|

市场调查报告书

商品编码

1740813

有机干酒糟饲料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Organic Dried Distiller's Grain Feed Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

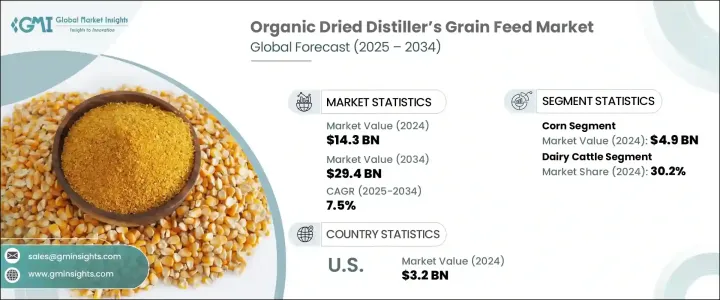

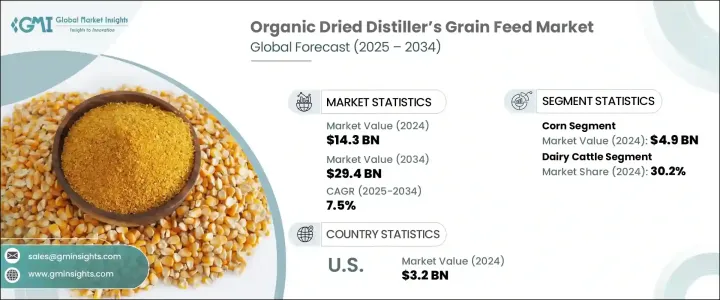

2024年,全球有机干酒糟饲料市场价值143亿美元,预计到2034年将以7.5%的复合年增长率增长,达到294亿美元,这得益于有机畜产品需求的不断增长,以及全行业对可持续、环保的农业实践的推动。随着消费者偏好迅速转向更清洁、更符合道德标准的食品,畜牧业面临越来越大的压力,需要与有机和再生饲料系统接轨。有机干酒糟(DDG)正日益成为关键解决方案,弥合营养需求与有机合规性之间的差距。全球贸易中断也凸显了具有韧性、可追溯性的供应链的重要性,这进一步将有机干酒糟定位为传统饲料的可行替代品。随着有机认证标准的收紧以及人们对动物福利和永续性的认识不断加深,生产商正在迅速采用有机饲料投入,以满足监管要求和消费者信任。在整个畜牧业,从家禽到乳牛和肉牛,有机玉米酒糟粕 (DDG) 如今已成为营养计画中的关键成分,不仅性能可靠,而且符合有机认证标准。这一成长轨迹得益于持续的投资、不断发展的监管框架以及成熟市场和新兴市场的基础设施建设。

过去几年,随着乙醇生产商转向有机谷物投入并寻求生产设施认证,经认证的有机玉米酒糟粕(DDG)供应量大幅增加。这些发展正值市场对永续透明农业供应链的需求达到新高之际。生产商和饲料製造商比以往任何时候都更渴望采用既符合永续发展目标又符合市场需求的有机解决方案。北美凭藉其完善的有机农业生态系统,继续在市场应用方面保持领先地位。然而,随着各国投资有机生产模式并加强其认证和分销基础设施,亚太地区正迅速迎头赶上。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 143亿美元 |

| 预测值 | 294亿美元 |

| 复合年增长率 | 7.5% |

玉米干酒糟仍是主要原料,2024年将创造49亿美元的收入,预计2034年将以7%的复合年增长率成长。玉米的广泛供应、高淀粉含量以及乙醇发酵效率使其成为有机干酒糟(DDG)生产的首选作物。玉米干酒糟富含蛋白质和能量,营养密度高,也使其特别适合有机畜牧系统。对于依赖优质饲料投入以满足严格的有机认证标准的生产商来说,这种一致性至关重要。随着畜牧生产商继续优先考虑营养和合规性,预计玉米干酒糟将在有机饲料领域保持领先。

