|

市场调查报告书

商品编码

1740792

无线心臟监测系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Wireless Cardiac Monitoring Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

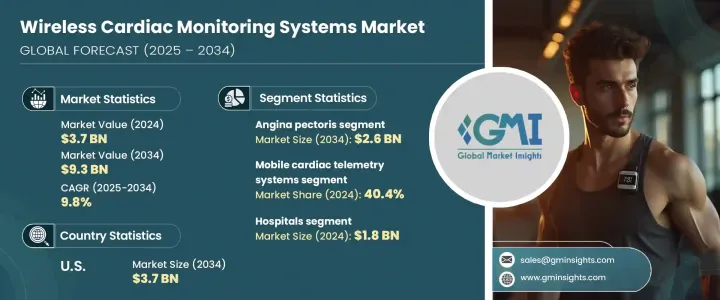

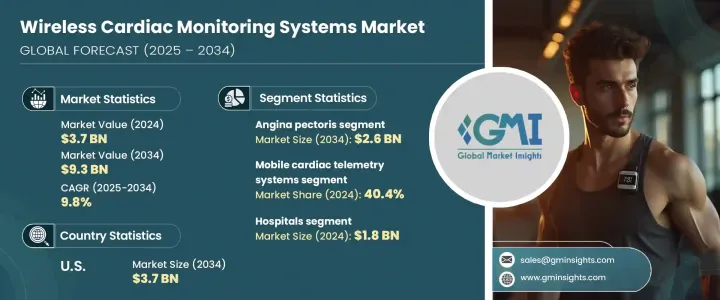

2024年,全球无线心臟监测系统市场规模达37亿美元,预计2034年将以9.8%的复合年增长率成长,达到93亿美元。这主要得益于全球范围内对即时远端心臟护理日益增长的需求以及心血管疾病日益普遍的发病率。无线心臟监测系统正在改变医护人员监测心臟健康的方式,以实现持续追踪和无线资料传输。这些系统透过提供近乎即时的洞察,帮助医生更快、更精准地做出临床反应,在早期识别心房颤动、心臟衰竭和心律不整等心臟相关疾病方面发挥关键作用。随着老龄化人口和慢性病患者对持续监测的需求不断增长,无线心臟监测的吸引力也日益凸显。

技术创新仍然是推动这一市场发展的关键催化剂。新一代设备如今具备即时心电图传输、人工智慧分析以及与云端平台整合等先进功能,使临床医生能够更有效地解读心臟资料并迅速采取行动。这些工具显着提高了诊断的准确性,并改善了患者护理效果,尤其是在门诊或远端环境中。日益向分散式护理和居家监护的转变进一步推动了这个市场的扩张,使这些系统成为现代心臟护理的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 93亿美元 |

| 复合年增长率 | 9.8% |

就产品细分而言,市场分为植入式心臟监视器 (ICM)、行动心臟遥测 (MCT) 系统和其他无线心臟监测产品。截至 2023 年,全球市场价值为 34 亿美元,其中行动心臟遥测系统在 2024 年的营收份额为 40.4%。 MCT 设备能够即时、连续地监测心律,并透过蓝牙或蜂窝连接自主发送警报。此功能可确保立即检测和报告异常心臟活动,从而提供一种主动的方法来诊断传统的短期监测可能忽略的短暂性心律不整。门诊环境中的广泛应用以及对便携式、经济高效的监测解决方案的日益偏好进一步支持了这一细分市场的持续成长。这些优势对于需要长期照护的患者以及专注于降低再入院率和住院费用的医疗保健系统尤其重要。

无线心臟监测系统在心绞痛等疾病的管理中也发挥着至关重要的作用,这类疾病通常需要持续观察,以识别可能引发严重心臟事件的缺血性事件或异常情况。即时监测有助于更好地评估症状模式和诱因,从而实现更个人化、更及时的介入。当症状出现异常或异常时,持续监测可以提供静态测试方法可能遗漏的关键讯息,从而支持风险管理和预防保健策略。

从终端用途来看,市场细分为医院、专科诊所、诊断中心、家庭护理机构等。 2024年,光是医院市场就达到了18亿美元。配备先进心臟科室和专业人员的医院是无线心臟技术的领先采用者,利用这些技术来提高诊断精度并优化患者护理路径。在这些机构中,对支援云端整合和人工智慧驱动资料管理的技术的投资也日益普遍,从而实现了即时分析和更快的医疗决策。此外,医院正在积极采用尖端系统,包括穿戴式心电图感测器和植入式设备,以提供高品质的护理并简化营运。

预计到2034年,美国无线心臟监测系统市场规模将超过37亿美元,这得益于其强大的医疗基础设施和心血管疾病发生率的上升。美国受益于医疗创新的快速普及以及监管机构和投资者的持续支持。国内企业和研究机构也在开发下一代监测解决方案方面发挥关键作用,进一步推动了市场发展。心臟相关健康问题的日益增长以及对先进诊断工具的需求,正在推动临床和家庭环境中无线心臟监测系统的采用率不断提高。

该行业竞争依然激烈,美敦力、雅培实验室、波士顿科学、iRhythm Technologies 和荷兰皇家飞利浦等主要公司合计占据全球约 40% 的市场份额。这些公司持续专注于远端监控、人工智慧辅助诊断和无缝资料传输技术的突破,以在这个快速发展的市场中保持领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病(CVD)盛行率上升

