|

市场调查报告书

商品编码

1740822

双极电外科设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bipolar Electrosurgical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

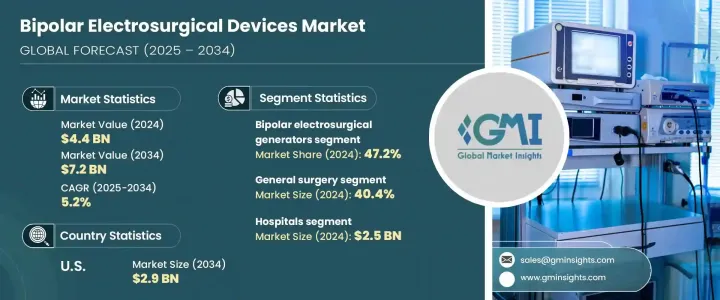

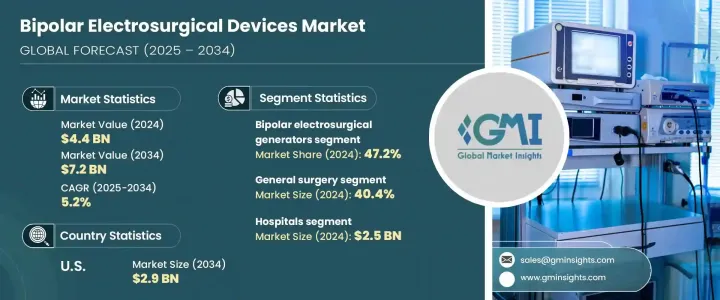

2024年,全球双极电外科设备市场规模达44亿美元,预计2034年将以5.2%的复合年增长率成长,达到72亿美元。随着患者和外科医生对微创手术的需求日益增长,双极电外科已成为现代外科工作流程中不可或缺的一部分。这些手术具有许多优势,包括切口较小、失血量更少、出院时间更短、恢復速度更快。微创手术的持续发展显着提高了医院和外科中心对双极电外科技术的采用率。

双极电外科器械旨在以极高的精度进行切割和凝固,同时最大程度地减少对周围组织的损伤。这意味着术后感染和併发症的发生率更低。随着血管封闭能力、热控制和人体工学工具设计的改进,这些器械不断提升手术效果。对精准度和组织保护的日益重视,使其在神经外科、骨科、妇科等外科领域的应用日益广泛,进一步推动了市场扩张。与机器人和腹腔镜系统相容的新型设备的采用也巩固了其在标准化手术方案中的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 72亿美元 |

| 复合年增长率 | 5.2% |

这些设备使用透过双极配置施加的高频电能进行操作,电流仅流经两个钳状电极之间的组织。这种设计可确保局部能量输送并最大程度地减少组织损伤。市场根据产品类型进行细分,包括双极电外科发电机、双极电外科器械以及配件和耗材。其中,双极电外科发电机在2024年的收入份额最高,为47.2%。这些发电机是所有连接器械和配件的核心能源,因此对于任何电外科设备都至关重要。与可重复使用的器械和配件相比,它们的高成本显着影响了整体市场收入。

双极电外科器械进一步细分为钳子、剪刀和探针或电极。虽然这些工具广泛应用于各种外科手术,但相对于发生器而言,它们价格实惠,使其成为该细分市场中收入贡献中等的产品。发生器是资本密集型产品,且对于系统功能不可或缺,因此在基于产品的细分市场中占据主导地位。

根据应用,市场分为一般外科、神经外科、心血管外科、妇科外科和其他专科领域。 2024年,一般外科占据该领域的主导地位,市占率为40.4%。随着全球老龄人口的增长,胆囊疾病、阑尾炎和疝气等与年龄相关的疾病的盛行率也在上升。由于退化性疾病和慢性疾病的发生率较高,老年人更有可能接受外科手术,这刺激了对双极器械等可靠安全的手术工具的需求。双极器械在止血和精确切口方面的高效性使其成为一般外科各科室的首选。

