|

市场调查报告书

商品编码

1740819

飞机零件 MRO 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aircraft Component MRO Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

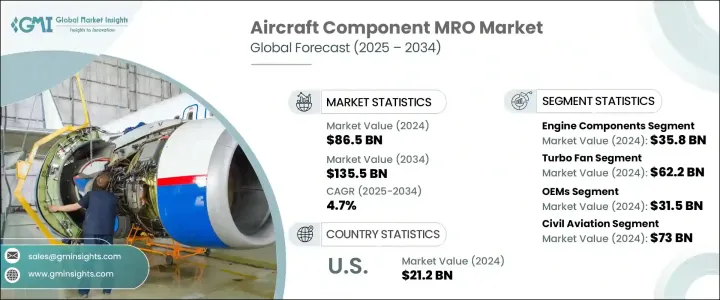

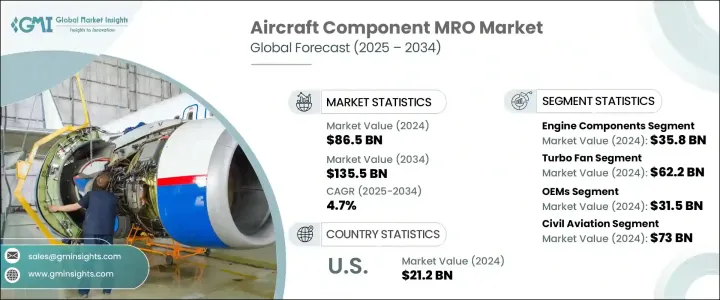

2024年,全球飞机零件MRO市场价值达865亿美元,预计到2034年将以4.7%的复合年增长率成长,达到1355亿美元,这得益于国际航空运输量的激增和全球飞机机队规模的扩大。随着民航业的復苏和旅行需求的飙升,航空公司正在加大对维护、维修和大修服务的投资,以确保营运效率、法规合规性和乘客安全。随着机队日益多样化和技术先进,MRO供应商正在利用尖端诊断工具、预测性维护技术和先进的材料修復技术来应对新的挑战。人们对配备下一代引擎和整合系统的节油飞机的偏好日益增长,这正在重塑市场格局。随着竞争加剧,营运商正在寻求更快的周转时间、更高的技术专长和更具成本效益的解决方案,这促使MRO公司扩展能力、投资数位化并采用更智慧的服务模式以保持领先地位。

航空公司正在大力投资MRO服务,以满足营运安全标准和不断变化的监管要求。飞机系统(尤其是航空电子设备和推进部件)日益复杂,推动MRO流程采用数位化工具、智慧诊断和预测性维护技术。配备下一代引擎和整合电子系统的现代机队对技术专长提出了更高的要求,这进一步刺激了全球对专业MRO服务的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 865亿美元 |

| 预测值 | 1355亿美元 |

| 复合年增长率 | 4.7% |

不断变化的全球贸易政策为MRO业者带来了更多障碍。对关键航空零件征收进口关税导致营运成本上升,尤其对美国供应商而言。这些关税扰乱了现有的供应链,引发了人们对零件供应的严重担忧,迫使航空公司重新考虑采购策略和维护计划。同时,航空公司面临越来越大的压力,需要在确保完全合规的同时提高成本效益,这促使他们更加依赖长期服务协议,并扩大内部零件维修能力。

2024年,引擎零件市场产值达358亿美元,占据飞机零件MRO市场的主导地位。这一领先地位源于引擎零件至关重要且高昂的更换成本,这些零件需要细緻的维护和严格的大修计划。燃烧室、涡轮叶片和燃油喷嘴等零件承受着极端的热应力和机械应力,需要采用先进的修復工艺,包括热障涂层、等离子喷涂和雷射熔覆。数位孪生和人工智慧驱动的诊断等智慧维护技术的整合正在彻底改变传统的MRO工作流程,帮助供应商预测磨损模式,最大限度地减少停机时间,并显着延长零件的使用寿命。

按飞机类型划分,涡轮扇发动机市场在2024年创造了622亿美元的市场规模。涡轮风扇发动机复杂的设计和卓越的推力效率使其成为商用和军用航空领域不可或缺的部件。这些引擎的维护程序通常涉及高精度雷射钻孔和对高压涡轮和风扇叶片等关键模组进行专门的防护涂层。随着航空业追求更安静、更省油的飞机,MRO服务供应商正在扩大其营运规模,以满足采用复合材料和齿轮传动结构的新一代引擎的需求。

