|

市场调查报告书

商品编码

1740785

水溶性豆荚及胶囊包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Water-Soluble Pods and Capsules Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

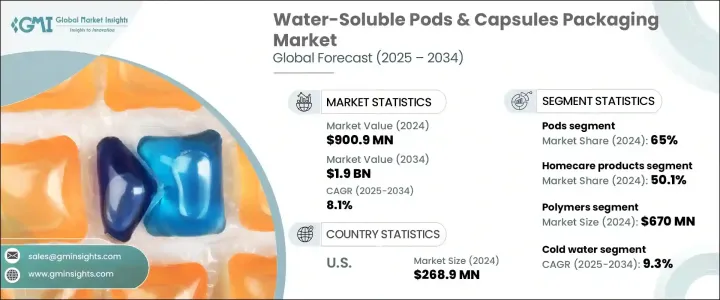

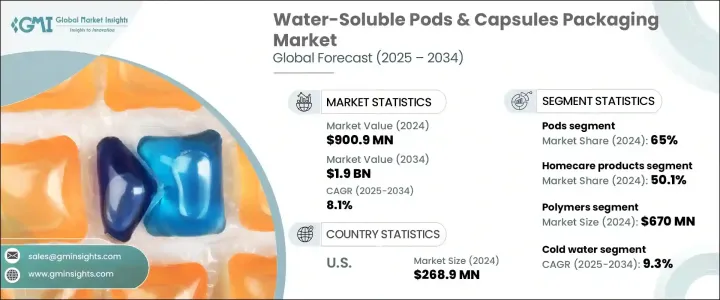

2024年,全球水溶性胶囊和豆荚包装市场价值达9.009亿美元,预计2034年将以8.1%的复合年增长率成长,达到19亿美元。这得益于一次性定量消费品的日益普及以及改进型水溶性薄膜技术的不断发展。对便利、环保和高效包装形式的需求正在塑造该市场的未来。从居家照护到医药,各行各业的消费者都在积极寻求能够消除塑胶垃圾、减少产品过度使用并提升使用者体验的解决方案。这种偏好的转变正推动品牌和製造商采用先进的包装解决方案来重新构想产品交付,这些解决方案不仅简化了使用,还有助于环境保护。此外,城市生活的兴起、卫生意识的增强以及对永续替代品的日益接受,正在推动水溶性胶囊和豆荚的快速普及。随着消费者越来越青睐更智慧、更干净、更安全的日用产品,市场对紧凑型可溶包装的需求激增,这种包装兼具永续性、高性能和便利性。从洗衣液到农业製剂,这种包装形式正日益受到青睐,成为那些致力于兼顾功能与责任的品牌的首选解决方案。

技术进步,尤其是水溶性薄膜成分的进步,是推动这一成长的关键力量。聚合物科学领域的创新,尤其是聚乙烯醇 (PVA) 领域的创新,正在彻底改变水溶性包装在不同产品类别中的表现。这些尖端薄膜如今拥有卓越的溶解性、更高的拉伸强度和更强的防潮性能。这意味着,无论您包装的是粉末还是液体,都能延长保质期、更安全的产品处理和更可靠的性能。这些改进使其能够广泛应用于农业化学品、药品和化妆品等领域。多功能性已成为此类包装的显着特征,吸引了各行各业的製造商。然而,市场也并非一帆风顺。贸易法规带来了许多复杂性,最显着的是美国对中国进口的聚合物和特种化学品等重要原料征收关税。这些关税扰乱了供应链,推高了生产成本,促使企业重新思考采购策略,并探索区域替代方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.009亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 8.1% |

从产品细分来看,水溶性洗衣凝珠在2024年占了65%的市占率。它们的受欢迎程度很大程度上得益于其在家庭应用中的强大功能,尤其是在洗衣和洗碗方面。凝珠提供精准的用量,避免了传统包装带来的混乱和猜测。其用户友好的设计和完全溶解的特性,为现代家庭带来了更多便利。随着人们追求更清洁、更永续的生活方式,这些凝珠正迅速成为家庭必需品。它们结构紧凑,能够完全溶解且无残留,不仅减少了浪费,也迎合了当今快节奏的消费习惯,便利性是其关键所在。

