|

市场调查报告书

商品编码

1740771

凸轮轴升降机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Camshaft Lifters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

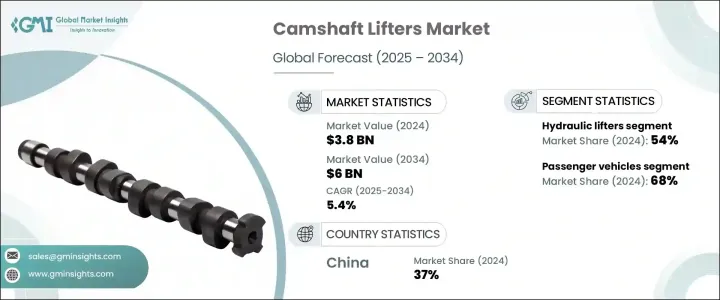

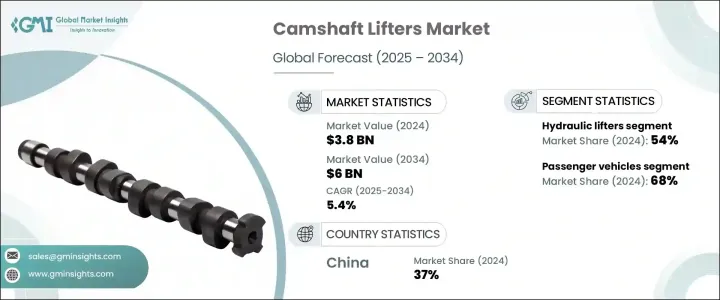

2024 年全球凸轮轴挺桿市场规模为 38 亿美元,预计到 2034 年将以 5.4% 的复合年增长率成长,达到 60 亿美元。推动这一成长的因素包括对引擎优化和燃油经济性的日益关注,製造商致力于打造能够在遵守更严格排放法规的同时使引擎运行更平稳的零件。凸轮轴挺桿在优化气门正时、减少内部摩擦和提高燃烧效率方面发挥关键作用,从而提高燃油经济性并减少排放。随着汽车製造商不断创新以满足对高性能、环保汽车日益增长的需求,凸轮轴挺桿在现代内燃机设计中变得至关重要。此外,全球汽车产量的成长,尤其是在註重燃油的市场,进一步加速了对先进挺桿技术的需求。

挺桿设计技术进步也正在塑造市场,例如滚轮挺桿、液压挺桿和可变气门正时 (VVT) 系统。这些创新提高了引擎的耐用性、性能以及与下一代引擎的兼容性,延长了零件寿命,并使引擎运行更加平稳。随着高性能汽车和混合动力汽车的兴起,凸轮轴挺桿也在不断改进,以满足性能爱好者和注重环保的消费者的需求。此外,混合动力汽车为挺桿整合开闢了新的途径,确保了其在不断发展的动力系统中的相关性。人们日益转向节能环保汽车,这继续推动凸轮轴挺桿的普及,因为它们仍然是提高引擎效率和实现排放目标的关键部件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 60亿美元 |

| 复合年增长率 | 5.4% |

2024年,液压挺桿占据市场主导地位,占有54%的份额。这类挺桿因其维护需求低、气门间隙可自动调整以及引擎运转安静而备受青睐。它们还能提升引擎运转平稳性并延长其使用寿命,因此对主流车型和高阶车型都极具吸引力。液压挺桿适用于从普通车型到高性能车型的各种车型,这确保了其在汽车市场的广泛应用和日益增长的需求。

2024年,乘用车占据了凸轮轴挺桿市场的最大份额,占68%。全球乘用车的大量生产和销售推动了该领域对凸轮轴挺桿的需求。随着消费者追求更省油、排放更低的汽车,汽车製造商越来越多地将凸轮轴挺桿(尤其是液压挺桿和滚轮挺桿)融入其引擎设计中,以提高性能和燃油经济性。此外,由于车辆在其整个生命週期内都需要定期维修和更换,售后市场对凸轮轴挺桿的需求仍然强劲。

2024年,中国凸轮轴挺桿市场规模达6.181亿美元,占37%。中国汽车製造业的蓬勃发展以及政府对节能汽车的大力推动,推动了凸轮轴挺桿的普及。儘管电动车(EV)的快速发展(无需凸轮轴系统)带来了长期挑战,但中国在全球汽车生产中的主导地位及其对永续汽车技术的重视,将在短期内继续支撑凸轮轴挺桿的需求。

业界领导企业包括 Schrick GmbH、Rane Engine Valve、Shivam Autotech、Comp Cams、Hyundai Kefico、Aisin Seiki、Eaton、Tenneco、Elgin Industries 和 BorgWarner。为了保持竞争优势,这些公司正在大力投资先进的挺桿技术,扩大产品与混合动力和节能汽车的兼容性,并提升生产能力。他们还建立了全球战略合作伙伴关係,优先发展研发,并与汽车製造商合作,儘早整合新的挺桿技术,确保其在OEM和售后市场领域占有一席之地。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 凸轮轴挺桿製造商

- 原始设备製造商(OEM)

- 售后市场经销商和零售商

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 价格趋势

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对燃油效率和引擎性能的需求不断增长

- 升降机设计的技术进步

- 混合动力和电动车领域的成长

- 对高性能汽车的偏好日益增长

- 产业陷阱与挑战

- 生产成本高

- 技术复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 油压升降机

- 机械(固体)升降器

- 滚轮升降器

- 平底挺桿升降器

第六章:市场估计与预测:按引擎,2021 - 2034 年

- 主要趋势

- 汽油引擎

- 柴油引擎

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM (原始设备製造商)

