|

市场调查报告书

商品编码

1740773

时间温度指示标籤市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Time Temperature Indicator Labels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

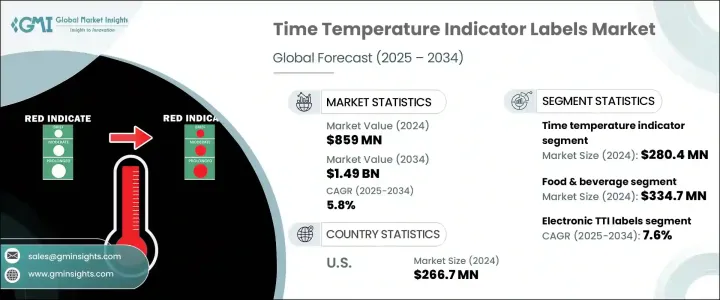

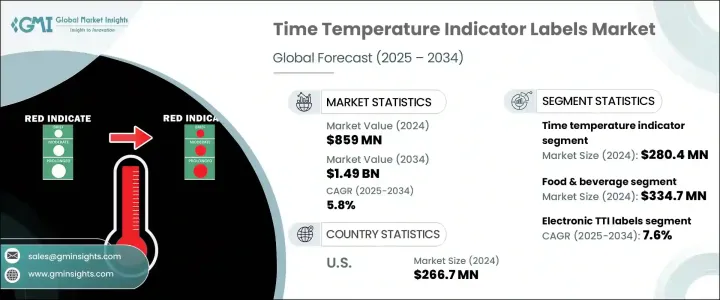

2024 年全球时间温度指示标籤市场价值为 8.59 亿美元,预计到 2034 年将以 5.8% 的复合年增长率增长,达到 14.9 亿美元,这得益于即食食品、方便食品需求的激增以及医药和医疗保健应用的不断扩大。随着全球供应链变得更加复杂和监管标准更加严格,对可靠的温度监控解决方案的需求变得比以往任何时候都更加重要。食品、饮料和製药行业的公司越来越多地将时间温度指示标籤整合到他们的物流和分销系统中,以确保产品安全、最大限度地减少浪费并维护品牌完整性。包括餐包配送和线上杂货平台在内的直接面向消费者管道的兴起,进一步推动了时间温度指示标籤的采用。同时,永续发展趋势正在重塑市场,製造商正在创新环保、智慧和数据驱动的解决方案,以满足环境标准和消费者期望。随着越来越多的消费者重视食品安全和品质保证,TTI 正在迅速从可选工具发展成为整个供应链中必不可少的组成部分,为未来十年的市场参与者创造重大机会。

儘管成长前景强劲,但某些挑战仍在拖累市场格局。川普政府时期征收的关税持续构成障碍,尤其是对特种化学品、黏合剂和TTI製造必需的电子元件等原料征收更高的进口关税。这些关税正在挤压製造商的利润率,除非增加的成本能够被吸收或转移给消费者。在全球舞台上,主要贸易伙伴的报復性关税使美国TTI供应商在国际上竞争更加艰难,尤其是在易腐烂商品监管更加严格、需求不断增长的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.59亿美元 |

| 预测值 | 14.9亿美元 |

| 复合年增长率 | 5.8% |

时间温度指示标籤市场按标籤类型分类,包括关键时间温度指示剂 (CTTI)、时间温度指示剂等。仅时间温度指示剂细分市场在 2024 年就创造了 2.804 亿美元的市场规模,这主要得益于食品和饮料行业对其应用的不断增长。监测乳製品、肉类、海鲜和即食食品的新鲜度和安全性从未如此重要。製药业也在推动成长,因为生物製剂、特种药物和疫苗需要精确的储存和运输监控。直销模式和最后一哩配送服务的激增,加剧了对能够确保即时新鲜度追踪的 TTI 的需求。

2024年,食品和饮料产业的市场规模达到3.347亿美元,主要得益于人们对食源性疾病、污染和腐败问题的日益担忧。城镇化进程的加速和现代消费者忙碌的生活方式显着推动了方便食品的消费,从而导致了TTI在整个供应链中的广泛整合。

2024年,德国时间温度指示标籤市场规模达4,850万美元,主要得益于药品出口成长和欧盟法规趋严。随着冷链物流的发展以及以永续发展为重点的温度控制技术创新,对时间温度指示标籤的需求激增。

时间温度指示标籤市场的主要参与者包括美国热工仪器公司 (American Thermal Instruments)、艾利丹尼森公司 (Avery Dennison)、柏林格公司 (Berlinger)、CCL Industries、Delta Trak、Freshliance Electronics、Insignia Technologies、Neogen、NiGK、Omex、Freshliance Electronics、Insignia Technologies、Neogen、NiGK、Ome Technologies Engineering、Sensi、St.Samt、Skbrame Technologies Engineering、Sensi)各公司正在推动智慧即时追踪解决方案,并拓展新兴市场,以满足食品安全和医药物流创新领域日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 新鲜易腐商品需求不断成长