在应用方面,2024年家庭护理产品占了50.1%的市场。这主要是因为消费者在日常清洁中越来越注重便利性和永续性。水溶性包装有助于品牌兼顾这两点。它能够创造出高效率、减少浪费的解决方案,同时又不牺牲清洁力。随着城市扩张,城市消费者寻求更快、更环保的居家清洁方式,对此类产品的需求也日益增长。为此,各公司纷纷增加研发投入,打造更智慧的胶囊,采用可生物降解的薄膜、更安全的配方和更强大的输送系统。这项持续的创新使消费者比以往任何时候都更容易养成永续的清洁习惯,同时又不影响产品的有效性。

2024年,美国水溶性豆荚和胶囊包装市场规模达2.689亿美元,这得益于先进的製造基础设施和消费者对永续生活的高度认知。美国消费者对兼具性能和环境安全性的包装提出了更高的要求。家庭护理和製药行业引领着这一潮流,这得益于人们对零浪费和卫生解决方案日益增长的兴趣。随着塑胶垃圾持续成为主要关注点,水溶性包装因其能够提供符合消费者价值的清洁环保替代品而备受关注。

三菱化学集团株式会社、Aicello Corporation、积水化学工业株式会社和ConstantiaFlexibles等公司正积极塑造竞争格局。他们专注于与家庭护理和製药领域的製造商建立合作伙伴关係,丰富产品组合以满足新的需求,并改进聚合物技术以提高性能。许多公司也加大对永续材料的投资,并拓展新兴市场,以增强其全球影响力并赢得消费者信任。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 主要原物料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 衝击力

- 成长动力

- 一次性、预装消费品的成长

- 可溶性薄膜材料的技术进步

- 跨产业应用多样化

- 对永续和环保包装的需求不断增长

- 严格的环境和包装法规

- 产业陷阱与挑战

- 水溶性薄膜成本高

- 阻隔性能有限且保存期限受限

- 成长动力

- 成长潜力分析

- 科技与创新格局

- 专利分析

- 重要新闻和倡议

- 未来市场趋势

- 波特的分析

- PESTEL分析

- 监管格局

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 豆荚

- 胶囊

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 聚合物

- 界面活性剂

- 纤维

第七章:市场估计与预测:依溶解度类型,2021 - 2034

- 主要趋势

- 冷水

- 热水

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 居家护理产品

- 个人护理和化妆品

- 农业化学品

- 食品和饮料

- 製药

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Aicello Corporation

- Arrow GreenTech Ltd.

- Constantia Flexibles

- Foshan Polyva Materials Co., Ltd

- Guangdong Proudly New Material Technology Corp.

- Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- Mattpak Inc.

- Medanos Claros HK Limited

- Mitsubishi Chemical Group Corporation

- NOBLE INDUSTRIES

- Sekisui Chemical Co., Ltd.

- Solupak

The Global Water-Soluble Pods and Capsules Packaging Market was valued at USD 900.9 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 1.9 billion by 2034, driven by the growing popularity of single-use, pre-measured consumer goods and the development of improved soluble film technologies. The demand for convenient, eco-conscious, and efficient packaging formats is shaping the future of this market. Consumers across sectors-from homecare to pharmaceuticals-are actively seeking out solutions that eliminate plastic waste, reduce product overuse, and enhance user experience. This shift in preference is pushing brands and manufacturers to reimagine product delivery with advanced packaging solutions that not only simplify usage but also contribute to environmental preservation. What's more, the rise of urban living, growing hygiene awareness, and increased acceptance of sustainable alternatives are driving rapid adoption of water-soluble pods and capsules. As consumers gravitate toward smarter, cleaner, and safer daily-use products, the market is witnessing a surge in demand for compact, dissolvable packaging that ticks all the boxes for sustainability, performance, and convenience. From laundry detergents to agricultural formulations, this packaging format is gaining traction as the go-to solution for brands aiming to combine function with responsibility.