在强劲的国内航空业的支撑下,美国飞机零件维护、大修 (MRO) 市场规模在 2024 年达到 212 亿美元。美国拥有全球最大的商用飞机机队之一,并在主要航空枢纽拥有密集的认证维修站和与原始设备製造商(OEM)合作的设施网络。战略现代化建设和美国联邦航空管理局 (FAA) 法规正在推动 MRO 能力的提升,尤其是在引擎和航空电子设备等关键系统方面。数位化记录保存、可持续性合规性和整合维护追踪如今已成为美国 MRO 营运的核心。

飞机零件MRO产业的知名企业包括通用电气公司、AAR、汉莎技术公司、新科工程公司和新航工程公司。这些领先公司正在拓展全球网络,投资数位化维护工具,并增强垂直整合的服务模式。与航空公司和原始设备製造商建立长期合作伙伴关係,专注于永续维修技术,以及提昇技术团队的技能,仍然是增强服务可靠性并顺应航空业发展趋势的关键策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税对飞机零件的影响分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 航空旅行需求不断增加

- 航空当局的监管要求

- 将 MRO 活动外包给第三方供应商

- 低成本航空公司在全球的扩张

- 预测性维护技术的采用日益增多

- 产业陷阱与挑战

- 零件维修成本高且复杂

- 全球熟练的MRO技术人员短缺

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依组件类型,2021 - 2034 年

- 主要趋势

- 引擎部件

- 航空电子设备

- 起落架

- 机身部件

- 电气系统

- 液压系统

- 气动系统

- 燃油系统

- 其他的

第六章:市场估计与预测:依飞机类型,2021 - 2034 年

- 主要趋势

- 涡轮螺旋桨飞机

- 涡轮轴

- 涡轮喷射发动机

- 涡轮风扇

- 窄体飞机

- 宽体飞机

- 支线喷射机

- 其他的

第七章:市场估计与预测:依服务提供者类型,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 航空公司(内部维修、维修和大修)

- 第三方 MRO 提供者(独立)

- 军事MRO单位

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 民航

- 军事航空

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- MEA 其余地区

第十章:公司简介

- Lufthansa Technik

- General Electric Company

- ST Engineering

- SIA Engineering Company

- AAR

- AFI KLM E&M

- MTU Aero Engines AG

- Hong Kong Aircraft Engineering Company Limited.

- Delta Air Lines, Inc.

- Pratt & Whitney

- Rolls-Royce plc

- Ameco

- Turkish Technic Inc.

- Guangzhou Aircraft Maintenance Engineering Co.,Ltd.

- SR Technics Switzerland Ltd.

- AFI KLM E&M

- TAP.

- AJ Walter Aviation Limited

- Aero Norway AS

- StandardAero

The Global Aircraft Component MRO Market was valued at USD 86.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 135.5 billion by 2034, driven by the surge in international air traffic and the expanding global fleet of aircraft. As commercial aviation recovers and travel demand skyrockets, airlines are ramping up investments in maintenance, repair, and overhaul services to ensure operational efficiency, regulatory compliance, and passenger safety. With fleets becoming increasingly diverse and technologically advanced, MRO providers are adapting to new challenges by leveraging cutting-edge diagnostic tools, predictive maintenance technologies, and advanced material repair techniques. The rising preference for fuel-efficient aircraft, equipped with next-generation engines and integrated systems, is reshaping the market landscape. As competition intensifies, operators are seeking faster turnaround times, greater technical expertise, and cost-effective solutions, pushing MRO firms to expand capabilities, invest in digitalization, and adopt smarter service models to stay ahead.

Airlines are heavily investing in MRO services to meet operational safety standards and evolving regulatory mandates. Increasing complexity in aircraft systems, particularly in avionics and propulsion components, is pushing MRO procedures toward the adoption of digital tools, smart diagnostics, and predictive maintenance technologies. Modern fleets featuring next-generation engines and integrated electronic systems demand a higher degree of technical expertise, further fueling the global demand for specialized MRO services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $86.5 Billion |

| Forecast Value | $135.5 Billion |

| CAGR | 4.7% |

Shifting global trade policies are creating additional hurdles for MRO operators. The introduction of import tariffs on key aviation parts has elevated operational costs, especially for U.S.-based providers. These tariffs are disrupting established supply chains and raising serious concerns over component availability, compelling airlines to rethink procurement strategies and maintenance planning. At the same time, carriers are under mounting pressure to enhance cost-efficiency while ensuring full regulatory compliance, driving greater reliance on long-term service agreements and the expansion of in-house component repair capabilities.