按最终用户划分,市场细分为医院、门诊手术中心、专科诊所以及学术或研究机构。医院占据了这个细分市场的主导地位,2024 年的收入达到 25 亿美元。医院着重提升病人安全、提高手术准确性并缩短恢復时间,刺激了对先进手术设备的投资。双极设备具有关键优势,例如热扩散最小、出血减少和意外烧伤更少,有助于改善临床疗效并缩短手术时间。随着医院不断升级设备以相容于尖端手术系统(包括机器人和腹腔镜工具),对双极电外科设备的需求预计将持续成长。

从区域来看,北美在塑造市场趋势方面发挥关键作用。光是在美国,双极电外科设备市场规模预计将从2024年的18亿美元成长到2034年的29亿美元。心血管疾病、糖尿病和肥胖等生活型态相关疾病的激增,导致手术数量不断增加。随着慢性病的日益普遍,对高效率、精准手术器械的需求也愈发迫切。双极电外科设备能够有效满足这些临床需求,从而增强其在美国医疗机构中的价值。

双极电外科设备市场的竞争格局体现在,全球和区域性企业纷纷提供客製化解决方案,以满足日益增长的外科手术需求。美敦力、强生、贝朗、史赛克和奥林巴斯等领先公司合计占全球约65%的市占率。这些公司透过持续创新、产品客製化和定价策略展开竞争,以在已开发市场和新兴市场保持领先地位。在成本敏感型地区,本土企业透过提供价格实惠、品质优良的设备向跨国品牌发起挑战,促使全球领导者调整策略,同时确保符合安全和性能标准。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 微创手术的需求不断增长

- 慢性病和外科手术的盛行率不断上升

- 电外科设备的技术进步

- 门诊手术中心的扩建

- 产业陷阱与挑战

- 先进电外科系统成本高昂

- 烧伤、神经损伤、手术烟雾等併发症的风险

- 成长动力

- 成长潜力分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑川普政府关税

- 对贸易的影响

- 产业价值链分析

- 原料分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争仪錶板

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 双极电外科发生器

- 双极电外科器械

- 双极钳

- 双极剪刀

- 双极探头和电极

- 配件和耗材

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 一般外科

- 神经外科

- 妇科手术

- 心血管外科

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 学术和研究机构

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Applied Medical

- B Braun

- Boston Scientific

- Bovie Medical

- BOWA Medical

- ConMed

- Encision

- Erbe Elektromedizin

- Johnson and Johnson

- KLS Martin Group

- Medtronic

- Olympus

- Smith and Nephew

- Stryker

- Zimmer Biomet

The Global Bipolar Electrosurgical Devices Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 7.2 billion by 2034. As the demand for minimally invasive procedures gains momentum among patients and surgeons alike, bipolar electrosurgery has become an integral part of modern surgical workflows. These procedures offer substantial benefits, including smaller incisions, reduced blood loss, quicker discharge times, and faster recovery. The ongoing shift towards minimally invasive approaches has significantly increased the adoption of bipolar electrosurgical technologies in hospitals and surgical centers.

Bipolar electrosurgical instruments are designed to perform both cutting and coagulation with exceptional precision while limiting harm to the surrounding tissue. This translates to a lower rate of post-operative infections and complications. With advancements in vessel sealing capabilities, improved thermal control, and ergonomic tool designs, these instruments continue to enhance procedural outcomes. The heightened focus on precision and tissue conservation supports their growing use in surgical fields such as neurosurgery, orthopedics, gynecology, and others, further driving market expansion. The adoption of newer devices compatible with robotic and laparoscopic systems also reinforces their position in standardized surgical protocols.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 5.2% |

These devices operate using high-frequency electrical energy applied through a bipolar configuration, where the current flows only through the tissue between two forceps-like electrodes. This design ensures localized energy delivery and minimal tissue trauma. The market is segmented based on product types, with categories including bipolar electrosurgical generators, bipolar electrosurgical instruments, and accessories and consumables. Among these, bipolar electrosurgical generators accounted for the highest revenue share at 47.2% in 2024. These generators act as the core energy source for all connected instruments and accessories, making them essential for any electrosurgical setup. Their high cost compared to reusable instruments and accessories contributes significantly to overall market revenue.

