转变。美国人正在寻求更有效、更亲肤的除毛解决方案,以适应他们积极的生活方式和日益增强的自我照顾意识。这种需求正在促进成分采购和配方流程的创新,鼓励品牌提供同时满足安全性和功效双重需求的解决方案。

在全球格局中,一群竞争激烈的公司对价值链拥有重要影响力。主要参与者将精力集中在研发和产品差异化上,以满足市场对成分完整性和永续性日益增长的期望。虽然价格战在这一领域相对少见,但对创新和监管准备的重视已成为竞争策略的基石。领先的公司正在投资生态认证,并透过合作和收购来拓展其采购能力。品牌声誉、优质原料的取得以及满足B2B配方需求的能力,对于维持强大的市场地位至关重要。

随着数位化互动的不断增长,品牌越来越依赖精准行销和技术支援来建立B2B关係并扩大覆盖范围。消费者对透明度、安全性和持久功效的需求持续推动市场发展,促使企业持续投资于配方技术和临床测试,以确保产品宣传可信赖且具吸引力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供给侧影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 全球监理框架概览

- FDA法规

- 欧盟化妆品法规

- 中国化妆品监督管理条例

- 衝击力

- 成长动力

- 消费者对家用除毛产品的需求不断增长

- 消费者对天然和有机化妆品成分的偏好日益增加

- 新兴经济体个人护理市场不断扩大

- 监管支持更安全、更亲肤的配方

- 产业陷阱与挑战

- 对化学成分使用的严格规定

- 与活性除毛剂相关的皮肤敏感性和过敏问题

- 成长动力

- 市场机会

- 天然和有机配方的开发

- 拓展电子商务通路

- 发展中经济体尚未开发的市场

- 除臭技术的创新

- 多功能除毛产品

- 市场进入和扩张策略

- 市场进入障碍与挑战

- 监管障碍和合规成本

- 智慧财产权限制

- 确立了玩家主导地位

- 技术专长要求

- 市场进入策略

- 合资企业和策略联盟

- 许可和技术转让

- 收购和棕地进入

- 绿地投资和有机成长

- 地理扩张机会

- 高成长区域市场

- 尚未开发的市场潜力评估

- 文化和监管考虑

- 在地化和适应策略

- 产品组合扩展策略

- 产品线延伸和产品变体

- 跨品类扩张

- 高端和价值细分市场定位

- 客製化和个人化方法

- 市场进入障碍与挑战

- 风险评估和缓解策略

- 市场风险

- 需求波动性和週期性

- 竞争强度与价格压力

- 替代产品和技术

- 消费者偏好转变

- 营运风险

- 供应链中断

- 品质控制和产品安全

- 製造和配方挑战

- 劳动力和人才管理

- 监理与合规风险

- 不断变化的监管格局

- 不合规处罚和召回

- 成分限制和禁令

- 标籤和行销索赔风险

- 市场风险

- 未来展望与市场预测

- 短期市场展望(1-2年)

- 立即成长的机会

- 近期挑战

- 竞争格局演变

- 中期市场展望(3-5年)

- 新兴市场领域

- 技术采用曲线

- 供需平衡预测

- 长期市场展望(5-10年)

- 颠覆性技术与创新

- 永续发展驱动的市场转型

- 消费者行为的演变

- 产业整合与重组情景

- 情境分析与应急计划

- 最佳成长情景

- 基准市场演变

- 最糟糕的市场萎缩

- 颠覆性情境分析

- 短期市场展望(1-2年)

