|

市场调查报告书

商品编码

1740781

备用商用燃气发电机组市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Standby Commercial Gas Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

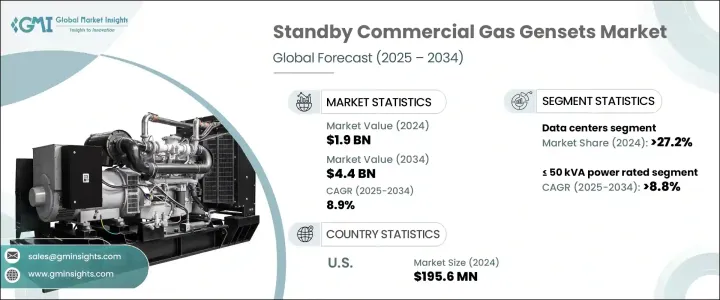

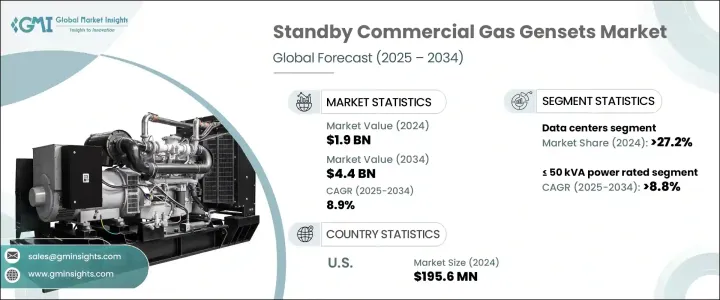

2024 年全球备用商用瓦斯发电机组市场规模达 19 亿美元,预计到 2034 年将以 8.9% 的复合年增长率成长至 44 亿美元。医疗保健、零售和製造业等关键商业领域对能源可靠性的日益关注,推动了对备用发电机组解决方案的需求。这些系统因其在电网故障、停电或紧急情况下提供稳定备用电源的能力而持续获得强劲发展。随着全球企业意识到公用事业基础设施老化、极端天气事件和日益增长的数位依赖性导致电力中断的风险不断上升,备用发电机组的作用变得更加关键。向永续营运的转变、对节能係统的投资激增以及环保意识的增强,正在推动人们从传统柴油发电机组向燃气发电机组过渡。备用商用瓦斯发电机组不再被视为可有可无的可选项,而是现代弹性规划中必不可少的组成部分。它们运作成本更低、更符合日益严格的排放标准,并且能够更快地与智慧能源系统集成,使其成为各行业面向未来基础设施的首选。此外,市场也见证了物联网监控、混合系统相容性和预测性维护等技术创新,进一步强化了燃气发电机组在关键应用中的价值主张。

商业建筑、资料中心和零售空间的成长正在重塑电力备用需求,企业越来越重视不间断营运。频繁的电网不稳定、过时的电力框架以及天气相关的停电,正在推动各行各业更广泛地采用燃气发电机组。监管机构对清洁燃烧技术的重视以及政府对低排放系统的激励措施,使得燃气发电机组比传统柴油系统更具吸引力。企业青睐燃气发电机组不仅是因为其营运效率高,还因为其维护需求低、生命週期价值更高,并且能够满足下一代能源标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 44亿美元 |

| 复合年增长率 | 8.9% |

预计到2034年,额定功率大于125 kVA至200 kVA的发电机组市场将创造7亿美元的市场价值。此类别在电信基础设施领域依然需求旺盛,尤其是在专注于灾难復原准备的行动讯号塔和商业中心。人们对永续营运和灾难准备的认识不断提高,推动了对中等容量发电机组的投资,这些发电机组在成本、灵活性和性能之间实现了最佳平衡。

2024年,服务资料中心的备用商用发电机组占了27.2%的市场。随着数位经济的扩张,尤其是边缘运算和超大规模云端模型的采用,发电机组对于确保资料连续性至关重要。智慧诊断、自动化控制器和先进负载管理系统的集成,使得备用发电机组对于追求近乎零停机时间的运营商不可或缺。

2024年,美国备用商用瓦斯发电机组市场规模达1.956亿美元。更严格的排放法规、日益增长的可持续发展承诺以及日益增强的极端天气影响,正在推动医疗保健、金融和零售业对燃气发电机组的需求。企业正在转向低排放解决方案,以缩短启动时间、减少维护需求,并与混合能源系统无缝整合。

全球备用商用燃气发电机组市场的主要参与者包括瓦锡兰、卡特彼勒、阿特拉斯·科普柯、ASHOK LEYLAND、JC Bamford Excavators、库珀、Kirloskar、MAHINDRA POWEROL、劳斯莱斯、康明斯、西门子能源、Aggreko、Gene远 Power System、GENehl PowerRonY各公司正专注于创新、混合燃料准备、本地製造扩张、战略原始设备製造OEM联盟以及物联网解决方案,以增强市场影响力并满足不断变化的客户需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 - 2034 年