在动物应用方面,乳牛是最大的消费群。预计2024年乳牛市场价值将达到43亿美元,复合年增长率将达到7.8%,反映了有机干玉米酒糟(DDG)在满足乳牛养殖业饮食需求方面发挥的关键作用。有机乳牛场限制使用合成添加剂和抗生素,越来越依赖有机干玉米酒糟来天然提供蛋白质和纤维。这不仅有助于维持产奶量,还能促进牛群整体健康和活力。随着全球对有机乳製品需求的成长,营养丰富、符合有机标准的饲料对该产业的重要性将日益凸显。

2024年,美国有机干酒糟饲料市场产值达32亿美元,预计复合年增长率为7.3%。这一增长得益于人们对再生农业日益增长的兴趣,以及消费者青睐可持续、来源透明的动物产品。美国饲料製造商正在迅速适应,将有机干酒糟(DDG)纳入营养计划,以支持性能和环境目标。鑑于其在循环农业中的作用——重新利用有机乙醇生产的副产品——有机干酒糟正成为寻求提高生产力和可持续性的美国生产商的诱人选择。

弗林特山资源公司 (Flint Hills Resources)、阿彻丹尼尔斯米德兰公司 (ADM)、绿色平原公司 (Green Plains Inc.)、POET LLC 和瓦莱罗能源公司 (Valero Energy Corporation) 等领先公司正在积极投资扩张和认证。这些关键参与者正在升级设施以满足有机标准,与有机谷物供应商合作,并定制其产品线以满足特定的牲畜营养需求。策略合作伙伴关係以及对可追溯性和透明度的日益重视,继续决定这些公司的市场策略,因为它们在不断发展的有机饲料格局中为长期增长做好了准备。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供给侧影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对有机动物产品的需求不断增加

- 扩大有机畜禽养殖

- 政府支持和有机认证政策

- 强调永续和循环的农业实践

- 产业陷阱与挑战

- 经过认证的有机原料供应有限

- 与传统饲料相比生产加工成本较高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依来源,2021-2034

- 主要趋势

- 玉米

- 小麦

- 米

- 大麦

- 高粱

- 燕麦

- 黑麦

- 粟

- 其他的

第六章:市场估计与预测:依动物类型,2021-2034

- 主要趋势

- 乳牛

- 肉牛

- 猪

- 家禽

- 水蓝色

- 其他动物类型

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 动物饲料

- 生物能源生产

- 肥料和土壤改良剂

- 其他的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Bayer Animal Health

- ADM

- Agrifeeds

- Alcogroup SA

- Chimique India

- COFCO Biochemical (Anhui) Co. Ltd.

- Feedpedia

- Furst-McNess Company

- Greenfield Global Inc.

- Gulshan Polyols Ltd.

- Kemin Industries, Inc.

- Midas Overseas

- Nutrigo Feeds Pvt Ltd

- Poet LLC

- Valero Energy Corporation

The Global Organic Dried Distiller's Grain Feed Market was valued at USD 14.3 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 29.4 billion by 2034, driven by the rising demand for organic livestock products and an industry-wide push toward sustainable, eco-conscious farming practices. With consumer preferences rapidly shifting toward cleaner, ethically sourced food, the livestock sector is under mounting pressure to align with organic and regenerative feed systems. Organic DDGs are increasingly emerging as a key solution, bridging the gap between nutritional needs and organic compliance. Global trade disruptions have also heightened the importance of resilient, traceable supply chains-further positioning organic DDGs as a viable alternative to conventional feed. As organic certification standards tighten and awareness surrounding animal welfare and sustainability deepens, producers are rapidly adopting organic feed inputs to meet both regulatory expectations and consumer trust. Across the livestock industry, from poultry to dairy and beef cattle, organic DDGs are now a crucial ingredient in nutrition programs, offering both performance reliability and alignment with organic certifications. This growth trajectory is supported by continued investments, evolving regulatory frameworks, and infrastructure developments across established and emerging markets.