- 投资机会和策略建议

- 投资吸引力评估

- 高成长细分市场

- 技术投资机会

- 地理投资热点

- 併购与合作机会

- 针对原料製造商的策略建议

- 产品开发与创新重点领域

- 市场定位和差异化策略

- 永续性和合规路线图

- 伙伴关係和合作机会

- 针对最终产品製造商的策略建议

- 配方和产品开发重点

- 消费者参与和行销策略

- 分销和通路优化

- 永续性和品牌定位

- 为投资者和金融利益相关者提供策略建议

- 高潜力投资目标

- 风险评估和缓解方法

- 投资组合多元化策略

- 退出策略考虑

- 投资吸引力评估

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 松香酸甘油酯(松香)/松香

- 氢化松香

- 蜂蜡

- 精油

- 巯基乙酸

- 羊毛脂

- 甘油

- 其他的

第六章:市场估计与预测:依类别,2021-2034

- 主要趋势

- 天然除毛成分

- 合成打蜡成分

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 软蜡

- 硬蜡

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Aadra International

- Arjun Bees Wax Industries

- Ataman Chemical

- BRM Chemicals

- DKSH Holding Ltd.

- Making Cosmetics Inc.

- Guangzhou ECOPOWER

- Gustav Heess Oleochemische Erzeugnisse GmbH

- JKB Infotech PVT LTD

- Koster Keunen

- Koster Keunen LLC

- Knowde

- Mishra Chemical Works

- Rimpro-india

- SpecialChem Arkema Global

- SOPHIM IBERIA SL

- Strahl and Pitsch

- Synthomer

- Unicorn petroleum industries pvt. Ltd

- Zoic Cosmetics

The Global Cosmetic Ingredients for Hair Removal Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 8.5 billion by 2034. This growth is largely driven by increased interest in personal grooming and wellness practices, particularly as consumers place greater importance on their skincare routines. Over the past decade, there has been notable progress in both the formulation and innovation of cosmetic ingredients used in hair removal products. Whether in creams, gels, waxes, or foams, the demand for ingredients that deliver effective hair removal while being gentle on the skin has surged. Manufacturers are consistently developing formulations that meet evolving consumer expectations, especially those preferring cleaner, safer, and more sustainable options.

The shift in consumer behavior toward natural and eco-conscious products has significantly shaped this market. Buyers are increasingly avoiding synthetic chemicals, showing a clear preference for ingredients derived from natural sources. This preference is not just about product content but extends to values like transparency, ethical sourcing, and environmental safety. As such, cosmetic brands are now focusing heavily on clean-label offerings and emphasizing product purity and regulatory compliance. The appeal of products free from artificial additives or harsh preservatives is contributing to a rise in demand for chemical-free hair removal solutions that do not compromise on performance. This evolution aligns closely with broader trends in the personal care sector, where ingredient transparency and product safety are prioritized.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 6.6% |

Among the various ingredient types, beeswax-based formulations have shown significant traction. In 2024, the market for beeswax-based cosmetic hair removal ingredients was estimated at USD 1.2 billion and is anticipated to grow at a CAGR of 6.9% during the forecast period from 2025 to 2034. Beeswax remains a preferred ingredient due to its natural origin, favorable skin properties, and ease of application. It is widely used in hard wax formulations that eliminate the need for cloth strips, making it suitable for at-home users and professionals alike. Its semi-solid consistency allows for direct application, which makes it user-friendly, especially for sensitive areas.

There is a growing preference for hair removal products made with natural waxing components. In 2024, the natural waxing ingredients segment was valued at USD 2.9 billion and is projected to grow at a CAGR of 6.9% through 2034, securing a market share of 65.4%. Consumers are turning to these alternatives due to their perceived safety, minimal side effects, and compatibility with sensitive skin. As the demand for holistic self-care rises, so does interest in products crafted from naturally derived materials that align with wellness-focused lifestyles. The push for organic, sustainable, and preservative-free formulations has become a major driving force behind product development and purchasing decisions. Clean labeling, organic certifications, and environmental claims are playing an essential role in how brands position themselves in the market.

