|

市场调查报告书

商品编码

1740820

CO2 雷射市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测CO2 Laser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

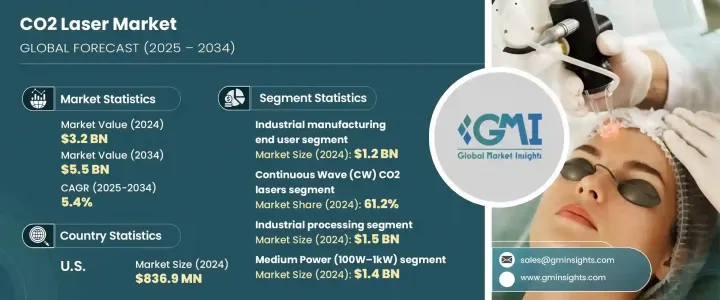

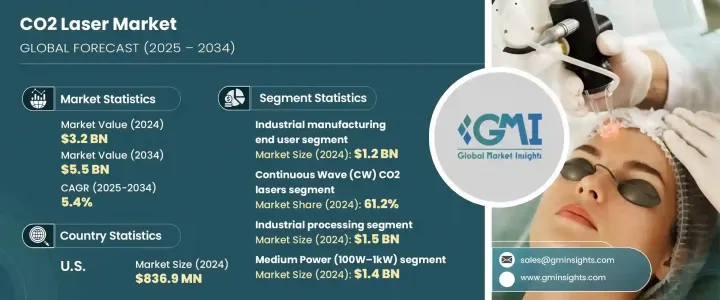

2024 年全球二氧化碳雷射器市场规模达 32 亿美元,预计到 2034 年将以 5.4% 的复合年增长率成长,达到 55 亿美元。这一增长得益于工业製造、医疗和美容等关键领域应用范围的不断扩大。二氧化碳雷射器凭藉其无与伦比的精度、多功能性以及加工塑胶、纺织品、玻璃和金属等多种材料的能力,已成为首选技术。随着各行各业日益转向自动化和精密生产系统,二氧化碳雷射的采用率持续飙升。这些系统提供非接触式加工,可最大限度地减少磨损、延长使用寿命,并确保切割更干净,同时最大程度地减少热变形。

它们与工业 4.0 和智慧製造系统的集成,使其成为精简营运、提升产品品质和减少浪费的关键资产。此外,对可持续、节能生产技术日益增长的需求,进一步巩固了它们作为各製造垂直领域重要工具的地位。技术进步,尤其是在光束控制、冷却机制和模组化设计方面的进步,正在帮助製造商在不影响品质或效率的情况下扩大营运规模。因此,无论是老牌企业或新进者,都在利用这一趋势,提升产品性能,扩大在高需求市场的影响力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 55亿美元 |

| 复合年增长率 | 5.4% |

CO2 雷射在需要复杂、非接触式切割、焊接、钻孔和雕刻解决方案的行业中日益受到青睐。与传统加工工具相比,这些雷射可提供卓越的边缘质量,并减少二次精加工的需求,从而显着提高整体营运效率。其高速执行高精度任务的能力使其特别适合大规模生产环境。随着製造商力求在保持品质标准的同时提高产量,CO2 雷射正越来越多地被部署用于替换老旧、效率低下的设备。

贸易政策持续影响市场动态,尤其是对来自关键雷射部件供应国的进口零件征收关税。这些政策变化增加了製造成本,促使企业重新思考其采购和营运模式。为了应对这些挑战,许多企业正在探索替代供应商,并增加对国内製造能力的投资。这种转变不仅有助于减少对全球贸易的依赖,也能缩短週转时间,并提升供应链的韧性。儘管面临这些不利因素,但由于对自动化和数位化整合生产生态系统的需求不断增长,市场势头依然强劲。

在产品细分方面,中等功率类别(功率范围从 100W 到 1kW)在 2024 年创造了 14 亿美元的市场规模。该细分市场因其在高性能和经济实惠之间实现了理想的平衡而持续受到欢迎。汽车、电子、纺织和包装等行业青睐中功率 CO₂ 雷射器,因为它们能够在各种材料上实现清晰的焊接、精细的标记和精细的雕刻。其紧凑的设计和高效的能源效率,使其对于希望在不超出预算的情况下实现自动化的中小型製造工厂尤其具有吸引力。这些系统还能与CNC工具机和机器人平台无缝集成,使其成为智慧工厂环境的理想选择。