Technological advances, especially in water-soluble film composition, are a key force behind this growth. Innovations in polymer science-particularly around polyvinyl alcohol (PVA)-are transforming how water-soluble packaging performs across diverse product categories. These cutting-edge films now offer superior solubility, improved tensile strength, and enhanced moisture barrier properties. That means better shelf life, safer product handling, and more reliable performance, whether you're packaging powders or liquids. These improvements have made it possible to scale usage across segments like agrochemicals, pharmaceuticals, and cosmetics. Versatility has become a defining trait of this packaging type, attracting manufacturers from a broad range of industries. However, the market isn't without challenges. Trade regulations have introduced complexities-most notably, US-imposed tariffs on Chinese imports of essential raw materials like polymers and specialty chemicals. These tariffs have disrupted supply chains and pushed up production costs, prompting companies to rethink sourcing strategies and explore regional alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $900.9 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 8.1% |

In terms of product segmentation, water-soluble pods commanded a 65% market share in 2024. Their popularity is driven largely by their high functionality in household applications, especially laundry and dishwashing. Pods offer precise dosing, eliminating the mess and guesswork of traditional packaging. Their user-friendly design and complete solubility add a layer of convenience that modern households value. With the push for cleaner, more sustainable lifestyles, these pods are quickly becoming a household staple. Their compact nature and ability to dissolve completely without residue not only reduce waste but also cater to today's fast-paced consumer behavior where ease of use is key.

On the application side, homecare products held a 50.1% market share in 2024. That's largely because consumers are increasingly focused on convenience and sustainability in their everyday cleaning routines. Water-soluble packaging helps brands deliver on both counts. It allows for the creation of efficient, waste-reducing solutions that don't sacrifice cleaning power. As cities expand and urban consumers look for quicker, greener ways to maintain their homes, the demand for such products is only rising. Companies are responding by investing heavily in RandD to create smarter pods with biodegradable films, safer formulations, and enhanced delivery systems. This ongoing innovation is making it easier than ever for consumers to adopt sustainable habits without compromising on product effectiveness.

The United States Water-Soluble Pods and Capsules Packaging Market generated USD 268.9 million in 2024, driven by advanced manufacturing infrastructure and high awareness around sustainable living. American consumers are demanding packaging that delivers both performance and environmental safety. The home care and pharmaceutical sectors are leading the charge, fueled by a rising interest in zero-waste and hygienic solutions. As plastic waste continues to be a major concern, water-soluble packaging is gaining attention for its ability to provide a clean, eco-friendly alternative that aligns with consumer values.

Companies like Mitsubishi Chemical Group Corporation, Aicello Corporation, SEKISUI CHEMICAL CO., LTD., and Constantia Flexibles are actively shaping the competitive landscape. They are focusing on forging partnerships with manufacturers in home care and pharma, diversifying product portfolios to meet new demands, and refining polymer technologies for higher performance. Many of these players are also ramping up investments in sustainable materials and expanding into emerging markets to strengthen their global footprint and build consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key raw material

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of single-use, pre-dosed consumer products

- 3.3.1.2 Technological advancements in soluble film materials

- 3.3.1.3 Application diversification across industries

- 3.3.1.4 Rising demand for sustainable and eco-friendly packaging

- 3.3.1.5 Stringent environmental and packaging regulations

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High cost of water-soluble films

- 3.3.2.2 Limited barrier properties and shelf-life constraints

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Pods

- 5.3 Capsules

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Polymers

- 6.3 Surfactants

- 6.4 Fibers

Chapter 7 Market Estimates & Forecast, By Solubility Type, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Cold water

- 7.3 Hot water

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Homecare products

- 8.3 Personal care & cosmetics

- 8.4 Agrochemicals

- 8.5 Food & beverage

- 8.6 Pharmaceuticals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aicello Corporation

- 10.2 Arrow GreenTech Ltd.

- 10.3 Constantia Flexibles

- 10.4 Foshan Polyva Materials Co., Ltd

- 10.5 Guangdong Proudly New Material Technology Corp.

- 10.6 Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- 10.7 Mattpak Inc.

- 10.8 Medanos Claros HK Limited

- 10.9 Mitsubishi Chemical Group Corporation

- 10.10 NOBLE INDUSTRIES

- 10.11 Sekisui Chemical Co., Ltd.

- 10.12 Solupak