In the United States, the cosmetic ingredients for hair removal market reached USD 1.1 billion in 2024, with projections suggesting a 6.9% CAGR from 2025 to 2034. This regional growth is fueled by a noticeable change in consumer attitudes toward personal wellness and hygiene. Americans are seeking more effective, skin-friendly solutions for hair removal that align with their active lifestyles and heightened awareness around self-care. This demand is fostering innovation in ingredient sourcing and formulation processes, encouraging brands to deliver solutions that meet the dual need for safety and efficacy.

The global landscape features a competitive group of companies that hold significant influence over the value chain. Major participants have centered their efforts around research, development, and product differentiation to meet rising expectations for ingredient integrity and sustainability. While pricing battles are relatively uncommon in this segment, the emphasis on innovation and regulatory readiness has become a cornerstone of competitive strategy. Leading companies are investing in eco-certifications and expanding their sourcing capabilities through partnerships and acquisitions. Brand reputation, access to high-quality raw materials, and the ability to meet B2B formulation demands are central to sustaining a strong market presence.

As digital engagement grows, brands are leaning on targeted marketing and technical support to build B2B relationships and expand reach. Consumer demand for transparency, safety, and long-lasting effectiveness continues to push the market forward, prompting ongoing investment in formulation technology and clinical testing to ensure product claims are both credible and appealing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 Global regulatory framework overview

- 3.7.2 Fda regulations

- 3.7.3 Eu cosmetics regulation

- 3.7.4 China's csar (cosmetic supervision and administration regulation)

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising consumer demand for at-home hair removal products

- 3.8.1.2 Increasing preference for natural and organic cosmetic ingredients

- 3.8.1.3 Expanding personal care markets in emerging economies

- 3.8.1.4 Regulatory support for safer, skin-friendly formulations

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Stringent regulations around chemical ingredient usage

- 3.8.2.2 Skin sensitivity and allergy concerns related to active depilatory agents

- 3.8.1 Growth drivers

- 3.9 Market opportunities

- 3.9.1 Development of natural and organic formulations

- 3.9.2 Expanding e-commerce channels

- 3.9.3 Untapped markets in developing economies

- 3.9.4 Innovation in odor-neutralizing technologies

- 3.9.5 Multi-functional hair removal products

- 3.10 Market entry and expansion strategies

- 3.10.1 Market entry barriers and challenges

- 3.10.1.1 Regulatory hurdles and compliance costs

- 3.10.1.2 Intellectual property constraints

- 3.10.1.3 Established player dominance

- 3.10.1.4 Technical expertise requirements

- 3.10.2 Market entry strategies

- 3.10.2.1 Joint ventures and strategic alliances

- 3.10.2.2 Licensing and technology transfer

- 3.10.2.3 Acquisition and brownfield entry

- 3.10.2.4 Greenfield investment and organic growth

- 3.10.3 Geographic expansion opportunities

- 3.10.3.1 High-growth regional markets

- 3.10.3.2 Untapped market potential assessment

- 3.10.3.3 Cultural and regulatory considerations

- 3.10.3.4 Localization and adaptation strategies

- 3.10.4 Product portfolio expansion strategies

- 3.10.4.1 Line extensions and product variants

- 3.10.4.2 Cross-category expansion

- 3.10.4.3 Premium and value segment targeting

- 3.10.4.4 Customization and personalization approaches

- 3.10.1 Market entry barriers and challenges

- 3.11 Risk assessment and mitigation strategies

- 3.11.1 Market risks

- 3.11.1.1 Demand volatility and cyclicality

- 3.11.1.2 Competitive intensity and price pressure

- 3.11.1.3 Substitute products and technologies

- 3.11.1.4 Consumer preference shifts

- 3.11.2 Operational risks

- 3.11.2.1 Supply chain disruptions

- 3.11.2.2 Quality control and product safety

- 3.11.2.3 Manufacturing and formulation challenges

- 3.11.2.4 Workforce and talent management

- 3.11.3 Regulatory and compliance risks

- 3.11.3.1 Changing regulatory landscape

- 3.11.3.2 Non-compliance penalties and recalls

- 3.11.3.3 Ingredient restrictions and bans

- 3.11.3.4 Labeling and marketing claim risks

- 3.11.1 Market risks

- 3.12 Future outlook and market projections

- 3.12.1 Short-term market outlook (1-2 years)

