|

市场调查报告书

商品编码

1740812

阀门远端控制系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Valve Remote Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

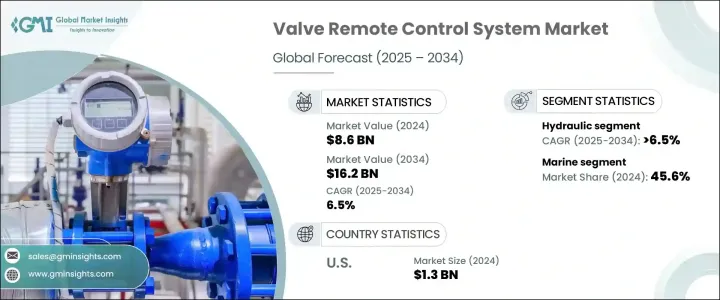

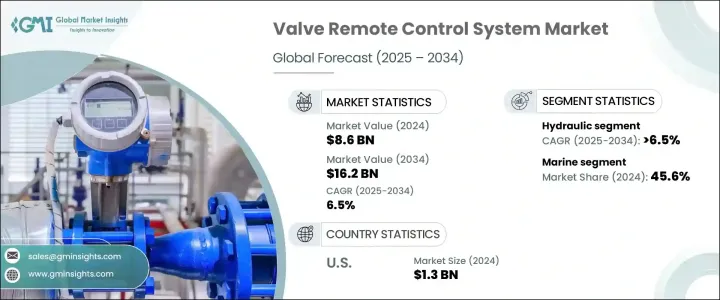

2024年,全球阀门远端控制系统市场规模达86亿美元,预计到2034年将以6.5%的复合年增长率成长,达到162亿美元。这得益于自动化技术的日益普及,以及远端系统在紧急洩漏预防和安全合规方面发挥的关键作用。这些系统在关闭管道流体流动方面发挥着至关重要的作用,可大幅缩短反应时间,并最大限度地降低环境和营运损害的风险。随着各行各业越来越重视营运效率、安全性和法规合规性,对稳健智慧的阀门控制解决方案的需求也持续成长。

随着企业向更智慧的基础设施和数位转型迈进,阀门远端控制系统正变得不可或缺。石油天然气、海事、水处理、化学加工和公用事业等行业正在采用这些系统,以增强即时流体管理并减少对人工干预的依赖。关键营运中对更快、更安全、反应更快的系统的需求,推动了对自动化阀门技术的投资。随着极端天气事件、地缘政治紧张局势和全球能源需求对基础设施的韧性造成进一步压力,远端阀门控制提供了一个极具吸引力的解决方案。在日益数据驱动的世界中,将这些系统与工业物联网平台、SCADA(数据采集与监控系统)和基于人工智慧的预测性维护工具整合的能力不仅仅是一种优势,而正迅速成为一种必需品。企业也优先考虑提供模组化、可扩展性和网路安全连接的解决方案,这标誌着从传统机械操作转向智慧自适应控制架构的转变。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 86亿美元 |

| 预测值 | 162亿美元 |

| 复合年增长率 | 6.5% |

推动这一增长的一个关键因素是紧急关闭阀的普及,它使操作员能够在几秒钟内隔离问题区域,从而降低洩漏和其他灾难性故障的可能性。这项技术优势,加上日益严格的全球安全法规,正在推动高风险产业大规模升级基础设施。危险和偏远环境中的自动化趋势进一步加速了市场发展,因为远端阀门系统允许从安全控制中心进行集中操作。在海运、石化炼油和废水处理等对精度和速度要求极高的行业中,这些系统已被证明是关键资产。

光是气动阀门远端控制系统领域,2024 年就创造了 15 亿美元的市场规模。这类系统尤其适用于电气元件可能有安全风险或必须在不依赖恆定电源的情况下持续运作的产业。气动系统以压缩空气为动力,即使在易爆或腐蚀性环境中也能提供快速可靠的驱动。其机械结构简单、可靠性高且适应性强,使其成为寻求减少停机时间和提高系统安全性的设施的首选解决方案。从石油天然气设施到工业製造工厂和海洋环境,气动系统在高风险环境中都是持久耐用的选择。

在应用领域,海洋领域引领市场,到2024年将占据45.6%的主导份额。船舶、潜水艇和海上平台都需要精确管理燃料、压载水和废水系统,因此集中阀门控制不仅优势显着,而且至关重要。阀门自动化操作能力可显着减少人工干预,支援即时决策,并提高船上安全。随着全球海事营运商不断推进船舶智慧化运营,对阀门远端控制系统的需求持续增长,尤其是在旨在对老旧船队进行现代化改造的项目中。

2024年,美国阀门远端控制系统市场规模达13亿美元,反映出在产业升级和基础设施现代化的推动下,美国各产业对该系统的采用率强劲成长。随着对预测性维护、数位监控和智慧自动化的日益重视,美国各行业正在将这些系统整合到更广泛的营运平台中。从水务公司和能源生产到重工业和航运,各大公司都在利用远端阀门驱动来提高安全性、降低人力成本并确保更快的紧急应变。

包括 Velan、霍尼韦尔国际、HAWE Hydraulik、Rotork、艾默生电气、福斯、维美德、KSB SE、Mowe Marine & Offshore 和 ATHENA ENGINEERING 在内的主要行业参与者正在大力投资先进的自动化技术。他们的策略包括开发模组化和可扩展的系统设计、提高生产能力、确保网路弹性通讯协议的安全,以及收购利基阀门技术供应商,以扩大市场覆盖范围和产品供应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 油压