The engine component segment generated USD 35.8 billion in 2024, dominating the aircraft component MRO market. This leadership comes from the critical importance and high replacement cost of engine parts, which require meticulous servicing and strict overhaul schedules. Components like combustors, turbine blades, and fuel nozzles endure extreme thermal and mechanical stress, necessitating advanced repair processes including thermal barrier coatings, plasma spraying, and laser cladding. The integration of smart maintenance technologies such as digital twins and AI-driven diagnostics is revolutionizing traditional MRO workflows, helping providers predict wear patterns, minimize downtime, and significantly extend component lifespans.

By aircraft type, the turbofan engines segment generated USD 62.2 billion in 2024. Turbofan engines' complex design and superior thrust efficiency make them essential across both commercial and military aviation sectors. Maintenance procedures for these engines often involve high-precision laser drilling and specialized protective coatings for critical modules like high-pressure turbines and fan blades. As the aviation industry pushes for quieter and more fuel-efficient aircraft, MRO service providers are scaling their operations to meet the needs of new-generation engines made with composite materials and geared architectures.

The U.S. Aircraft Component MRO Market reached USD 21.2 billion in 2024, supported by a robust domestic aviation industry. Hosting one of the world's largest commercial aircraft fleets, the U.S. boasts a dense network of certified repair stations and OEM-aligned facilities across key aviation hubs. Strategic modernization efforts and FAA regulations are driving advancements in MRO capabilities, especially for critical systems like engines and avionics. Digital recordkeeping, sustainability compliance, and integrated maintenance tracking are now central to U.S. MRO operations.

Prominent players in the aircraft component MRO industry include General Electric Company, AAR, Lufthansa Technik, ST Engineering, and SIA Engineering Company. Leading firms are expanding global networks, investing in digital maintenance tools, and enhancing vertically integrated service models. Long-term partnerships with airlines and OEMs, focus on sustainable repair technologies, and upskilling of technical teams remain key strategies to strengthen service reliability and align with evolving aviation industry trends.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs impact analysis on aircraft components

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-Side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-Side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Consumer response patterns

- 3.2.1.3.1 Supply-Side impact

- 3.2.1.4 Key Companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for air travel

- 3.3.1.2 Regulatory mandates from aviation authorities

- 3.3.1.3 Outsourcing MRO activities to third-party providers

- 3.3.1.4 Expansion of low-cost carrier operations globally

- 3.3.1.5 Increasing adoption of predictive maintenance technologies

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost and complexity of component repairs

- 3.3.2.2 Shortage of skilled MRO technicians globally

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Engine components

- 5.3 Avionics

- 5.4 Landing gear

- 5.5 Airframe components

- 5.6 Electrical systems

- 5.7 Hydraulic systems

- 5.8 Pneumatic systems

- 5.9 Fuel systems

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Aircraft Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Turboprops

- 6.3 Turbo shafts

- 6.4 Turbo jet

- 6.5 Turbo fan

- 6.5.1 Narrow-body

- 6.5.2 Wide-body

- 6.5.3 Regional jets

- 6.5.4 Others

Chapter 7 Market Estimates & Forecast, By Service Provider Type, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Airlines (In-house MRO)

- 7.4 Third-Party MRO Providers (Independent)

- 7.5 Military MRO Units

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Civil aviation

- 8.3 Military aviation

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Lufthansa Technik

- 10.2 General Electric Company

- 10.3 ST Engineering

- 10.4 SIA Engineering Company

- 10.5 AAR

- 10.6 AFI KLM E&M

- 10.7 MTU Aero Engines AG

- 10.8 Hong Kong Aircraft Engineering Company Limited.

- 10.9 Delta Air Lines, Inc.

- 10.10 Pratt & Whitney

- 10.11 Rolls-Royce plc

- 10.12 Ameco

- 10.13 Turkish Technic Inc.

- 10.14 Guangzhou Aircraft Maintenance Engineering Co.,Ltd.

- 10.15 SR Technics Switzerland Ltd.

- 10.16 AFI KLM E&M

- 10.17 TAP.

- 10.18 A J Walter Aviation Limited

- 10.19 Aero Norway AS

- 10.20 StandardAero