|

市场调查报告书

商品编码

1740786

兽医骨科医学市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Orthopedic Medicine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

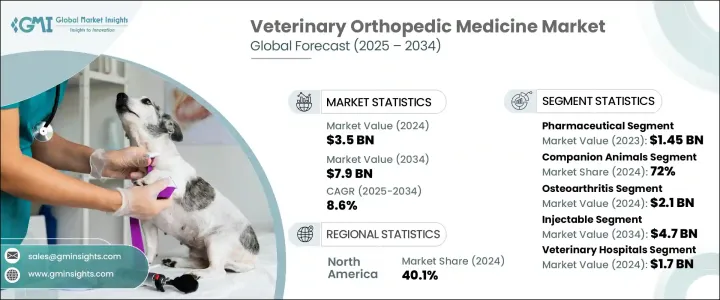

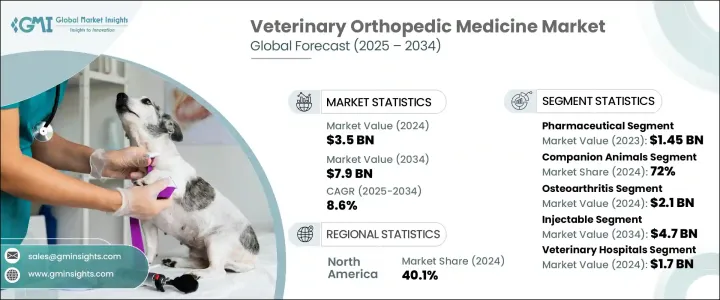

2024年,全球兽医骨科医学市场规模达35亿美元,预计2034年将以8.6%的复合年增长率成长至79亿美元。这一增长主要源于伴侣动物和家畜骨科疾病盛行率的上升,以及生物製剂和再生疗法的快速创新。随着全球宠物拥有量的增加以及家畜医疗保健日益受到重视,对有效骨科解决方案的需求持续激增。兽医诊断、预防保健和疼痛管理解决方案的进步,促使宠物主人寻求早期干预,从而改善动物护理的长期效果。现代宠物主人越来越重视宠物的整体健康,并认识到随着宠物年龄增长,活动能力和生活品质的重要性。兽医专科医生就诊便利性的提高、动物医疗保健保险渗透率的提高以及宠物人性化护理的蓬勃发展,为兽医骨科解决方案创造了新的机会。此外,对微创手术和尖端再生疗法的高度关注正在为治疗方案树立新的标准。随着技术融合的深入,动物骨科医学正在快速发展,为临床医生、研究人员和製药公司创造了一个充满活力的前景。

微创治疗方法正在迅速改变兽医骨科护理格局。黏液补充疗法、富血小板血浆 (PRP) 疗法以及基于干细胞的再生医学等技术因其併发症风险较低且术后恢復较快而广泛应用。这些疗法对于慢性骨科疾病的治疗尤其重要,无需进行大规模手术即可持续缓解症状。同时,药物解决方案在日常兽医护理中继续发挥至关重要的作用。非类固醇抗发炎药物 (NSAID)、皮质类固醇注射以及新兴的改善病情的骨关节炎药物 (DMOAD) 有助于控制疼痛、减轻发炎并改善患有肌肉骨骼疾病的动物的整体关节功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 79亿美元 |

| 复合年增长率 | 8.6% |

2023年,製药业产值达到14.5亿美元,凸显了其在骨科护理中的关键角色。科技正在进一步重塑市场,人工智慧赋能的活动能力评估工具、穿戴式监视器以及先进的影像平台,能够加快诊断速度并制定更个人化的治疗方案。宠物主人对骨科问题的认识日益提高,加上復健治疗的可近性不断提升,激发了人们对专科骨科干预的兴趣。生物製剂、新型药物和精准疗法的发展将继续重新定义治疗标准,并推动未来十年市场扩张。

2024年,伴侣动物市场占据了72%的主导地位,这反映出越来越多的宠物被诊断出患有关节炎和韧带损伤等关节疾病。随着兽医医疗保健的进步和宠物寿命的延长,与年龄相关的退化性疾病也变得越来越普遍。水疗和物理治疗等復健选择越来越多,而且通常包含在宠物保险中,这使得高级骨科护理更加便捷。

美国兽医骨科药物市场在 2024 年占据 40.1% 的份额,预计到 2034 年将以 8.5% 的复合年增长率稳步增长。该国的领先地位源于广泛的宠物拥有量、对动物健康的高度关注以及宠物主人对早期诊断和专门骨科治疗的认识不断提高。

为了加强在模组化变电站领域的布局,各公司正在采用智慧电网技术,并投资于数位基础设施整合。与电力公司和基础设施开发商的策略合作有助于确保大规模部署。各公司专注于模组化设计创新,以减少设置时间和成本,同时提高其在城市和农村应用中的适应性。更重视紧凑型气体绝缘装置,以增强其在空间受限环境中的性能。此外,主要参与者优先考虑在地化生产,以减轻电价影响并确保供应链的弹性。对远端监控工具和预测性维护平台的投资提高了可靠性和正常运行时间,使模组化变电站在快速电网现代化和再生能源整合方面更具吸引力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 宠物拥有量增加,兽医护理支出增加

- 人们对动物福利和骨科疾病的认识不断提高

- 动物再生医学和疼痛管理的进展

- 产业陷阱与挑战

- 兽医骨科治疗费用高昂

- 新疗法和新药的监管障碍

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 生物製剂

- 干细胞

- 富血小板血浆(PRP)