- 气动

- 电的

- 电动液压

第六章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 球阀

- 截止阀

- 蝶阀

- 闸阀

- 隔膜阀

- 旋塞阀

- 止回阀

- 安全阀

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 海洋

- 发电

- 炼油厂

- 水和废水处理

- 化学

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 马来西亚

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 阿曼

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ATHENA ENGINEERING

- Emerson Electric

- Flowserve

- HAWE Hydraulik

- Honeywell International

- Hoppe Marine

- kdu

- KSB SE

- Mingda Valve

- Mowe Marine & Offshore

- Nantong Navigation Machinery

- Navalimpianti

- Rotork

- Schubert & Salzer Control Systems

- SPX FLOW

- Valmet

- ValvTechnologies

- Velan

- Wartsila

The Global Valve Remote Control System Market was valued at USD 8.6 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 16.2 billion by 2034, driven by the increasing adoption of automation technologies and the critical role of remote systems in emergency leak prevention and safety compliance. These systems play a vital role in shutting down fluid flow in pipelines, drastically reducing response times and minimizing the risk of environmental and operational damage. As industries across the board place growing emphasis on operational efficiency, safety, and regulatory compliance, the demand for robust and intelligent valve control solutions continues to rise.

Valve remote control systems are becoming indispensable as companies push toward smarter infrastructure and digital transformation. Industries such as oil and gas, maritime, water treatment, chemical processing, and utilities are embracing these systems to enhance real-time fluid management and reduce reliance on manual intervention. The need for faster, safer, and more responsive systems in critical operations is propelling investments in automated valve technologies. As extreme weather events, geopolitical tensions, and global energy demand place further pressure on infrastructure resilience, remote valve control offers a compelling solution. In an increasingly data-driven world, the ability to integrate these systems with industrial IoT platforms, SCADA, and AI-based predictive maintenance tools is not just a bonus-it's fast becoming a necessity. Businesses are also prioritizing solutions that offer modularity, scalability, and cyber-secure connectivity, signaling a shift from traditional mechanical operations to smart, adaptive control architectures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.6 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 6.5% |

A key factor fueling this growth is the adoption of emergency shut-off valves that empower operators to isolate problem areas within seconds, reducing the likelihood of leaks and other catastrophic failures. This technological advantage, paired with increasingly stringent global safety regulations, is prompting widespread infrastructure upgrades across high-risk industries. The drive toward automation in hazardous and remote environments has further accelerated market momentum, as remote valve systems allow centralized operation from safe control centers. In sectors like marine shipping, petrochemical refining, and wastewater treatment-where precision and speed are non-negotiable-these systems are proving to be mission-critical assets.

The pneumatic valve remote control systems segment alone generated USD 1.5 billion in 2024. These systems are especially popular in industries where electrical components may pose safety risks or where operations must continue without reliance on constant power sources. Operating on compressed air, pneumatic systems offer fast, dependable actuation even in explosive or corrosive settings. Their mechanical simplicity, reliability, and adaptability make them a go-to solution for facilities looking to reduce downtime and enhance system safety. From oil and gas facilities to industrial manufacturing plants and marine environments, pneumatic systems provide a durable option in high-risk scenarios.

Within the application landscape, the marine sector leads the market, capturing a dominant 45.6% share in 2024. Ships, submarines, and offshore platforms all require precise management of fuel, ballast, and wastewater systems, making centralized valve control not only advantageous but essential. The ability to automate valve operations significantly reduces manual intervention, supports real-time decision-making, and enhances onboard safety. As global maritime operators push for more intelligent vessel operations, the demand for valve remote control systems continues to rise, especially in retrofitting initiatives aimed at modernizing older fleets.

The U.S. Valve Remote Control System Market generated USD 1.3 billion in 2024, reflecting strong nationwide adoption driven by industrial upgrades and infrastructure modernization. With a growing emphasis on predictive maintenance, digital monitoring, and smart automation, U.S. industries are integrating these systems into broader operational platforms. From water utilities and energy production to heavy industry and shipping, companies are leveraging remote valve actuation to improve safety, reduce labor costs, and ensure faster emergency response.

Key industry players-including Velan, Honeywell International, HAWE Hydraulik, Rotork, Emerson Electric, Flowserve, Valmet, KSB SE, Mowe Marine & Offshore, and ATHENA ENGINEERING-are investing heavily in advanced automation technologies. Their strategies include developing modular and scalable system designs, boosting production capacity, securing cyber-resilient communication protocols, and acquiring niche valve technology providers to expand their market reach and product offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hydraulic

- 5.3 Pneumatic

- 5.4 Electric

- 5.5 Electro-hydraulic

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Ball valve

- 6.3 Globe valve

- 6.4 Butterfly valve

- 6.5 Gate valve

- 6.6 Diaphragm valve

- 6.7 Plug valve

- 6.8 Check valve

- 6.9 Safety valve

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Marine

- 7.3 Power generation

- 7.4 Refinery

- 7.5 Water and wastewater treatment

- 7.6 Chemical

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Malaysia

- 8.4.6 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Oman

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ATHENA ENGINEERING

- 9.2 Emerson Electric

- 9.3 Flowserve

- 9.4 HAWE Hydraulik

- 9.5 Honeywell International

- 9.6 Hoppe Marine

- 9.7 kdu

- 9.8 KSB SE

- 9.9 Mingda Valve

- 9.10 Mowe Marine & Offshore

- 9.11 Nantong Navigation Machinery

- 9.12 Navalimpianti

- 9.13 Rotork

- 9.14 Schubert & Salzer Control Systems

- 9.15 SPX FLOW

- 9.16 Valmet

- 9.17 ValvTechnologies

- 9.18 Velan

- 9.19 Wartsila