|

市场调查报告书

商品编码

1740818

转向拉桿市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Steering Tie Rod Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

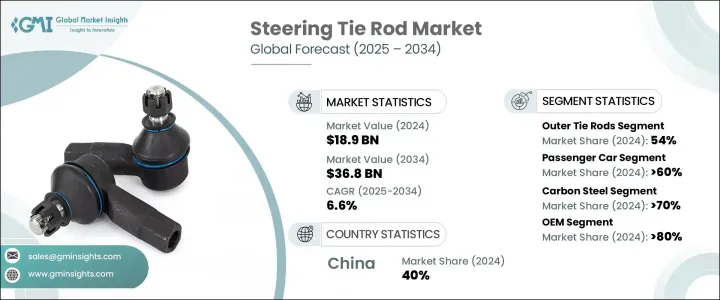

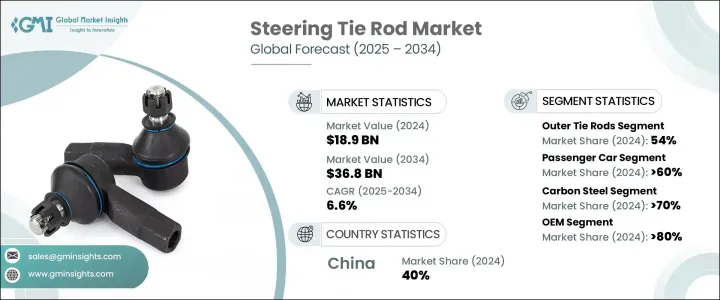

2024年,全球转向拉桿市场规模达189亿美元,预计到2034年将以6.6%的复合年增长率成长,达到368亿美元。这一成长主要得益于汽车产业的快速扩张,尤其是在工业化和城市化快速发展的地区。随着越来越多的人获得更高的可支配收入以及基础设施的改善,汽车需求大幅增加。汽车产量的激增自然转化为对转向拉桿等关键部件的需求增长,这些部件对于保持车辆的正常控制和确保道路安全至关重要。随着人们对车辆性能和使用寿命的期望不断提高,汽车製造商和消费者都要求转向系统先进、耐用,能够适应现代驾驶条件。

随着汽车技术创新不断重塑汽车产业,转向系统也正在经历显着的变化。电动辅助转向、线控转向配置以及感测器整合等现代技术进步正日益普及。这些发展不仅提升了车辆性能,也使汽车更加省油、驾驶更安全。随着汽车变得更加智慧化,对电子设备的依赖程度也越来越高,对转向拉桿等精密工程零件的需求也愈发重要。这些部件现在必须满足更高的精度和可靠性标准,以确保与先进的转向系统实现最佳整合。自动化和电子驾驶辅助系统的转变,也加剧了对能够提供高精度、低机械复杂性和更高操控性的零件的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 189亿美元 |

| 预测值 | 368亿美元 |

| 复合年增长率 | 6.6% |

就产品细分而言,市场分为内拉桿和外拉桿。外拉桿在2024年占据主导地位,约占市场份额的54%,预计在整个预测期内将以7.2%的复合年增长率增长。由于这些零件位于外部,因此更换频率更高,更容易受到环境侵蚀和磨损的影响。由于经常受到道路碎屑、潮湿和恶劣环境的影响,会导致零件更快老化。如果不及时更换,磨损的外拉桿会导致转向反应迟缓和轮胎磨损不均。这自然会增加汽车售后市场的需求,使外拉桿成为关键的收入驱动部分。

按车型细分市场,乘用车在2024年占总销量的60%以上,预计到2034年将继续以约6%的复合年增长率成长。乘用车的使用寿命通常更长,并且随着使用年限的增加而需要持续维护,因此对替换零件的需求持续增长。转向拉桿对车辆安全操控至关重要,通常需要定期检查和更换,尤其是在高里程或崎岖路面驾驶的情况下。全球乘用车数量的成长确保了对OEM和售后市场转向拉桿产品的持续需求,从而巩固了该细分市场在整个市场的领先地位。