- 无线心臟监测技术的技术进步

- 日益重视预防性医疗保健

- 产业陷阱与挑战

- 农村和欠发达地区的可用性有限

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 植入式心臟监测仪(ICM)

- 移动心臟遥测系统

- 铅基

- 基于补丁

- 其他产品

第六章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 冠状动脉疾病

- 心绞痛

- 动脉粥状硬化

- 心臟衰竭

- 中风

- 其他适应症

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 专科诊所

- 诊断中心

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- AliveCor

- Baxter International

- Biotronik

- Boston Scientific

- InfoBionic

- iRhythm Technologies

- Koninklijke Philips NV

- Medtronic

- Nihon Kohden

- SmartCardia

- Vital Connect

The Global Wireless Cardiac Monitoring Systems Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 9.8% to reach USD 9.3 billion by 2034, driven by the rising demand for real-time, remote cardiac care and the increasing prevalence of cardiovascular diseases worldwide. Wireless cardiac monitoring systems are transforming how healthcare professionals monitor heart health, allowing continuous tracking and wireless data transmission. These systems play a critical role in the early identification of heart-related conditions such as atrial fibrillation, heart failure, and arrhythmias by providing near real-time insights that enable faster and more precise clinical responses. As demand for continuous monitoring rises in aging populations and patients with chronic conditions, the appeal of wireless cardiac monitoring becomes more pronounced.

Technological innovation remains a key catalyst behind this market's momentum. New-generation devices now offer advanced features such as real-time ECG transmission, AI-enabled analytics, and integration with cloud platforms, empowering clinicians to interpret cardiac data more effectively and act promptly. These tools significantly enhance the accuracy of diagnosis and improve patient care outcomes, especially in outpatient or remote settings. The increasing shift toward decentralized care and home-based monitoring further fuels this market expansion, making these systems an essential component of modern cardiac care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 9.8% |

In terms of product segmentation, the market is categorized into implantable cardiac monitors (ICMs), mobile cardiac telemetry (MCT) systems, and other wireless cardiac monitoring products. As of 2023, the global market was valued at USD 3.4 billion, with mobile cardiac telemetry systems accounting for 40.4% of the revenue share in 2024. MCT devices enable real-time, continuous monitoring of cardiac rhythms and autonomously transmit alerts using Bluetooth or cellular connectivity. This functionality ensures immediate detection and reporting of abnormal heart activity, offering a proactive approach to diagnosing transient arrhythmias that traditional short-term monitoring may overlook. The consistent growth of this segment is further supported by broader adoption in outpatient settings and an increasing preference for portable, cost-efficient monitoring solutions. These benefits are particularly significant for patients requiring long-term care and for healthcare systems focused on reducing hospital readmissions and in-patient costs.

Wireless cardiac monitoring systems also play a vital role in managing conditions like angina pectoris, which often require ongoing observation to identify ischemic events or irregularities that can precede serious cardiac episodes. Real-time monitoring facilitates better evaluation of symptom patterns and triggers, allowing for more personalized and timely interventions. When symptoms occur unpredictably or present atypically, continuous monitoring provides critical insights that static testing methods might miss, thereby supporting risk management and preventive care strategies.

From an end-use perspective, the market is segmented into hospitals, specialty clinics, diagnostic centers, homecare settings, and others. In 2024, the hospital segment alone reached USD 1.8 billion. Hospitals equipped with advanced cardiology departments and specialized staff are leading adopters of wireless cardiac technologies, using them to improve diagnostic precision and optimize patient care pathways. Investments in technologies that support cloud integration and AI-driven data management have also become increasingly common in these facilities, enabling real-time analysis and faster medical decisions. Additionally, hospitals are actively adopting cutting-edge systems, including wearable ECG sensors and implantable devices, to deliver high-quality care and streamline operations.

The United States wireless cardiac monitoring systems market is projected to surpass USD 3.7 billion by 2034, driven by robust healthcare infrastructure and rising incidence of cardiovascular disease. The country benefits from the rapid adoption of medical innovations and consistent support from both regulatory bodies and investors. Domestic companies and research institutes are also playing a pivotal role in developing next-generation monitoring solutions, further advancing the market. The rise in heart-related health concerns and demand for advanced diagnostic tools are pushing adoption rates higher across clinical and home settings.

This industry remains highly competitive, with key players like Medtronic, Abbott Laboratories, Boston Scientific, iRhythm Technologies, and Koninklijke Philips N.V. collectively accounting for around 40% of the global market share. These companies continue to focus on breakthroughs in remote monitoring, AI-assisted diagnostics, and seamless data transmission technologies to stay ahead in this fast-evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased prevalence of cardiovascular diseases (CVDs)

- 3.2.1.2 Technological advancements in wireless cardiac monitoring technologies

- 3.2.1.3 Rising emphasis on preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability in rural and underdeveloped areas

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implantable cardiac monitors (ICM)

- 5.3 Mobile cardiac telemetry systems

- 5.3.1 Lead-based

- 5.3.2 Patch-based

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Coronary artery disease

- 6.3 Angina pectoris

- 6.4 Atherosclerosis

- 6.5 Heart failure

- 6.6 Stroke

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Diagnostic centers

- 7.5 Home care settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AliveCor

- 9.3 Baxter International

- 9.4 Biotronik

- 9.5 Boston Scientific

- 9.6 InfoBionic

- 9.7 iRhythm Technologies

- 9.8 Koninklijke Philips N.V.

- 9.9 Medtronic

- 9.10 Nihon Kohden

- 9.11 SmartCardia

- 9.12 Vital Connect