Over the past few years, the supply of certified organic DDGs has grown considerably, as ethanol producers shift toward organic grain inputs and seek certification for their production facilities. These developments come at a time when the demand for sustainable and transparent agricultural supply chains is reaching new heights. Producers and feed manufacturers are more eager than ever to embrace organic solutions that align with both sustainability goals and market demand. North America continues to lead in market adoption due to its well-established organic agriculture ecosystem. However, the Asia-Pacific region is quickly catching up, as countries invest in organic production models and enhance their certification and distribution infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $29.4 Billion |

| CAGR | 7.5% |

Corn-based dried distiller's grain remains the dominant feedstock, generating USD 4.9 billion in revenue in 2024 and projected to grow at a 7% CAGR through 2034. Corn's widespread availability, high starch content, and efficiency in ethanol fermentation make it a preferred crop for organic DDG production. The nutritional density of corn-derived DDGs, rich in protein and energy, also makes it especially well-suited for organic livestock systems. This consistency is vital for producers who rely on quality feed inputs to meet stringent organic certification standards. As livestock producers continue to prioritize nutrition and compliance, corn-based DDG is expected to retain its leadership in the organic feed segment.

In terms of animal application, dairy cattle represent the largest consumer segment. Valued at USD 4.3 billion in 2024 and forecasted to grow at a CAGR of 7.8%, this segment reflects the critical role that organic DDG plays in supporting the dietary needs of dairy operations. Organic dairy farms, which restrict the use of synthetic additives and antibiotics, increasingly rely on organic DDGs to deliver protein and fiber naturally. This not only helps maintain milk production levels but also supports overall herd health and vitality. As demand for organic dairy products grows globally, the importance of nutrient-rich, organically compliant feed will only become more central to the sector.

The United States Organic Dried Distiller's Grain Feed Market generated USD 3.2 billion in 2024 and is expected to grow at a 7.3% CAGR. This growth is fueled by increased interest in regenerative agriculture and consumer trends favoring sustainable, transparently sourced animal products. US feed manufacturers are adapting swiftly by integrating organic DDGs into nutrition plans that support both performance and environmental goals. Given their role in circular agriculture-repurposing by-products of organic ethanol production-organic DDGs are becoming an attractive choice for American producers looking to boost both productivity and sustainability.

Leading companies such as Flint Hills Resources, Archer Daniels Midland Company (ADM), Green Plains Inc., POET LLC, and Valero Energy Corporation are actively investing in expansion and certification. These key players are upgrading facilities to meet organic standards, collaborating with organic grain suppliers, and tailoring their product lines to cater to specific livestock nutrition requirements. Strategic partnerships and a growing emphasis on traceability and transparency continue to define the market strategies of these firms as they position themselves for long-term growth in the evolving organic feed landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.3 Demand-Side Impact (Selling Price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing consumer demand for organic animal products

- 3.8.1.2 Expansion of organic livestock and poultry farming

- 3.8.1.3 Government support and organic certification policies

- 3.8.1.4 Emphasis on sustainable and circular agricultural practices

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Limited availability of certified organic raw materials

- 3.8.2.2 High production and processing costs compared to conventional feed

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Corn

- 5.3 Wheat

- 5.4 Rice

- 5.5 Barley

- 5.6 Sorghum

- 5.7 Oats

- 5.8 Rye

- 5.9 Millet

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Animal Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dairy cattle

- 6.3 Beef cattle

- 6.4 Swine

- 6.5 Poultry

- 6.6 Aqua

- 6.7 Other animal types

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Animal feed

- 7.3 Bioenergy production

- 7.4 Fertilizers & Soil amendments

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bayer Animal Health

- 10.2 ADM

- 10.3 Agrifeeds

- 10.4 Alcogroup SA

- 10.5 Chimique India

- 10.6 COFCO Biochemical (Anhui) Co. Ltd.

- 10.7 Feedpedia

- 10.8 Furst-McNess Company

- 10.9 Greenfield Global Inc.

- 10.10 Gulshan Polyols Ltd.

- 10.11 Kemin Industries, Inc.

- 10.12 Midas Overseas

- 10.13 Nutrigo Feeds Pvt Ltd

- 10.14 Poet LLC

- 10.15 Valero Energy Corporation