- 其他生物製剂

- 黏液补充剂

- 製药

- 类固醇

- 非类固醇抗发炎药

- 其他药品

第六章:市场估计与预测:依动物类型,2021 - 2034 年

- 主要趋势

- 伴侣动物

- 牲畜

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 骨关节炎

- 退化性关节病变

- 其他应用

第八章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 注射剂

- 外用

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医院

- 兽医诊所

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Ardent Animal Health

- Bimeda

- Bioiberica

- Boehringer Ingelheim

- Ceva Sante Animale

- Contipro

- Contura Vet US

- Elanco Animal Health

- Hester Biosciences

- MEDREGO

- Merck

- PetVivo Holdings

- T-Cyte Therapeutics

- Vetoquinol

- VetStem

- Virbac

- Zoetis

The Global Veterinary Orthopedic Medicine Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 7.9 billion by 2034. This growth is driven by the rising prevalence of orthopedic conditions in both companion and livestock animals, coupled with rapid innovations in biologics and regenerative therapies. As pet ownership rises globally and livestock healthcare gains greater attention, the demand for effective orthopedic solutions continues to surge. Advancements in veterinary diagnostics, preventive care, and pain management solutions are pushing owners to seek early intervention, enhancing long-term outcomes in animal care. Modern pet owners are increasingly prioritizing the overall wellness of their animals, recognizing the importance of mobility and quality of life as pets age. Improved accessibility to veterinary specialists, increasing insurance penetration for animal healthcare, and the booming trend of pet humanization are creating new opportunities for veterinary orthopedic solutions. Furthermore, the strong focus on minimally invasive procedures and cutting-edge regenerative therapies is setting a new standard in treatment protocols. As technology integration deepens, orthopedic medicine for animals is rapidly evolving, creating a dynamic landscape for clinicians, researchers, and pharmaceutical companies alike.

Minimally invasive treatment methods are rapidly transforming the veterinary orthopedic care landscape. Techniques such as viscosupplementation, platelet-rich plasma (PRP) therapy, and stem cell-based regenerative medicine are witnessing widespread adoption thanks to their lower risk of complications and faster post-treatment recovery. These therapies are particularly valuable for managing chronic orthopedic conditions, offering sustained relief without the need for extensive surgical intervention. At the same time, pharmaceutical solutions continue to play a crucial role in daily veterinary care. Non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroid injections, and emerging disease-modifying osteoarthritis drugs (DMOADs) help control pain, reduce inflammation, and improve overall joint function in animals suffering from musculoskeletal disorders.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 8.6% |

The pharmaceutical segment generated USD 1.45 billion in 2023, underscoring its pivotal role in orthopedic care. Technology is further reshaping the market, with AI-enabled mobility assessment tools, wearable monitors, and advanced imaging platforms enabling faster diagnosis and more personalized treatment plans. Growing awareness among pet owners about orthopedic issues, coupled with better access to rehabilitation therapies, is fueling interest in specialized orthopedic interventions. Developments in biologics, novel pharmaceuticals, and precision therapies will continue to redefine treatment standards, driving market expansion over the next decade.

In 2024, the companion animals segment held a dominant 72% market share, reflecting the growing number of pets diagnosed with joint conditions like arthritis and ligament injuries. As veterinary healthcare advances and pets live longer, age-related degenerative diseases are becoming more prevalent. Rehabilitation options such as hydrotherapy and physiotherapy are increasingly available and often covered by pet insurance, making advanced orthopedic care more accessible.

The United States veterinary orthopedic medicine market accounted for a 40.1% share in 2024 and is projected to grow steadily at a CAGR of 8.5% through 2034. The country's leadership stems from widespread pet ownership, a heightened focus on animal wellness, and rising awareness about early diagnosis and specialized orthopedic treatments among pet owners.

To strengthen their presence in the modular substation space, companies are adopting smart grid technologies and investing in digital infrastructure integration. Strategic collaborations with power utilities and infrastructure developers are helping secure large-scale deployments. Firms are focusing on modular design innovations that reduce setup time and cost while improving adaptability in both urban and rural applications. Increased emphasis on compact, gas-insulated units enhances performance in space-constrained settings. Additionally, key players prioritize localization of production to mitigate tariff impacts and ensure supply chain resilience. Investments in remote monitoring tools and predictive maintenance platforms boost reliability and operational uptime, making modular substations more appealing for rapid grid modernization and renewable energy integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and increased spending on veterinary care

- 3.2.1.2 Growing awareness of animal welfare and orthopedic disorders

- 3.2.1.3 Advancements in regenerative medicine and pain management for animals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of veterinary orthopedic treatments

- 3.2.2.2 Regulatory hurdles for new therapies and pharmaceuticals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biologics

- 5.2.1 Stem cells

- 5.2.2 Platelet-rich plasma (PRP)

- 5.2.3 Other biologics

- 5.3 Viscosupplements

- 5.4 Pharmaceuticals

- 5.4.1 Steroids

- 5.4.2 NSAIDs

- 5.4.3 Other pharmaceuticals

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.3 Livestock animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Osteoarthritis

- 7.3 Degenerative joint disease

- 7.4 Other applications

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals

- 9.3 Veterinary clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ardent Animal Health

- 11.2 Bimeda

- 11.3 Bioiberica

- 11.4 Boehringer Ingelheim

- 11.5 Ceva Sante Animale

- 11.6 Contipro

- 11.7 Contura Vet US

- 11.8 Elanco Animal Health

- 11.9 Hester Biosciences

- 11.10 MEDREGO

- 11.11 Merck

- 11.12 PetVivo Holdings

- 11.13 T-Cyte Therapeutics

- 11.14 Vetoquinol

- 11.15 VetStem

- 11.16 Virbac

- 11.17 Zoetis