- 主要趋势

- ≤50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200 千伏安 - 330 千伏安

- > 330 千伏安 - 750 千伏安

- > 750千伏安

第六章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 电信

- 卫生保健

- 资料中心

- 教育机构

- 政府中心

- 饭店业

- 零售额

- 房地产

- 商业综合体

- 基础设施

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- Aggreko

- ASHOK LEYLAND

- Atlas Copco

- Caterpillar

- Cooper

- Cummins

- Generac Power System

- Genesal Energy

- Green Power International

- JC Bamford Excavators

- Kirloskar

- MAHINDRA POWEROL

- Mitsubishi Heavy Industries

- Rehlko

- Rolls Royce

- Siemens Energy

- Sudhir Power

- Wartsilä

The Global Standby Commercial Gas Gensets Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 4.4 billion by 2034. Increasing focus on energy reliability across critical commercial sectors like healthcare, retail, and manufacturing is driving the demand for standby genset solutions. These systems continue to gain strong traction for their ability to deliver consistent backup power during grid failures, blackouts, or emergencies. As businesses worldwide recognize the rising risks of power disruptions due to aging utility infrastructure, extreme weather events, and growing digital dependency, the role of standby gensets becomes even more critical. Shifts toward sustainable operations, surging investments in energy-efficient systems, and rising environmental consciousness are fueling the transition toward gas-based gensets over conventional diesel options. Standby commercial gas gensets are no longer seen as optional but essential components in modern resilience planning. Their lower operational costs, better compliance with tightening emission norms, and quicker integration with smart energy systems have made them a preferred choice for future-ready infrastructure across industries. The market is also witnessing technological innovations like IoT-based monitoring, hybrid system compatibility, and predictive maintenance capabilities, further strengthening the value proposition of gas gensets in critical applications.

The growth of commercial buildings, data centers, and retail spaces is reshaping power backup needs, with businesses increasingly prioritizing uninterrupted operations. Frequent grid instability, outdated power frameworks, and weather-related outages are pushing broader adoption across sectors. Regulatory emphasis on cleaner combustion technologies and government incentives for lower-emission systems are making gas gensets an attractive solution compared to traditional diesel systems. Businesses are favoring gas gensets not only for operational efficiency but also for their lower maintenance needs, improved lifecycle value, and readiness to meet next-generation energy standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 8.9% |

The >125 kVA to 200 kVA power rating segment is expected to generate USD 700 million by 2034. This category remains in demand across telecom infrastructure, particularly for mobile towers and commercial hubs focused on disaster recovery preparedness. Rising awareness around sustainable operations and disaster readiness is boosting investments in medium-capacity gensets, which offer an optimal balance between cost, flexibility, and performance.

Standby commercial gensets serving data centers accounted for a 27.2% market share in 2024. As the digital economy expands, especially with the adoption of edge computing and hyper-scale cloud models, gensets are becoming vital for ensuring data continuity. Integration of smart diagnostics, automation-ready controllers, and advanced load management systems is making standby gensets indispensable for operators aiming for near-zero downtime.

The U.S. Standby Commercial Gas Gensets Market generated USD 195.6 million in 2024. Stricter emissions regulations, growing sustainability commitments, and increased vulnerability to extreme weather are pushing demand for gas gensets across healthcare, finance, and retail sectors. Businesses are turning to low-emission solutions that deliver faster start times, reduced maintenance needs, and seamless integration with hybrid energy systems.

Key market players in the Global Standby Commercial Gas Gensets Market include Wartsila, Caterpillar, Atlas Copco, ASHOK LEYLAND, JC Bamford Excavators, Cooper, Kirloskar, MAHINDRA POWEROL, Rolls Royce, Cummins, Siemens Energy, Aggreko, Generac Power System, GENSEAL ENERGY, Green Power International, Mitsubishi Heavy Industries, Rehlko, and Sudhir Power. Companies are focusing on innovation, hybrid fuel readiness, local manufacturing expansion, strategic OEM alliances, and IoT-enabled solutions to strengthen market presence and meet evolving customer demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Healthcare

- 6.4 Data centers

- 6.5 Educational institutions

- 6.6 Government centers

- 6.7 Hospitality

- 6.8 Retail sales

- 6.9 Real estate

- 6.10 Commercial complex

- 6.11 Infrastructure

- 6.12 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 ASHOK LEYLAND

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cooper

- 8.6 Cummins

- 8.7 Generac Power System

- 8.8 Genesal Energy

- 8.9 Green Power International

- 8.10 JC Bamford Excavators

- 8.11 Kirloskar

- 8.12 MAHINDRA POWEROL

- 8.13 Mitsubishi Heavy Industries

- 8.14 Rehlko

- 8.15 Rolls Royce

- 8.16 Siemens Energy

- 8.17 Sudhir Power

- 8.18 Wartsilä