2024年,连续波 (CW) CO2 雷射器占据了 61.2% 的市场份额,占据主导地位,这反映出其在需要不间断高强度雷射输出的应用中得到了广泛的应用。连续波雷射发射恆定的光束,可在结构金属切割、深孔钻孔和连续焊接等製程中实现深度穿透和始终如一的精度。航太、造船和重型机械等关键产业依赖这些雷射器,因为它们能够在高产量生产线中高效运作。它们的可靠性和减少停机时间的能力与全球对精实製造和提高生产力的重视高度契合。

受先进製造业强劲需求的推动,美国二氧化碳雷射器市场在2024年达到8.369亿美元。这些雷射在註重微观精度和无缝自动化的行业中不可或缺。航太、医疗保健和消费性电子产品製造商正在采用二氧化碳雷射器,因为它们拥有卓越的精度和灵活的材料处理能力,可处理从金属到聚合物的各种材料。在医疗领域,雷射辅助美容手术(例如皮肤重建和皮肤病治疗)的日益普及也扩大了市场规模。

包括科医人 (Lumenis)、相干公司 (Coherent, Inc.)、Epilog Laser、通快集团 (TRUMPF Group) 和科恩雷射系统 (Kern Laser Systems) 在内的领先公司正透过高性能雷射模组的策略研发巩固其市场地位。这些公司正在扩展其产品组合,并客製化解决方案以满足特定行业的独特需求。与自动化公司和关键终端用户的合作有助于强化供应链并改善服务交付。同时,对区域製造设施的投资正在扩大市场覆盖范围,并加快对不断变化的贸易动态的反应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 二氧化碳雷射在材料加工上的应用日益增多

- 医疗和美容应用需求激增

- 提高工业流程的自动化程度

- 二氧化碳雷射在国防和军事领域的应用日益增多

- 雷射技术的不断进步

- 产业陷阱与挑战

- 初始资本投入高

- 替代雷射技术的出现

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按输出功率,2021 - 2034 年

- 主要趋势

- 低功率(100W以下)

- 中等功率(100W~1kW)

- 大功率(1kW以上)

第六章:市场估计与预测:依技术类型,2021-2034

- 主要趋势

- 连续波(CW)CO2雷射器

- 脉衝二氧化碳雷射

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 医疗与美容

- 工业加工

- 科学与研究

- 感测与通信

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 航太和国防

- 工业製造

- 卫生保健

- 汽车

- 电信

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Alma Lasers

- Baison Laser

- Boss Laser

- Camfive Laser

- Epilog Laser

- Eurolaser

- Gravotech

- Haotian Laser

- INTERmedic

- JEISYS Medical

- JenaSurgical

- Kern Laser Systems

- Lasering USA

- Lumenis

- Lutronic

- Novanta Inc.

- OmniGuide

- RedSail

- Thunder Laser

- Trotec Laser

- Wattsan

The Global CO2 Laser Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 5.5 billion by 2034. This growth is fueled by an expanding range of applications across key sectors, including industrial manufacturing, medical treatments, and cosmetic procedures. CO2 lasers have emerged as a preferred technology due to their unmatched precision, versatility, and ability to process diverse materials such as plastics, textiles, glass, and metals. As industries increasingly shift toward automation and precision-based production systems, the adoption of CO2 lasers continues to surge. These systems offer non-contact processing, which minimizes wear and tear, boosts operational lifespan, and ensures cleaner cuts with minimal thermal distortion.

Their integration into Industry 4.0 and smart manufacturing setups makes them a critical asset in streamlining operations, improving product quality, and reducing waste. Moreover, the rising need for sustainable, energy-efficient production technologies further solidifies their position as an essential tool across various manufacturing verticals. Technological advancements, especially in beam control, cooling mechanisms, and modular design, are helping manufacturers scale operations without compromising on quality or efficiency. As a result, both established players and new entrants are capitalizing on this trend by enhancing product capabilities and expanding their presence in high-demand markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 billion |

| Forecast Value | $5.5 billion |

| CAGR | 5.4% |

CO2 lasers are gaining traction in industries that demand intricate, contact-free solutions for cutting, welding, drilling, and engraving. Compared to traditional processing tools, these lasers deliver superior edge quality and reduce the need for secondary finishing, which significantly improves overall operational efficiency. Their ability to execute high-precision tasks at high speed makes them particularly suitable for mass production environments. As manufacturers aim to improve throughput while maintaining quality standards, CO2 lasers are increasingly being deployed to replace older, less efficient equipment.