- 冷链物流扩张

- 电子商务和线上杂货配送的成长

- 製药和医疗保健领域采用率不断提高

- 即食食品和方便食品的成长

- 产业陷阱与挑战

- 先进TTL技术成本高

- 温度灵敏度和可靠性不一致

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按标籤讯息,2021 年至 2034 年

- 主要趋势

- 关键时间温度指标 (CTTI)

- 临界温度指标

- 时间温度指示器

- 其他的

第六章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 电子TTI标籤

- 化学基TTI标籤

- 酶促TTI标籤

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药和医疗保健

- 化学品

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- American Thermal Instruments

- Avery Dennison

- Berlinger

- CCL Industries

- Delta Trak

- Freshliance Electronics

- Insignia Technologies

- Neogen

- NiGK

- Omega Engineering

- Sensitech

- SpotSee

- Timestrip

- Zebra Technologies

The Global Time Temperature Indicator Labels Market was valued at USD 859 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 1.49 billion by 2034, fueled by surging demand for ready-to-eat meals, convenience foods, and expanding pharmaceutical and healthcare applications. As global supply chains become more sophisticated and regulatory standards tighten, the need for reliable temperature monitoring solutions is becoming more critical than ever. Companies across the food, beverage, and pharmaceutical industries are increasingly integrating TTIs into their logistics and distribution systems to guarantee product safety, minimize waste, and maintain brand integrity. The rise of direct-to-consumer channels, including meal kit deliveries and online grocery platforms, is further pushing the adoption of TTIs. Meanwhile, sustainability trends are reshaping the market, with manufacturers innovating eco-friendly, smart, and data-driven solutions to meet environmental standards and consumer expectations. As more consumers prioritize food safety and quality assurance, TTIs are rapidly evolving from optional tools to essential components across supply chains, creating significant opportunities for market players over the next decade.

Despite the strong growth outlook, certain challenges are weighing on the market landscape. Tariffs imposed during the Trump administration continue to present hurdles, particularly through higher import duties on raw materials like specialty chemicals, adhesives, and electronic components essential for TTI manufacturing. These tariffs are pressuring manufacturers' profit margins unless the increased costs can be absorbed or passed on to consumers. On the global stage, retaliatory tariffs from key trading partners are making it harder for U.S.-based TTI suppliers to compete internationally, especially as demand intensifies under stricter perishable goods regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $859 Million |

| Forecast Value | $1.49 Billion |

| CAGR | 5.8% |

The Time Temperature Indicator Labels Market is categorized by label types, including critical time-temperature indicators (CTTI), time temperature indicators, and others. The time temperature indicator segment alone generated USD 280.4 million in 2024, driven largely by heightened adoption in the food and beverage sector. Monitoring the freshness and safety of dairy, meat, seafood, and ready-to-eat meals has never been more important. The pharmaceutical sector is also fueling growth as biologics, specialty drugs, and vaccines demand precise storage and transportation monitoring. The explosion of direct-to-consumer models and last-mile delivery services is amplifying the need for TTIs that ensure real-time freshness tracking.

The food and beverage segment accounted for USD 334.7 million in 2024, powered by growing concerns over foodborne illnesses, contamination, and spoilage. Rising urbanization and the busy lifestyles of modern consumers are significantly boosting convenience food consumption, leading to widespread TTI integration across supply chains.

Germany Time Temperature Indicator Labels Market generated USD 48.5 million in 2024, led by increased pharmaceutical exports and tighter EU regulations. Demand for TTIs is surging with the development of cold chain logistics and sustainability-focused innovations in temperature control technologies.

Key players in the Time Temperature Indicator Labels Market are American Thermal Instruments, Avery Dennison, Berlinger, CCL Industries, Delta Trak, Freshliance Electronics, Insignia Technologies, Neogen, NiGK, Omega Engineering, Sensitech, SpotSee, Timestrip, and Zebra Technologies. Companies are advancing smart, real-time tracking solutions and expanding into emerging markets to capture the rising demand for food safety and pharmaceutical logistics innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for fresh & perishable goods

- 3.3.1.2 Expansion of cold chain logistics

- 3.3.1.3 Growth in e-commerce & online grocery delivery

- 3.3.1.4 Increasing adoption in pharmaceuticals & healthcare

- 3.3.1.5 Growth of ready-to-eat & convenience foods

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of advanced TTL technologies

- 3.3.2.2 Inconsistent temperature sensitivity & reliability

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Label Information, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Critical Time Temperature Indicators (CTTI)

- 5.3 Critical temperature indicator

- 5.4 Time temperature indicator

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Electronic TTI labels

- 6.3 Chemical-Based TTI labels

- 6.4 Enzymatic TTI labels

Chapter 7 Market Estimates and Forecast, By End-use Industry, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals & healthcare

- 7.4 Chemicals

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 American Thermal Instruments

- 9.2 Avery Dennison

- 9.3 Berlinger

- 9.4 CCL Industries

- 9.5 Delta Trak

- 9.6 Freshliance Electronics

- 9.7 Insignia Technologies

- 9.8 Neogen

- 9.9 NiGK

- 9.10 Omega Engineering

- 9.11 Sensitech

- 9.12 SpotSee

- 9.13 Timestrip

- 9.14 Zebra Technologies