从材料角度来看,碳钢在2024年成为製造转向拉桿的首选材料,占了超过70%的市场。碳钢的受欢迎程度源于其高强度和高耐用性的结合,使其能够长期承受持续的压力和道路衝击。与铝或钛等替代材料相比,碳钢还具有成本优势,使製造商能够以具有竞争力的价格提供高性能零件。这种品质与成本效益的平衡使碳钢成为原始设备製造商和售后市场供应商的实用选择,尤其是在汽车零件这样一个对价格敏感的市场。

从销售管道来看,2024年,原始设备製造商(OEM)占据了转向拉桿市场80%以上的份额。 OEM的强劲表现可以归因于车辆组装过程中对原厂零件的需求。 OEM零件的设计旨在精确匹配新车的规格,并提供性能和相容性保证的保固。汽车製造商青睐这些零件,因为它们一致性高、品质保证,并且能够支援车辆的原始工程设计。全球汽车产量的成长显着推动了该领域的需求。

从地理分布来看,中国在2024年占据全球近40%的市场份额,创造了约164亿美元的市场收入,占据了市场主导地位。这一领先地位得益于中国强大的汽车产量和完善的汽车零件供应链。中国拥有强大的製造商和供应商基础,这使得转向拉桿的生产效率更高、分销管道更广。具竞争力的价格加上高品质的标准,使本土生产商能够有效满足国内外市场需求。

全球企业持续投资,拓展产品线,整合先进技术。他们透过建立策略伙伴关係和进行研发活动,提升产品性能和耐用性。这些公司积极拥抱线控转向和电动转向系统等创新技术,确保其产品满足现代汽车市场不断变化的需求。同时,区域製造商则专注于根据本地需求客製化产品,提供与特定车型和驾驶环境相契合的客製化解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 汽车原厂设备製造商

- 供应商

- 材料和锻造公司

- 售后市场经销商和零售商

- 最终用途

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 价格传导至终端市场

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 价格趋势

- 地区

- 产品

- 成本細項分析

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球汽车产量不断成长

- 转向系统的技术进步

- 强调车辆安全和法规合规性

- 电动车和自动驾驶汽车的成长

- 产业陷阱与挑战

- 电动和自动驾驶汽车技术的颠覆

- 原物料价格波动与供应链中断

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 内拉桿

- 外拉桿

第六章:市场估计与预测:依车型,2021-2034

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 碳钢

- 不銹钢

第 8 章:市场估计与预测:按销售管道,2021-2034 年,

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- ACDelco

- APA Industries

- BorgWarner

- Bosch Group

- Crown Automotive Sales

- CTR

- Delphi Technologies

- Dorman Products

- First Line

- HL Mando

- Ingalls Engineering

- JTEKT

- Mando

- Moog

- Motorcraft

- Nexteer Automotive Group Limited

- NSK

- Sankei Industry

- Synergy Manufacturing

- ZF Friedrichshafen

The Global Steering Tie Rod Market was valued at USD 18.9 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 36.8 billion by 2034. This growth is primarily fueled by the rapid expansion of the automotive industry, especially in regions undergoing fast-paced industrialization and urban development. As more people gain access to higher disposable incomes and infrastructure improves, the demand for vehicles rises significantly. The surge in vehicle production naturally translates into higher demand for crucial components like steering tie rods, which are essential for maintaining proper vehicle control and ensuring safety on the road. With growing expectations for vehicle performance and longevity, automakers and consumers alike are demanding advanced, durable steering systems that can withstand modern driving conditions.

The steering system is undergoing a notable transformation as innovations in vehicle technology continue to reshape the automotive sector. Modern advancements such as electric power steering, steer-by-wire configurations, and the incorporation of sensors are becoming more widespread. These developments are not just enhancing vehicle performance-they are also making cars more fuel-efficient and safer to drive. As vehicles become smarter and more reliant on electronics, the demand for precisely engineered parts like steering tie rods becomes even more important. These components must now meet higher standards of accuracy and reliability to ensure optimal integration with advanced steering systems. The shift toward automation and electronic driving assistance has intensified the need for parts that can deliver precision, minimal mechanical complexity, and improved handling.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.9 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 6.6% |

In terms of product segmentation, the market is divided into inner and outer tie rods. Outer tie rods held the dominant position in 2024, accounting for around 54% of the market, and are projected to grow at a CAGR of 7.2% throughout the forecast period. These components face more frequent replacements due to their external position, which makes them more vulnerable to environmental exposure and wear. Being constantly subjected to road debris, moisture, and harsh elements leads to quicker degradation. When not replaced in time, worn-out outer tie rods can contribute to poor steering response and uneven tire wear. This naturally increases demand within the automotive aftermarket, making outer tie rods a crucial revenue-driving segment.