Bipolar electrosurgical instruments are further divided into forceps, scissors, and probes or electrodes. While these tools are widely used across various surgical procedures, their affordability relative to generators places them as mid-level revenue contributors within the segment. Generators, being capital-intensive and indispensable for system functionality, maintain a dominant hold on product-based segmentation.

Based on application, the market is categorized into general surgery, neurosurgery, cardiovascular surgery, gynecological surgery, and other specialized fields. General surgery led the segment with a market share of 40.4% in 2024. The prevalence of age-related conditions such as gallbladder disease, appendicitis, and hernias has grown alongside the expanding global elderly population. Older adults are more likely to undergo surgical procedures due to the higher frequency of degenerative and chronic illnesses, which boosts the demand for reliable and safe surgical tools like bipolar devices. Their efficiency in managing bleeding and enabling precise incisions makes them a preferred choice across general surgery departments.

By end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and academic or research institutions. Hospitals dominated this segment, with revenue amounting to USD 2.5 billion in 2024. Their focus on enhancing patient safety, improving procedural accuracy, and reducing recovery time has spurred investments in advanced surgical equipment. Bipolar devices offer key advantages such as minimal thermal spread, reduced bleeding, and fewer accidental burns, supporting better clinical outcomes and shorter procedure durations. As hospitals continue to upgrade to equipment that is compatible with cutting-edge surgical systems, including robotics and laparoscopic tools, the demand for bipolar electrosurgical devices is expected to climb.

Regionally, North America plays a pivotal role in shaping market trends. The bipolar electrosurgical devices market in the United States alone is projected to rise from USD 1.8 billion in 2024 to USD 2.9 billion by 2034. A surge in lifestyle-related diseases, including cardiovascular disorders, diabetes, and obesity, has led to a growing number of surgeries. As chronic conditions become more prevalent, the need for efficient, precision-driven surgical instruments becomes more pressing. Bipolar electrosurgical units meet these clinical demands effectively, reinforcing their value across U.S. healthcare facilities.

The competitive landscape of the bipolar electrosurgical devices market features a blend of global and regional players offering tailored solutions to meet rising surgical demands. Leading companies such as Medtronic, Johnson & Johnson, B. Braun, Stryker, and Olympus together represent approximately 65% of the global market. These organizations compete through continuous innovation, product customization, and pricing strategies to maintain relevance across both developed and emerging markets. In cost-sensitive regions, domestic players challenge multinational brands by delivering affordable, quality devices, prompting global leaders to adapt their approach while ensuring compliance with safety and performance standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for minimally invasive surgeries

- 3.2.1.2 Rising prevalence of chronic diseases and surgical interventions

- 3.2.1.3 Technological advancements in electrosurgical devices

- 3.2.1.4 Expansion of outpatient surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced electrosurgical systems

- 3.2.2.2 Risk of complications such as burns, nerve damage, surgical smoke

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Industry value chain analysis

- 3.6 Raw material analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive dashboard

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bipolar electrosurgical generators

- 5.3 Bipolar electrosurgical instruments

- 5.3.1 Bipolar forceps

- 5.3.2 Bipolar scissors

- 5.3.3 Bipolar probes and electrodes

- 5.4 Accessories and consumables

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Neurosurgery

- 6.4 Gynecological surgery

- 6.5 Cardiovascular surgery

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Applied Medical

- 9.2 B Braun

- 9.3 Boston Scientific

- 9.4 Bovie Medical

- 9.5 BOWA Medical

- 9.6 ConMed

- 9.7 Encision

- 9.8 Erbe Elektromedizin

- 9.9 Johnson and Johnson

- 9.10 KLS Martin Group

- 9.11 Medtronic

- 9.12 Olympus

- 9.13 Smith and Nephew

- 9.14 Stryker

- 9.15 Zimmer Biomet