Trade policies continue to play a role in shaping market dynamics, especially tariffs on imported components from countries that supply essential laser parts. These policy changes have increased manufacturing costs, prompting companies to rethink their sourcing and operational models. To mitigate these challenges, many firms are exploring alternative suppliers and increasing investments in domestic manufacturing capabilities. This shift not only helps reduce dependency on global trade but also supports quicker turnaround times and improved supply chain resilience. Despite these headwinds, market momentum remains strong due to the growing demand for automation and digitally integrated production ecosystems.

In terms of product segmentation, the medium power category-ranging from 100W to 1kW-generated USD 1.4 billion in 2024. This segment continues to gain popularity as it offers an ideal balance between high performance and affordability. Industries such as automotive, electronics, textiles, and packaging prefer medium-power CO2 lasers for their ability to deliver clean welding, intricate marking, and detailed engraving across various materials. Their compact design and energy efficiency make them especially attractive for small to mid-sized manufacturing facilities looking to implement automation without overextending budgets. These systems also integrate seamlessly with CNC machines and robotics platforms, making them a natural fit for smart factory environments.

The Continuous Wave (CW) CO2 laser segment held a dominant 61.2% market share in 2024, reflecting its widespread use in applications that demand uninterrupted, high-intensity laser output. CW lasers emit a constant beam, enabling deep penetration and consistent precision in processes like structural metal cutting, deep-hole drilling, and continuous welding. Key industries such as aerospace, shipbuilding, and heavy machinery rely on these lasers for their ability to operate efficiently in high-throughput production lines. Their reliability and capacity to reduce downtime align well with the global emphasis on lean manufacturing and productivity enhancement.

The United States CO2 laser market generated USD 836.9 million in 2024, driven by strong demand across advanced manufacturing sectors. These lasers are indispensable in industries where microscopic precision and seamless automation are critical. Aerospace, healthcare, and consumer electronics manufacturers are adopting CO2 lasers for their exceptional accuracy and material-handling flexibility-from metals to polymers. In the medical space, the growing use of laser-assisted cosmetic procedures like skin resurfacing and dermatological treatments is also expanding the market scope.

Leading companies, including Lumenis, Coherent, Inc., Epilog Laser, TRUMPF Group, and Kern Laser Systems, are reinforcing their positions through strategic R&D in high-performance laser modules. These players are expanding their product portfolios and customizing solutions to meet the unique requirements of specific industries. Collaborations with automation firms and key end-users are helping strengthen supply chains and improve service delivery. At the same time, investments in regional manufacturing facilities are enhancing market reach and providing faster response times to shifting trade dynamics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increase in adoption of CO2 lasers in material processing

- 3.7.1.2 Surge in demand from medical and aesthetic applications

- 3.7.1.3 Increased automation in industrial processes

- 3.7.1.4 Rise in applications of CO2 lasers in the defense and military sector

- 3.7.1.5 Growing advancements in laser technology

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial capital investment

- 3.7.2.2 Emergence of alternative laser technologies

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Output Power, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low power (Below 100W)

- 5.3 Medium power (100W–1kW)

- 5.4 High power (Above 1kW)

Chapter 6 Market Estimates & Forecast, By Technology Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Continuous wave (CW) CO2 lasers

- 6.3 Pulsed CO2 lasers

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Medical & aesthetic

- 7.3 Industrial processing

- 7.4 Scientific & research

- 7.5 Sensing & communications

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Aerospace and defense

- 8.3 Industrial manufacturing

- 8.4 Healthcare

- 8.5 Automotive

- 8.6 Telecommunication

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alma Lasers

- 10.2 Baison Laser

- 10.3 Boss Laser

- 10.4 Camfive Laser

- 10.5 Epilog Laser

- 10.6 Eurolaser

- 10.7 Gravotech

- 10.8 Haotian Laser

- 10.9 INTERmedic

- 10.10 JEISYS Medical

- 10.11 JenaSurgical

- 10.12 Kern Laser Systems

- 10.13 Lasering USA

- 10.14 Lumenis

- 10.15 Lutronic

- 10.16 Novanta Inc.

- 10.17 OmniGuide

- 10.18 RedSail

- 10.19 Thunder Laser

- 10.20 Trotec Laser

- 10.21 Wattsan