When examining the market by vehicle type, passenger cars represented more than 60% of total sales in 2024 and are expected to continue expanding at a CAGR of approximately 6% through 2034. Passenger vehicles tend to remain in service longer and require ongoing maintenance as they age, leading to consistent demand for replacement parts. Steering tie rods, being critical to safe vehicle handling, often need periodic inspection and substitution, especially in high-mileage or rough-road driving scenarios. The growing number of passenger cars in operation globally ensures a sustained need for both OEM and aftermarket tie rod products, reinforcing this segment's leading position in the overall market.

Material-wise, carbon steel emerged as the preferred choice for manufacturing steering tie rods in 2024, accounting for over 70% of the market share. Its popularity stems from a combination of high strength and durability, allowing it to endure continuous stress and road shocks over time. Carbon steel also offers a cost advantage over alternative materials like aluminum or titanium, enabling manufacturers to deliver high-performance parts at competitive pricing. This balance of quality and cost-effectiveness makes carbon steel a practical option for both OEMs and aftermarket suppliers, especially in a price-sensitive market like automotive components.

From a sales channel perspective, OEMs captured more than 80% of the steering tie rod market in 2024. The strong presence of OEMs can be attributed to the need for original parts during vehicle assembly. OEM components are designed to match the exact specifications of new vehicles and come with warranties that assure performance and compatibility. Automakers prefer these components for their consistency, quality assurance, and the ability to support the vehicle's original engineering design. The growth in global vehicle production has significantly driven demand from this segment.

Geographically, China led the market in 2024 with nearly 40% of the global share, generating around USD 16.4 billion in revenue. This leadership is supported by the country's high volume of vehicle production and a well-established supply chain for automotive components. China benefits from a strong base of manufacturers and suppliers, enabling efficient production and widespread distribution of steering tie rods. Competitive pricing, combined with high-quality standards, has allowed local producers to meet both domestic and international demands effectively.

Global players continue to invest in expanding their product lines and integrating advanced technologies. Strategic partnerships and R&D initiatives are being used to enhance product performance and durability. These companies are embracing innovations like steer-by-wire and electric steering systems, ensuring their offerings align with the evolving demands of the modern automotive market. Meanwhile, regional manufacturers focus on tailoring their products to local requirements, offering customized solutions that resonate with specific vehicle types and driving environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Suppliers

- 3.1.3 Material and forging companies

- 3.1.4 Aftermarket distributors and retailers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Impact of trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Price trend

- 3.4.1 Region

- 3.4.2 Product

- 3.5 Cost breakdown analysis

- 3.6 Profit margin analysis

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising global automotive production

- 3.10.1.2 Technological advancements in steering systems

- 3.10.1.3 Emphasis on vehicle safety and regulatory compliance

- 3.10.1.4 Growth in electric and autonomous vehicles

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Disruption from electric and autonomous vehicle technologies

- 3.10.2.2 Fluctuating raw material prices and supply chain disruptions

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034, ($Bn, Units)

- 5.1 Key trends

- 5.2 Inner tie rods

- 5.3 Outer tie rods

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034, ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicle (LCV)

- 6.3.2 Medium commercial vehicle (MCV)

- 6.3.3 Heavy commercial vehicle (HCV)

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034, ($Bn, Units)

- 7.1 Key trends

- 7.2 Carbon steel

- 7.3 Stainless steel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021-2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ACDelco

- 10.2 APA Industries

- 10.3 BorgWarner

- 10.4 Bosch Group

- 10.5 Crown Automotive Sales

- 10.6 CTR

- 10.7 Delphi Technologies

- 10.8 Dorman Products

- 10.9 First Line

- 10.10 HL Mando

- 10.11 Ingalls Engineering

- 10.12 JTEKT

- 10.13 Mando

- 10.14 Moog

- 10.15 Motorcraft

- 10.16 Nexteer Automotive Group Limited

- 10.17 NSK

- 10.18 Sankei Industry

- 10.19 Synergy Manufacturing

- 10.20 ZF Friedrichshafen