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Aisin Seiki

- BorgWarner

- Cam Motion

- Competition Cams

- Crower Cams & Equipment Company

- Eaton

- Elgin Industries

- Hyundai Kefico

- Jinan Haiyu Power Machinery Equipment

- Johnson Lifters

- Lunati Cams

- Otics

- Rane Engine Valve

- Schrick

- Sealed Power

- Shivam Autotech

- SM Motorenteile

- Tenneco

- TRW Automotive Holdings

- Wuxi Xizhou Machinery

The Global Camshaft Lifters Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6 billion by 2034. This growth is driven by a rising focus on engine optimization and improving fuel economy, with manufacturers striving to create components that deliver smoother engine operations while adhering to stricter emission regulations. Camshaft lifters play a critical role in enhancing valve timing, reducing internal friction, and improving combustion efficiency, which translates into better fuel economy and reduced emissions. As automakers continue innovating to meet the growing demand for high-performance, eco-friendly vehicles, camshaft lifters are becoming essential in modern internal combustion engine designs. In addition, the growing vehicle production across the globe, particularly in fuel-conscious markets, further accelerates the demand for advanced lifter technologies.

The market is also being shaped by technological advancements in lifter designs, such as roller lifters, hydraulic lifters, and variable valve timing (VVT) systems. These innovations improve engine durability, performance, and compatibility with next-generation engines, extending component life and enabling smoother engine operation. With the rise in high-performance and hybrid vehicles, camshaft lifters are adapting to meet the requirements of both performance enthusiasts and eco-conscious consumers. Furthermore, hybrid vehicles are opening new avenues for lifter integration, ensuring their relevance in evolving powertrain systems. The growing shift toward fuel-efficient and environmentally friendly vehicles continues to push the adoption of camshaft lifters, as they remain a crucial component for enhancing engine efficiency and meeting emission targets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $6 Billion |

| CAGR | 5.4% |

In 2024, hydraulic lifters dominated the market, holding a 54% share. These lifters are valued for their low maintenance needs, self-adjusting valve clearances, and quiet engine operation. They also contribute to smoother functioning and longer engine life, making them highly attractive to both mainstream and premium vehicle segments. Hydraulic lifters are compatible with a wide range of vehicles, from everyday cars to high-performance models, ensuring their widespread adoption and increasing demand in the automotive market.

Passenger vehicles represented the largest portion of the camshaft lifters market in 2024, accounting for a 68% share. The demand for camshaft lifters in this segment is fueled by the large volume of passenger vehicles produced and sold globally. As consumers seek more fuel-efficient and low-emission cars, automakers are increasingly incorporating camshaft lifters-particularly hydraulic and roller lifters-into their engine designs to enhance performance and fuel economy. Additionally, the aftermarket demand for camshaft lifters remains strong, as vehicles require regular servicing and replacement throughout their life cycle.

China's camshaft lifters market generated USD 618.1 million in 2024, accounting for a 37% share. The country's robust automotive manufacturing sector and the government's push for energy-efficient vehicles have contributed to the rising adoption of camshaft lifters. Despite the long-term challenge posed by the growth of electric vehicles (EVs), which do not require camshaft-based systems, China's dominance in global automotive production and its focus on sustainable vehicle technologies will continue to support camshaft lifter demand in the near term.

Leading industry players include Schrick GmbH, Rane Engine Valve, Shivam Autotech, Comp Cams, Hyundai Kefico, Aisin Seiki, Eaton, Tenneco, Elgin Industries, and BorgWarner. To maintain their competitive edge, these companies are investing heavily in advanced lifter technologies, expanding product compatibility with hybrid and fuel-efficient vehicles, and enhancing production capabilities. They are also forming strategic global partnerships, prioritizing R&D, and collaborating with automakers for early integration of new lifter technologies, ensuring their presence in both OEM and aftermarket segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Camshaft lifter manufacturers

- 3.2.4 Original Equipment Manufacturers (OEM)

- 3.2.5 Aftermarket distributors and retailers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Patent analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for fuel efficiency and engine performance

- 3.10.1.2 Technological advancements in lifter designs

- 3.10.1.3 Growth in hybrid and electric vehicle segments

- 3.10.1.4 Growing preference for high-performance vehicles

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High production costs

- 3.10.2.2 Technological complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hydraulic lifters

- 5.3 Mechanical (solid) lifters

- 5.4 Roller lifters

- 5.5 Flat tappet lifters

Chapter 6 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Petrol (gasoline) engines

- 6.3 Diesel engines

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM (Original Equipment Manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Aisin Seiki

- 10.2 BorgWarner

- 10.3 Cam Motion

- 10.4 Competition Cams

- 10.5 Crower Cams & Equipment Company

- 10.6 Eaton

- 10.7 Elgin Industries

- 10.8 Hyundai Kefico

- 10.9 Jinan Haiyu Power Machinery Equipment

- 10.10 Johnson Lifters

- 10.11 Lunati Cams

- 10.12 Otics

- 10.13 Rane Engine Valve

- 10.14 Schrick

- 10.15 Sealed Power

- 10.16 Shivam Autotech

- 10.17 SM Motorenteile

- 10.18 Tenneco

- 10.19 TRW Automotive Holdings

- 10.20 Wuxi Xizhou Machinery