- 3.12.1.1 Immediate growth opportunities

- 3.12.1.2 Near-term challenges

- 3.12.1.3 Competitive landscape evolution

- 3.12.2 Medium-term market outlook (3-5 years)

- 3.12.2.1 Emerging market segments

- 3.12.2.2 Technology adoption curves

- 3.12.2.3 Supply-demand balance projections

- 3.12.3 Long-term market outlook (5-10 years)

- 3.12.3.1 Disruptive technologies and innovations

- 3.12.3.2 Sustainability-driven market transformation

- 3.12.3.3 Consumer behavior evolution

- 3.12.3.4 Industry consolidation and restructuring scenarios

- 3.12.4 Scenario analysis and contingency planning

- 3.12.4.1 Best-case growth scenario

- 3.12.4.2 Base-case market evolution

- 3.12.4.3 Worst-case market contraction

- 3.12.4.4 Disruptive scenario analysis

- 3.12.1 Short-term market outlook (1-2 years)

- 3.13 Investment opportunities and strategic recommendations

- 3.13.1 Investment attractiveness assessment

- 3.13.1.1 High-growth market segments

- 3.13.1.2 Technology investment opportunities

- 3.13.1.3 Geographic investment hotspots

- 3.13.1.4 M&a and partnership opportunities

- 3.13.2 Strategic recommendations for ingredient manufacturers

- 3.13.2.1 Product development and innovation focus areas

- 3.13.2.2 Market positioning and differentiation strategies

- 3.13.2.3 Sustainability and compliance roadmap

- 3.13.2.4 Partnership and collaboration opportunities

- 3.13.2.5 Strategic recommendations for end-product manufacturers

- 3.13.2.6 Formulation and product development priorities

- 3.13.2.7 Consumer engagement and marketing strategies

- 3.13.2.8 Distribution and channel optimization

- 3.13.2.9 Sustainability and brand positioning

- 3.13.3 Strategic recommendations for investors and financial stakeholders

- 3.13.3.1 High-potential investment targets

- 3.13.3.2 Risk assessment and mitigation approaches

- 3.13.3.3 Portfolio diversification strategies

- 3.13.3.4 Exit strategy considerations

- 3.13.1 Investment attractiveness assessment

- 3.14 Growth potential analysis

- 3.15 Porter’s analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Glyceryl rosinate (rosin)/gum rosin

- 5.3 Hydrogenated rosin

- 5.4 Beeswax

- 5.5 Essential oils

- 5.6 Thioglycolic acid

- 5.7 Lanolin

- 5.8 Glycerin

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural waxing ingredients

- 6.3 Synthetic waxing ingredients

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Soft wax

- 7.3 Hard wax

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aadra International

- 9.2 Arjun Bees Wax Industries

- 9.3 Ataman Chemical

- 9.4 BRM Chemicals

- 9.5 DKSH Holding Ltd.

- 9.6 Making Cosmetics Inc.

- 9.7 Guangzhou ECOPOWER

- 9.8 Gustav Heess Oleochemische Erzeugnisse GmbH

- 9.9 JKB Infotech PVT LTD

- 9.10 Koster Keunen

- 9.11 Koster Keunen LLC

- 9.12 Knowde

- 9.13 Mishra Chemical Works

- 9.14 Rimpro-india

- 9.15 SpecialChem Arkema Global

- 9.16 SOPHIM IBERIA S.L

- 9.17 Strahl and Pitsch

- 9.18 Synthomer

- 9.19 Unicorn petroleum industries pvt. Ltd

- 9.20 Zoic Cosmetics